Delta Air Lines and Aeromexico implemented their long-planned Joint Cooperation Agreement (akin to a joint venture, but not called such for some esoteric reason) today. The move allows the two carriers to coordinate on pricing, schedules, operations and other factors to reduce costs and increase profits. The press release issued talks about some of that coordination while also trying to sell it as an increase in competition in the market, a rather baffling contradiction of thoughts.

New @Delta/@Aeromexico Joint Cooperation Agreement (not JV!!, except it basically is) goes live. Cooperation equals competition?!?!? #PaxEx pic.twitter.com/ofXDqmd210

— Seth Miller (@WandrMe) May 8, 2017

Here’s what the cooperation looks like, according to the companies:

This partnership will allow the carriers to expand competition and serve new destinations. Additional service and more convenient schedules will benefit customers of both companies, while deepening the relationship the airlines have shared for more than 20 years.

Starting today, Delta and Aeromexico will work together to enhance the customer experience on the ground and in the air by investing in airport facilities, boarding gates and lounges. The two companies will also be able to implement joint sales and marketing initiatives in both countries.

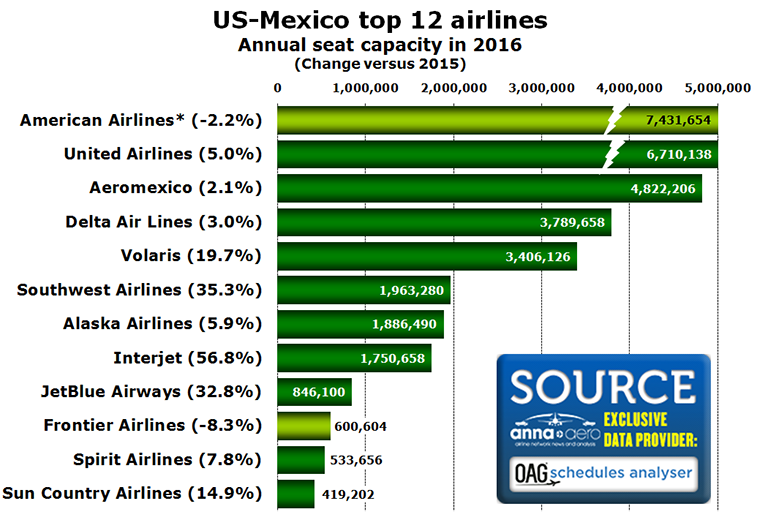

How does this translate into increased competition? The airlines argue that more markets will be served with better connecting flow, allowing the new operation to compete against American Airlines and United Airlines in more markets. The counter argument is that fewer airlines will be competing overall in many markets so the options for consumers does not really expand overall. Some passengers in some markets will undoubtedly see better deals while in other (typically larger, with more demand and passengers flying trunk routes) markets that won’t.

Most interesting to watch will be the impact on smaller transborder players, including Southwest Airlines, Alaska Airlines, Interjet and Volaris. The combined “big three” will now control approximately two thirds of the total transborder market, leaving a decent share still up for grabs. If Delta and Aeromexico do get the consolidation they want in many markets, however, competition will most definitely be squeezed.

The two carriers also point out the tightly intertwined ownership structure of the two, with Delta controlling a massive portion of Aeromexico’s shares:

In March 2017, Delta completed a cash tender offer to acquire 32% of Grupo Aeromexico. With the completion of the tender offer, Delta owns 36.2% of the outstanding shares of Grupo Aeromexico and holds options to acquire an additional 12.8% for a total of 49% of the outstanding shares of Grupo Aeromexico.

In the infographic Delta produced for the event it suggests that the 49% ownership stake is already in place and that airport teams are colocated at JFK. Aeromexico remains in Terminal 1 while Delta is in Terminals 2 & 4 so unclear what any of that really means for passengers.

Definitely mixed feelings about this as a consumer given the history such joint operations have had in the TATL and TPAC markets. Will this one be different? Will the small divestitures of slots at MEX and JFK really open competition up for the smaller players? Alas, I’m mostly betting “no” on that.

Never miss another post: Sign up for email alerts and get only the content you want direct to your inbox.

One Comment

Comments are closed.