Michelle Edkins is Managing Director, Hilary Novik-Sandberg is an Associate and Victoria Gaytan is a Vice President at BlackRock Investment Stewardship. This post is based on a BlackRock memorandum by Ms. Edkins, Ms. Novik-Sandberg, Ms. Gaytan, and Sandra Boss.

Our fiduciary responsibility

BlackRock Investment Stewardship’s (BIS) activities are a crucial component of our fiduciary duty to our clients. Investment stewardship is how we use our voice as an investor to promote sound corporate governance and business practices to help maximize long-term shareholder value for our clients, the vast majority of whom are investing for long-term goals such as retirement. In addition to direct dialogue with the companies in which our clients invest, we help shape norms in corporate governance, sustainability, and stewardship through active participation in private sector initiatives and the public policy debate. In the reporting year from July 1, 2019 to July 30, 2020, we responded formally to seven policy consultations and spoke at more than 180 events to advance sound governance and sustainable business practices.

Promoting sound corporate governance is at the heart of our stewardship program. We believe that high-quality leadership and business management is essential to delivering sustainable financial performance. That is why we focus on board quality, effectiveness, and accountability across the broad universe of companies globally that our clients are invested in. Engagement and voting are the two most frequently used instruments in BIS’ stewardship toolkit.

Engagement

is how we build our understanding of a company’s approach to governance and sustainable business practices, and how we communicate our views and ensure companies understand our expectations.

Voting

is how we hold companies accountable when they fall short of our expectations. Our voting takes two forms: we might vote against directors or other management proposals, or we might vote to support a shareholder proposal.

In the 2019-20 reporting period, we had more engagements* with more companies than ever before, covering 61% by value of our clients’ equity investments. Where companies fell short of our expectations and were not responsive to our feedback, we voted against key items of business on the shareholder meeting ballot.

As shown in the “By the numbers” section, we held companies accountable for not acting in the interests of long-term shareholders by voting against at least one management proposal at 37% of the approximately 16,200 shareholder meetings at which we voted.

Maximizing long-term value for shareholders

When we vote against a company, we do so with a singular purpose: maximizing long-term value for shareholders. There are two main categories of our voting actions: we might vote against directors—or other management proposals—or vote to support a shareholder proposal. As we discuss below, we employ votes against directors more frequently since that is a globally available signal of concern. ESG shareholder proposals, while often non-binding and less common outside of the U.S., can garner significant attention and send a strong public signal of disapproval. BIS may support shareholder proposals that address issues material to a company’s business model, which need to be remedied urgently and that, once remedied, would help build long-term value. In our assessment, 15% of the 1,087 ESG shareholder proposals on which we voted this year met these criteria and resulted in our support for such proposals.

The importance of leadership in unprecedented times

The fundamental reshaping of finance that Larry Fink wrote about in his letter to CEOs in January has been brought front and center by the COVID-19 pandemic. Both climate change and the pandemic have enormous implications for society and the global economy. In the case of the pandemic, the worst impacts are already being borne by the most vulnerable in our communities and by the countries and economies least able to weather them. Climate change, if not managed, threatens to have a similarly disproportionate effect, exacerbating inequality and associated unrest.

For many companies, COVID-19 has created near-term existential challenges. Companies were plunged into an unprecedented test of their operational resilience, focused on ensuring the health and safety of their workforce while managing business continuity challenges and global supply chain disruptions at a scale never imagined. Financial resilience was, and remains, a pressing issue for many companies, with revenues in some industries struggling.

In the immediate response period, we were able to be supportive as companies sought flexibility from investors to weather the initial storm. In the first half of 2020, our Investment Stewardship team had more than 400 engagements where we discussed the impact of COVID-19.

Given the unprecedented circumstances, we aimed to be constructive and support companies on proposals outside our normal governance policies, such as virtual shareholder meetings, supporting poison pills, dividend cuts, off-cycle revision of executive pay, and authorization for additional financing without shareholder approval. Companies will have to justify these difficult choices in their 2020 reporting and explain how they weighed their decisions in relation to balancing the interests of investors, employees, customers, suppliers, and communities.

Expectations of boards and executive leadership

Our investment stewardship efforts have always started with the board and executive leadership: it is their role to look after the interests of investors and we look to them to meet the expectations we set out. If we are not satisfied with their decisions, we then hold them to account with our vote.

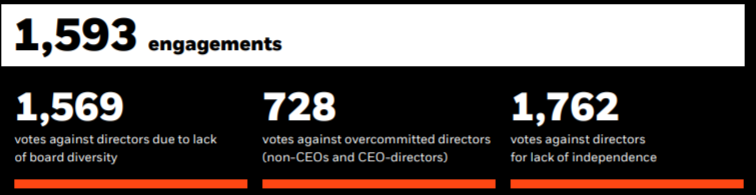

We set out in our market-specific voting guidelines clear expectations of directors to ensure boards have the diversity, capabilities, and independence to effectively oversee management and help drive long-term value creation. We opposed the re-election of over 5,100 directors due to concerns that these characteristics were lacking or that the actions taken by the board were not aligned with the interests of long-term shareholders.

- We expect boards to have a sufficient degree of director independence to look after the interests of all shareholders and at least one independent non-executive director to be accessible to shareholders. We voted against management more than 1,700 times for lack of director independence, with 1,000 votes against in Asia where controlling state or private shareholders can undermine the independence institutional investors are seeking.

- We have long engaged on board diversity, including directors’ personal characteristics and professional experience, as beneficial to good governance and effective decision-making. This year, we voted against management more than 1,500 times for insufficient diversity. We have seen significant improvements in gender diversity in the Russell 1000 and the STOXX 600. Smaller companies and those with more concentrated ownership are lagging, but we expect more progress in the We are increasingly looking to companies to consider the ethnic diversity of their boards, as we are convinced tone from the top matters as companies seek to become more diverse and inclusive.

- We have high expectations for directors to avoid overcommitment and ensure that they have the capacity to fulfill their duties—expectations proven out by the intensification of demands on directors’ time during the COVID-19 crisis. Our votes against directors for being overcommitted have increased to over 700 this year, up from 430 two years While sitting CEOs are reducing their non-executive commitments, we need to see more progress and focus from non-executive directors.

- We are increasingly voting against management on executive pay proposals, up from 15% to 16% this year, or nearly 1,100 votes against management. We voted against compensation committee members at more companies in the S. and UK than in any other markets. Our votes against proposed equity incentive plans in certain markets have fallen as a result of companies making a stronger connection between rewards and performance. Looking ahead, we are sensitive to the need for compensation committees to reflect stakeholder matters in pay determinations, particularly when companies have received government support.

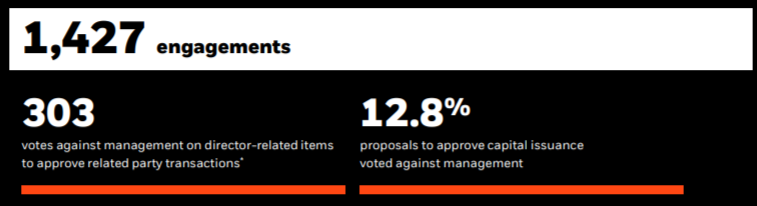

- Over the past year, we have also voted against management to protect the rights of minority shareholders, such as our clients. In many markets in which BlackRock’s clients are invested, it is common to have a controlling shareholder or group of shareholders. These may be founders or their families, government entities or strategically aligned investors.

- The economic interests of the controlling shareholders are sometimes equivalent to the voting rights but often this is not the We voted in support of six out of seven shareholder proposals to introduce a one share, one vote standard. Further, we voted against over 300 proposals to approve related party transactions on the grounds that they were not aligned with the interests of minority investors such as BlackRock’s clients.

Enhanced disclosure builds understanding

We asked in January that companies publish reports aligned with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB) standards. Consistent with the TCFD’s recommendations, this should include a plan for operating under a scenario where global warming is limited to less than two degrees Celsius. We believe the TCFD framework’s four pillars—Governance, Strategy, Risk Management, Metrics and Targets—are applicable to corporate reporting of all business relevant or material environmental and social risks and opportunities. SASB’s sector-specific standards inform the metrics pillar of the framework. These reporting tools help companies demonstrate that they have integrated the management of material environmental and social factors into their strategy and operations.

We have been engaging companies about sustainable business practices for many years and believe TCFD- and SASB-aligned reporting will provide the information investors need to take better informed investment and stewardship decisions, supporting more efficient capital markets. We are encouraged by the momentum building behind these two reporting tools and the recognition amongst practitioners—investors, companies and their advisors, and policy makers—of the need for convergence to establish a globally recognized sustainability reporting standard.

Notably, there has been a nearly 140% increase in companies publishing SASB-aligned reports so far in 2020 over calendar year 2019,* of which 40% are based outside the U.S.

We are committed to being transparent with companies, our clients, and other stakeholders about our investment stewardship activities. We publish our governance principles and voting guidelines to help companies understand our expectations as a long-term shareholder on behalf of our clients. We define engagement priorities each year to alert companies and clients to our areas of focus. As we outline in the following sections, our investment stewardship engagement focuses on companies that we believe may not be acting in the long-term interests of shareholders.

In January, BlackRock wrote to clients about how we are making sustainability central to the way we invest, manage risk, construct portfolios, design products, and execute our stewardship responsibilities. This commitment is based on our conviction that climate risk is investment risk: a changing climate impacts all aspects of society and the economy globally. We believe that sustainable business practices, and sustainability-integrated portfolios, can produce better long-term, risk-adjusted returns.

As a fiduciary, we have a responsibility to our clients to make sure companies are adequately managing and disclosing environmental and social risks and opportunities that can impact their ability to generate long-term financial performance—and to hold them accountable if they are not.

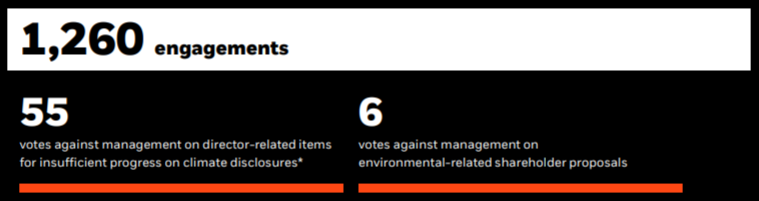

As reported in Our approach to sustainability, we have focused on a universe of 244 companies with significant climate risk inherent in their business models, asking them to demonstrate that they are managing and mitigating that risk. We took voting action against 53 companies for insufficient progress on climate risk management, as assessed from their reporting and through our engagement. We put 191 companies “on watch” and expect them to demonstrate over the coming year that they have taken significant steps to address the business risks they face from climate change. We expect all the companies in this universe to report on their progress on integrating climate risk and other sustainability factors into their business management through disclosures aligned with TCFD and SASB.

Stewardship in 2020 and beyond

Looking ahead, our engagements to date indicated how corporate leaders are seeking a longer-term strategic response to the crisis that is more responsive to the expectations of all their stakeholders. We engaged with more than 1,000 companies this year on corporate strategy, an increase of nearly half over the prior year. Companies are responding to an acceleration of strategic trends like digitalization and reshaping of global supply chains with a reallocation of capital, often toward more sustainable business practices. We find increasing recognition among companies of our conviction that those with a credible long-term strategy, founded on a clearly articulated purpose, will generate more long-term value and be rewarded by more patient, long-term capital. We believe that companies that fail to get this right will face increasing market skepticism, and as a result, a higher cost of capital.

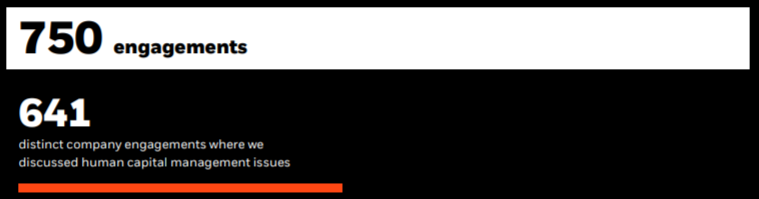

We are observing a shift in awareness of the role companies must play in society in order to demonstrate they have earned their social license to operate. We expect scrutiny of companies on their societal impact and commitment to stakeholders to remain high in the coming year. This year, we engaged with just over 640 companies on human capital management issues and a further 125 on other social issues.

We find companies are increasingly attuned to the need to invest in their workforces, and to provide their employees with opportunities for secure and rewarding employment. This interest is extending to the fair treatment of workforces by companies in supply chains, where sourcing companies increasingly expect standards that may be higher than legal requirements in some countries. Attention to health and safety of customers has never been stronger, whether it is dealing with re-opening of retailing in the context of COVID-19 or fundamental issues of product safety.

Ultimately, BIS is committed to advocating for robust corporate governance and business practices that contribute to the ability of companies to deliver the sustainable long-term returns on which our clients depend to meet their financial goals. We hope that this report helps clients, companies, and other stakeholders understand our approach to investment stewardship. We believe that our transparency helps us meet our commitment to continually enhance our policies and practices in order to protect our clients’ interests.

Our stewardship priorities

Delivering on our fiduciary duty

For 2020, BIS articulated five Engagement Priorities: board quality, environmental risks and opportunities, corporate strategy and capital allocation, human capital management, and compensation to promotes long-termism. Our 2020 Priorities are a continuation from 2019, with each priority now including accompanying key performance indicators for 2020 that align with our expectations for measurable disclosure and action toward creating long-term value for shareholders

Board quality

Board composition, effectiveness, diversity, and accountability is a top priority. We believe that high-quality leadership and business management is essential to delivering sustainable financial performance.

Environmental risks and opportunities

Sound practices in relation to the material environmental factors inherent to a company’s business model can be a signal of operational excellence and management quality

Corporate strategy and capital allocation

We expect boards to be fully engaged with management on the development and implementation of the company’s strategy.

Human capital management

Compensation that promotes long-termism

We expect executive pay policies to use performance measures that are closely linked to the company’s long-term strategy and goals.

* * *

The complete report is available here.

Print

Print