Dorothy M. Donohue is Deputy General Counsel, Securities Regulation; Susan M. Olson is General Counsel; and Eric J. Pan is President & Chief Executive Officer of the Investment Company Institute. This post is based on their comment letter submitted to the U.S. Securities and Exchange Commission.

Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders? (discussed on the Forum here) both by Lucian A. Bebchuk and Roberto Tallarita; Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy – A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here); and Stakeholder Capitalism in the Time of COVID, by Lucian Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here).

This post is based on a comment letter submitted to the SEC regarding The Proposed SEC Climate Disclosure Rule by the Investment Company Institute. Below is the text of the letter with minor adjustments to eliminate the correspondence-related parts.

The Investment Company Institute is writing to provide our views on the Securities and Exchange Commission’s proposal to require public companies to provide investors with consistent, comparable, and reliable information related to climate-related risks. Our members, US regulated funds, on whose behalf we write today, hold total assets of $29.7 trillion, serving more than 100 million investors. They clearly have a significant interest in how the nature and availability of climate-related risk information provided by public companies evolves. Fund managers analyze this, and other, information in formulating their investment decisions on behalf of those millions of long-term individual investors.

Executive Summary

Our comments on the proposal are based on our belief that any climate risk disclosure framework should be designed in a manner that:

- provides investors with information that is consistent, comparable, and reliable;

- promotes investors’ ability to efficiently allocate capital;

- distinguishes between material and other information;

- reflects an appropriate balance of costs and benefits;

- considers the importance to investors of a global baseline of sufficiently comparable reporting requirements across various jurisdictions to avoid regulatory and market fragmentation; and

- is sufficiently flexible to respond to changing circumstances.

The Commission’s proposal advances some, but not all, of these goals. We therefore express support for several elements of the proposal and recommend modifying other aspects to more effectively align with those goals. In addition, in an appendix to this letter, we explain the importance of the Commission adhering to the materiality standard that underlies the federal securities laws in designing any final rules.

We urge the Commission to adopt a final rule that requires a company to file certain climate-risk related information which the company determines is material in annual reports and registration statements (SEC filings) and, to the extent that the company determines this information is not material, to furnish such information and any additional SEC-mandated information in a new climate report (furnished climate report). Under our recommended approach, a company would furnish the climate report to the Commission 120 days after its fiscal year-end. If a company subsequently determines that information included in the furnished climate report (that had not been included in the SEC filings) is actually material, it would incorporate it by reference when making its next SEC filing.

We support key components of the proposal, including that a company be required to disclose Scopes 1 and 2 emissions and narrative disclosure consistent with certain aspects of the Task Force on Climate-related Financial Disclosures (TCFD) framework. In our view, how to measure and report Scopes 1 and 2 emissions is now sufficiently developed to provide investors, including fund managers, with reliable, consistent and comparable information that can help them make investment decisions in a cost-efficient manner. We also support requiring companies to obtain limited assurance for their Scopes 1 and 2 emissions disclosures, which should enhance their reliability.

We recommend, however, that the SEC not require companies to disclose Scope 3 emissions at this time because of significant data gaps and the absence of agreed-upon measurement methodologies. That said, we do support the Commission requiring all large accelerated filers and accelerated filers that have publicly announced a target or goal to reduce their Scope 3 emissions to describe the amount and intensity only of those Scope 3 emissions.

We recommend that the Commission not adopt the proposed amendments to Regulation S-X that would require a company to provide climate-related financial metrics in a footnote to its financial statements. We believe that investors’ information needs will be met more efficiently and effectively through narrative disclosure that discusses whether and how any identified climate risks have affected, or are reasonably likely to affect, the company’s consolidated financial statements.

We first provide background on the fund industry generally and specific data about ESG funds. We then provide recommendations on key aspects of the proposal. Our comments are intended to assist the Commission as it considers how best to formulate final rules that will benefit investors and the capital markets.

Background on the Fund Industry

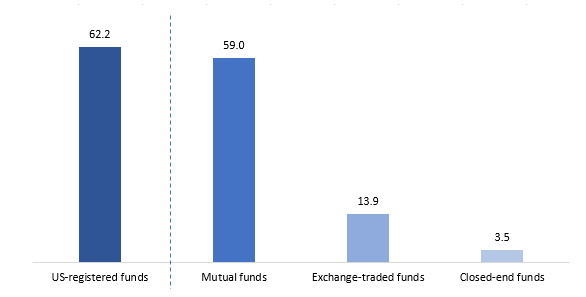

In 2021, nearly half (47.9 percent) of US households owned shares of mutual funds or other US registered investment companies—including ETFs and closed-end funds—representing an estimated 62.2 million households and 108.1 million investors. Mutual funds were the most common type of investment company owned, with 59.0 million US households, or 45.4 percent, owning mutual funds in 2021 (Figure 1). In 2021, 13.9 million US households, or about 11 percent, owned ETFs, and 3.5 million households reported closed-end fund ownership.

Figure 1: More Than 62 Million US Households Invest in US-Registered Funds

Millions of US households owning mutual funds, ETFs, or closed-end funds, 2021

Note: Households may own more than one type of fund.

Source: Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey

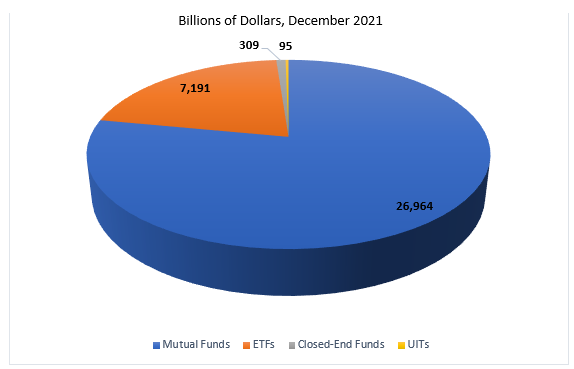

In 2021, mutual funds held almost $27 trillion, ETFs held over $7 trillion, closed-end funds held $309 billion, and UITs held $95 billion of net assets (Figure 2).

Figure 2: Investment Company Total Net Assets by Type

Source: Investment Company Institute

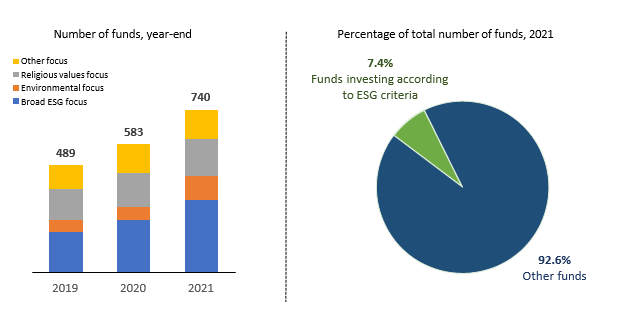

ICI’s Research Department examines the prospectuses of funds to classify those that invest according to ESG criteria, reviewing for language indicating that a fund places an important and explicit emphasis on environmental, social, or governance criteria to achieve certain goals.

Following this approach, in 2021, 740 mutual funds and ETFs, with assets of $529 billion were classified generally as investing according to exclusionary, inclusionary, or impact investing ESG criteria. Those funds represent slightly over 1.5 percent of the total net assets of US mutual funds and ETFs, with the total net assets of environmentally focused funds representing less than 0.15 percent of the total net assets (Figure 3).

Figure 4: Number of Funds That Invest According to ESG Criteria and Their Share of Total Number of Funds

Note: Data include mutual funds and ETFs. Data include mutual funds that invest primarily in other mutual funds and ETFs that invest primarily in other ETFs.

Source: Investment Company Institute

Section 1: Overview of Disclosure Framework

1.1 Companies Should Provide Disclosure Consistent with the TCFD Framework

The Release explains that the Commission’s proposed climate-related disclosure framework is modeled in part on the TCFD’s recommendations. The Commission points out that the TCFD framework has been widely accepted by investors and other market participants, and, accordingly, using it as a framework for the rules may facilitate both eliciting better disclosure and limiting compliance costs.

We support the Commission’s approach. Building on the long-standing aspects of the TCFD framework would better enable investors to analyze and compare any newly required disclosures. Taking this approach will also position the Commission to participate in discussions with foreign authorities and international standard-setting bodies to promote a global baseline of consistent and comparable sustainability-related disclosure to support the global character of asset managers, other types of companies, and the financial markets.

To this end, we note that the IFRS Foundation’s International Sustainability Standards Board (ISSB) also is basing its proposed international standards on the TCFD framework and its work has received strong support from several jurisdictions and the International Organization of Securities Commissions of which the SEC is a member. We believe that the SEC should look closely at the work of the ISSB and actively engage the ISSB to ensure comparability of the SEC framework with any final ISSB standards.

1.2 The Commission Should Adopt our Recommended File and Furnish Framework

The Commission proposed requiring a company to include climate-related disclosure in Securities Act of 1933 or Securities Exchange Act of 1934 registration statements and Exchange Act annual reports in a separately captioned climate-related disclosure section. The Commission explains that requiring climate-related disclosure to be presented in this manner would facilitate review of the climate-related disclosure by investors alongside other relevant company financial and nonfinancial information. The Commission asks whether it should adopt the proposed approach or instead place the climate-related disclosure requirements in a new report.

We recommend that the Commission require each company to provide material climate-related disclosure in SEC filings and also require a company to furnish that information and any additional mandated information that the company determines is not material in a new climate report. A company would furnish its climate report to the Commission 120 days after its fiscal year-end. If a company subsequently determines that information included in the furnished climate report (that had not been included in the SEC filings) is actually material, it would incorporate it by reference when making its next SEC filing.

The recommended approach will allow fund managers to evaluate, for proxy voting and other purposes, in a consolidated source, information sufficiently in advance of a company’s annual meeting, promoting well-informed voting. At the same time, it would preserve the legal distinction between, and acknowledge the differences in liability that attach to, information that is filed as compared to furnished.

The recommended “file and furnish” approach is consistent with the TCFD’s acknowledgement that the TCFD-recommended disclosures may be included in a company’s financial filings if material and may be provided outside of a financial filing if they are not. In addition, as the TCFD notes, providing information that could be material in the future outside of a financial filing can facilitate the incorporation of such information into financial filings once climate-related issues are determined to be material to the company.

The remainder of our comments should be read in the context of our recommended furnish and file framework.

1.3 Companies Should Be Required to Provide Narrative Disclosure Regarding Climate-Related Impacts

The proposal would require a company to disclose any “climate-related risk” reasonably likely to have a material impact on the company, which may manifest over the short, medium, and long term. We support the Commission using the TCFD’s definition of climate-related risk because it is familiar terminology for investors and companies alike and therefore should promote consistent and comparable disclosure across companies.

The proposal would require each company to report climate-related risks using their own definitions of “short-, medium-, and long-term time horizons.” To promote comparability across companies, we recommend instead that the Commission require companies to uniformly define the time horizons captured by “short term, medium term, and long term” as one, five, and ten years, respectively.

Because information about how climate-related risks have impacted, or are likely to impact, a company’s strategy, business model, and outlook can be important for purposes of making an investment or voting decision, the Commission proposed requiring each company to disclose, in narrative form, impacts of those risks on its:

- Business operations, including the types and locations of its operations;

- Products or services;

- Suppliers and other parties in its value chain;

- Activities to mitigate or adapt to climate-related risks, including adoption of new technologies or processes;

- Expenditure for research and development; and

- Any other significant changes or impacts.

The proposal also would require a company, when discussing climate-related risks, to specify whether they are physical or transitions risks and the nature of the risks presented. We support the Commission requiring companies to provide this information in SEC filings if material and also require companies to provide this information in a furnished climate report, on a comply-or-explain basis, if the company determines it is not material. The recommended approach should elicit more robust and company specific information than that provided today, and we agree with the Commission’s observation that while some of this information may be common across companies, other aspects of it will vary by industry and company.

1.4 Companies Should Provide Information about Offsets and Renewable Energy Credits

The Commission would require a company to disclose, if applicable, the role that carbon offsets or renewable energy credits (RECs) play in its climate-related business strategy or if the company used them to meet targets or goals. We support requiring companies to provide the proposed disclosure in the company’s SEC filings, if the company determines that it is material and in a furnished climate report, on a comply-or-explain basis, if the company determines the use of offsets or RECs is not material. The degree to which a company uses offsets or RECs will vary, and the recommended approach will generate sufficient information to allow investors to understand how the company uses one or both of them.

1.5 Companies Should Provide Internal Carbon Prices and Scenario Analysis

The Commission would require a company that maintains an internal carbon price to disclose information about the carbon price. Companies providing disclosure related to internal carbon prices would quantify the potential costs the company would incur should a carbon price be put into effect. Information about internal carbon prices can help investors better understand the company’s climate-related strategy. We recommend that any final rule require a company that calculates an internal carbon price to either disclose that price or explain the rationale for not disclosing that information (e.g., the limited reliability of the internal carbon price). The recommended approach provides flexibility, recognizing that many companies may not currently track the information called for and a robust carbon market on which to base such a price may not always exist.

Under the Proposal, a company also would be required to describe any analytical tools, such as scenario analysis, that it uses to assess the impact of climate-related risks on its business and consolidated financial statements. We support requiring companies that conduct scenario analysis to either disclose the results of the analysis or explain the rationale for not disclosing that information (e.g., the uncertainty of forward looking information). Information about scenario analysis can help investors evaluate the resilience of the company’s business strategy in the face of various climate scenarios that could impose potentially different climate-related risks.

At the same time, the recommended flexible approach avoids imposing a costly requirement on those companies that have not yet undertaken to conduct such analysis.

In addition, a comply-or-explain disclosure requirement would mitigate the potential chilling effect of triggering a disclosure requirement simply by engaging in practices that support robust climate risk management.

Section 2: Proposed GHG Emissions Disclosure

2.1 Companies Should Disclose Scopes 1 and 2 Emissions

The Commission proposed requiring a company to disclose its GHG emissions for its most recently completed fiscal year. The proposed definitions of GHG emissions are substantially similar to the corresponding definitions in The Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (GHG Protocol), which the Commission correctly describes as the leading accounting and reporting standard for GHG emissions. Companies would be required to disclose Scopes 1 and 2 emissions on an aggregated and disaggregated basis.

We support the Commission requiring companies to disclose Scopes 1 and 2 emissions on an aggregated basis and additionally on a disaggregated basis for any particular constituent GHG that is material to the company. We support companies providing this disclosure for the most recently completed fiscal year in a structured format. Doing so would make more consistent, comparable, and reliable data available for fund managers to use in making investment decisions. We agree with the Commission’s judgement that “[b]y sharing certain basic concepts and a common vocabulary with the GHG Protocol, the proposed rules should help limit the compliance burden for those companies that are already disclosing their emissions pursuant to the GHG Protocol. Similarly, to the extent that companies elect to follow GHG Protocol standards and methodologies, investors already familiar with the GHG Protocol may also benefit.”

We particularly support the Commission requiring companies to disclose Scopes 1 and 2 emissions in gross terms, excluding any use of purchased or generated offsets. Disclosing emissions data in this manner would allow investors to assess the full magnitude of climate-related risk posed by a company’s emissions and its plans for managing such risk.

We note that the Commission has repeatedly applied the materiality standard in contexts comparable to those relating to the questions being raised today about climate change-related disclosures. In fact, many prior SEC releases requiring disclosure relating to environmental laws have applied the materiality standard in connection with requiring such disclosures. We recommend that the Commission take that same approach here and indicate as part of any final rule that it has based its requirement that companies disclose Scopes 1 and 2 emissions on an aggregated basis on the materiality of that information to the company.

2.2 It Would be Premature to Require Companies to Provide Scope 3 Emissions

The Proposal would require larger companies to disclose Scope 3 emissions only if those emissions are material, or if the company has set a GHG emissions reduction target or goal that includes its Scope 3 emissions. Scope 3 emissions capture, among other things, emissions associated with a company’s supply chain and those associated with a company’s products and services.

A large majority of our members believe that the Commission should not require companies to report Scope 3 emissions at this time, because of significant data gaps and the absence of agreed-upon methodologies to measure Scope 3 emissions. These deficiencies seriously undermine the ability of most companies to report consistent, comparable, and verifiably reliable data.

Any company calculating Scope 3 emissions will have to make a number of assumptions that can vary greatly in magnitude and will use different methodologies. The Commission explicitly acknowledges these shortcomings, stating that

the evolving and unique nature of GHG emissions reporting involves and, in some cases, warrants varying methodologies, differing assumptions, and a substantial amount of estimation. Certain aspects of GHG emissions disclosure also involve reliance on third-party data…. In particular, it may be difficult to obtain activity data from suppliers, customers, and other third parties in a registrant’s value chain, or to verify the accuracy of that information ….

The Commission’s proposed solution to these limitations is to allow companies to use estimations and ranges (as long as they also describe the assumptions underlying, and the reasons for using, the estimates and ranges) and to choose any methodology they “deem fit” to calculate Scope 3 emissions. We are concerned that this approach will generate data that will not be consistent, comparable, or verifiably reliable.

We therefore recommend that rather than requiring companies to report Scope 3 emissions, the Commission promote the development of reporting practices, including assumptions, models, and methodologies. In fact, as more companies make their Scopes 1 and 2 emissions data publicly available, these data can serve as the input for other companies’ Scope 3 calculations. Mandating Scope 3 emissions after companies and investors gain experience with Scopes 1 and 2 reporting therefore ultimately will allow for more accurate reporting that will redound to the benefit of investors.

That said, our members do support the Commission requiring any larger company that has publicly disclosed a GHG emission reduction target or goal that includes its Scope 3 emissions to disclose only those Scope 3 emissions. The proposed requirement, if adopted, could assist investors in tracking the company’s progress toward reaching its particular target or goal, and, at the same time, encourage companies to carefully calibrate any such target or goals.

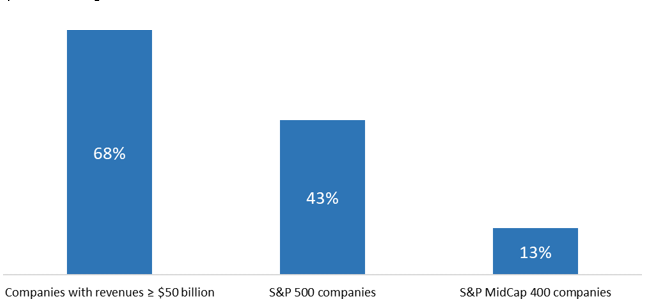

According to one source, 68 percent of companies with revenues of greater than $50 billion, 43 percent of S&P 500 companies, and 13 percent of S&P MidCap 400 companies report some information about their Scope 3 GHG emissions.

Figure 5: Percent of Companies Disclosing Scope 3 GHG Emissions

By selected categories

Source: ESGAUGE, 2021

In addition, our members believe that companies that currently are providing investors with Scope 3 emissions information should not be prohibited or discouraged from doing so. Voluntary reporting could foster a more informed understanding of climate-related risks and opportunities and improve Scope 3 reporting over time. We support companies being permitted to provide this disclosure in a furnished climate report or by other means because of its importance to investors.

We provide the comments below in Sections 2.3 and 2.4 in the event that the SEC does not agree with our members that oppose the SEC mandating disclosure of Scope 3 emissions at this time and ultimately requires companies to report Scope 3 emissions.

2.3 The Commission Should Clarify that Scope 3 Emissions Do Not Include Managed Assets

With respect to the case in which an asset manager is also a reporting company, the Commission should clarify that the investments category of Scope 3 emissions does not include investments that are not on a company’s balance sheet, such as those of registered funds managed by an asset manager (“managed assets”). The proposed rule text and the Release suggest that the Commission does not intend for Scope 3 emissions information for an asset manager to include managed assets, and we urge the Commission to make this intention clearer.

In the proposed rule’s examples of Scope 3 downstream activities, it lists “investments by a registrant” (emphasis supplied), which suggests the inclusion of investments by the registrant on its own behalf, not on behalf of others. Similarly, the proposed definition of “value chain,” which states that it is the “upstream and downstream activities related to a registrant’s operations” (emphasis supplied), indicates the intention that Scope 3 emissions relate to the registrant’s operations.

This clarification would make the proposed rule consistent with the GHG Protocol, which states that whether an organization is required to report on investments “depends on whose capital is being invested.” Under the GHG Protocol, asset owners investing their own capital are required to report emissions from equity investments but asset managers, who are investing clients’ capital, “may optionally report on emissions from equity investments managed on behalf of clients (e.g., mutual funds).”

In addition, the TCFD has observed that, in the case where an asset manager is a public company, it has two distinct audiences for its climate-related financial disclosures. It notes that the first audience is its shareholders, who need to understand enterprise-level risks and opportunities and how these are managed, and the second audience is its clients, for whom product-, investment strategy-, or client-specific disclosures are more relevant. The Commission’s proposed new reporting requirements are for the former audience: a company’s shareholders. As such, the required reporting obligations of asset managers in this context should be for the benefit of the asset manager’s shareholders.

Excluding managed assets from any Scope 3 emissions disclosure requirements of an asset manager also would appropriately reflect the parameters of an asset manager’s exposures and the limits of its control. A fund, for example, is a separate legal entity, the assets of which are separate and distinct from its asset manager. An asset manager itself does not take on the risks inherent in the securities or other assets it manages for funds or other clients. Those are investment risks that appropriately are borne by the funds or other clients. Moreover, an asset manager does not control the GHG emissions of portfolio companies held by funds or other clients. An asset manager must manage a fund’s assets consistent with the fund’s investment objectives and strategies, which may or may not include strategies related to GHG emissions reduction. Any disclosures about an asset manager’s activities for the intended audience of advisory clients are more appropriate for the adviser’s disclosures. Likewise, disclosure about a fund’s investment objectives and strategies for the intended audience of fund shareholders is more appropriate for fund regulatory documents.

The costs of requiring asset managers to include managed assets in any Scope 3 emissions disclosure would greatly exceed any possible benefits. First, even with a future Commission rule that US companies report Scopes 1, 2 and 3 emissions, there would continue to be large gaps in data available for asset managers to calculate Scope 3 emissions (e.g., foreign companies, private companies), and there are no standardized calculation methodologies for certain asset classes (e.g., government securities, municipal securities, derivatives, and other financial instruments).

Second, reporting by asset managers and issuers of the portfolio securities could result in double-counting. Third, because a fund’s risk exposures are distinct from those of its adviser’s, such reporting by the asset manager could be confusing and possibly misleading, particularly if managed assets are large in relation to the asset manager’s own assets.

Accordingly, we urge the Commission to clarify that a company that is required to disclose Scope 3 emissions is not required to include managed assets in its Scope 3 emissions disclosure.

2.4 The Commission Should Apply a Robust Safe Harbor to Scope 3 Emissions

The Commission acknowledges that calculating and disclosing Scope 3 emissions could represent a challenge for certain companies, in particular those that do not currently report such information on a voluntary basis. To address this concern, the Commission proposed, among other accommodations, a safe harbor for Scope 3 emissions disclosure, which would deem Scope 3 emissions “by or on behalf of the registrant not to be a fraudulent statement unless it is shown that such statement was made or reaffirmed without a reasonable basis or was disclosed other than in good faith.”

While we support the Commission accompanying any Scope 3 reporting requirement with a safe harbor from liability, we recommend strengthening the proposed safe harbor. In particular, the Commission should replace the proposed safe harbor with one that hews much more closely to the safe harbor for forward-looking statements provided by the PSLRA, which precludes liability for certain categories of forward-looking statements that (i) are identified as such and “accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially” or are otherwise immaterial or (ii) were not made with actual knowledge that the statement was false or misleading. Doing so should promote more fulsome disclosure.

2.5 Any Final Rule Should Not Include a Quantitative Threshold for Materiality

The Release requests comment on whether the Commission should require companies to use a quantitative threshold, such as a percentage of total emissions (e.g., 25%, 40%, 50%) when assessing the materiality of Scope 3 emissions for purposes of determining their disclosure obligations. We recommend that the Commission not include in any final rule, or reference in any adopting release, such a quantitative threshold. Basing a mandate to disclose Scope 3 emissions on its relationship to overall aggregated emissions would require so many assumptions and caveats that ultimately it will be of little or no value for investors. Further, our members are concerned that if the Commission were to adopt the 40 percent threshold referenced in the Release, it effectively would encompass almost all companies, even financial services firms, given the wide breadth of emissions sources in a company’s value chain.

2.6 Companies Should Provide Emissions Data for Historical Periods Unless It Is Not Reasonably Available

The Proposal would require a company to provide emissions data for its most recently completed fiscal year and for the historical fiscal years included in its consolidated financial statements in the relevant filing, to the extent such historical GHG emissions data is reasonably available.

The Commission reasons that “requiring historical emissions data, to the extent available, would provide useful information for investors by enabling investors to track over time the registrant’s exposure to climate-related impacts represented by the yearly emissions data, and to assess how it is managing the climate-related risks associated with those impacts.” The Commission asks whether it should instead only require GHG emissions metrics for the most recently completed fiscal year presented in the relevant filing.

We support the requirement to provide both current and historical period Scopes 1 and 2 emissions and agree that it will allow investors to analyze trends. We recognize, however, that providing emissions for prior periods at implementation may be difficult. Accordingly, we also support the accommodation in the proposal that allows companies to provide this information on a going-forward basis (i.e., excluding historical information “that is not reasonably available without unreasonable effort or expense”).

2.7 Companies Should Follow a GAAP-Based Approach to Determine Organizational and Operational Boundaries

The Proposal would require a company to describe the methodology, significant inputs, and significant assumptions used to calculate its emissions. As proposed, the description of the company’s methodology would be required to include the company’s organizational boundaries, operational boundaries, calculation approach, and any calculation tools used to calculate the company’s emissions. The Commission states that “[t]his information should help investors understand the scope of a registrant’s operations included in its emissions metrics and how those metrics were measured. With this information, investors could more knowledgeably compare a company’s emissions metrics with the emissions metrics of other companies and make more informed investment decisions.” The Commission requests comment on whether prescribing this method of determining organizational boundaries would result in more robust guidance for companies and enhanced comparability for investors.

We support the Commission following a GAAP-based approach for determining organizational and operational boundaries when calculating Scopes 1 and 2 emissions. Under the proposed approach a company would be required to include all the emissions from an entity that it consolidates and a proportionate share of the emissions from an equity method investee. We prefer this approach because it would better align the company’s financial and emissions disclosures and provide investors with a consistent view of the business. Requiring companies to follow the scope of reporting used in their financial statements should also enhance comparability across companies when compared with the multiple options for boundary setting available under the GHG Protocol.

2.8 Companies Should Obtain Limited Assurance of Scopes 1 and 2 Emissions Data

The Proposal would require a company that is a large accelerated filer or accelerated filer to obtain, and include in the relevant filing, an assurance report covering the disclosure of its Scopes 1 and 2 emissions and to provide certain related disclosures about the assurance provider. The Commission proposed a transition period for companies to obtain these assurances.

We support subjecting Scopes 1 and Scope 2 emissions data to limited assurance. We believe that the emissions data being subject to a company’s disclosure controls and procedures and limited assurance will be sufficient to ensure the reliability and accuracy of the data by requiring that a company maintains appropriate processes for collecting and communicating the necessary information by which to formulate the climate-related disclosures.

While the Commission also proposed subjecting Scopes 1 and 2 emissions to reasonable assurance, we believe that the costs associated with reasonable assurance would outweigh the associated benefits. We also support the phased approach to limited assurance and believe that it provides appropriate time for companies to develop robust reporting practices and assurance providers to scale up their capacity to meet demand for assurance services.

2.9 Assurance Providers Should be Required to Disclose Their Qualifications

The Proposal would require the assurance provider to prepare and sign the GHG emissions assurance report. While the Commission does not prescribe specific attestation standards, it would require that attestation standards be publicly available, established with appropriate due process, and subject to public comment. Further, the company would be required to provide disclosure about the assurance provider intended to inform investors about his or her qualifications including: (i) any licensing or accreditation standards; (ii) any record-keeping obligations and their duration; and (iii) whether the assurance provider is subject to any oversight inspection program and, if so, which program.

We support the proposed approach. The information describing the assurance provider’s qualifications would enable investors to evaluate each provider, and the proposed independence and expertise requirements would ensure that the assurance provider is free from conflicts and sufficiently qualified to perform the engagement. We view the proposed independence requirements as particularly important so as to ensure that the provider cannot concurrently consult or advise on emissions reduction strategies and provide assurance on the company’s emissions.

Section 3: Governance Disclosure

3.1 Disclosure Should Address the Board’s Oversight Process, and Not Individual Expertise

The Commission proposed requiring a company to disclose certain information concerning the board’s oversight of climate-related risks, as applicable, including:

- the identity of any board members or board committee responsible for the oversight of climate-related risks;

- whether any director has expertise in climate-related risks, with disclosure in such detail as necessary to fully describe the nature of the expertise;

- the processes by which the board or board committee discusses climate-related risks, including how the board is informed about climate-related risks, and the frequency of such discussion;

- whether and how the board or board committee considers climate-related risks as part of its business strategy, risk management, and financial oversight; and

- whether and how the board sets climate-related targets or goals, and how it oversees progress against those targets or goals, including the establishment of any interim targets or goals.

We support the disclosure that is consistent with the TCFD framework regarding a board’s process, whether the board considers climate-related risks as part of its oversight, and its oversight of any targets or goals.

We recommend, however, that any final rule not require companies to disclose “the identity of any board members or board committee responsible for the oversight of climate-related risks” and whether any director “has expertise in climate-related risks, with disclosure detailed enough to fully describe the nature of the expertise.” These two aspects of the proposed requirement are particularly unnecessary given that boards provide oversight and rely on experienced employees or outside advisers for advice on such technical matters. The proposed approach may cause companies to create larger, and possibly less cohesive, boards to the detriment of the company’s investors. In addition, the Commission adopting such requirements would be inconsistent with, and go beyond, the TFCD’s framework for governing climate risk.

3.2 Disclosure Should Address Management’s Role and Not Individual Expertise

The Commission also proposed requiring a company to disclose certain information concerning management’s role in assessing and managing those risks, including the following, as applicable:

- whether certain management positions or committees are responsible for assessing and managing climate-related risks and, if so, the identity of such positions or committees and the relevant expertise of the position holders or members in such detail as necessary to fully describe the nature of the expertise;

- the processes by which such positions or committees are informed about and monitor climate-related risks; and

- whether and how frequently such positions or committees report to the board or a committee of the board on climate-related risks.

Similar to our comments in connection with disclosure regarding the board’s role, we recommend that the required disclosure regarding management’s role follow the TCFD framework more closely by addressing the process and not require disclosure of the relevant expertise of committee members or managers.

Section 4: Risk Management Disclosure

4.1 Companies Should Describe Processes for Identifying, Assessing, and Managing Climate-Related Risks

The Proposal would require a company to describe any processes it has for identifying, assessing, and managing climate-related risks. When describing the processes for identifying and assessing climate-related risks, the company would be required to disclose, as applicable, how it:

- determines the relative significance of climate-related risks compared to other risks;

- considers existing or likely regulatory requirements or policies, such as GHG emissions limits, when identifying climate-related risks;

- considers shifts in customer or counterparty preferences, technological changes, or changes in market prices in assessing potential transition risks; and

- determines the materiality of climate-related risks, including how it assesses the potential size and scope of any identified climate-related risk.

When describing any processes for managing climate-related risks, a company would be required to disclose, as applicable, how it:

- decides whether to mitigate, accept, or adapt to a particular risk;

- prioritizes addressing climate-related risks; and

- determines how to mitigate a high priority risk.

We support the Commission requiring such information following our recommended file and furnish framework. This type of information would help investors evaluate whether a company has implemented adequate processes for identifying, assessing, and managing climate-related risks. It also should allow investors to make better informed investment and voting decisions. We also support companies being required to disclose whether and how climate-related risks are integrated into the company’s overall risk management system or processes. This disclosure should help investors assess how the company handles climate-related risk as compared to other risks.

4.2 Companies Should Provide Disclosure about Transition Plans

The Proposal would require a company that has adopted a transition plan as part of its climate-related risk management strategy to describe the plan, including the relevant metrics and targets used to identify and manage any physical and transition risks and how it plans to mitigate or adapt to any transition risks as part of its climate-related risk management strategy. We support this disclosure as it would inform investors of the nature of the risks and the company’s actions or plans to mitigate or adapt to them. To mitigate any chilling effect mandated disclosure might have on companies’ adoptions of transition plans, however, we recommend that the Commission require companies to provide the information on a comply-or-explain basis.

Section 5: Financial Statement Metrics

5.1 Companies Should Not be Required to Provide Financial Statement Metrics

The proposed amendments to Regulation S-X would require companies to disclose, in a footnote to the financial statements, the material impacts of climate-related events, including severe weather events such as flooding, drought, wildfires, extreme temperatures, and sea-level rise; and transition activities, including efforts to reduce GHG emissions or otherwise mitigate exposure to transition risks. For both climate-related events and transition activities, the footnote disclosures would include financial impact metrics, expenditure metrics, and a discussion of whether the estimates and assumptions that were used to prepare the financial statements were impacted by exposures to climate-related events and transition activities. The proposed disclosures would be provided for the most recently completed fiscal year and for the historical fiscal year(s) included in the financial statements. The disclosures would be subject to management’s internal control over financial reporting and independent audit.

We believe the proposed financial statement metrics will not be useful to investors and we do not support them. First, we believe that the proposed one percent disclosure threshold is too low and risks overloading investors with inconsequential information that will complicate their analysis of the company’s operations and financial condition. Second, we believe the requirement to identify the financial statement impacts of severe weather events and other natural conditions will require companies to make calculations that are highly judgmental and therefore raises comparability concerns (i.e., companies interpreting similar circumstances differently). Finally, the proposed disaggregated line-by-line presentation is inconsistent with the manner in which investors consider and evaluate climate-related events and transition activities. Instead, we believe investors would benefit from the proposed requirements for a more holistic narrative discussion of the effects of climate-related events and transition activities.

Accordingly, we support the proposed narrative discussion of whether and how any identified climate-related risks have affected or are reasonably likely to affect the company’s consolidated financial statements and recommend that it be adopted in lieu of the proposed financial statement metrics. If, notwithstanding our recommendation, the Commission adopts the proposed financial statement metrics, the Commission should require disclosure of financial impacts that are greater than five percent (rather than one percent or greater as proposed).

Section 6: Targets and Goals

6.1 Companies Should be Required to Disclose Information Regarding Publicly Set Climate-Related Targets and Goals

Under the proposal, a company that has set any targets or goals related to the reduction of GHG emissions, or any other climate-related target or goal would be required to disclose the targets or goals, including, if applicable, certain features of the targets or goals, such as the unit of measurement (e.g., absolute or intensity) and the time horizon by which the target is intended to be achieved, and information about its progress toward meeting the target or goal.

We support requiring a company that has publicly set a target or goal to provide information under our recommended file and furnish framework. In contrast, we do not believe a company that has set internal targets or goals should be required to make that information public and provide the proposed information about those targets and goals. It is when a company has made a public commitment that investors are interested in understanding the scope of the commitment and its progress toward meeting it. Therefore, we recommend that any final rule be modified to clarify that it applies only if a company publicly sets a goal or target.

Section 7: Scope of Proposal

7.1 Any Final Rule Should Exclude BDCs and ETFs

The Release proposed requiring companies, including ETFs that are registered only under the Securities Act and business development companies, or BDCs to provide certain climate-related information in their SEC filings.

The Commission asks if BDCs should be excluded from some or all of the proposed climate-related disclosure rules. We recommend that the Commission exclude them from any final rule requirements because they typically do not have physical operations or employees, making the calculation of any GHG emissions wholly unnecessary. We recommend that the Commission exclude ETFs that are registered only under the Securities Act for similar reasons. In addition, the Commission’s recent proposal for enhanced ESG-related disclosures by funds is the more appropriate vehicle for addressing fund disclosures for the benefit of fund investors.

7.2 Smaller Reporting Companies Should Have More Time to Comply

The Release proposed allowing smaller reporting companies (SRCs) more time to provide certain climate-related information in their SEC filings and exempting them from any Scope 3 reporting requirements. We support these aspects of the Proposal. We also support providing emerging growth companies (EGCs) with additional time to comply with any final rules.

In addition, we support the Commission not proposing generally to exempt SRCs or EGCs from the entire scope of the proposed climate-related disclosure rules because climate-related risks may pose a significant risk to the operations and financial condition of smaller companies. At the same time, providing them with more time than other companies to comply with any new requirements could mitigate the Proposal’s compliance burden for smaller companies by giving them additional time to allocate the resources necessary to compile and prepare climate-related disclosures.

7.3 The SEC Should Play a Leading Role in Shaping a Global Baseline for Climate-Related Disclosure

The Commission proposed to require foreign private issuers that file Form 20-F to make climate-related disclosures consistent with those of domestic companies. ICI members are global firms, and, as a general matter, we strongly support consistent requirements being applied to companies, domestic and foreign, to foster appropriate cross-border interoperability. As the SEC recognizes, however, many other jurisdictions have already moved forward with their own climate change disclosure regimes, including the home jurisdictions of some foreign private issuers. Such disclosure regimes may be largely aligned with the Proposal and with certain international standard setter recommendations, like those of the TCFD and ISSB.

We urge the SEC to move forward and prioritize work with the ISSB and other jurisdictions towards developing common global baseline standards in order to mitigate fragmentation and provide investors with useful and generally consistent disclosure. In this regard, we encourage the SEC to do its part, in concert with market participants and regulators around the globe, to permit foreign private issuers to fulfill their climate-related disclosure obligations by complying with the ISSB standards.

Section 8: Compliance Periods

8.1 Companies Should be Required to Provide Certain Newly-Required Disclosure in Accord with the Proposed Timelines

The Commission provides a series of proposed compliance dates for companies to provide any newly-required climate-related disclosure in SEC filings. We expect that companies will be able to comply with the Commission’s proposed timeframes if any final rule reflects our recommendations. If the Commission goes forward with requiring financial statement disclosures in annual reports, we recommend that the Commission extend the compliance date for this aspect of any final rule for at least an additional year.

The complete publication, including footnotes, is available here.

Print

Print

One Comment

The ICI’s comment letter to the SEC’s proposed Climate Change Rule was clear, concise, critical [in some areas] and solutions oriented. I was very impressed how helpful it was, beginning with the Executive Summary, to §3: Governance Disclosure, and §4: Risk Management Disclosure regarding the “File and Furnish” framework. Now contrast the ICI’s useful comment letter to the SEC [summarized above], to the U.S. Chamber of Commerce comment letter which reads more like an Answer to a Complaint in civil litigation and not helpful but rather simply argumentative. If the SEC wants to get things done, the ICI roadmap is a clear winner.