Dan Romito is Consulting Partner, ESG Strategy & Integration, at Pickering Energy Partners. This post is based on a Pickering Energy Partners memorandum by Mr. Romito and Addison Holmes. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

Across the existing spectrum of ESG ratings, guidelines, and frameworks, higher quality environmental scores are commonly associated with technology companies while lower relative scores are typically linked to energy companies. This is not necessarily a novel statement, but it does highlight a critical inefficiency. We feel ESG-ratings agencies and, in some cases, reporting frameworks, currently miss the mark in their respective evaluation environmental impact for both sectors. Digitalization, artificial intelligence, and big data are evolutionary trends affecting every sector; however, these trends mean something inherently different for energy. Long-term success for the energy space is contingent upon developing greener technologies and adopting advanced data analytics, yet ratings agencies provide less of an opportunity for energy companies to showcase these explicit talents.

As a result, the narrative conveyed by ESG ratings data fails to outline the longer-term economic reality for most capital-intensive businesses, particularly energy. Empirically speaking, the data indicates environmental impact metrics for the energy and technology sectors are actually converging, but existing ratings data does not reflect this. As paradigm shifts within the global economy materialize, technology and energy are becoming increasingly interlaced. As big data and technological advances continue to represent a greater proportion of the overall global economy, think about the respective “inputs” the technology world will require just to keep the lights on.

Robert Bryce addresses this very notion in a recent article he penned for Forbes:

“In 2019, amid rising pressure from its employees, the company finally revealed its carbon- dioxide emissions, which totaled about 44.4 million tons in 2018. Last June, the company reported that its emissions jumped by 15% over the prior year to about 51.1 million tons. That means Amazon’s emissions are nearly as high as those of oil giant Chevron, which emitted 60 million tons of CO2 in 2019. Amazon’s uptick in emissions should not be surprising. As it handles more goods and services, the company has to use more energy in its data centers, warehouses, delivery trucks, and more than 80 cargo jets.” [1]

Mr. Bryce’s point above reinforces our internal findings and analysis, which concludes there exists an inherent sector-based skew within environmental scoring methodologies. For example, we estimate the weight of the “E” within an ESG score for Integrated Oil and Gas (i.e., Chevron) is approximately 45-50%. In contrast, less than 10% of the overall analysis for Internet Retail (i.e., Amazon) is dedicated to the “E.” This begs the question – is economic reality accurately represented if both environmentally-focused metrics and overall scores are similar between Amazon and Chevron, yet ~50% of Chevron’s score derives from the “E” as opposed to ~10% for Amazon? To be clear, we do not believe these methodologies are entirely without merit. We do feel, however, methodologies require drastic improvement. We also believe companies run the risk of unknowingly distorting economic reality if they decide to solely base their ESG implementation strategies around ratings methodologies.

In any case, empirical analysis highlights the unique codependence which exists between technology and energy. The degree of co-dependence also suggests the two sectors should not reside on opposite ends of the environmental ratings spectrum. Technology companies need the energy space to keep the proverbial lights on while energy companies need their technology brethren to enhance their own processes and reduce their respective environmental footprint. Further, the notion of “big data” blurs sector lines and should not solely associated with or predisposed to the technology sector. Technology is less of a sector and more of a concept, yet sector classification is more concerned with the widget produced as opposed to the strategy employed. Big data and digitization are endemic to the energy sector and data analytics are extremely critical to the broader energy transition evolution.

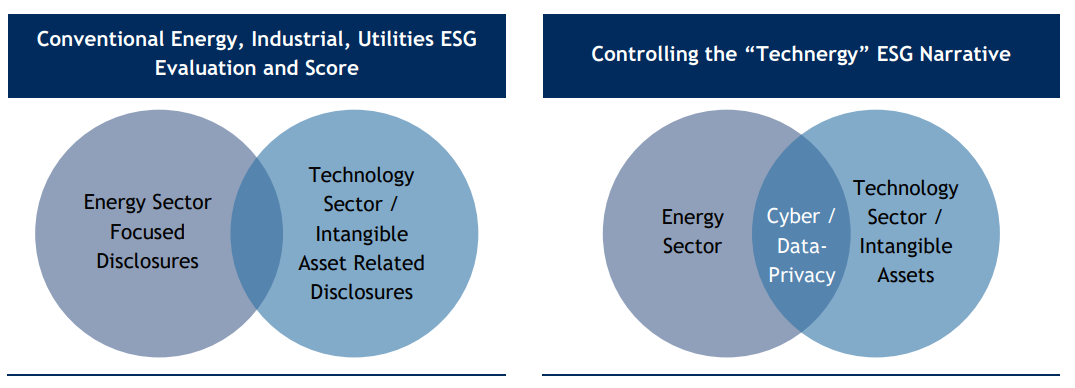

The economic realities associated with any given environmental footprint transcend high-level sector definitions. This creates a disruptive dynamic with ESG-related disclosures and corresponding investment narratives. Because existing frameworks and third-party data/ratings providers rely almost exclusively on sector designations, “hybrid” designations, like that of the energy-technology dynamic outlined here, are not adequately addressed. Ratings agencies and frameworks also tend to provide technology companies with “environmental leeway,” whereas environmental considerations are the primary focal point for energy companies. This highlights one of the key shortcomings associated with ESG data and ratings—the false sense of security companies in both sectors can garner from solely following these recommendations.

Energy teams must adapt more of what we refer to as a “technergy” perspective when conveying their respective forward-looking directives and ESG disclosures. An adequate set of technergy-related ESG disclosures should address two distinct buckets of risk. First, a management team must outline how their respective strategy approaches and mitigates “stranded asset risk.” Stranded assets are considered assets that have suffered from unanticipated or premature write-downs, devaluations, or conversion to liabilities, typically from environmental-related risks. [2] Investors generally think of a stranded asset as a resource that once had value but no longer does due to an external change. Conveying a digestible and material long-term strategic directive without addressing stranded asset risk is nearly impossible.

Secondly, the increased implementation of technology among energy companies requires the subsequent need to address data privacy and cybersecurity. Technology solutions can mitigate the resulting impact of stranded asset risk, but that attribute is by no means a one-sided coin. While digitization, cloud-based solutions and data analytics are generally considered positive traits, they can also further complicate the respective investment thesis. Introducing advanced forms of technology opens the door to a new set of manageable risks, namely cybersecurity and data privacy. With respect to energy disclosure recommendations, this is practically ignored universally by existing frameworks and data providers.

The paradox created from this dynamic, however, is technology solutions are typically marketed as key differentiators, but without proper controls, infrastructure, and disclosures, those same differentiators can potentially result in value destruction. The recent event with Colonial Pipeline is a prime example of this. For instance, with respect to ESG-ratings agencies, we estimate the respective weighting of the “E” for an Integrated Oil & Gas ESG evaluation is roughly 40%. Approximately 30% of the evaluation is focused on governance, specifically ownership, board composition, incentive pay structure, ethics, and tax transparency, while the remaining 30% or so centers on community relations and employee health and safety. [3]

Once again, these proportions are incredibly incomplete. For reference, approximately 25% of the entire evaluation for the data processing space (defined by GICs classification) focused on cybersecurity measures and data privacy. This marks a substantial shortcoming within the ESG-ratings ecosystem – namely, as we have previously pointed out, the ratings agencies focus more on the retrospective aspects of the “E,” as opposed to the forward-looking strategic thesis of the energy firm in its entirety.

The existing weights within the broader energy space also reinforce the shortcomings of ratings data and echo what we refer to as the “square-peg/round-hole” dilemma. The economic reality of a forward-looking strategic directive is not adequately addressed within ratings methodologies. Adhering solely to the guidelines outlined by conventional frameworks and ratings agencies could potentially prove counterproductive (i.e., Colonial Pipeline). Adhering to the recommended bare minimum set of disclosures could result in a false sense of security when internally evaluating an ESG profile.

We recommend management teams adopt more of a technergy-based ESG narrative when orchestrating their respective investment narrative. If management teams rely solely on the recommended disclosures provided by ratings agencies, they fail to address three risks:

- Disproportionately addressing the “E” without adequately incorporating key technological differentiators within the narrative

- Albeit unknowingly, remaining opaque with respect to addressing cybersecurity risk and data privacy infrastructure

- Increasing the odds of remaining “bucketed” within an evaluation framework that does not address the forward-looking strategy of the firm and/or limits the degree of economic reality incorporated within the evaluation.

These risks reinforce the strategic necessity of proactively controlling the narrative when developing and communicating ESG-related disclosures. There is utility in using ratings agencies as a place to start. That said, it is the evolution of a company’s ESG story and disclosure that will drive long term value, or at the very least, distinguish a company amongst its peers.

When outlining the central tenets of a concise and substantive set of ESG-related disclosures, three key factors must be considered:

- Outlining value creation over the long-term. Determining what is material to value creation should center on first outlining both the likelihood and magnitude an adverse event would have on company financials. Investors and regulators are laser-focused on cybersecurity across all sectors and understating such considerations into the evaluation is a distinct oversight on behalf of the ratings agencies.

- Providing a comprehensive controversy assessment. Controversy assessment attempts to pinpoint a structural problem within a company’s risk management policies. A management team can be ineffective with matters pertaining to cybersecurity but showcase impressive traction and progress on the “E.” Telling an impressive “E-story” does not imply controversy immunity. We feel there exists inherent “caps” on environmental scores across most capital-intensive sectors anyway. Since cybersecurity breaches reflect much more of a controllable risk, unique differentiation relative to peers is easier to showcase. Accountability, regulatory compliance, and transparency as it relates to data will only grow in importance as all attributes of the global economy shift towards digitalization.

- Take a devil’s advocate when assessing potential liabilities. Liabilities express the probability which derives from the relative lack of transparency on any material topic. Regarding data privacy and cybersecurity, we feel ratings agencies are providing management teams with a false sense of security since cybersecurity and data privacy is incredibly underemphasized for capital-intensive businesses. Management teams in these respective spaces are unknowingly and unintentionally setting themselves up for ESG-failure if they rely on these “bare minimums.”

Endnotes

1“Amid Record Results, Amazon Obscures Its Massive Energy Consumption.” Forbes Online, Author – Robert Bryce. February 3, 2021. https://www.forbes.com/sites/robertbryce/2021/02/03/amazon-is-reporting-record-smashing-revenue-and-profits-why-wont-it-disclose-how-much-energy-it-is-using/?sh=21bd784cfd0a(go back)

2Ben Caldecott, Elizabeth Harnett, Theodor Cojoianu, Irem Kok, and Alexander Pfeiffer Editor: Ana R. Rios. “Stranded Assets: A Climate Risk Challenge.” Inter-American Development Bank. https://publications.iadb.org/publications/english/document/Stranded-Assets-A-Climate-Risk-Challenge.pdf(go back)

3Analysis on weights and estimates is based on internal research centered on extensively reviewing publicly available methodologies released by MSCI, Sustainalytics and ISS.(go back)

Print

Print