Keith E. Gottfried is partner at Morgan, Lewis & Bockius LLP. This post is based on his Morgan Lewis white paper. Related research from the Program on Corporate Governance includes Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here).

The primary focus of many retailers in the near term will likely be on staying afloat and addressing their liquidity needs, the health and safety of their employees and customers, the overall health of their businesses, and how best to pivot their business models to adapt to shifting consumer preferences and expectations in the wake of the ongoing coronavirus (COVID-19) pandemic. However, as the retail industry has been upended by the pandemic as never before, and taking into consideration that almost all well-known activist investors have a longstanding interest in the retail sector, retailers should also be concerned with how the turmoil caused by the pandemic has made them attractive targets for activist investors. It is also likely that the recent proliferation of special purpose acquisition companies (SPACS), particularly SPACS with an expressed interest in consumer-facing companies or SPACS formed by well-known activist investors with retail industry experience, may be a strong catalyst for increased shareholder activism in the retail industry.

Current Situation

The retail industry is clearly one of the industries most impacted by the ongoing COVID-19 pandemic. Since March 2020, when heightened concerns about the pandemic began to take hold, retailers have had to cope with government-mandated business closures and, later, slow and inconsistent guidance on reopening, as well as the need to implement new social distancing and health and safety protocols. In addition, retailers have had to pivot their business models and reimagine their businesses in ways that allow them to service their customers in a new normal and take into account a new paradigm of not only government-imposed social distancing, but also consumers’ increased wariness for public spaces and crowds, particularly indoors.

While the retail industry has a history of experiencing numerous dynamic and disruptive changes that it has had to adapt to, never before has the industry had to cope with extended government-imposed store closures or rules on how many customers could be in a physical store at one time. Nor did the retail industry ever have to cope with public health advisories encouraging consumers to avoid, or minimize time in, crowded indoor spaces, which, pre-pandemic, would have included many indoor shopping locations.

Pre-pandemic, the retail industry was already experiencing numerous challenges as the ongoing shift from physical stores to digital shopping continued. The pandemic not only furthered that trend, but also, according to data from IBM’s US Retail Index, accelerated by five years the shift away from physical stores to digital shopping.

In the wake of the pandemic, numerous well-known “brick and mortar” retailers have been pushed into bankruptcy and/or liquidation and others have turned to the debt and equity markets to bolster their liquidity. According to Retail Dive, a publication that covers the retail industry, 27 retailers have filed for bankruptcy in 2020 to date, compared to 17 in all of 2019.

Other “brick and mortar” retailers are moving quickly to optimize their physical store footprint, not only to reduce expenses, but also, as noted above, in recognition of the accelerated shift away from physical stores to digital shopping. If you have been to a shopping mall recently, no doubt you noticed quite a few stores that permanently closed in the wake of the pandemic and the ensuing government mandates that closed malls and mall-based stores across the country for months. According to data from Moody’s Analytics, the rate of shopping mall vacancies was at a historic high of 9.8% in early September, exceeding the previous peak of 9.3% in September 2011.

COVID-19 Presents Retailers with New Challenges

As Memorial Day 2020 approached, much of the country began to reopen, including many of the country’s largest retailers. In reopening to a “new normal,” retailers found themselves faced with new challenges, including the following:

- The continued reluctance of consumers to visit and meander at physical stores and public places, particularly indoors

- The need to reconfigure physical stores and customer traffic patterns to adapt to social distancing mandates and protocols

- The need to install in-store plexiglass shields and other barriers to protect employees and customers

- State and local laws that limit how many customers can be in a store at any given time

- The critical importance of robust omni-channel fulfillment capabilities that satisfy the preference of many consumers for touchless environments

- Changes in consumer demand caused by the pandemic, including how demand for certain categories of goods have been adversely impacted by working from home, virtual schooling, and social distancing recommendations, while other categories have seen explosive growth due to the evolving role of the home as the epicenter for day-to-day life

- Supply chains that had been severely challenged by mandatory closures and rapid and unanticipated shifts in consumer demand, leaving many retailers unable to meet consumer demand for certain categories of goods

COVID-19 Presents Retailers with New Opportunities

While the pandemic has created, and continues to create, numerous challenges for retailers historically dependent on physical stores, it has also created new opportunities for such retailers as consumers become more accustomed to interacting with retailers in touchless environments, including self-checkout, curbside pickup, and online orders with same-day delivery. Retailers have also begun to reimagine physical stores as just one component of a suite of omni-channel fulfillment capabilities.

While in the short term, many retailers have had to cope with supply chain issues that limited their ability in the near term to satisfy demand for certain categories of goods that have seen explosive upticks in demand, consumers less able to spend money on various services, including travel, entertainment, and other experiences typically enjoyed in crowd-like settings, may be allocating more of their disposable income to purchasing goods from retailers. In some cases, this increased shift in demand may be for goods that replace services that are no longer available or, even if available, are not particularly popular in light of pandemic-related concerns. In other cases, the increased demand is for goods to adapt the home to all the multiple roles it now plays, including a virtual workplace and virtual schoolroom, as well as to make it more comfortable as the epicenter for day-to-day life. Clearly, few retailers (and their suppliers) could have anticipated the significant uptick in demand that has occurred since March 2020 for cleaning products, groceries, personal grooming products, home fitness products, appliances, and electronics. While, as noted above, the pandemic has accelerated the shift away from physical stores to digital shopping, it has also likely forced many retailers to adapt on an accelerated timetable in ways that may eventually make them stronger, more nimble businesses, capable of thriving in a 21st century digital-centric environment.

The seismic shifts in the retail industry caused or accelerated by the pandemic and the numerous challenges that some retailers have faced in adapting their businesses have not gone unnoticed by activist investors. So with all the other challenges retailers must contend with in the wake of the pandemic, retailers should also anticipate that activist investors, continuing their longstanding interest in the retail sector, will be scrutinizing their businesses, their recent financial and stock performance, how they steered their businesses through the pandemic, how they pivoted their business models in response to the challenges created by the pandemic, any missteps that were made, and whether there are opportunities for an activist investor to be a catalyst to unlock shareholder value, including opportunities that may not have existed prior to the pandemic.

Snapshot of Shareholder Activism in the Retail Industry

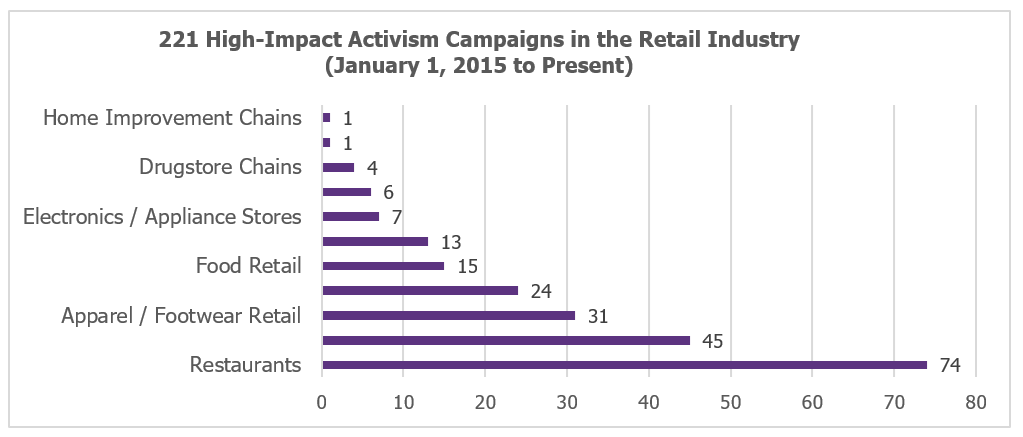

Activist investors have a longstanding interest in the retail industry. As the chart below shows, since January 1, 2015 there have been 221 high-impact activism campaigns in the retail sector:

Source: Factset Research Systems, Inc.

As shown below, in the last 12 months, there have been 38 high-impact activism campaigns in the retail industry.

Source: Factset Research Systems, Inc.

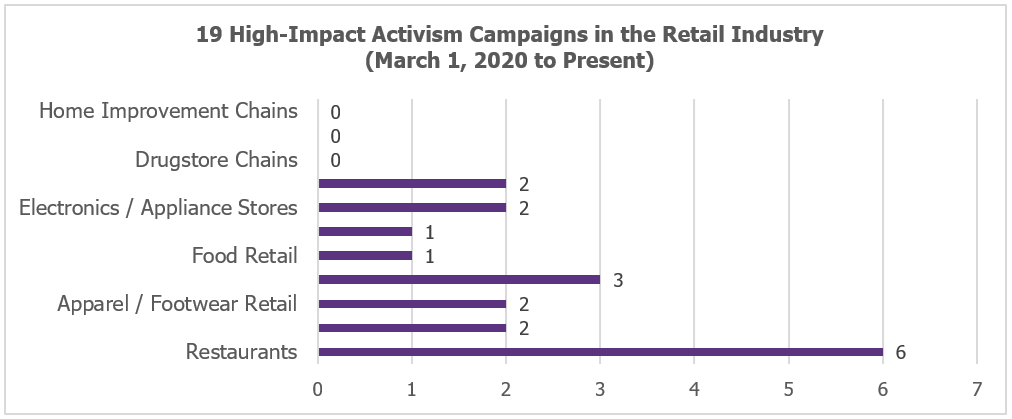

More recently, since March 1, 2020, when heightened concerns about the ongoing COVID-19 pandemic began to take hold, and continuing through the present, there have been 19 high-impact activism campaigns in the retail industry.

Source: Factset Research Systems, Inc.

Retail Sectors That Have Attracted Activist Investors

While the above charts make clear that activist investors may tend to target certain retail sectors over others, and certainly specialty stores and restaurants are retail sectors that have historically been very much of interest, over time, activist investors’ interest in retail has extended to almost every retail sector, including apparel/footwear retail, catalog/specialty distribution, drugstore chains, electronics/appliance stores, department stores, discount stores, food retail, home improvement chains, internet retail, specialty stores, and restaurants.

Impact of COVID-19 on Activist Investors’ Interest in the Retail Industry

Notwithstanding all the uncertainty and turmoil the pandemic has created for the retail industry, there are no signs that the longstanding interest of activist investors in retail has been adversely impacted. One has only to look at the Form 13F [1] filings made with the US Securities and Exchange Commission on August 14, 2020, for the quarter ended June 30, 2020, to confirm that activist investors remain very interested in retail. A review of those filings shows that not only do many of the most well-known activist investors continue to have sizeable investments in retailers, but also, during the quarter ended June 30, 2020, many of these activist investors reported new investments in retailers, including in the following sectors: apparel/footwear, discount stores, and restaurants. Also, during the quarter ended June 30, 2020, activist investors added to existing investments in the following retail sectors: apparel/footwear, discount stores, food retail, home improvement chains, restaurants, and specialty stores.

Why Activist Investors Like the Retail Industry

There are numerous reasons that may explain why activist investors have historically been drawn to the retail industry, including the following:

- The retail industry has always been very dynamic and continuously evolving, and there have always been retailers in a state of turmoil or otherwise experiencing a pivotal inflection point in their lifecycle that resulted in their shares being potentially undervalued in light of their intrinsic value, their growth prospects, or their value enhancement opportunities

- There is no shortage of retailers that are attractive targets

- Many activist investors are value investors and there has always been a constant supply of retailers that can be perceived as value or deep value plays

- Retailers present numerous opportunities for value enhancement, perhaps more so than companies in other industries

- Activist investors like to invest in what they believe they know and understand, and many believe they know and understand retail

- The historical interest of private equity firms in acquiring retailers encourages activist investors to look for retailers that could be attractive merger and acquisition (M&A) targets

- Extensive media coverage of activism campaigns in retail presents activist investors with the opportunity to build their brand

- There are numerous examples of activist investors being successful in unlocking value at retailers

In addition, going forward, the recent surge in the formation of SPACS, including numerous SPACS focused on the consumer sector, is likely to only bolster activist investors’ interest in the retail industry.

Retail Industry Has Always Been Very Dynamic and Continuously Evolving, and There Have Always Been Retailers in a State of Turmoil or Otherwise Experiencing a Pivotal Inflection Point in Their Lifecycle

Historically, the retail industry has always been very dynamic and continuously evolving and there have always been retailers in a state of turmoil or otherwise experiencing a pivotal inflection point in their lifecycle. Prior to the pandemic, the advent of ecommerce was probably the change that was looked to most often for its dramatic impact on the retail industry and how retail business is conducted. However, over time, there have been other changes that also had a dramatic impact on retail, particularly how and where retail business is conducted.

Many among us can still remember a time when the enclosed suburban shopping mall was a novel concept that shook up the retail industry and, as the mall became the retail epicenter for many communities, resulted in the demise of numerous Main Street and other outdoor shopping venues. The retail industry was also later shaken up by the emergence of big-box “category-killer” retail stores and even later by the nationwide expansion of today’s market-leading discount superstores. Pre-pandemic, many of the nation’s suburban shopping malls, those same malls that had dominated their communities’ retail landscape for decades, had fallen into decline and many malls, particularly those where the anchor stores had closed and could not be replaced, were permanently closed or even torn down. The term “dead mall” entered our lexicon and referred to a shopping mall with a high vacancy rate or a low consumer traffic level, or that is deteriorating in some significant manner.

In addition, retail has always been an industry where there have been retailers that were market leaders at one point, perhaps even for decades, but eventually became challenged and embroiled in dysfunction and turmoil. The history of retail is filled with iconic and once industry-leading retailers that eventually went bankrupt and liquidated, long before ecommerce began to pose a threat to “brick and mortar” retailers. That same history also includes numerous retailers that successfully pivoted in response to the dynamic changes and challenges they faced and reinvented themselves.

No Shortage of Retailers That Are Attractive Targets

As the retail industry continues to evolve, yesterday’s market leaders may find themselves in a less favored status, with their shares trading at prices way below their historical trading range, including where there is some question as to the retailer’s ability to rebound. There may, of course, be many reasons for this less favored status, such as shifting consumer preferences, management missteps, poor merchandising, poor market positioning, competitive threats, poor physical store layout, less than optimal physical store footprint, inability to evolve the business in the wake of disruptive technological shifts, excessive debt leverage, etc.

While such a retailer might be out of favor with Wall Street and Main Street, an activist investor may see an array of opportunities to unlock shareholder value and profit from that retailer’s less favored status, such as through a sale of the retailer to a stronger or larger company, a sale of a division or other assets, a change of strategy, or a change of management team. There has never been a shortage of retailers that fit such profile and are attractive for activist investors to target.

Constant Flow of Retailers That Are Perceived as Value or Deep Value Plays

Many activist investors are value and/or deep value investors that may view themselves as disciples of Benjamin Graham, the famed economist, professor, author, and value investor, who is widely known as the “father of value investing.” While the pandemic may have created a number of value or deep value plays in retail, there has always been a constant flow of retailers that could be perceived as value or deep value plays, meaning that the retailer’s stock appears to be cheaply priced because it has been trading at low valuation metrics, such as multiples in terms of price to earnings, price to cash flow, or price to book value over an extended period of time.

Retailers Present Numerous Opportunities for Value Enhancement

Retailers present activist investors with numerous opportunities for value enhancement. In addition to activist investor demands common in other industries, such as the sale of the retailer, optimization of capital structure, return of cash to shareholders through stock repurchases or dividends, strategy shift, margin expansion, and changes in the retailer’s management and/or the board of directors, activist investors could look to retailers to unlock shareholder value by (a) selling or spinning off the real estate occupied by the physical stores, distribution centers, and/or corporate offices, (b) optimizing the retailer’s physical store footprint, (c) selling or spinning off credit card or financing arms, (d) implementing and/or expanding franchising or other asset-light strategies, (e) selling or spinning off noncore retail or other businesses, and (f) developing and/or enhancing omni-channel capabilities.

Activist Investors Like to Invest in What They Believe They Know and Understand

Activist investors like to invest in what they believe they know and understand. Like others, many activist investors may be familiar with a particular retailer, having shopped at or purchased from such retailer in the past, and may believe that, even before performing any deep analysis, they know and understand that retailer’s business.

Activist Investors’ Perception That the Learning Curve for Retail Is Less Steep Than for More Esoteric Industrial and Technology Sectors

While not to underestimate the complexity of a publicly traded retailer and the sophistication and knowledge required to manage and drive a retail business in the current environment, an activist investor may have the perception that the learning curve for understanding a particular retailer’s business and challenges and identifying value enhancement opportunities may be less steep than for industrial and technology sectors that are more esoteric. It is not hard to fathom that an activist investor would believe it is easier to get up to speed on the business challenges faced by a specialty retailer or fast food restaurant chain than those faced by a biotechnology company. It may also be the case that an activist investor may find the retail industry easier to speak about and critique in communications with institutional and retail investors.

Historical Interest of Private Equity Firms in Acquiring Retailers Encourages Activist Investors to Look for Retailers That Could Be Attractive M&A Targets

When you look at activist campaigns at retailers over the last year, the dominant primary campaign demand or objective has been the maximization of shareholder value or, in simpler terms, the sale of the retailer. [2] While some of us may remember a time when publicly traded diversified retail holding companies or conglomerates owned multiple retail chains under the same corporate umbrella and were frequent acquirers of other retailers, those days are long behind us and not likely to return. In recent years, if you were an activist investor in retail and looking to push a retailer to maximize shareholder value, it is likely you were looking for a private equity firm to step up as the acquirer.

The historical interest of private equity firms in acquiring retailers, even retailers facing challenging circumstances, has no doubt played a role in encouraging activist investors to look for retailers that could be attractive M&A targets. It is likely that the recent proliferation of SPACS, including those formed for the purpose of acquiring consumer-facing companies, will only further fuel activist investors’ interest in the retail industry.

Extensive Media Coverage of Activism Campaigns in Retail Provides Activist Investors with a Branding Opportunity

For some activist investors, particularly smaller, lesser known activist investors, part of the allure of the retail industry is that activist campaigns against retailers tend to garner more media attention than those in other industries. For an activist investor still trying to develop its brand and develop a track record that will help it attract and raise capital for future activist campaigns, the media attention that could be received may be a factor, even if not the critical dispositive factor, in the activist investor’s decision to target a retailer. Given that possibility, nationally known retailers should expect that they could be targeted, in part, because of the branding that an activist campaign against them may provide an activist investor.

Numerous Examples of Activist Investors Being Successful in Unlocking Value at Retailers

While there are examples of activist investors making bad bets in the retail industry or pushing value enhancement strategies than didn’t ultimately pan out, there are numerous examples of activist investors being very successful in unlocking shareholder value in retail. Given, as described above, the extensive media attention given to activist campaigns against retailers, where an activist investor’s involvement at a retailer has been successful in unlocking value, that success story has often been well publicized.

Why an Activist Investor Would Target a Retailer in the Wake of COVID-19

In deciding whether to target a particular retailer in the wake of the pandemic, an activist investor would need to determine that it has an opportunity to generate an outsized return because the retailer is undervalued by the financial markets relative to its intrinsic value or potential for growth or value enhancement. It may be the case that the retailer has lost favor with Wall Street and Main Street and is undervalued because of poor stock price and/or financial performance, including in the wake of the pandemic, relative to its peers. It may also be the case that there exists doubt among investors about the retailer’s ability to successfully persevere through the pandemic and pivot its business model in response thereto.

The activist investor would then have to determine that there is a “lever” that it can access, whether through engagement with the retailer’s management and/or board of directors or through a proxy contest or other activist campaign, which will enhance shareholder value. As discussed elsewhere, that “lever” could include a sale of the retailer; sale of a division or other noncore businesses; sale or spinoff of the real estate under the physical stores, distribution centers, or corporate offices; optimization of the retailer’s physical store footprint; adoption of an asset-light strategy such as franchising, strategy shift, change in board composition and/or management team; or the return of cash to shareholders.

In the event that the activist investor believes it needs leverage to make its threat of a proxy contest or other activist campaign as credible as possible, the activist investor may look for a retailer that is in a vulnerable position. Those vulnerabilities may also suggest to the activist investor that the retailer and/or board of directors may be more likely to constructively engage with the activist investor so as not to risk the activist investor making its case for change and/or presenting its value enhancement thesis directly to the retailer’s shareholders.

The activist investor would also be looking for a retailer where shareholders may doubt the retailer’s ability to execute and drive shareholder value creation, such that they will support the activist investor if, for no other reason, to place added pressure on the retailer’s board of directors and/or management team to execute and take a more focused approach to shareholder value creation. The activist investor would likely also look for a retailer where, even with a relatively small non-controlling stake, it would be credible in pressing its demands for change.

How a Retailer Could be Vulnerable to an Activist Investor in the Wake of COVID-19

An activist investor does not target a retailer just because the retailer is vulnerable. As noted above, an activist investor must first determine (1) that there is an opportunity to generate an outsized return because the retailer is undervalued by the financial markets relative to its intrinsic value or potential for growth or value enhancement, and (2) that there is a lever the activist investor can access that will unlock shareholder value. If a retailer meets those two criteria, it may be an attractive target for an activist investor. Thereafter, the activist investor needs to determine how vulnerable the retailer is to an activist investor seeking to be a catalyst for change.

Many retailers were already vulnerable to activist investors pre-pandemic due to the following:

- Poor stock price, operating, and/or financial performance, particularly compared to peers

- Perceived inability to create shareholder value without meaningful change

- Numerous missteps by the retailer’s management team and the perception that the retailer’s management team is unable to execute

- The management team’s inability to articulate a strategy on how the retailer will drive shareholder value creation

- Less than optimal physical store footprint, taking into consideration the continuing shift from physical stores to ecommerce and other fulfillment channels

- Higher general and administrative expenditures than peers

- Executive compensation not sufficiently aligned with performance

- Lack of attention to environmental, social, and governance (ESG) issues

- Lack of confidence by investors in the retailer’s board of directors and/or management team

COVID-19 has not only exacerbated pre-pandemic vulnerabilities for some retailers, but it also provides activist investors with an opportunity to illustrate their pre-pandemic concerns with those retailers. Even if the COVID-19 pandemic and government-mandated business closures that followed in response thereto have resulted in an unprecedented crisis of such an epic scope that would have been impossible for any retailer to anticipate and plan for, some activist investors may believe that the retailer’s performance during COVID-19 supports their case for change. In the wake of COVID-19, an activist investor seeking to build a narrative of why activist-driven change is needed at a retailer may look to highlight the following vulnerabilities:

- Lack of a crisis-ready, resilient board of directors and management team

- Inability of the retailer to scale its cost structure to correspond to reductions in demand that occurred while physical stores were closed

- Inability of the retailer to successfully and quickly pivot to channel fulfillment capabilities that facilitate touchless transactions

- Inability of the retailer to manage its supply chain to address quick-moving shifts in consumer demand and reduce dependency on particular geographic regions

- Inability of the retailer to thoughtfully and responsibly manage and address liquidity issues

- Inability of the retailer to publicly articulate a strategy on how the retailer will be able to persevere through the pandemic and rebound

- Inability of the retailer to develop a strategy for restarting once government mandates on store closures began to be loosened

- Inability of the retailer to thoughtfully manage and retain its human capital, even in the midst of mandated store closures and related furloughs, such that it had sufficient human capital to successful restart once mandated government mandates on store closures began to be loosened

- Inability of the retailer to demonstrate a commitment to providing a safe shopping environment consistent with CDC and other public health guidelines

- Less than optimal physical store footprint, taking to consideration the COVID-19-driven accelerated shift from physical stores to ecommerce and other fulfillment channels

- Flaws in a retailer’s strategic plan and business model, particularly in light of the pandemic-driven changes in retail and consumers’ preferences and expectations

- The disconnect between executive compensation and the retailer’s share price performance

- Missing functional competencies among the retailer’s board of directors and management team

Possible Activist Investor Demands at Retailers

From an activist investor’s perspective, a retailer could present numerous opportunities for value enhancement, perhaps more so than companies in other industries. As noted above, the most frequent demand by activist investors targeting a retailer is the maximization of shareholder value or the sale of the retailer. That demand has historically been aided by the strong appetite that private equity firms have shown for acquiring retailers. Given the recent proliferation of SPACS, including the numerous SPACS that have announced their intention to focus on the consumer sector and look for consumer-facing companies to acquire, it appears likely that, in the near term, the maximization of shareholder value will remain the most frequent demand that activist investors make at retailers.

Demands to separate businesses and/or sell assets are also frequent demands by activist investors. For retailers with multiple retail concepts and other noncore businesses, an activist investor may seek a sale of the noncore retail businesses so that the retailer can focus on its core retail business.

To the extent that the retailer owns the real estate under its physical stores, distribution centers, or corporate offices, an activist investor may seek to have the retailer divest itself of the real estate or spin off the real estate into a newly formed publicly traded entity such as a real estate investment trust (REIT) and then have the retailer lease back the real estate.

For retailers that still have their credit card and financing operations in-house, an activist investor may demand that the retailer sell or spin off these operations.

For restaurant chains and other retailers that have a mixed model of company-owned stores and franchised locations, an activist investor may demand a further shift to an asset-light strategy through the conversion of more company-owned locations to franchises.

The pandemic has bolstered the case for retailers to develop and/or enhance their omni-channel capabilities, including ecommerce, curbside pickup, and same-day delivery. An activist investor may demand that a retailer adopt a better strategy for driving a higher percentage of revenue from channels not dependent on consumers entering and/or making their buying decisions at physical stores.

As more retailers enhance their ecommerce and other omni-channel capabilities in recognition of the accelerated shift away from physical stores to digital shopping, as well as consumers’ wariness for crowds and indoor public spaces, an activist investor may demand that a retailer optimize its physical store footprint. Such a demand can take a number of forms, including a reduction in total physical stores, the closure of lesser-performing physical stores, a reduction in the square footage of various physical stores, a renegotiation of lease payment terms, and/or the relocation of physical stores.

In addition to the above, an activist investor’s demands at a retailer may resemble the demands an activist investor would make at companies in other industries, such as the following:

- Changes in the retailer’s management and/or board of directors

- Optimization of capital structure

- Return of cash to shareholders through stock repurchases or dividends

- Expansion of margins

Steps Retailers Can Take to Avoid Being a ‘Sitting Duck’ for an Activist Investor

As noted above, the primary focus of many retailers in the near term will likely be on staying afloat and addressing their liquidity needs, the health and safety of their employees and customers, and the overall health of their businesses, and discerning how best to pivot their business models to adapt to shifting consumer preferences and expectations amid the COVID-19 pandemic. However, as the retail industry has been upended by the pandemic as never before, and taking into consideration that almost all well-known activist investors have a longstanding interest in the retail sector, retailers should also be concerned with how the turmoil caused by the pandemic has made them attractive targets for activist investors. Ironically, it is possible that the success that many retailers have had in successfully pivoting their businesses to adapt to the demands and challenges created by the pandemic has made them attractive targets for activist investors, as it has highlighted new paths to unlock shareholder value that may not have been so obvious pre-pandemic. It is also likely that the recent proliferation of SPACS, particularly SPACS with an expressed interest in consumer-facing companies or SPACS formed by well-known activist investors with retail industry experience, may be a strong catalyst for increased shareholder activism in the retail industry.

Accordingly, retailers should prepare for the possibility that they will be targeted by one or more activist investors or other opportunistic investors and consider taking the following actions:

- Assemble an activism response team (e.g., activism defense counsel, financial advisor, public relations/crisis communications firm, proxy solicitor)

- Enhance processes to receive early warning of an activist and/or other opportunistic investor targeting the retailer (e.g., stock watch, SEC filings on Form 13F, Schedule 13G, and Schedule 13D, activist investors attending earnings calls, market rumors, media inquiries)

- Review and analyze the retailer’s shareholder profile on a regular basis

- Consider the possible need, now or in the future, for a “poison pill,” either one intended to protect against a takeover or one to protect and preserve net operating loss carryforwards

- Even if a “poison pill” is not needed today, consider having a “poison pill” prepared, vetted with the retailer’s board of directors, placed on the “shelf,” and ready to go if and when needed

- Conduct a comprehensive assessment of the retailer’s vulnerabilities to an activist investor and/or other opportunistic investor, including, but not limited to, ESG vulnerabilities

- Prepare a defense profile and consider enhancing structural defenses, taking into consideration the voting guidelines of the proxy advisory firms and institutional investors

- Identify any activist investors and/or other opportunistic investors that could be potentially interested in targeting the retailer

- Monitor activist campaigns against retail industry peers

- Develop a “break-glass” plan for responding to an activist investor and/or other opportunistic investor targeting the retailer

- Plan today for how the retailer and its board of directors would engage with an activist investor and/or other opportunistic investor targeting the retailer

- Develop and maintain a timetable of key corporate events and deadlines, including for nominations and shareholder proposals

- Anticipate how an activist investor would criticize the retailer’s response to the pandemic, its business restart, and its ability to pivot its business model in light of the challenges posed by the pandemic

- Become intimately familiar with any paths available to unlock shareholder value and be prepared to explain why any of those paths may not be appropriate to consider pursuing

- Be prepared to explain why a sale of the retailer in the near term would not maximize shareholder value

- Determine whether there are any gaps in critical experiences and competencies on the retailer’s board of directors, particularly in light of the pandemic

- Refine strategic communications to hone key messages on how the retailer is being impacted by the pandemic and what steps the retailer is taking to rebound from the pandemic, and, as necessary, pivot its business model

- Proactively address market rumors that question the retailer’s liquidity and/or its ability to rebound from the pandemic

- Proactively engage with investors to enhance investor relations, assess investor sentiment, gather intelligence, and market current strategy for rebounding from the pandemic and enhancing shareholder value

Endnotes

1Form 13F is the reporting form filed by institutional investment managers pursuant to Section 13(f) of the Securities Exchange Act of 1934. Institutional investment managers that use the United States mail (or other means or instrumentality of interstate commerce) in the course of their business and that exercise investment discretion over $100 million or more in Section 13(f) securities must file Form 13F. Section 13(f) securities generally include US exchange-traded stocks (e.g., NYSE, AMEX, NASDAQ), shares of closed-end investment companies, and shares of exchange-traded funds (ETFs).(go back)

2Factset Research Systems, Inc.(go back)

Print

Print