Donald W. Cassidy is executive vice president of business development and corporate strategy; Hannah Orowitz is managing director of corporate governance; and Brigid Rosati is director of business development at Georgeson. This post is based on their Georgeson memorandum.

The Impact of COVID-19 on the 2020 Proxy Season

The COVID-19 global pandemic fundamentally altered the 2020 U.S. proxy season by changing the logistics of annual meetings, introducing regulatory changes, influencing voting decisions and shaping future shareholder proposal trends.

Changing Meeting Logistics and Investor Perceptions

Restriction on travel and large gatherings combined with growing global health and safety concerns forced companies worldwide to quickly modify meeting logistics late in the planning stages of their 2020 annual shareholder meetings. In the U.S., while COVID-19 caused some companies to postpone or cancel their meetings, the majority of companies shifted to a virtual-only or hybrid format.

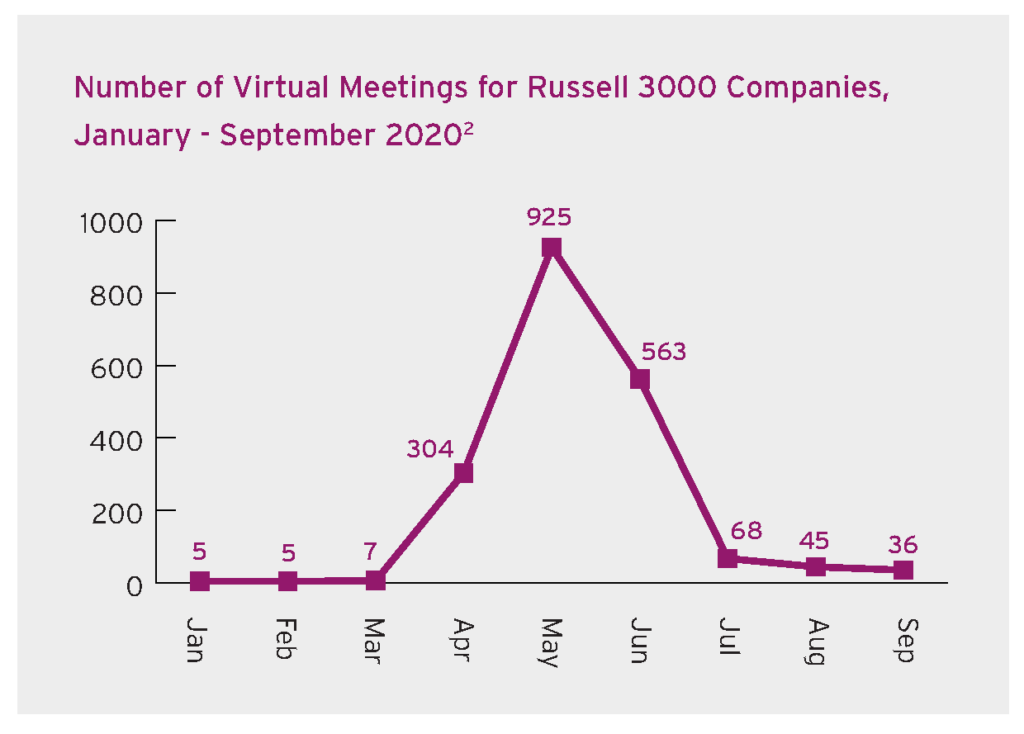

Most U.S. companies with mid-March 2020 and later meeting dates quickly opted to transition to a virtual meeting format—over 1,900 companies in the Russell 3000, which includes the S&P 1500, as of July 2020 according to ISS. Recognizing the need to prioritize health and safety, most investors were understanding of a company’s choice to hold a virtual meeting in 2020.

The use of virtual meetings will likely continue at least into the conclusion of the 2020 calendar year as the pandemic continues to maintain momentum in the U.S. Longer term, the 2020 proxy season will likely become the tipping point at which investors began to embrace virtual meeting technology. While lessons learned this season will certainly shape future best practice recommendations, a June 2020 Proxy Insight survey of investors [1] clearly signals broader future use: 90.5% of investors surveyed expect to see increased future use of virtual meeting technology, and 64.3% expect to see more hybrid meetings once COVID-19 subsides. Most notably, 58.4% of investors surveyed said that they support the use of virtual meetings and, if appropriate shareholder rights protections are in place, that number climbs to 82.2%, exceeding the number that reported supporting future use of a hybrid model (81%). [2]

Regulatory Guidance

U.S. regulatory bodies, state governments, investors and proxy advisory firms made rapid adjustments to accommodate COVID-19’s disruption of the 2020 proxy season. Read more in Georgeson U.S.’s mid-season report on Annual Meeting Adjustments Amid COVID-19.

In March 2020, the U.S. Securities and Exchange Commission (SEC) published guidance to provide publicly listed companies with additional flexibility with respect to certain annual meeting- related requirements, including communicating with shareholders about the change in meeting format and details about additional filings. [3] The SEC guidance, which was later updated in April 2020, states that if a company has already mailed and filed its proxy materials, the company can notify shareholders of a change to the annual or special meeting, including from a physical location to a virtual location, without mailing additional soliciting materials or amending proxy materials, so long as the company: [1]

- Issues a press release announcing such change

- Files the release as definitive additional soliciting material

- Takes reasonable steps necessary to inform other related parties of such change [5]

Recognizing the risk associated with disruption to the proxy mailing process, Computershare U.S. engaged with the SEC during the 2020 season to agree to further guidance to help more issuers take advantage of “Notice and Access” options.

Shareholder Proposal Voting, Trends and Future Considerations

While COVID-19’s shadow loomed large over the peak proxy season, the proposals voted upon were submitted in advance of the pandemic’s arrival in the U.S. Accordingly, while in some cases a company’s to-date response to the pandemic may have factored into investors’ voting decisions, the full impact of the COVID-19 pandemic will crystalize as we head into the 2021 proxy season. In particular, investors are indicating intentions to scrutinize companies’ supply chain management, a range of human capital management topics and compensation practices.

For example, as off-season engagement gets underway, investors are seeking to understand how companies are addressing employee health and safety measures and pay practices. Topics like diversity, equity and inclusion also continue to be top of mind for investors, while focuses expand from gender to racial and ethnic diversity and investors seek data supporting companies’ commitments in this area. As discussed below, we expect these topics will also heavily influence the 2021 shareholder proposal landscape. As connections continue to be drawn between climate change, deforestation and the pandemic, we may also see some evolution within climate change proposals.

Furthermore, we expect there will be additional focus on compensation-related matters. Investors will be keen to know how companies adjust executive compensation practices and programs as compared to broader employee compensation decisions in light of pandemic-related financial performance issues.

Shareholder Sponsored Proposals

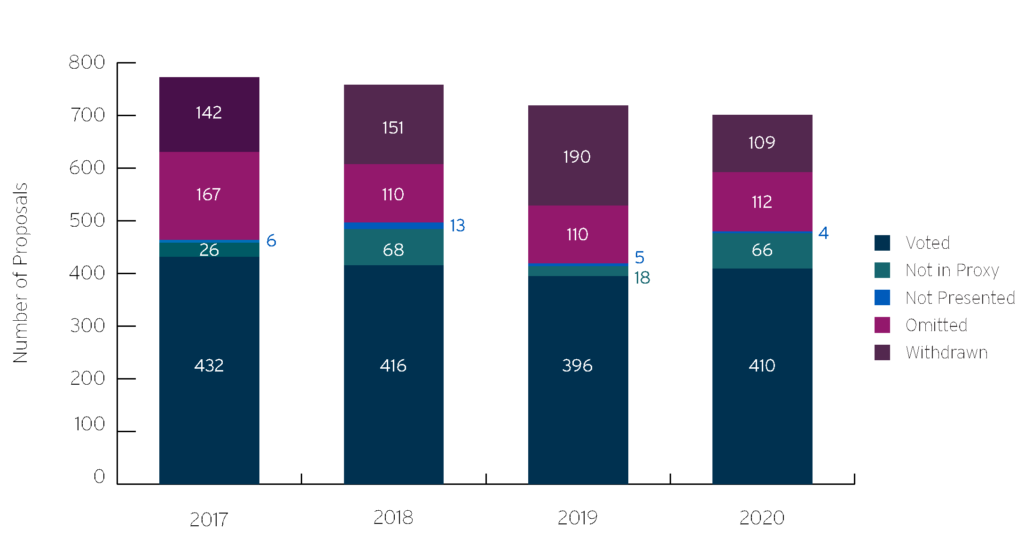

Approximately 58% of shareholder sponsored proposals submitted were voted upon this season, compared to approximately 55% in each of 2019 and 2018.

At the same time, the number of proposals withdrawn during the 2020 season represents 15.5% of submitted proposals, compared to 26.4% and 20.0% in 2019 and 2018, respectively. While an increase in the number of proposals not included in the proxy during the 2020 season (i.e., where there is no public record of a proponent withdrawing its proposal) offsets some of the decrease in withdrawals, there remains a notable decrease in negotiated settlements in 2020 as compared to 2019 and 2018. Based on our review of available data and conversations with shareholder proponents, it appears that a few factors may have contributed to this decrease. With respect to E&S topics, while withdrawals continue to be more common for these proposals compared to governance proposals, it is possible that target companies previously implemented practices that addressed fundamental aspects of the topic at issue, perhaps making both parties less willing to compromise than in prior seasons. Likewise, as convictions become more urgent with respect to climate matters in particular, negotiated withdrawals may be less palatable. Conversely, there may have been an increased willingness by proponents to reach settlement on environmentally- focused proposals during the 2018 and 2019 seasons as proponents learned to navigate the SEC’s October 2018 guidance regarding micromanagement as a basis of exclusion under Rule 14a-8. That guidance has also narrowed the format that many climate-related proposals take, which may also disincline proponents to further adjust their requests. Lastly, co-filers continue to be a popular approach to proposal submissions, and multiple co-filers may also make it more challenging for a company to negotiate withdrawal of a proposal.

As for proposals receiving no-action relief, those numbers have held relatively steady representing 15.9%, 15.2% and 14.5% of all submitted proposals for 2020, 2019 and 2018, respectively. Accordingly, it appears that the revisions to the SEC’s no-action process in the Fall of 2019 had minimal impact on the number of proposals receiving no-action relief.

Proponents

While the Chevedden group was responsible for the majority of governance proposals voted upon during the 2020 season, the majority of E&S proposals that went to a vote were put forth predominantly by what we have categorized as “other shareholder groups,” which include socially responsible asset managers, non-profit organizations, and religious organizations.

| Proponent* | 2020 total submissions | 2019 total submissions | Primary Focus |

|---|---|---|---|

| John Chevedden (& associates) | 191 | 250 | Governance |

| As You Sow Foundation | 63 | 53 | Environmental & diversity |

| Mercy Investment Services | 35 | 37 | Political, environmental & executive compensation |

| Trillium Asset Management | 36 | 29 | Environmental & social |

| New York City Comptrollers | 31 | 21 | Diversity & social |

*In some instances these proponents were co-filers or co-sponsors with other proponents.

Governance Shareholder Sponsored Proposals

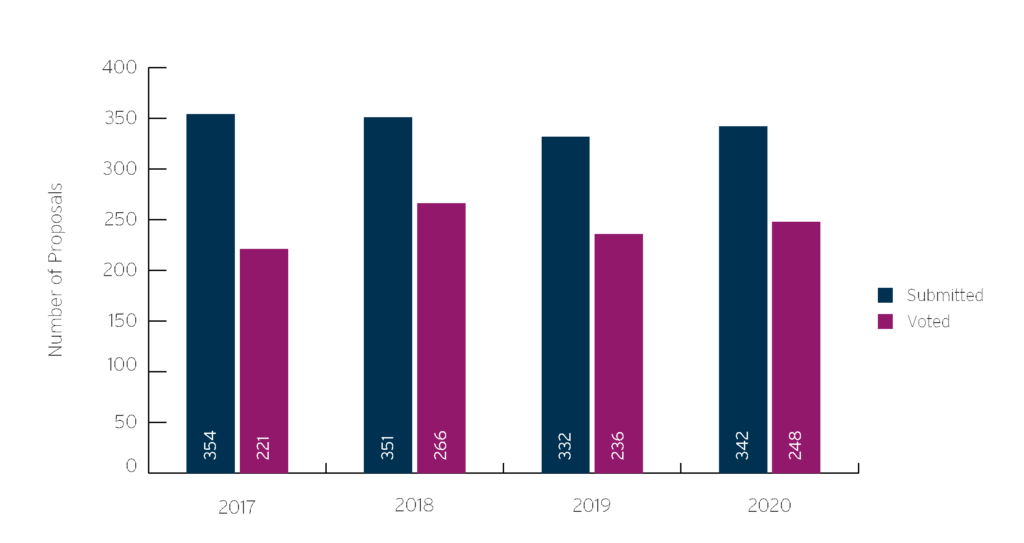

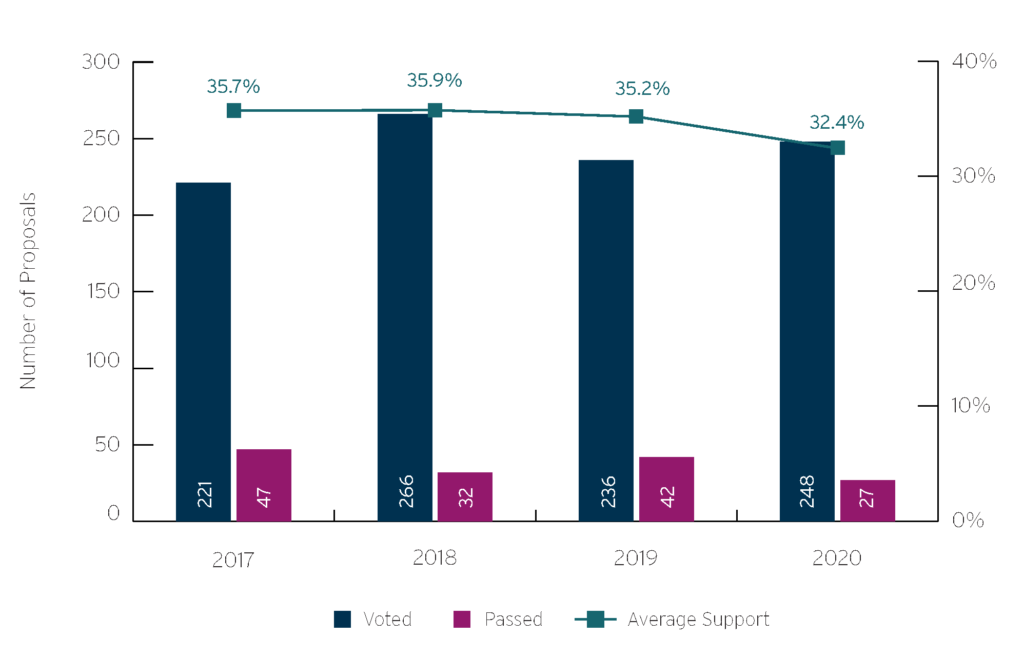

The number of corporate governance-related proposals submitted and voted on during the 2020 proxy season trended up slightly, but the number receiving majority support dropped significantly compared to 2019 (27 in 2020 as compared to 42 in 2019). This year the average support for governance proposals was slightly down from prior years.

An examination of proponents reveals that almost two-thirds of the governance proposals voted upon this proxy season were sponsored or co-sponsored by John Chevedden, James McRitchie, Kenneth Steiner, William Steiner or Myra Young (collectively “the Chevedden Group”).

The remaining proposals were sponsored primarily by public pension funds, labor unions and other socially responsible investors. This breakdown remains relatively unchanged from prior proxy seasons. One interesting trend in 2020 is that 11.7% of governance shareholder proposals did not disclose the proponent, which is up considerably from 1.3% in 2019. Companies need not disclose the proponent of the shareholder proposal, but it is generally considered best practice to do so. This shift is particularly interesting in light of Glass Lewis’s March 2019 launch of its Report Feedback Statement process, which among other things requires issuers to name the shareholder proponent of any shareholder proposal(s) up for a vote at the relevant annual meeting in the company’s proxy in order to use the process. [6]

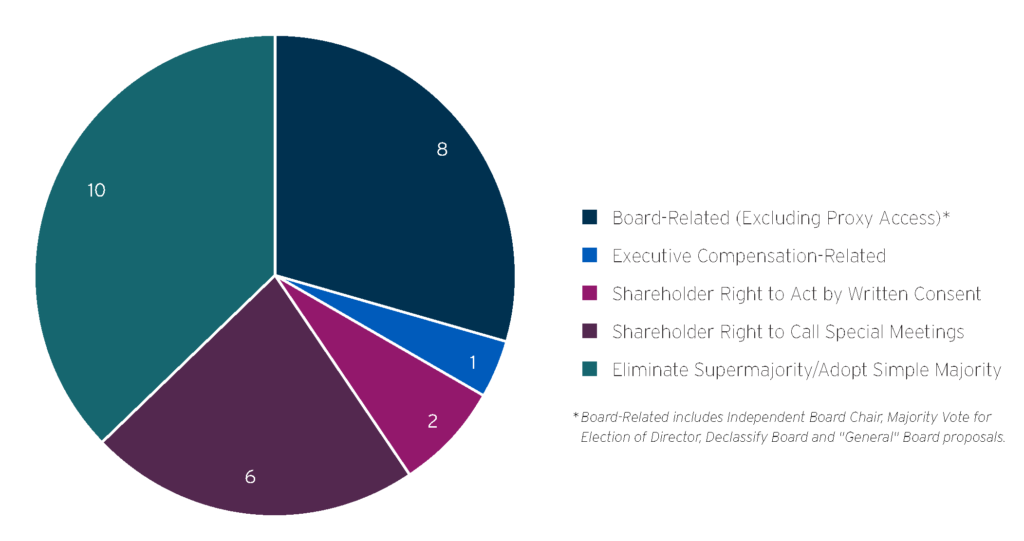

Independent Board Chair

Independent chair proposals have been prolific since the mid- 2000s. Despite their popularity, these proposals have experienced average support in the range of 29% to 32% since 2012.

After witnessing only one proposal pass in the past five calendar years (at Rite Aid Corporation in 2018), two proposals passed this year at Baxter International and The Boeing Company. In addition, 11 proposals received support in excess of 40% compared to four such proposals in 2019. The COVID-19 pandemic seems likely to have fueled shareholders’ focus on improving board oversight, effectiveness and independence by requiring an independent chair. Overall average support for these proposals rose to 34% in 2020.

The proposal at Baxter International, a company in the health care sector, received the highest support this proxy season, with 55% of the votes cast in favor. Although the company maintains a combined chairman and CEO position, it has an independent lead director with robust duties. However, the proponent (Kenneth Steiner) raised the lead independent director’s 19-year tenure as a factor compromising his independence. While Institutional Shareholder Services (ISS) did not identify any significant shareholder rights concerns at Baxter, it supported the shareholder proposal on the basis of a recently identified material weakness that resulted in financial restatements, suggesting the need for greater board oversight.

The proposal at Boeing received approximately 52% support even though the company put an independent board chair in place in late 2019. The grounding of the 737 MAX airliner following two deadly crashes, and the associated concerns relating to the culture and safety issues at the company, raised questions about the Boeing board’s failure in executing its oversight responsibilities. The undisclosed proponent of the proposal also highlighted concerns regarding the then current independent chair’s ability to effectively lead the board in light of his other professional responsibilities and interlocking directorships with two other board members (one of which was Boeing’s then CEO Dennis Muilenburg). While most of these concerns were addressed through leadership changes prior to Boeing’s annual meeting, the proposal still received majority support as investors believed formalization of this leadership structure was important to ensure ongoing independent board leadership.

Investors view strong, independent board leadership as a matter of importance to ensure effective board oversight and accountability to shareholders. While many investors recognize that an independent lead director with robust duties can be an acceptable alternative, they are increasingly expressing a preference for an independent board chair. Taking a historical view of this topic, it appears the preference for an independent chair gets stronger during the time of market-wide economic crisis. Although there is a current stock market rebound, persistent economic and social challenges presented by COVID-19 are not expected to subside in the near future. It will be interesting to see how these proposals fare during the 2021 proxy season. One thing, however, is certain: independent board oversight and leadership will remain an area of investor focus into 2021 and beyond.

Eliminate/Reduce Supermajority/Adopt Simple Majority

The number of proposals voted on in connection with the elimination of supermajority voting or the adoption of uniform simple majority requirements dropped significantly to 12 in 2020 as compared to 20 in 2019, but returned to historic norms in line with the number voted upon in the 2018 and 2017 seasons.

This proposal category also represents the most highly supported category among governance proposals, with 11 of the 12 proposals that reached a vote receiving majority support—10 of which received the necessary support to pass. [7] The two instances that did not receive the requisite support are distinguishable given individual facts and circumstances.

Despite shareholders’ routinely high support of these proposals, they sometimes prove difficult for management to implement in subsequent years. This is due to the supermajority vote required to eliminate the supermajority provisions themselves and the composition of the company’s shareholder base.

Reduction of Thresholds for Shareholders to Call a Special Meeting

The number of proposals seeking reduction of the threshold required for shareholders to call a special meeting saw a surge similar to what we saw in the 2018 proxy season, with 40 such proposals going to a vote this year. The 2018 surge was due to the Chevedden Group’s focus on the proposal and its ability to get the proposal on 52 companies’ proxy ballots. This proposal was a focus of the Chevedden Group again this year as at least 33 of the 40 proposals that went to a vote were proposed by John Chevedden or members of his group, particularly Kenneth and William Steiner. The continued high average support that these proposals received (42% in 2020) is not surprising given shareholders’ ability to call special meetings is broadly considered to be a fundamental right. However, less consensus exists among investors as to the specific ownership threshold that should be required to have the ability to call a special meeting. Accordingly, the threshold percentage is often a determining factor as to whether these shareholder proposals receive majority support. Of the six proposals that received majority support this season, three sought to reduce the threshold required from 25% ownership to 10%.

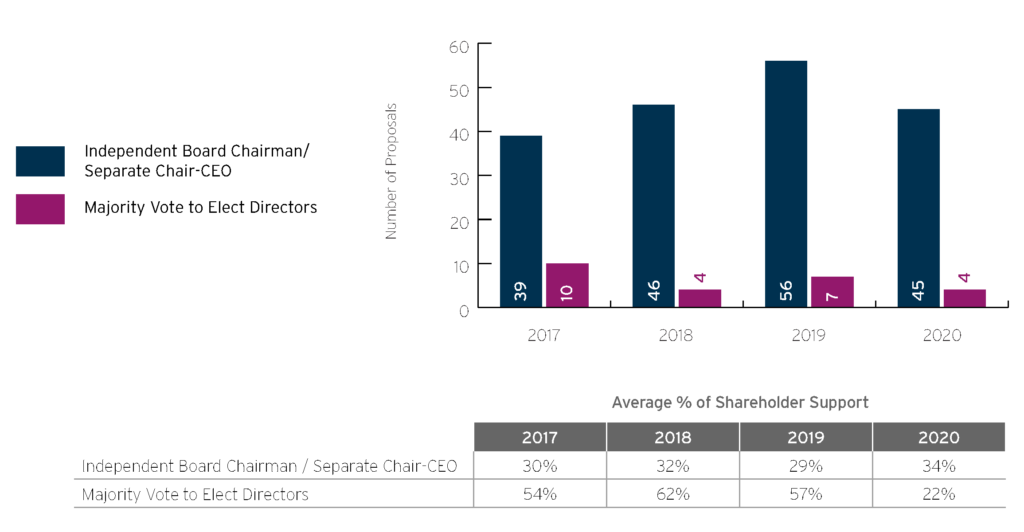

Shareholder Right to Act by Written Consent

This proxy season saw an acceleration in the frequency of proposals seeking the right to act by written consent—56 went to a vote in 2020, compared to 34 in 2019. Despite the increase in frequency, the average level of support continued its downward trend from the high of 45% in 2017 to 35% for 2020. Shareholders’ decisions to support proposals demanding a right to act by written consent are often influenced by whether shareholders have an existing right to call a special meeting at an acceptable threshold (generally ranging from 10% to 25% depending on the investor). In the two instances where this proposal received majority support this season, OGE Energy Corp. did not provide shareholders with the right to call a special meeting and Stanley Black and Decker, Inc. provides the right at a 35% threshold.

Shareholder Approval of Bylaw Amendments

A new shareholder proposal category from the Chevedden group during the 2020 proxy season sought to require non- binding shareholder approval of any board-adopted bylaw amendments. While the proposal was voted upon at 16 companies, it received average support of only 3.7% Given the low support across the proposals, it remains to be seen if Chevedden will continue to submit these proposals in the 2021 season.

S&P 1500 Shareholder Proposal Activity, 2017-2020

Governance Proposals Submitted vs. Voted, 2017-2020

Governance Proposals Voted vs. Passed & Average Support, 2017-2020

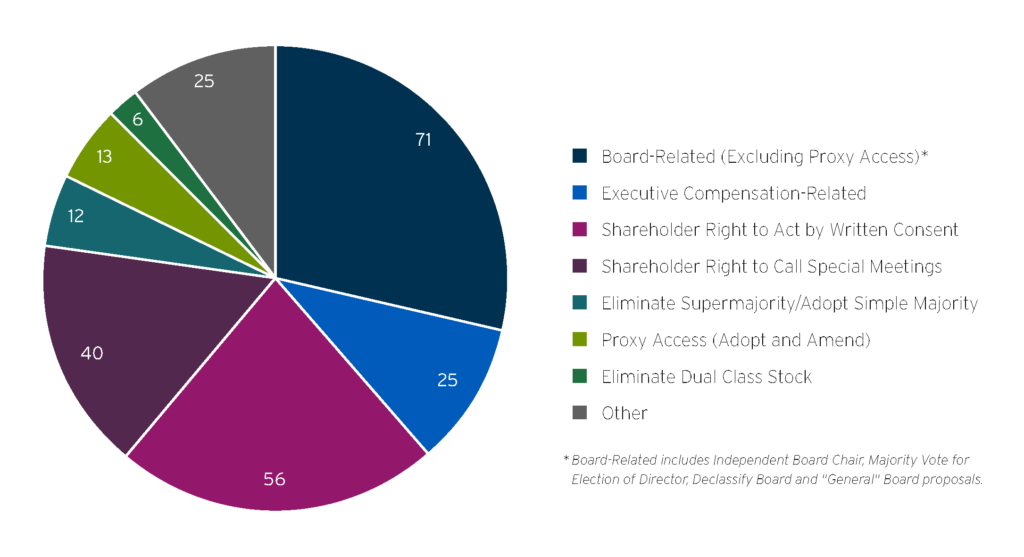

Governance Proposals Voted Upon by Type, 2020

Passing Governance Proposals, 2020

Proposals Voted Upon Relating to Board Issues, 2017-2020

Proposals Voted Upon Relating to Shareholder Rights, 2017-2020

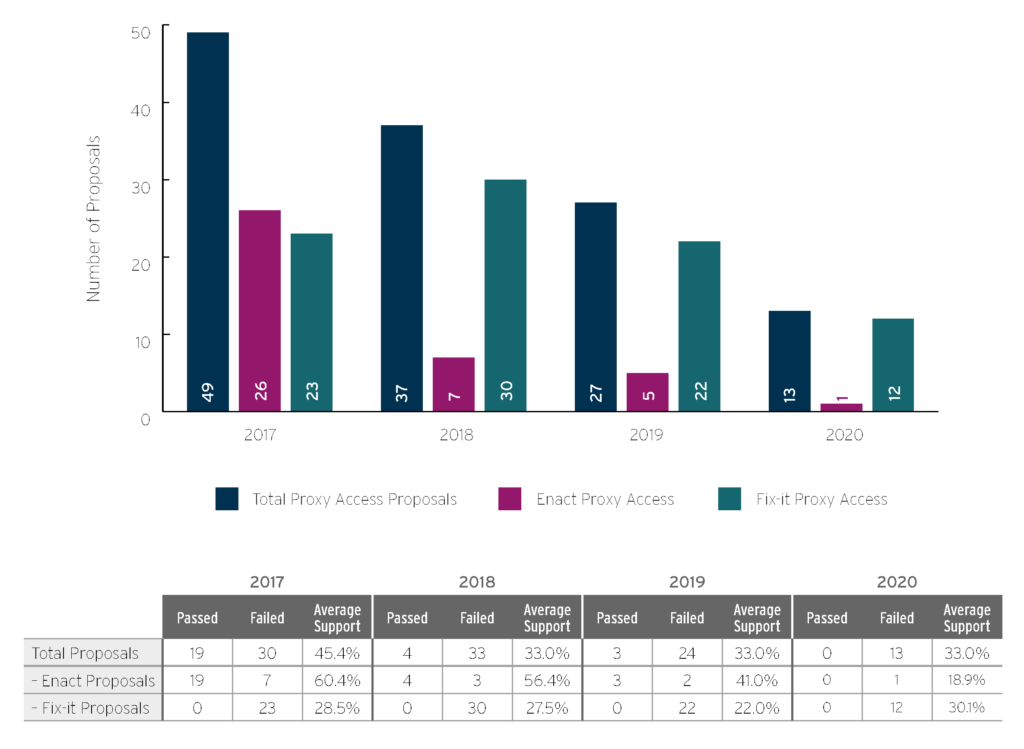

Proposals Voted Upon Relating to Proxy Access, 2017-2020

Environmental and Social Shareholder Sponsored Proposals

The number of E&S proposals submitted was marginally higher than the number of governance proposals this year. Notably, comparing the number of proposals submitted to those voted, while overall shareholder E&S proposal submissions continued their downward trend, the number of proposals voted on increased year-over-year which is consistent with our earlier observation that overall withdrawals decreased this season.

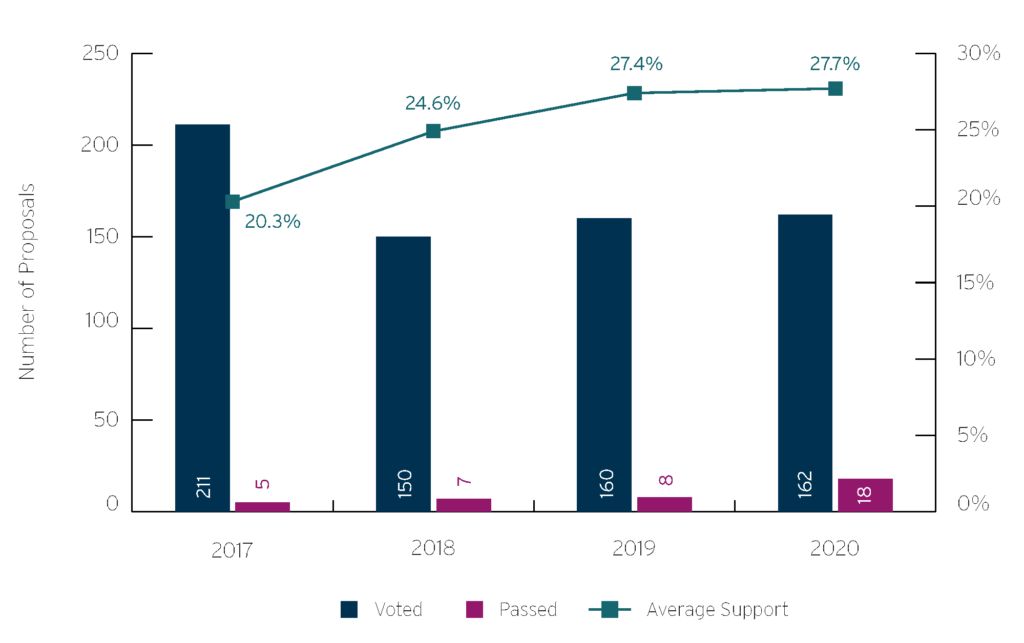

While average support for E&S proposals was relatively steady compared to the prior season, support has increased significantly since 2017 as reflected in below. Looking beyond average support however, there was also a material shift in the number of proposals that passed during the 2020 season—18 proposals received majority support representing approximately 11% of E&S proposals voted on. That is more than double the passage rate seen in the 2019 season and almost four times the passage rate experienced during the 2017 season.

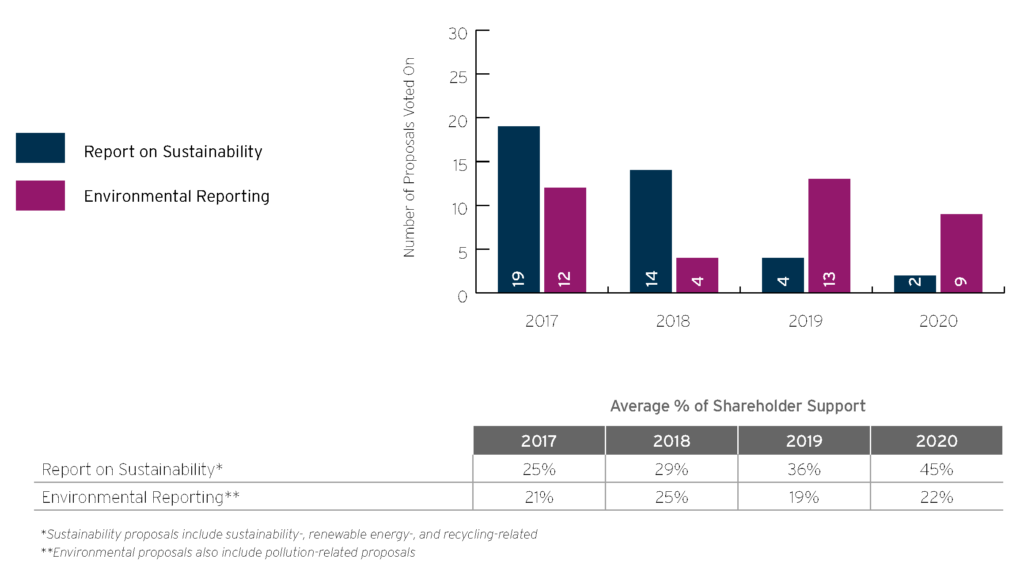

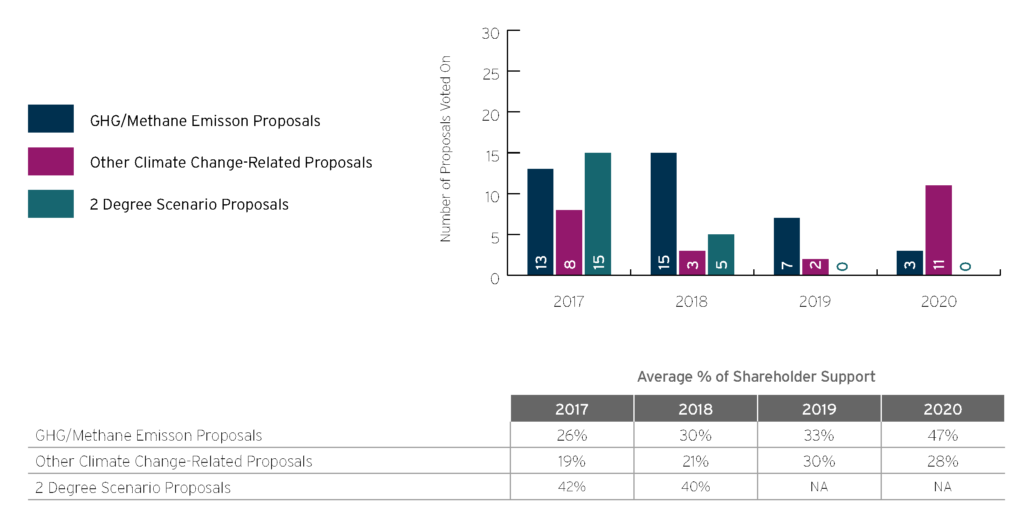

Environmental Proposals

As illustrated in the figures below, support for all environmental- related proposals, except “other climate-related proposals” (i.e., those not specifically focused on GHG emissions) increased in the 2020 season. The decrease in support for “other climate- related” proposals was significantly driven by two anti-climate proposals submitted at XCEL Energy and Exxon Mobil that received minimal support of 3.3% and 4.1% respectively. Excluding those proposals, support for these proposals increased as well from 30% in 2019 to 31.9% during 2020. Given the increasing urgency within society to address climate change, we expect these support levels will only continue to rise in the 2021 proxy season.

14 proposals primarily focused on climate change [8] reached a vote, and three [9] received majority support:

- B. Hunt Transport Services, Inc., where a proposal seeking a report describing if and how the company plans to reduce its contribution to climate change and align its operations with Paris Agreement goals received 54.3% support

- Dollar Tree, , where a proposal seeking reporting on GHG reduction goals and on how the company is aligning its long-term business strategy with the projected long-term constraints posed by climate change received 70.7% support

- Chevron, where a proposal seeking reporting on climate lobbying aligned with Paris Agreement goals received 5% support [10]

An additional two proposals receiving majority support, captured within the environmental and sustainability categories shown below, also included climate-related elements:

- Phillips 66, where a proposal seeking a report assessing the public health risks of expanding petrochemical operations and

investments in areas increasingly prone to climate change-induced storms, flooding and sea level rise received 53.9% support - Enphase Energy, where a proposal seeking a report on the company’s ESG performance—specifically citing wastewater reduction targets and product-related environmental impacts as topics that potentially pose significant risks to the company received 51.8% support

Phillips 66 and Chevron are two of the 161 companies targeted by the Climate Action 100+ investor initiative focused on climate change, which continued to gain momentum this proxy season. Notably, in line with BlackRock’s vocal focus on climate change this season, it became a Climate Action 100+ signatory in January 2020.

The volume of climate-related proposals receiving majority support returned to the level seen during the 2018 season after no such proposals passed during the 2019 season. BlackRock and Vanguard have already disclosed certain voting decisions demonstrating that both are voting in favor of these resolutions with increased frequency at companies where they have concerns around the company’s management of climate risk.

To be clear, BlackRock and Vanguard are certainly not the asset managers most frequently voting in favor of climate-related proposals, but they merit highlighting both because of their significant ownership positions within the S&P 1500 (and more broadly across the U.S. equity markets) and because they have been and continue to be criticized for not doing enough to address climate matters.

We expect that as these firms take further voting action at future meetings, support for these proposals will continue to increase. Part II of the Annual Corporate Governance Review will provide further analysis of institutions’ voting decisions on these proposals.

In addition to majority supported shareholder proposals, significant activity surrounding climate change during the 2020 proxy season took place outside of the four corners of a proxy ballot.

A review of withdrawn proposals shows nearly 40 environmentally- focused proposals where presumably the subject company and the proponent reached an agreement on the subject matter of the proposal. One company falling into this category—Southern Company—had a withdrawn proposal seeking climate change risk reporting from Climate Action 100+ participant As You Sow. At its recent annual meeting, Southern Company announced committing to a 2050 net-zero carbon emissions target consistent with the position advocated by Climate Action 100+.

Social Proposals

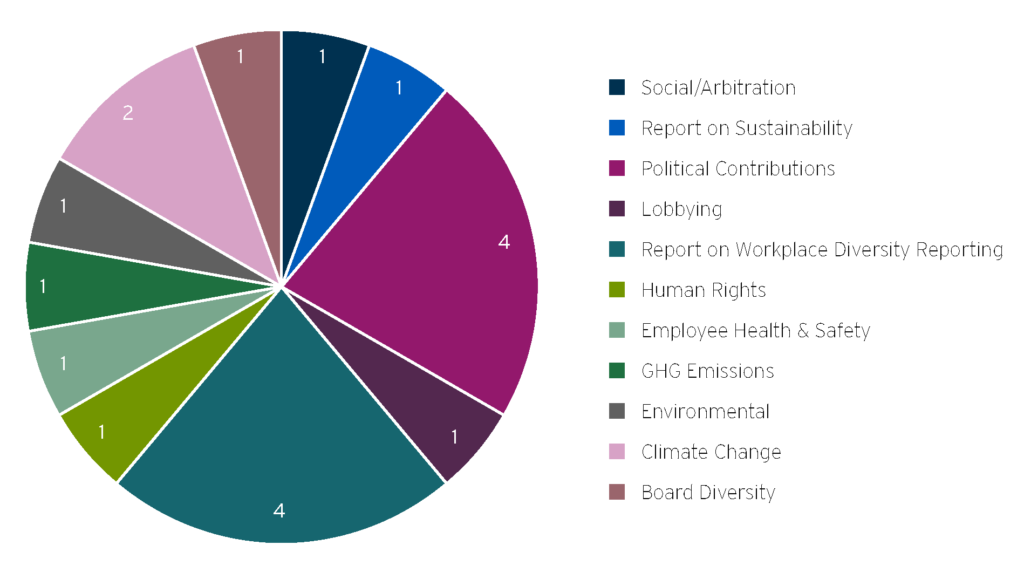

Across the 359 E&S shareholder proposal submissions, a wide range of social topics were addressed during the 2020 season including human capital management issues such as workforce diversity, gender and racial pay equity, sexual harassment, human rights, board diversity and political contributions and lobbying expenditures. As shown below, workforce diversity and political contributions proposals had the highest number of passages with four proposals for each category.

Board Diversity

Proponents filed 35 proposals addressing board diversity, eight of which were voted upon. This year, almost half (17) of these proposals were submitted by the New York City Comptroller’s Office as part of its Boardroom Accountability 3.0 campaign, which focused on the implementation of policies requiring the consideration of qualified women and racially/ethnically diverse candidates for director and external CEO searches. [11] The Comptroller’s proposed policy is referred to as the Rooney Rule, borrowed from the NFL, which requires teams to interview minority candidates for front office positions. 13 of the proposals were withdrawn prior to reaching a vote and one received majority support—at Expeditors International of Washington, Inc.

Two of the focus companies—Arthur J. Gallagher and PACCAR—implemented policies addressing only the director search prong of the Comptroller’s proposal. PACCAR subsequently successfully received no-action relief from the SEC to exclude the proposal. However, the proposal went to a vote at A.J. Gallagher receiving just over 24% support. The fourth proposal, at Berkshire Hathaway did not receive meaningful support given company’s significant insider ownership. While not passing, one additional proposal filed by Trillium Asset Management focused on management diversity at IPG Photonics Corporation received nearly 45% support. That proposal requested a report assessing the current state of IPG management’s diversity and how it plans to make the management team more diverse in terms of race, ethnicity, and gender. While not specifically seeking implementation of a Rooney Rule policy, the proposal suggested inclusion of disclosure regarding the company’s use of Rooney Rule practices when interviewing for open positions.

These results demonstrate that, during the 2020 season, the absence of any policy at a target company was heavily scrutinized by investors. However, extrapolating from the results at A.J. Gallagher as compared to those at Expeditors International, diverse candidate pools at the C-suite level appear to have been lower priority to investors than in the boardroom. We expect many companies may face increasing pressure to extend director search policies to CEOs considering the results of the Comptroller’s campaign and the current social climate. We also note that the Comptroller’s Office is not the only shareholder focusing on the implementation of Rooney Rule policies. The Midwest Investors Diversity Initiative, a 14-member alliance co-led by the Illinois State Treasurer’s Office and Segal Marco Advisors, recently announced that it obtained commitments from 32 companies to adopt Rooney Rule policies for every open board seat through engagements over the past four years.

The vast majority of these proposals reached a vote prior to George Floyd’s death and the resulting societal focus on racial inequality and systemic racism. Accordingly, we expect the submission, and passage, of proposals focused on diversity, equity and inclusion will likely accelerate in the 2021 proxy season. Indeed, the New York City Comptroller’s Office in July announced a letter writing campaign focused on 67 S&P 100 companies who issued supportive statements on racial equality, asking that they publicly disclose the composition of their workforce by race, ethnicity and gender. Other proponents such as Trillium, Calvert and the Interfaith Center for Corporate Responsibility have also been focused on this topic. BlackRock indicated in a June announcement outlining its strategy for racial equity and inclusion, that it will be “refreshing” its expectations regarding companies’ management and disclosure of human capital issues and sustainable social practices.

Workforce Diversity

36 proposals submitted during the 2020 proxy season addressed workforce diversity and inclusion. 12 of these proposals reached a vote, with four receiving majority support—at Fortinet, Inc., Fastenal Company, Genuine Parts Company and O’Reilly Automotive, Inc. The Fortinet proposal represented a new approach to this topic seeking a report assessing the company’s diversity and inclusion efforts, including the board’s (i) process for assessing the effectiveness of its diversity and inclusion programs, and (ii) assessment of program effectiveness. The other proposals all specifically sought reporting on the diversity of the respective company’s workforce based on gender and the Employer Information Report EEO-1 racial and ethnic categories. In the case of Genuine Parts and O’Reilly Automotive, the proposals also requested broader reporting on policies, performance and improvement targets (taking into account SASB-aligned metrics) related to material human capital risks and opportunities.

Also focused on the topic of board and workforce diversity, the National Center for Public Policy Research, a conservative think tank, this season submitted nine proposals relating to “ideological” diversity. Three of these proposals reached a vote, receiving support receiving support ranging from 1% to 1.6%.

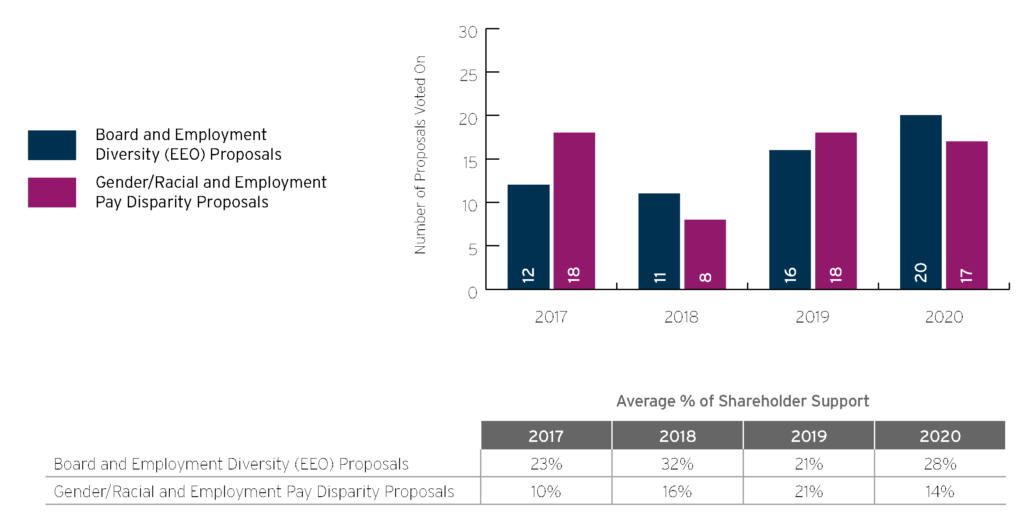

Gender and Racial Pay Disparity

Consistent with 2019 proposals, the majority of pay gap proposals voted upon in 2020 focused on reporting of unadjusted pay gaps, aimed at addressing not just whether equal pay exists but also equal opportunity, rather than information adjusted for seniority, geography and other factors. At least 7 of the 17 proposals voted upon this season were filed or co-filed by Arjuna Capital, which expanded its request this season to seek information on both gender and racial pay gaps, rather than gender pay gaps alone. Likely as a result of this shift in focus, support for these proposals decreased significantly during 2020 from an average of 21% during 2019 to 14% during 2020. Specifically, ISS recommended voting in favor of only three of these proposals due to concerns regarding how a racial pay gap ratio would be calculated. In comparison, it recommended votes in favor for 13 of the pay gap proposals voted on during 2019.

Voluntary agreements to publicly disclose unadjusted pay gap information continued to be rare during 2020, with only two companies agreeing to do so—MasterCard and Starbucks. In light of the current social climate, this may be another area ripe for expanded focus during the 2021 proxy season.

In 2020 six employment-related mandatory arbitration proposals were submitted (a slight increase from the five submitted during 2019). Two of these proposals reached a vote, and while ISS recommended votes in favor of both proposals and support for the proposals differed substantially, with one receiving majority support of 51% at Chipotle and the other, at Alphabet, receiving just over 16% support. This disparity can be accounted for in part due to Alphabet’s dual class structure.

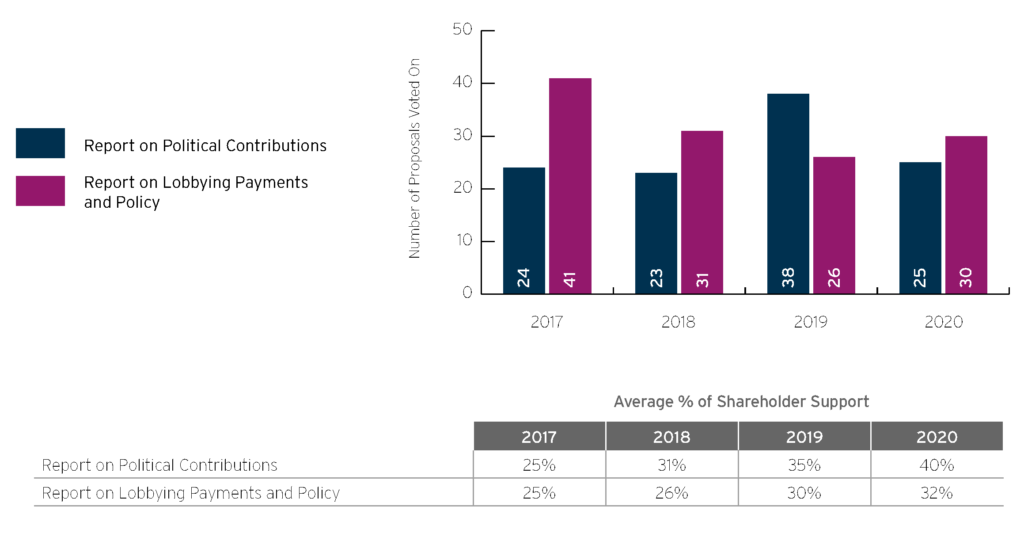

Lobbying and Political Contributions

During the 2020 proxy season proposals submitted seeking reporting on lobbying and political contributions decreased to 76, as compared to 101 in 2019. While the number of political contributions proposals decreased notably, the number of lobbying proposals increased slightly. Figure 17 illustrates the number of each of these proposals that reached a vote between 2017 and 2020. Part II of the Annual Corporate Governance Review will provide further analysis of institutions’ voting decisions on these proposals.

Environmental and Social Proposals Submitted vs. Voted, 2017-2020

Environmental and Social Proposals Voted vs. Passed & Average Support, 2017-2020

Passing Environmental and Social Proposals, 2020

Proposals Voted Upon Relating to Select Social Issues, 2017-2020

Proposals Voted Upon Relating to Select Social Issues, 2017-2020

Proposals Voted Upon Relating to Select Environmental Issues, 2017-2020

Proposals Voted Upon Relating to Select Environmental Issues, 2017-2020

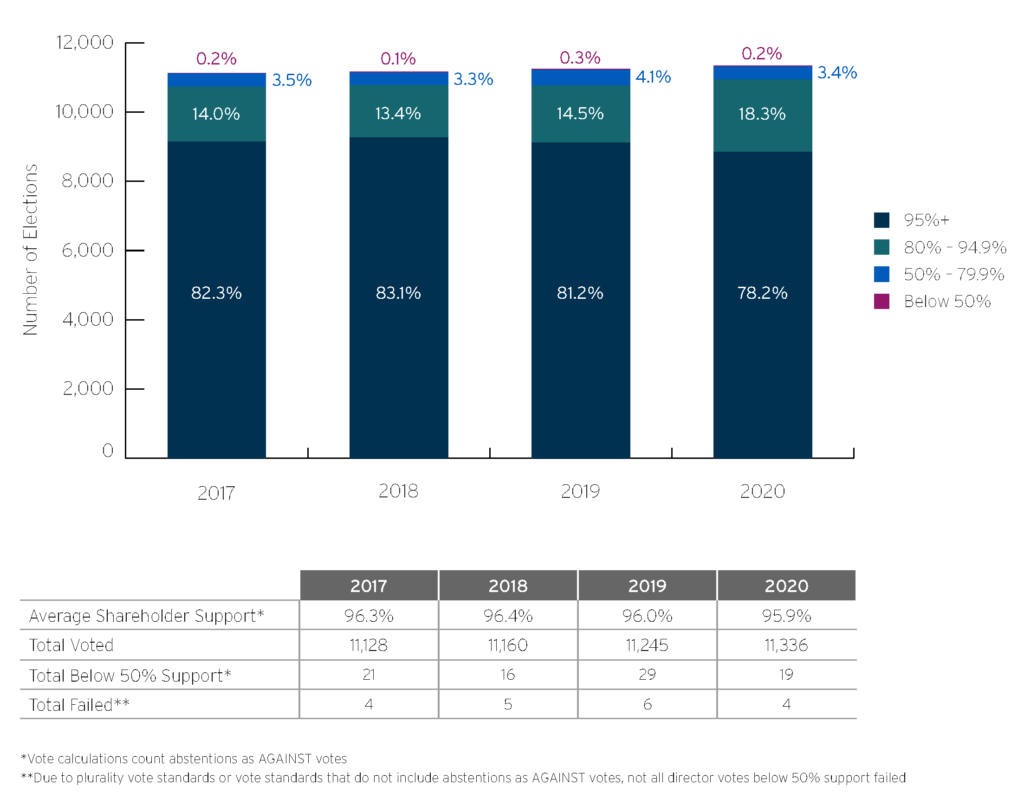

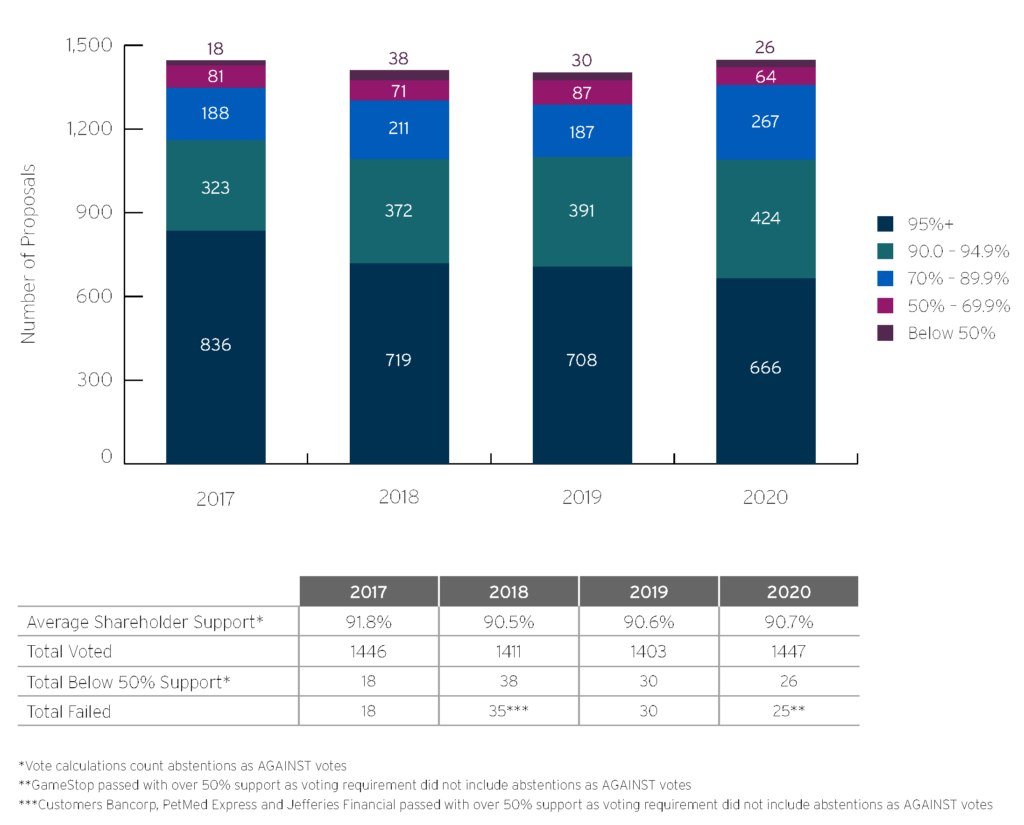

Director Elections

The investor spotlight continued to shine on director elections this proxy season. Compared to director support experienced during 2019, aggregate votes in favor of directors decreased only slightly year-over-year. Average support of director elections has hovered close to 96% over the past four years. In 2020, 19 directors received less than 50% support, of which four failed to be elected due to a majority voting standard.

This year, additional investor focus on director elections came from State Street Global Advisors. In January, State Street announced that, among its engagement priorities for 2020, the firm will consider voting against board members at companies in the S&P 500 with R-Factor™ scores in the bottom tenth percentile of their industries that cannot articulate how they plan to improve their score. Beginning in 2022, this voting action will extend to all companies within its portfolio whose R-Factor™ score places them in the bottom 30th percentile of their industries. According to State Street, its R-Factor™ rating system measures the performance of a company’s business operations and governance as it relates to ESG topics that are financially material to the company’s industry (based on applicable SASB standards).

BlackRock has also sharpened its focus on certain factors when evaluating its support of director elections. Specifically, the firm announced that it will expect portfolio companies to provide disclosure aligned with the TCFD framework and SASB standards prior to year-end. BlackRock believes that this disclosure will provide more comparable, financially material information to the market. The firm intends to use this TCFD- and SASB-aligned disclosure to assess portfolio investments and inform its engagements with portfolio companies. Additionally, BlackRock’s policies have been updated to state that the firm may make voting decisions regarding the election of relevant directors based on the disclosure or management of climate matters and when considering whether to support a range of shareholder-related proposals. Indeed, BlackRock recently announced that globally it voted against 53 companies it deemed to be dragging their feet on climate change and that it has placed an additional 191 companies “on watch” for voting action in the next 12 months if their practices do not improve. Other large asset managers such as Neuberger Berman and T. Rowe Price are also considering ESG criteria when evaluating whether to support director elections. Accordingly, we expect that we may see a decrease in director support beginning in the 2021 proxy season, particularly if BlackRock holds true to its mandate that all its portfolio companies produce SASB- and TCFD-aligned reporting by year end.

Additional board-related topics that appear to influence investors to vote against directors up for election are:

- Overboarding—Investor policies have become stricter on the maximum number of boards on which directors may serve. Consequently, investors are voting against directors who they believe serve on an excessive number of boards

- Composition—Continued focus on board composition as it relates to racial, and gender diversity, skill sets, and other factors that, in the investors view, ensures the board is composed appropriately

- Responsiveness and Accountability—Boards are expected to be responsive to shareholder votes and specific investor This expectation has also led to increased support for proposals seeking to separate the roles of board chair and CEO, as discussed below

Support for Director Elections, 2017-2020

Executive Compensation

Say-on-pay vote results for 2020 saw a slight decline in average support experienced within the S&P 500, with approximately 90% of votes cast in favor (excluding abstentions) of these proposals, compared to 91% support last year. In addition, approximately 74% of S&P 500 companies received 90% or higher shareholder support compared to approximately 79% of companies in 2019. S&P 1500 companies fared slightly better this year, with approximately 91% average votes cast in favor and 75% of the companies receiving greater than 90% vote support. 2020 results for the S&P 1500 companies were comparable to those in 2019 in terms of average support, although a higher proportion—78%—received greater than 90% vote support last year.

Ten S&P 500 companies failed to receive majority support for their say-on-pay proposals in 2020. Although Intel Corporation received more votes in favor than against, its say-on-pay proposal failed marginally with 49.7% support as abstentions counted and as votes and had the same effect as votes against the proposal. Among these ten companies, while most received vote support exceeding 40%, QUALCOMM Inc. and CVS Health Corp. received only 17.9% and 24.4% votes favorable votes, respectively. At QUALCOMM, special equity awards in consecutive years and the magnitude of CEO annual cycle long-term incentive awards likely contributed to the lack of support for the executive compensation program. At CVS Health the concerns related to the compensation committee accelerating the grant of the CEO’s performance stock units for 2020 to August 2019 and accelerating the grant of three additional years of performance units to the general counsel likely contributed to the results.

The failure rate for S&P 1500 companies fell to 1.7% in 2020 (26 companies) compared to 2.1% in 2019 (30 companies). The S&P 1500 companies with “red zone” results, i.e. those receiving between 50% to 70% [12] vote support also decreased from 6.2% in 2019 to 4.4% in 2020. The S&P 500 companies falling in the “red zone” decreased slightly from 5.5% in 2019 to 5.2% in 2020.

ISS recommended voting against at a higher percentage of S&P 500 companies in 2020 with 11.8% of say-on-pay proposals garnering a negative recommendation compared to 10.7% in 2019. This was in contrast to S&P 1500 companies, where ISS’s negative recommendations declined from 10.4% in 2019 to 8.3% in 2020. The decline in negative ISS recommendations for the S&P 1500 index was due to small- and midcap companies faring better under ISS analysis in 2020 compared to 2019. Negative ISS vote recommendations at S&P 500 companies and S&P 1500 companies in 2020 arguably reduced shareholder support by 28.1% and 30.7% respectively.

The main reason for ISS’s against vote recommendations continues to be CEO pay-for-performance misalignment. Large discretionary compensation and use of performance goals that were not sufficiently rigorous contributed to misalignment concerns at many companies where ISS recommended against say-on-pay proposals.

Support for Say-on-Pay, 2017-2020

The complete publication, including footnotes, is available here.

Endnotes

1Available at https://www.proxyinsight.com/wp-content/uploads/dlm_uploads/2020/06/ Corporate-Governance-and-COVID-19.pdf.(go back)

2Companies that have had or plan to have virtual meetings based on year-to-date data available from ISS Corporate Solutions, July 2020.(go back)

3U.S. Securities and Exchange Commission. “Staff Guidance for Conducting Shareholder Meetings in Light of COVID-19 Concerns.” April 2020. https://www.sec.gov/ocr/staff-guidance- conducting-annual-meetings-light-covid-19-concerns.(go back)

4Change in in the date, time or location of the meeting.(go back)

5Including intermediaries in the proxy process and other relevant market participants.(go back)

6See https://www.glasslewis.com/report-feedback-statement. This requirement must be met even if the report content the issuer wishes to comment on does not relate to the shareholder proposal(s).(go back)

7While the proposal at PetMed Express, Inc. received nearly 60% of votes cast in favor of the proposal, it required 67% of shares outstanding and entitled to vote in order to pass.(go back)

8This number does not include the proposal Chevron Corporation received relating to establishment of a board committee on climate risk, which we have categorized as a board- related governance proposal.(go back)

9A fourth proposal outside of the S&P 1500 also passed at Ovintiv, Inc. with 56.4% support, which sought disclosure of the company’s climate-related targets, risks and opportunities aligned with Paris Agreement goals.(go back)

10Our data counts abstentions as against votes. Chevron’s voting requirement did not count abstentions as against votes, so even though the climate change proposal received less than 50% as shown in Figure 12, the proposal passed with 53.5% support per Chevron’s voting standard.(go back)

11The New York City Comptroller’s Office was the primary proponent of 14 board diversity proposals, and the co-sponsor of an additional three.(go back)

12Support below 70% is the threshold at which ISS expects increased responsiveness to

shareholders. Glass Lewis’s threshold is higher, at 80%.(go back)

Print

Print