Scott Allen and Laura Wanlass are Partners and Jacob Harden is a Senior Consultant at Aon plc. This post is based on their Aon memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

As more companies provide required disclosure of their human capital management following a new SEC rule in 2020, we’re getting a more complete picture of disclosure trends and the topics that companies are providing details on.

It’s been less than a year since a new disclosure rule by the Securities and Exchange Commission (SEC) took effect, which required companies to provide additional detail in their 10-K reports around their human capital management (HCM). The issue is a hot topic for institutional investors and their advisors, particularly since the COVID-19 pandemic, and many of them supported the SEC rule.

As an update to our previous article on the first 100 10-K disclosures, this post includes an analysis of 725 companies who have filed since then—providing a more complete picture of disclosure trends and hot topics in HCM.

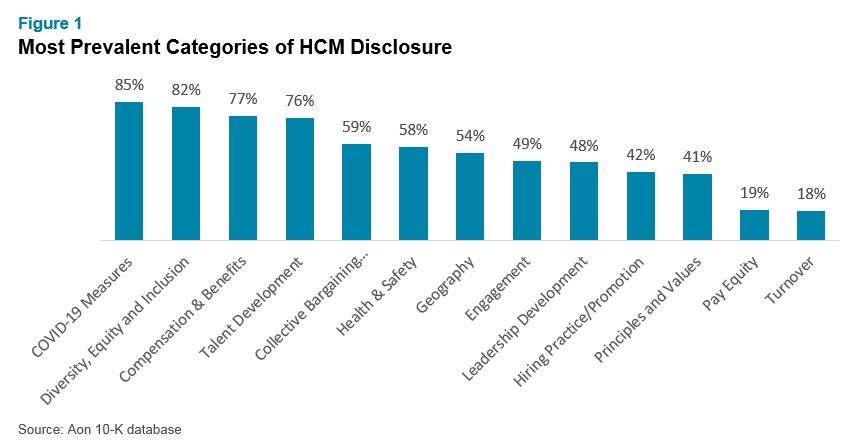

Quantitative and qualitative disclosures based on the new rule fit primarily into the 13 categories listed below. Using these categories, we calculated the prevalence of each along with the type of disclosure, with additional breakouts by industry.

- Geography (distribution of workforce)

- Turnover and attrition

- Diversity

- Hiring and promotion practices

- Health and safety

- Leadership development

- Compensation and benefits

- COVID-19 health measures

- Talent development

- Pay equity

- Engagement

- Collective bargaining agreements

- Principles and values

Key Findings

Overall, there was an increased robustness in both the number of items discussed and the prevalence of categories disclosed from our original article in January 2021 until now. The most prevalent categories are COVID-19 safety measures; diversity, equity and inclusion; compensation and benefits; and talent development. There is a big drop off in the prevalence of the other categories after those four, as shown in Figure 1.

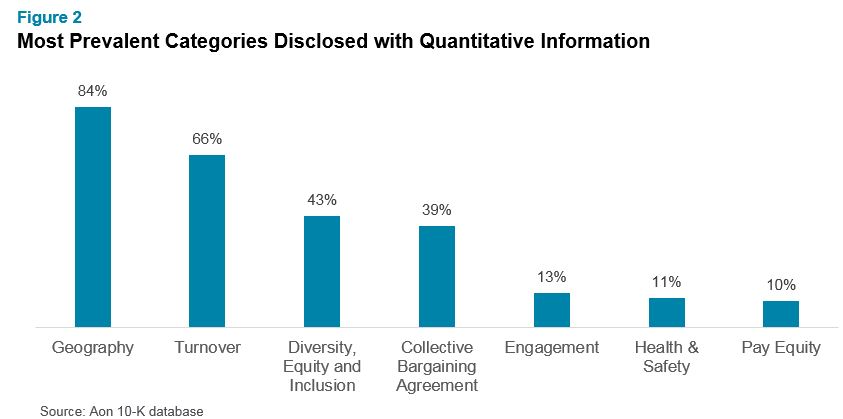

Topics such as geography; turnover; and diversity, equity and inclusion have high instances of quantitative disclosures. Categories shown in Figure 2 were the only ones with quantitative disclosure.

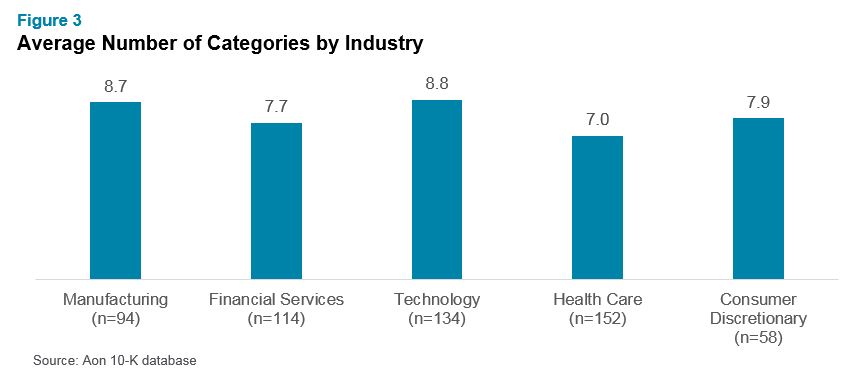

The average number of categories discussed was consistent across industries, with each industry discussing roughly eight topics. This includes information on number of employees and geography.

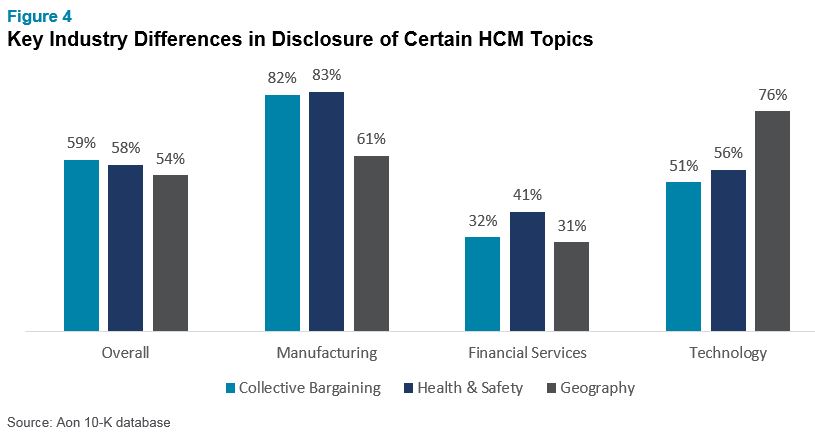

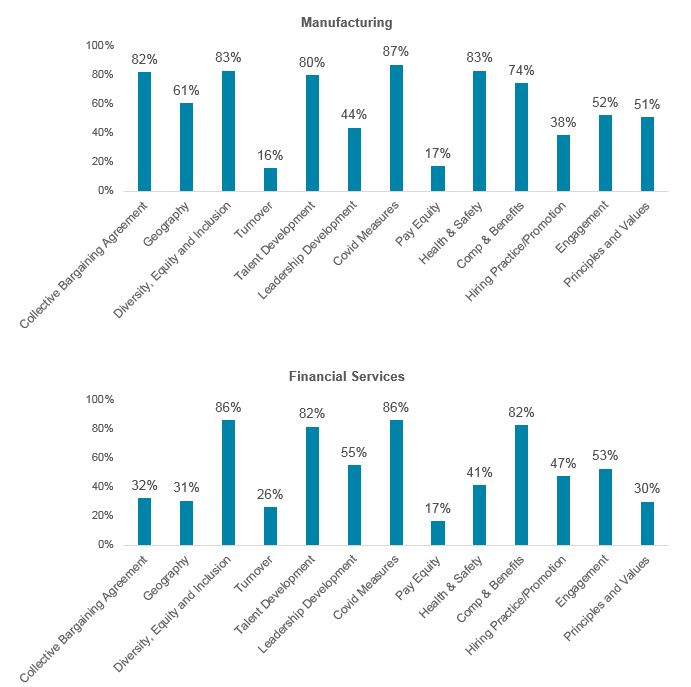

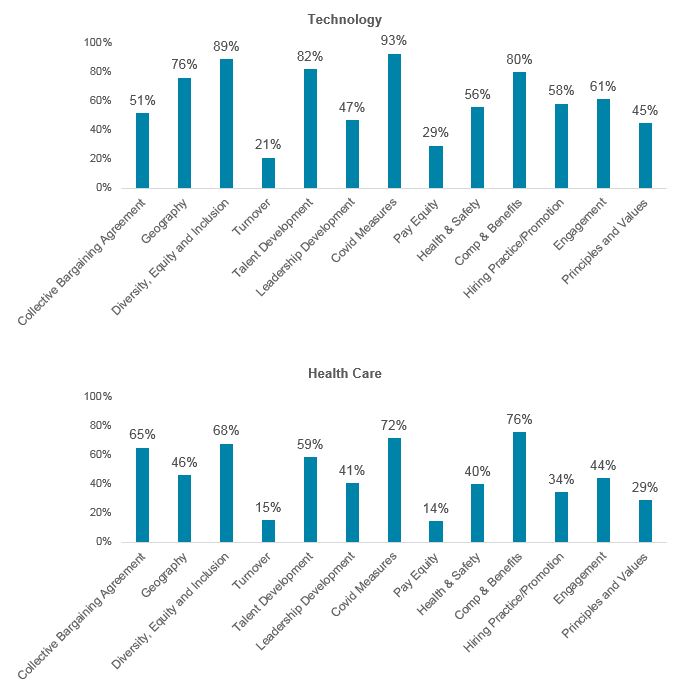

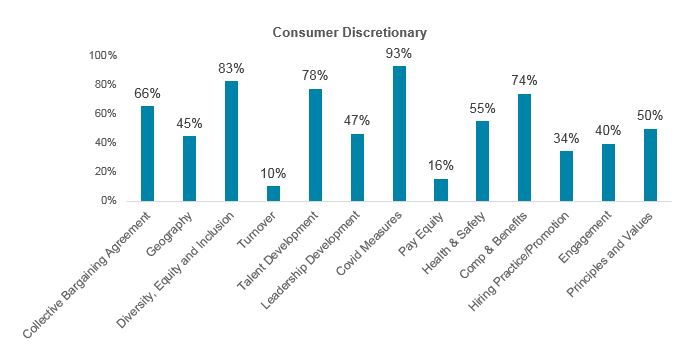

Certain HCM topics will impact industries differently, which is reflected in the types of disclosure. For example, manufacturing firms were most likely to include disclosure around collective bargaining agreements while technology companies were more likely to disclose information around geography given a more dispersed and now remote workforce, as shown in Figure 4.

Next Steps

The most compelling examples of HCM disclosure so far are organizations that provide clear information that strikes a balance between brevity and detail. We believe stakeholders will be less focused on the length or graphics of the disclosure and more on whether it conveys a compelling message that the company is tracking and monitoring topics of HCM that are relevant to its business and industry.

It’s also important to keep in mind that while complying with the SEC rule is top-of-mind for issuers, companies shouldn’t ignore the larger picture: Investors, proxy advisors, employees and other key stakeholders are increasingly interested in how companies are managing their human capital and measuring success against any goals. Businesses need a plan for how they will proactively track, measure and communicate HCM over time. We expect disclosures to evolve and become more detailed in the coming years.

In fact, many companies are taking stock of where they fall relative to industry peers on key quantitative metrics and practices to determine if they are aligned with market practice or are an outlier. This analysis is a helpful next step to not only determining if there are action items that need to be addressed within a human capital management strategy, but also whether qualitative context needs to be provided for any statistics, goals or metrics provided in the Form 10-K disclosure.

Appendix: Prevalence of HCM Categories by Industry

Print

Print