Dan Romito is Consulting Partner and Addison Holmes is an Associate in ESG Strategy & Integration at Pickering Energy Partners. This post is based on their Pickering Energy Partners memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here); and Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Max M. Schanzenbach and Robert H. Sitkoff (discussed on the Forum here).

Executive Summary

In this post, we analyze how the language used in the capital markets is evolving as a result of trends in ESG investing. We suggest that traditional index investors can no longer be described as passive, due to their active engagement with corporates. Further, we analyze how activist engagements are beginning to hinge more and more on ESG themes. We then describe the dependence of ESG analysis on vast sets of unstandardized data. Finally, we contend that management teams must have a strategy around the data they disclose. We believe it is imperative for corporates to evolve alongside the changing tide emerging within the capital markets.

We recommend the following seven action items for evolving with the markets:

- Take time to understand the data already being utilized by ratings providers along with the outputs reflected in investment analysis (i.e., SSGA R-Model, Blackrock Aladdin Climate, etc.)

- Ensure ESG disclosures are on topics material to economic reality rather than those that tell an easy marketing story—PR marketing and Investor marketing is analogous to Oil and Water

- The corporate sustainability report as it is known today is a great start, but it represents only the second inning of the ballgame—evolution is required to take control of the narrative

- Recognize that commitment to one framework is not enough – investors treat frameworks and ratings as a mosaic and use proprietary methodologies to piece together and measure differentiators

- Realize that ESG disclosures in their current form do not provide the underlying context required to properly value intangibles, implying a disconnect in firm value

- Understand that replicating peer efforts does not provide a unique perspective and in most cases compounds the “echo chamber” concern, especially at the board level

- Invest in a comprehensive cybersecurity program, as it is critical both to financial and to ESG performance, and is probably one of the next “shoes to drop”

“We can only see a short distance ahead, but we can see plenty there that needs to be done,”

– Alan Turing

The pursuit of long-term capital can often feel like a continual attempt at deciphering a never-ending array of complex codes. Attracting incremental capital requires persistence, patience and managing a variety of ever-changing complicated variables. Change, and certainly the velocity of change, is not going to decelerate anytime soon.

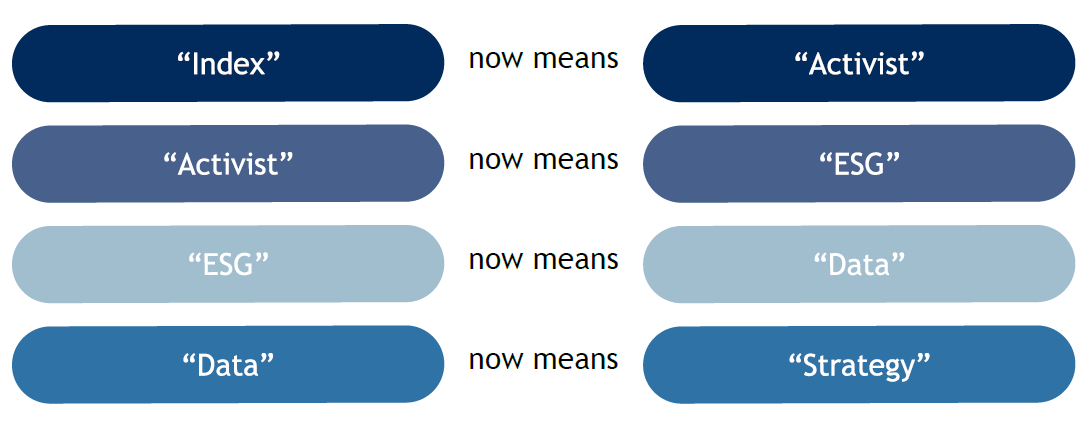

If management teams wish to remain competitive in their pursuit of capital, they must accept the revision of very conventional investment terms. The winning cipher in solving the capital raising riddle begins with the redefinition of four key terms:

Historically, conventional investment concepts have always taken on different meanings as technological innovation, globalization, and generational perspectives evolve. As fads transform into mainstays, the interpretations of investment vernacular simultaneously change as well. “IBM” is no longer synonymous with a literal business machine. In fact, the term “business machine” sounds more hilarious than outdated. “Stock settlement” provides another classic example—the term remains in circulation today, but settlement happens online rather than by courier. The concept of physical transfer of stock today sounds farcical, despite being commonplace only a few short decades ago.

We entered this current revolution with the conventional notions which once defined index management, shareholder activism, ESG and financial data. These concepts are not, however, immune from redefinition. While these keywords have not changed, their underlying conceptual definitions are continuously evolving. Management teams, both private and public, who strategize based upon outdated concepts will unilaterally fail to secure incremental quality capital. Strategy, as the maxim emphasizes, should be predicated on the anticipated future, not the past. In this future, it is vital for both management teams and boards to understand the new guiding principles of index managers, shareholder activism, ESG and data management.

Redefinition 1—“Index” Now Implies “Activism”

Traditionally, ongoing portfolio construction for index managers has generally followed a rules-based approach. The original intent of the index was to replicate a given benchmark without subjective bias. The S&P 500 is probably the best example of the traditional index—a given set of rules that identifies the 500 largest U.S. publicly traded companies based on float-weighted market cap. Index managers correspondingly replicated the simple composition of the index while simultaneously charging fees for a fraction of active management fees.

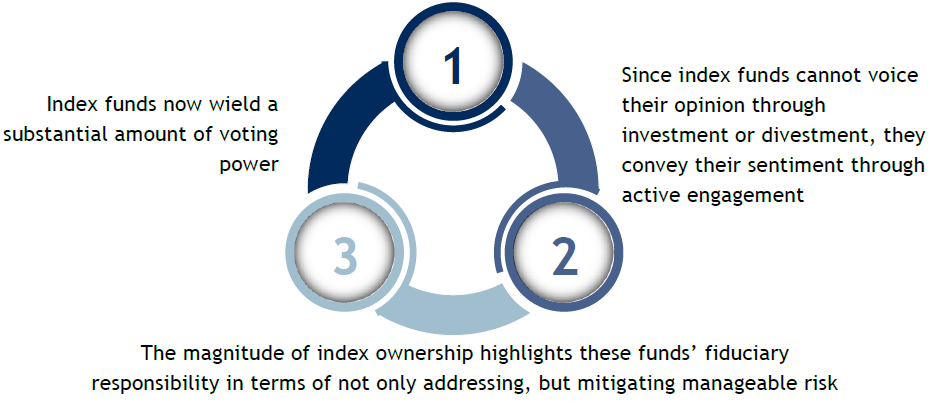

The immense growth of index funds over the last decade, however, has dramatically transformed the guiding subtleties of “passive” investing in three distinct and complex ways:

The preeminent example of these trends can be found with Blackrock’s stance on a variety of issues, particularly climate change. That said, regardless of the specific topic, index has now instituted subjective perspectives into index management, most notably reflected in Blackrock CEO Larry Fink’s annual letters to CEOs. Mr. Fink continues this theme of connecting climate risk and financial risk within 2021 Letter to CEOs. More importantly, whereas an index manager’s duration was solely associated with the long-term, Mr. Fink and Blackrock are conveying a distinct sense of urgency:

Initially, it may not be immediately intuitive that an index manager is leading the charge for companies to evolve quickly. The composition of the index will inherently take care of itself as issuers compete within their respective sectors. Conceptually, the reconstitution of the index is a function of the market punishing bad actors and rewarding innovators, so why would an index manager interfere? We feel this is not necessarily the correct perspective when judging index managers. Perhaps the more appropriate question is why would any investment manager, regardless of mandate or style, sit back and allow any anticipated adverse catalyst or risk within the portfolio to materialize?

“Companies that are not quickly preparing themselves will see their business and valuations suffer, as the same stakeholders lose confidence that those companies can adopt their business models to the dramatic changes that are coming” [1]

In most cases, action by dissatisfied traditional active managers comes in the form of divestiture. In the most extreme examples, shareholder activists enter the picture. The challenge for index managers, however, is the rules-based approach to portfolio construction. Index managers typically screen by sector, market cap and region, not the underlying competitive fundamental characteristics. By definition, index does not necessarily explicitly price in future potential or anticipated risk. They must also own certain equities even if they do not like them. Accordingly, the growth of index management has indirectly allowed a false sense of security to cultivate among corporates, especially boards. Management teams commonly believe that because these shareholders are passive, there is no need to engage or advance disclosure policies. Or even worse, there remains a common misnomer they are not as important to engage.

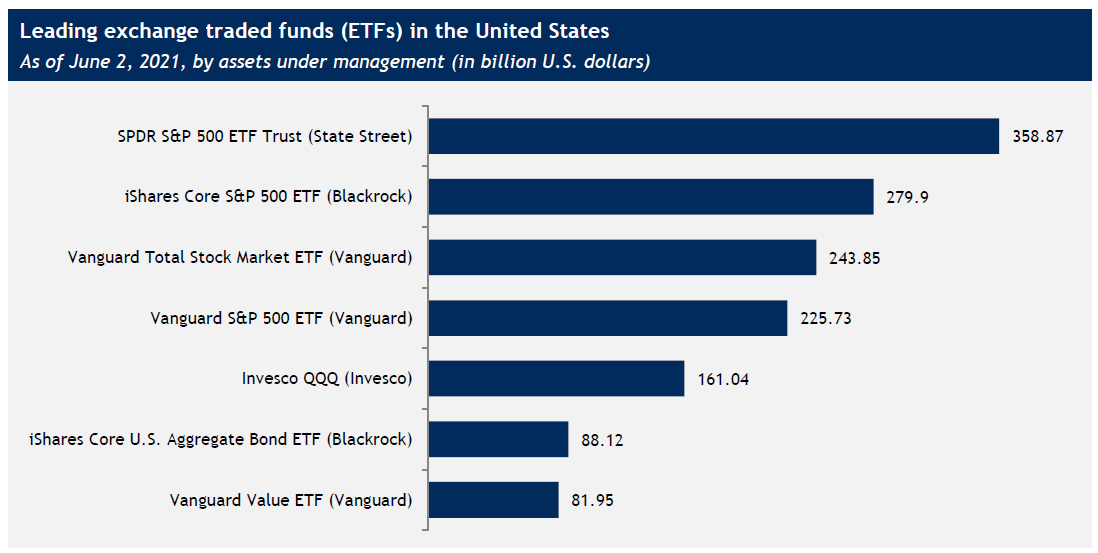

Source [2]

Engagement by index investors marks a preemptive attempt to not only mitigate risk but, in recent examples like Exxon, unlock untapped value as well. To this day, “index” and “passive” are typically used interchangeably. We feel the interchange of these terms is obsolete and such considerations are now fundamentally incorrect. Using proxy voting as an instrument to express displeasure and enact change is not passive—it is shareholder activism. In fact, when we review empirical analyses studying traditional shareholder activists from ten years ago, particularly Icahn and Ackman, we see eerily similar themes to those of index investing today. In a post on the Forum back in 2014, Matteo Tonello observes the following:

“The value of assets managed by activist hedge funds has increased dramatically in recent years. A study by eVestment documents a seven-fold increase in the assets managed by such funds from $23 billion in 2002 to an estimated $166 billion in early 2014. The momentum continues, with total new capital inflows into activist funds reaching $6 billion in the first quarter of 2014, which represents approximately 30 percent of all inflows into event driven funds.

According to eVestment, activism continues to be among the best-performing primary fund strategies, posting returns of nearly 10 percent since October 2013 and 18 percent for the year. The number of shareholder activist events has also increased—from 97 events in 2001 to 219 events in 2012. Those trends have led some observers to characterize activist hedge funds as the “new sheriffs of the boardroom.” [3]

As with traditional activism in the early 2010s, index equity under management has experienced incredible growth, displays notable returns, and as evidenced by various publications including Mr. Fink’s CEO letters, acts as “the new sheriffs of the boardroom.” Over the last five years, the emergence of the Big Three (i.e., Blackrock, SSGA, Vanguard), along with the larger state pensions like CalSTRS and CalPERS (also generally considered “passive”), resulted in a unique power shift, in both assets managed and voting authority.

Redefinition 2—Activist Now Implies ESG

Vanguard has also incorporated an activist-like perspective on a variety of social and environmental topics. Their climate change policy reflected within their “Say on Climate” program reinforces the “new sheriff” mentality. John Galloway, Vanguard’s Global Head of Investment Stewardship echoes the climate stance conveyed by Blackrock:

Vanguard Insights on Evaluating Say-On-Climate Proposals

“Climate change represents a profound, fundamental risk to investors’ long-term success and has the potential to materially affect companies across many sectors.

Our approach to evaluating climate-related proposals is grounded in our fiduciary duty to safeguard and grow our clients’ assets.

Vanguard expects boards to effectively oversee material climate-related risks, and to disclose those risks using widely recognized investor-oriented reporting frameworks.” [4]

Rather than relying solely on market cap, sector or region, the notion of risk-adjusted return has evolved for the index manager. Today, right or wrong, the general consensus among asset owners feels financial risk is increasingly influenced by climate risk considerations. The shift in mindset is exemplified by CalSTRS’ ongoing reported frustration with Exxon.

Like the traditional activist, CalSTRS took an almost identical set of steps throughout the engagement process. Back in January 2020, CalSTRS outlined their respective “Green Initiative Task Force.” Among other considerations, they explicitly identified climate risk and ESG as primary motivating factors within their engagement process:

CalSTRS Green Initiative Task Force Annual Report

“Consistent with CalSTRS’ fiduciary responsibility to our members, the Teachers’ Retirement Board board has a responsibility to ensure the corporations and entities in which we invest strive for long-term sustainability in their operations in order to achieve the long-term rate of return the fund needs to meet our obligations to our members. To help manage these risks, the board developed its Investment Policy for Mitigating Environmental, Social and Governance Risks.Climate change risk factor: An investment’s long-term profitability from inadequate attention to the impacts of climate change, including attention to relevant climate policy considerations and emerging climate risk mitigating technologies.

This policy identifies 25 ESG-related risks that staff and partners are to consider when making investment decisions. The policy also provides procedures for the Investments Branch staff, the chief investment officer and the Teachers’ Retirement Board Investment Committee to follow when faced with a decision or other activity that potentially violates the policy. The procedures call for a thorough staff analysis of the potential ESG violation and its ramifications to the Investment Portfolio as well as disclosure to the board as to the findings of the investigation and analysis”. [5]

Throughout the activist engagement with Exxon, CalSTRS provided some of the needed muscle to enact the resulting change. Based on a recent article release by Bloomberg, it is clear CalSTRS no longer associates their approach as passive or index. [6]

Instead, their efforts are self-defined as “activist stewardship.” Simply put, the days of index implying passive are over, and the complexity dictating index management are increasingly more complex.

Index funds now carry immense power and influence and as they pursue additional clarifications on anticipated or perceived risk, they are not at all afraid to put their strength on display. Above all, ESG has evolved as the mechanism which not only pinpoints perceived structural deficiencies, but also the underlying justification for entering an engagement. Further, from a practical standpoint, there is not an activist on the plant who would engage a company who did not think there could be untapped value to unleash. It is also in the best interest of the index manager to convey support to activist engagements since they remain “stuck” with equities anyway. These are economic considerations and opportunities which can be better understood when the ESG perspective complements fundamental assessment, investor messaging and competitive evaluation.

Redefinition 3 – ESG Now Implies Data

As W. Edwards Deming famously stated, “Without data, you are just another person with an opinion,” which perfectly justifies the underlying evolution of ESG messaging.

To borrow from the cliché, good policy requires good data and good data fuels good decisions. [7] Data management is critical to management teams attempting to integrate ESG in their corporate strategy. Engine No. 1’s investment presentation explicitly emphasized “low carbon investment as a share of capital expenditure” to bridge an ESG perspective to an influential fundamental. [8]

Engine No. 1 also stressed emission intensity projections and utilized that perspective to criticize management’s capital deployment strategies. Data without context, as the saying goes however, is not adequate to satisfy the demands of investors. Data also does not imply superlatives. In the context of investor messaging, those two concepts are mutually exclusive. Understanding data complexity requires an evaluation of the overall data ecosystem, which is now littered with a variety of ESG-focused data points and methodologies.

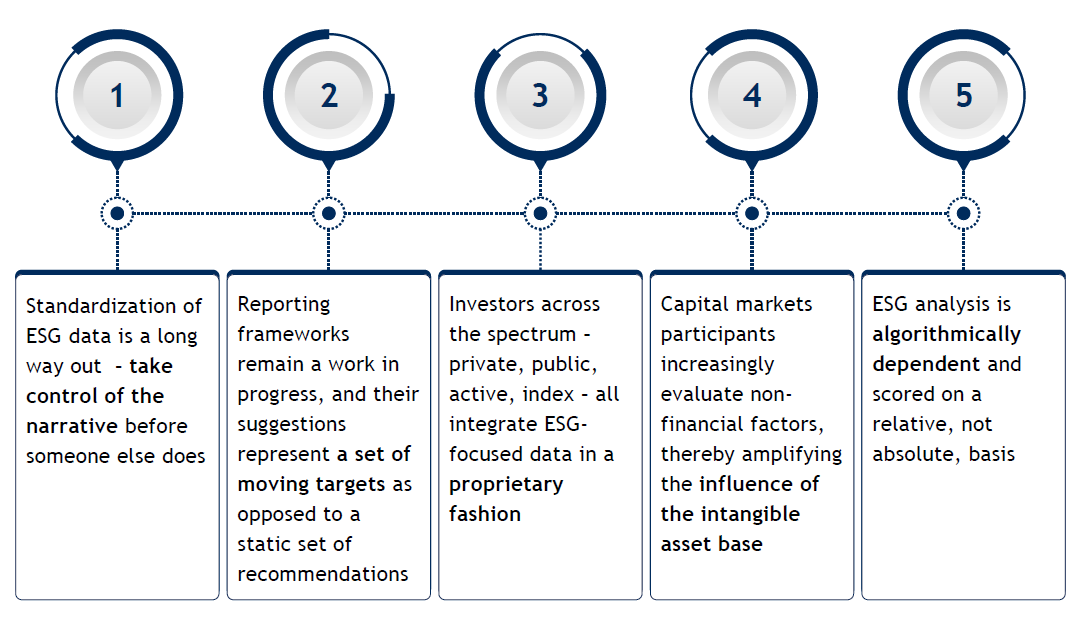

Like the conventional index mentality, what we refer to as “algorithmic literacy” is traditionally linked to quantitative/passive capabilities. This misconception needs to end since algorithms display broad implications regarding the accuracy, interpretability, and utility of ESG data. Armies of analysts are not searching the public domain in pursuit of ESG data points. Algorithms are increasingly relied upon to aggregate sought after non-fundamental data—they are cheaper and work longer hours. We feel the competitive landscape managing the ESG data ecosystem currently consists of several actors jockeying for market share. As a result, the data is unstandardized, methodologies are relatively opaque, and scores are inconsistent. In fact, there remains an incredibly low correlation among ESG scores and ratings. [9]

According to CFA UK, there exists about a 30% to 45% correlation among the top providers. [10] Inherent biases exist in these unique and opaque methodologies. In other words, a set of humans are laying out a set of unique rules that not only set out to aggregate data, but to differentiate the data as well. The process is not quantitative—those actions represent conscious action geared more towards competitive differentiation as opposed to empirical relevance. Ignoring the scores or marginalizing their influence is unwise. Additionally, outside of the ratings, the data analytics capabilities are also becoming more complex.

Blackrock recently introduced a climate change scenario platform that includes Baringa Climate Change Scenario Model which is an enhancement to their existing Aladdin platform. BlackRock originally began developing the Aladdin Climate platform “to fill a void in climate risk analytics by creating technology to help clients better understand and mitigate the financial impacts associated with climate change on their portfolios.” [11] The Aladdin platform and is used by BlackRock’s Financial Markets Advisory (FMA) group to deliver sustainability advisory services to clients. It measures both the impacts of physical risks, like extreme weather events, and transition risks—such as policy changes, new technology, and energy supply—at the financial instrument and portfolio levels.

As Blackrock publicly notes, “The new long-term partnership is a significant milestone for both firms, as they collaborate to set the standard for modelling the impacts of climate change and the transition to a low carbon economy on financial assets for investors, banks and other clients.” [12] In terms of strategic directive, the press release announcing the data indicates the distinct evolutionary bridge existing between ESG and data:

“Climate change is the number one challenge and opportunity of our generation. Having developed the leading Climate Change Scenario Model, we are excited to partner with BlackRock to accelerate the adoption of this solution by organizations across the globe. The integration of Baringa’s Climate Change Scenario Model into BlackRock’s Aladdin platform will inform the reallocation of capital across the global economy, accelerating the transition to net zero.”

Because of the limited overlap between frameworks and data providers, there is not just one source leveraged universally by investors. Instead, investors are coming up with proprietary ways to combine ESG ratings from providers, ESG frameworks, and firm-specific methodologies to generate proprietary ESG evaluations or scores. State Street’s R model is the quintessential example of this. Fueled by Sustainalytics, Vigeo-Eiris, ISS-ESG, and ISS-Governance data [13], State Street implements a diverse set of datapoints within a proprietary model to attain a more accurate depiction of risk. [14] The R-Model is another key example of how an ESG analysis cannot function without diverse sets of data. More importantly, the variety of ESG-data providers utilized within the model implies the noticeable magnitude of subjectivity that exists within the datasets.

Redefinition 4—Data Now Implies Strategy

As we previously stated, strategic execution requires access to quality (i.e., relevant and material to long-term valuation) data. Moreover, strategic execution entails the need to understand how investors are “scouting” the company. Blackrock’s Aladdin & Baringa technology platforms epitomize that requirement.

We feel the combination of five emerging data trends represent a distinct risk factor management teams must proactively account for and integrate within their corporate strategy:

As the influence intangible assets have over valuations also increase, incorrect or inaccurate ESG data can potentially stunt valuation potential. Just as with any risk factor, management needs to orchestrate a strategy which mitigates the potential implications of flawed data.

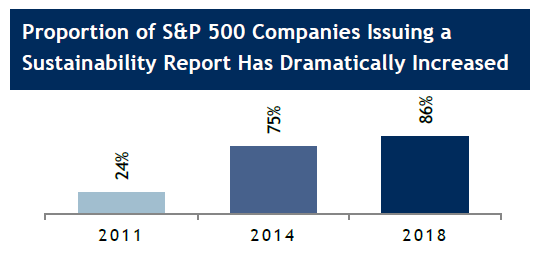

For example, Governance & Accounting Inc. began an annual research series began nine years ago covering the analysis of sustainability reporting activities for publication. They found that just about 20% of the S&P 500 companies in 2011 were publishing a sustainability report. That percentage grew to 75% by 2014 and to 86% by 2018. [15]While sustainability reports are great marketing tool, they fall short for communicating with investors. Evidence overwhelmingly suggests investors are not at all satisfied with the current state of sustainability reports.

However, extensive survey work released by Morrow Sodali shows that 78% of institutional investors want to discuss ESG topics “in the context of the company’s business plan, particularly considering the COVID-19 crisis.” [16]

In other words, what is supplied to investors is not necessarily addressing or fulfilling their inherent demands.

Given the extent of competitive disruption within the global economy, namely digitalization, supply-chain complexity and evolving consumer optionality, the absence of available data points represents a distinct risk for investors. Investor messaging and disclosures must transform from purely qualitative to noticeably quantitative.

More importantly, the presentation cannot be a retrospective “fashion show.” This is based on empirical review, not speculation or opinion. In fact, in a recent analysis released by McKinsey concluded “Investors say they cannot readily use companies’ sustainability disclosures to inform investment decisions and advice accurately.” [17]

Call to Action—Pivotal Next Steps for Management Teams & Boards

We recommend the following seven action items:

- Take time to understand the data already being utilized by ratings providers along with the outputs reflected in investment analysis (i.e., SSGA R-Model, Blackrock Aladdin Climate, etc.)

- Ensure ESG disclosures are on topics material to economic reality rather than those that tell an easy marketing story—PR marketing and Investor marketing is analogous to Oil and Water

- The corporate sustainability report as it is known today is a great start, but it represents only the second inning of the ballgame—evolution is required to take control of the narrative

- Recognize that commitment to one framework is not enough – investors treat frameworks and ratings as a mosaic and use proprietary methodologies to piece together and measure differentiators

- Realize that ESG disclosures in their current form do not provide the underlying context required to properly value intangibles, implying a disconnect in firm value

- Understand that replicating peer efforts does not provide a unique perspective and in most cases compounds the “echo chamber” concern, especially at the board level

- Invest in a comprehensive cybersecurity program, as it is critical both to financial and to ESG performance, and is probably one of the next “shoes to drop”

Within the context of investor messaging, ESG, when executed properly, centers on strategy and not superlatives. Optimizing an ESG narrative among investors is a function of addressing the myriad of disruption anticipated within a competitive landscape. Quality capital is not concerned with the superlatives as much as they are with the compass and the strategic path forward. A clear, concise, and digestible blueprint outlining the path forward is also a relative evaluation—and investors cannot solely rely or differentiate based on anecdotal perspectives.

Instead, the compass guiding a corporate’s respective risk journey must increasingly implement data and address material ESG-related perspectives in an objective fashion. Moreover, it is an ongoing effort to remain on par with the competitive pack. Given the dynamics of equity flows, both current and anticipated, index managers stand the most to lose should any given manageable risk ever materialize. It is imperative for corporates to evolve alongside the changing tide emerging within the capital markets. Index managers are not afraid to strike, and they will most likely utilize ESG as their weapon of choice.

Endnotes

1https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter(go back)

2https://www.statista.com/statistics/350591/leading-etfs-usa-by-assets-under-management/(go back)

3https://corpgov.law.harvard.edu/2014/05/29/the-activism-of-carl-icahn-and-bill-ackman/. Bolded portions of quotes intended to showcase overlap between characteristics of traditional activists and modern index investors.(go back)

4https://corpgov.law.harvard.edu/2021/06/14/vanguard-insights-on-evaluating-say-on-climate-proposals/(go back)

5https://corpgov.law.harvard.edu/2020/01/10/calstrs-green-initiative-task-force-annual-report/(go back)

6https://www.bloomberg.com/news/articles/2021-06-18/calstrs-s-crucial-phone-call-eased-path-for-activist-s-exxon-win(go back)

7https://www.etf.europa.eu/en/news-and-events/news/without-data-youre-just-another-person-opinion-w-edwards-deming(go back)

8“Reenergize ExxonMobil Investor Presentation.” Engine No. 1, May 2021. P. 26(go back)

9Based on various of research, including internal proprietary PEP research(go back)

10CFA UK ESG Investment Certificate Curriculum(go back)

11https://www.blackrock.com/corporate/newsroom/press-releases/article/corporate-one/press-releases/blackrock-to-acquire-baringa-partners(go back)

12https://www.blackrock.com/corporate/newsroom/press-releases/article/corporate-one/press-releases/blackrock-to-acquire-baringa-partners(go back)

13https://www.ssga.com/library-content/pdfs/esg/r-factor-for-companies-faqs.pdf(go back)

14R-Factor Model – A Roadmap to Build Sustainable Companies. https://www.ssga.com/us/en/institutional/ic/capabilities/esg/data-scoring/r-factor-transparent-esg-scoring(go back)

15“Flash Report S&P 500—2020.” Governance & Accountability Institute. July 2020. https://www.ga-institute.com/research-reports/flash-reports/2020-sp-500-flash-report.html(go back)

16Morrow Sodali Institutional Investor Survey 2021 Results. https://ioandc.com/wp-content/uploads/2021/05/5-Morrow-survey.pdf(go back)

17https://www.mckinsey.com/business-functions/sustainability/our-insights/more-than-values-the-value-based-sustainability-reporting-that-investors-want(go back)

Print

Print

One Comment

Dear Authors,

Enjoyed the article.

The last bit; 7 pointer …it seems most of those points have been plagiarized from CFA Institute’s ESG INVESTING OFFICIAL TRAINING MANUAL (Chapter 7- ESG ANALYSIS, VALUATION AND INTEGRATION by J. Jason Mitchell, Man group Plc)