Todd Sirras is Managing Director, Justin Beck is Consultant, and Austin Vanbastelaer is Senior Consultant at Semler Brossy LLP. This post is based on a Semler Brossy memorandum by Mr. Sirras, Mr. Beck, Mr. Vanbastelaer, Alexandria Agee, Sarah Hartman, and Kyle McCarthy.

Breakdown of Say on Pay Vote Results

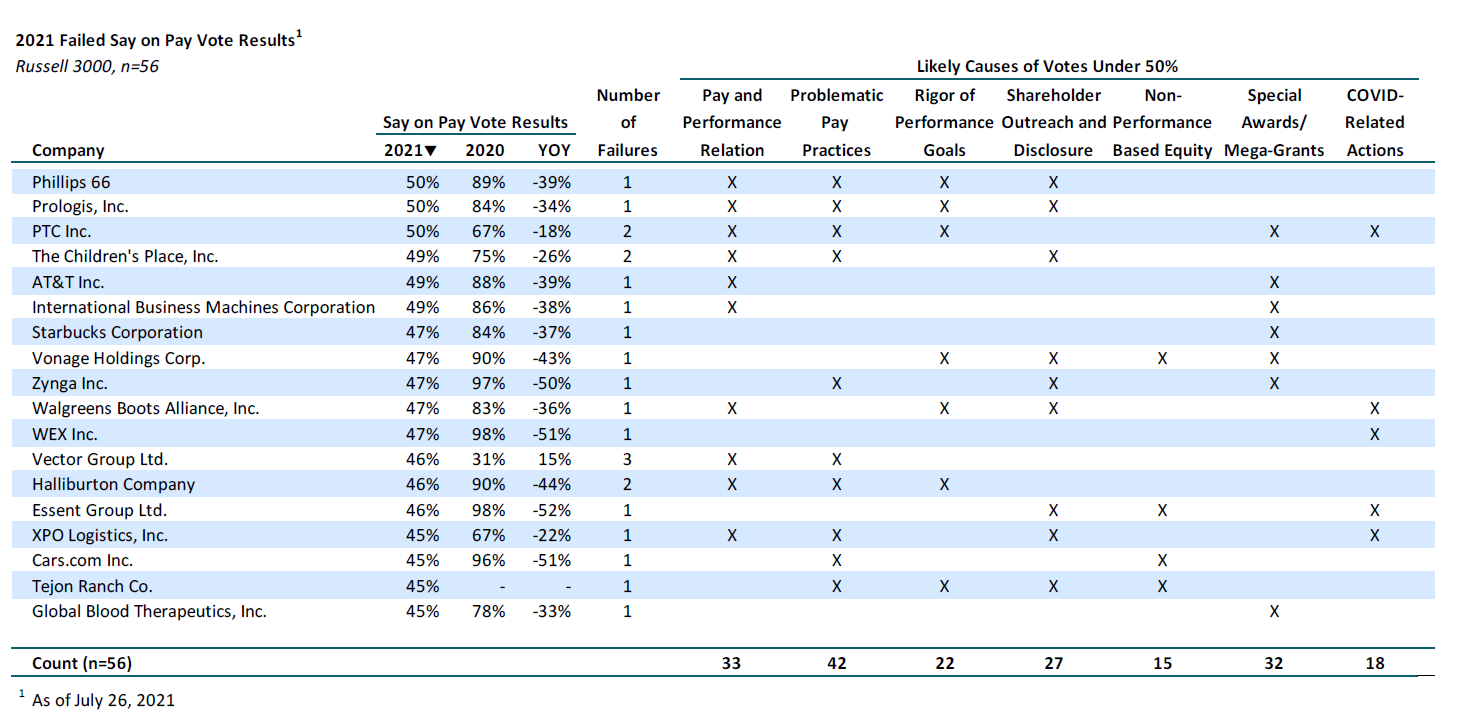

56 Russell 3000 companies (2.8%) failed Say on Pay thus far in 2021, 15 of which are in the S&P 500. The S&P 500 failure rate is currently 3.7%. No companies have failed since our last report. Our evaluation of the likely reasons for failure indicates that 18 of the 56 failed Say on Pay votes are due in part to Covid-19 related actions.

Say on Pay Observations

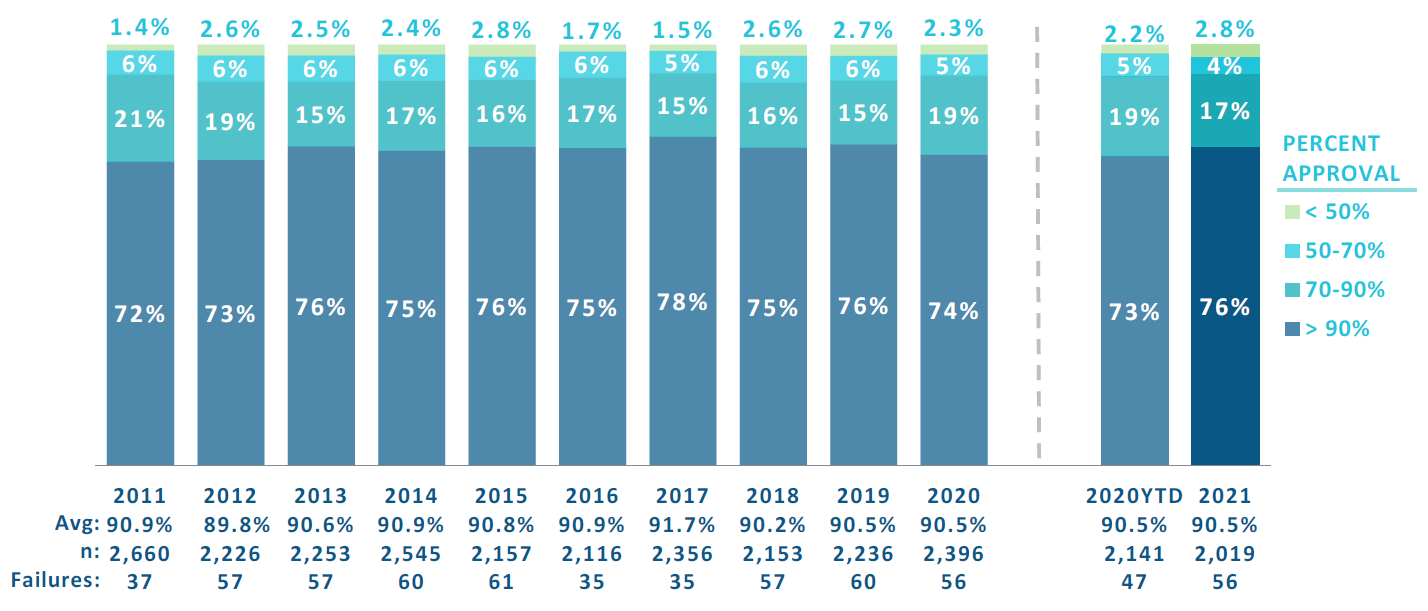

- The current failure rate (2.8%) remains above the failure rate at this time last year (2.2%) and is slightly lower than our June 24th report (2.9%)

- The percentage of Russell 3000 companies receiving greater than 90% support (76%) is greater than the percentage at this time last year (73%)

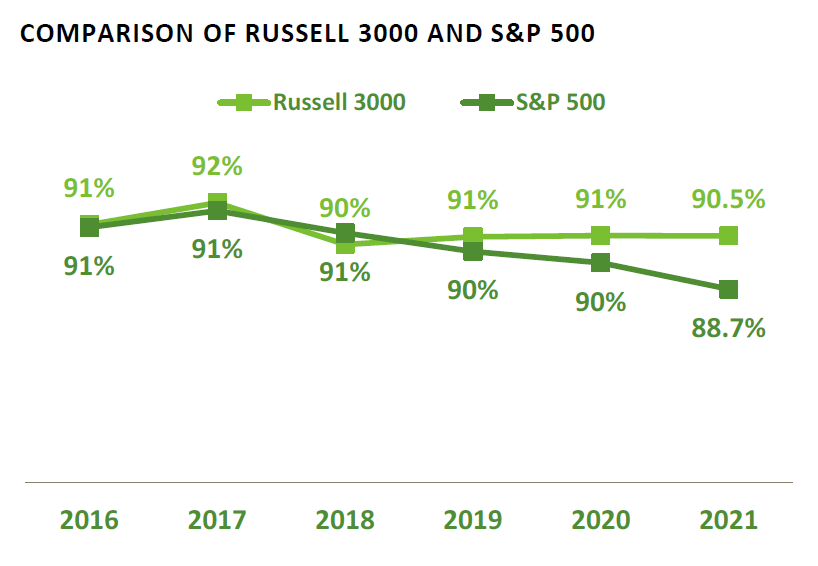

- The current average vote results of 90.5% for the Russell 3000 and 88.7% for the S&P 500 are below the average vote results at this time last year

- The average Russell 3000 vote result thus far is 180 basis points higher than the average S&P 500 vote result, which is 80 basis points larger than the spread at this time last year

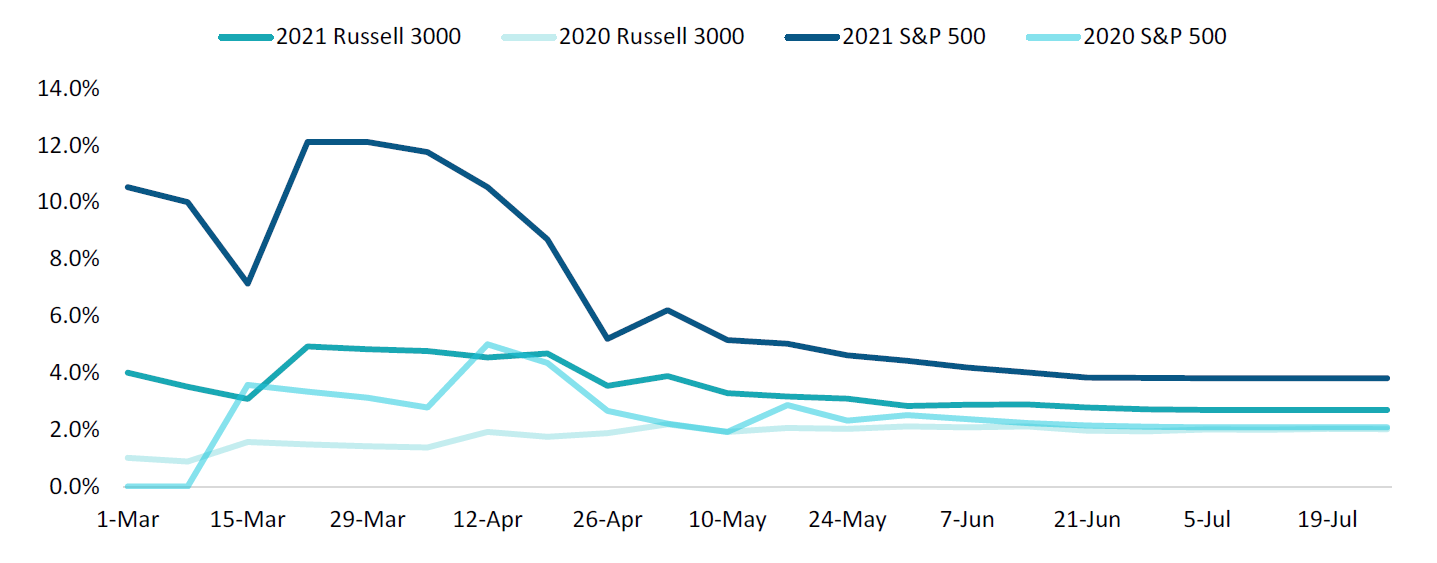

Russell 3000 vs. S&P 500 Average Failure Rate by Week

Failure rates started at significantly higher levels through mid April and have declined as the proxy season has progressed. The Russell 3000 rate declined from 4.0% among early filers down to 2.8% currently, while the S&P 500 rate declined from 10.5% down to 3. 7% over that period. The week to week decline in the failure suggests that investors have made intra-year adjustments in their evaluation approach and companies that have filed proxies more recently have improved disclosure. That said, the S&P 500 failure rate remains historically high.

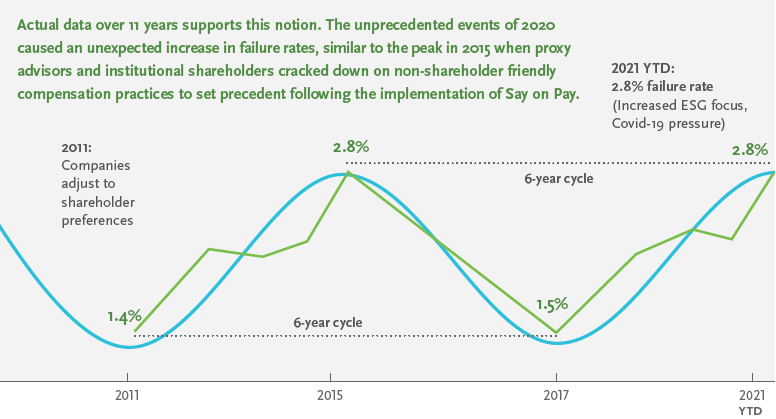

Russell 3000 Cycle of Say on Pay Failure Rate Over Time

The Russell 3000 Say on Pay failure rate has fluctuated in a wave pattern year to year since 2011. The 2.8% failure rate this year matches the previous highest rate observed (2015). Our evaluation of likely reasons for failure suggest this spike is due largely to the number of companies making Covid 19 adjustments and the more general trend of increased investor scrutiny.

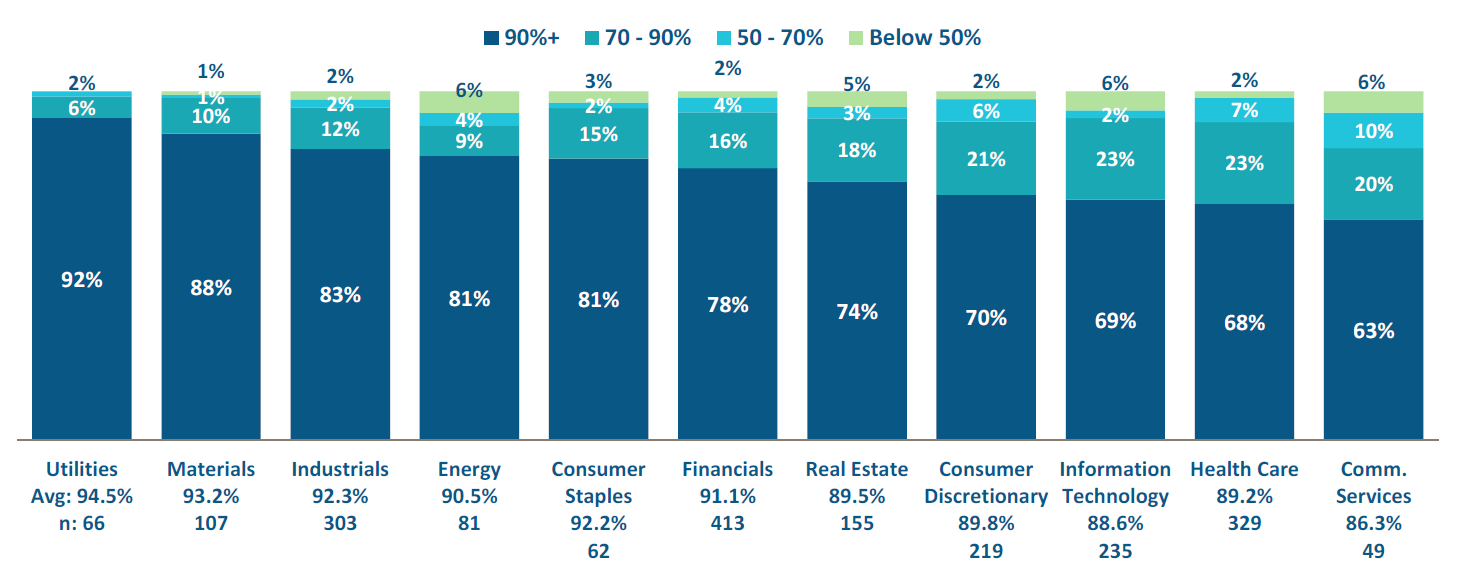

Say on Pay Vote Results by GICS Sector

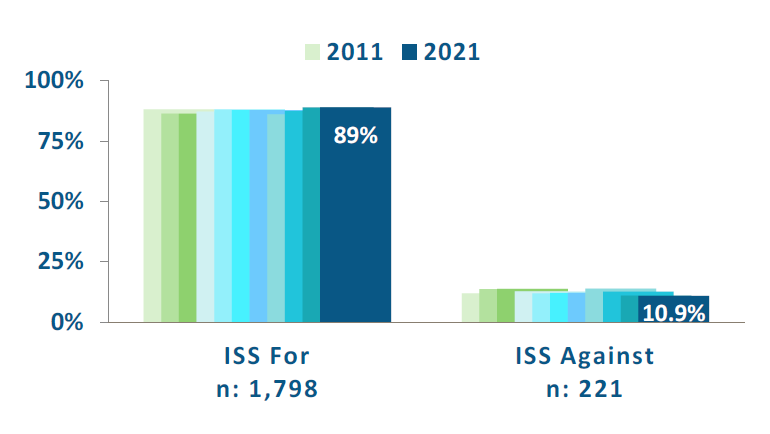

ISS Recommendation Rate

- 10.9% of companies thus far have received an “Against” recommendation from ISS which is equivalent to the 2020 rate

- The current average Say on Pay vote result for companies that received an ISS “Against” recommendation is 31 percentage points lower than for companies that received an ISS “For” recommendation, which is at the top of historical average range of 24 to 32 percentage points

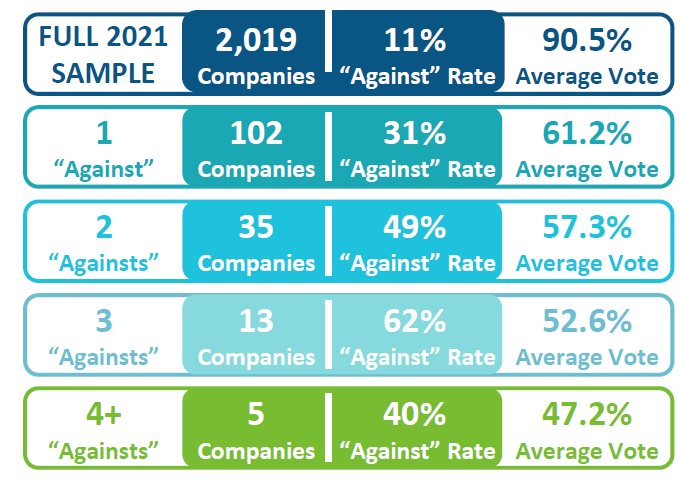

ISS “Against” Rate and Vote Impact of Multiple Consecutive “Against”

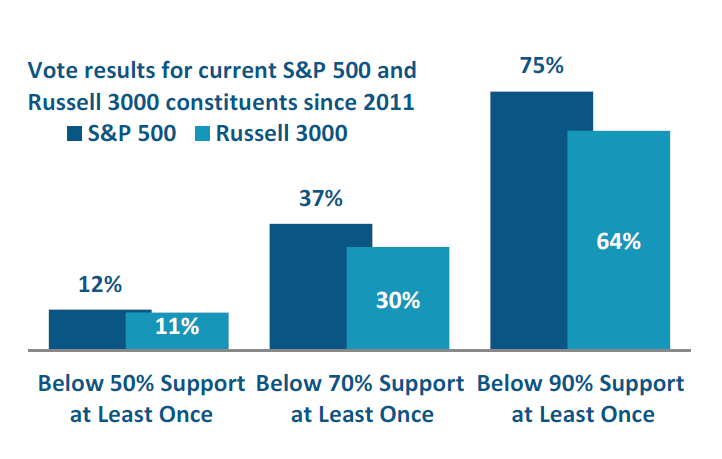

Likelihood of a Low Say on Pay Vote

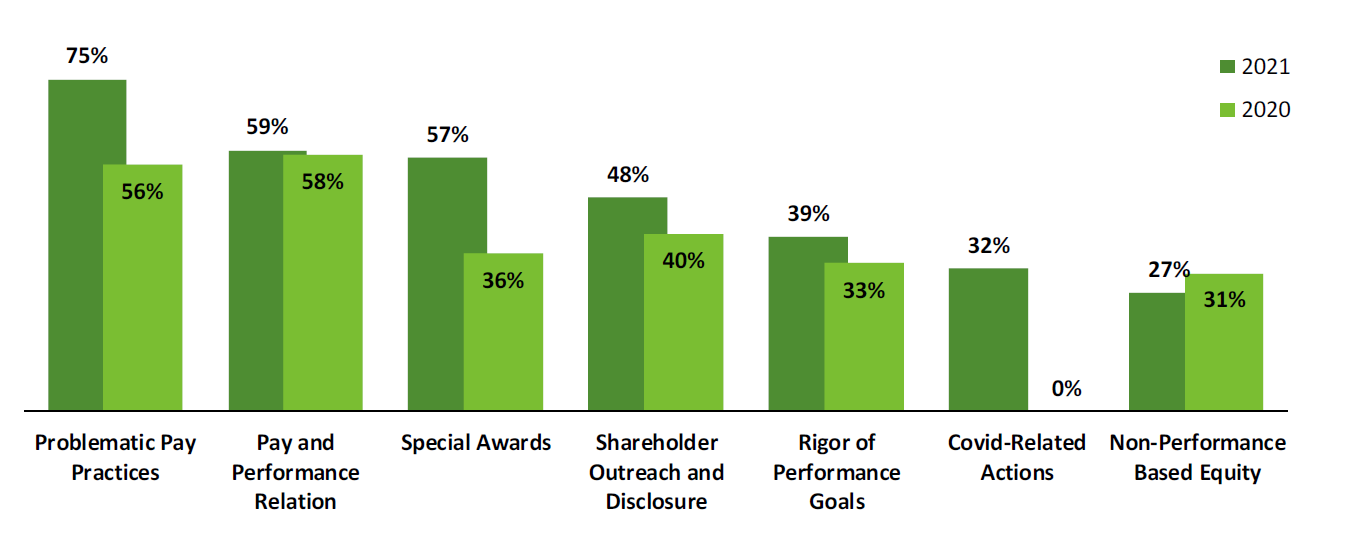

Russell 3000 2021 vs. 2020 Failure Reasons

A significant number of failures thus far in 2021 have been due to a misalignment between pay and performance (59%), and pay practices assumed to be problematic (75%). 32% of failures have been due to Covid-related actions; and we note that there has been a higher prevalence of special awards contributing to failures, though these are not always explicitly disclosed as being related to Covid.

Print

Print