Domenic Brancati is CEO of UK/Europe and Daniele Vitale is Head of Governance in UK and Europe at Georgeson. This post is based on their Georgeson memorandum.

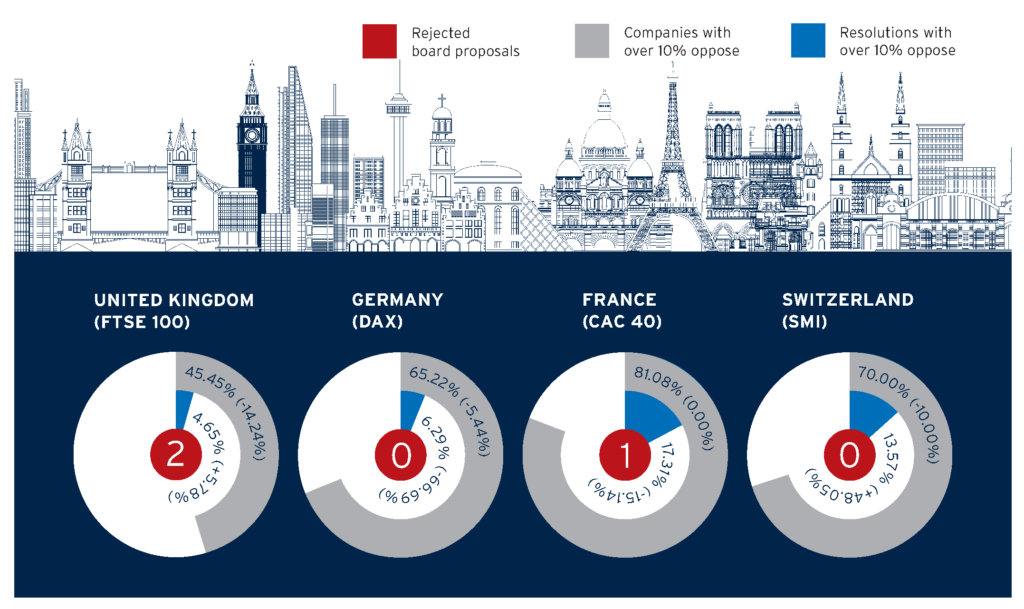

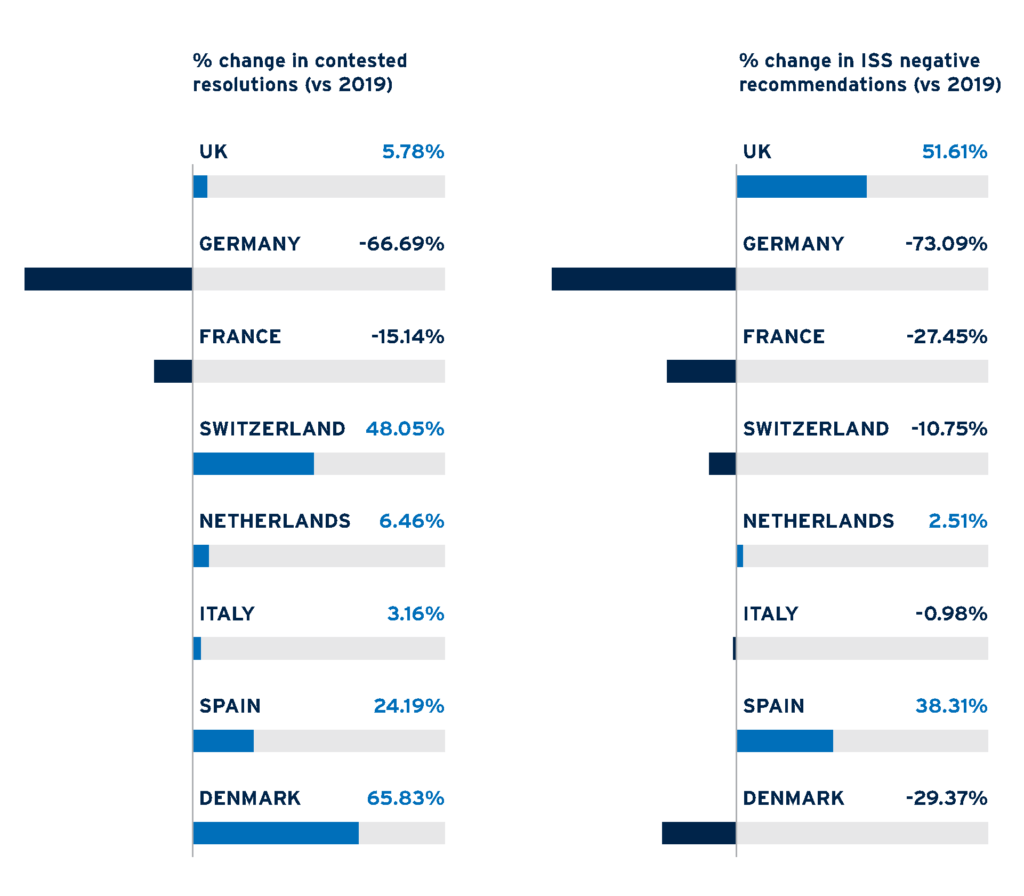

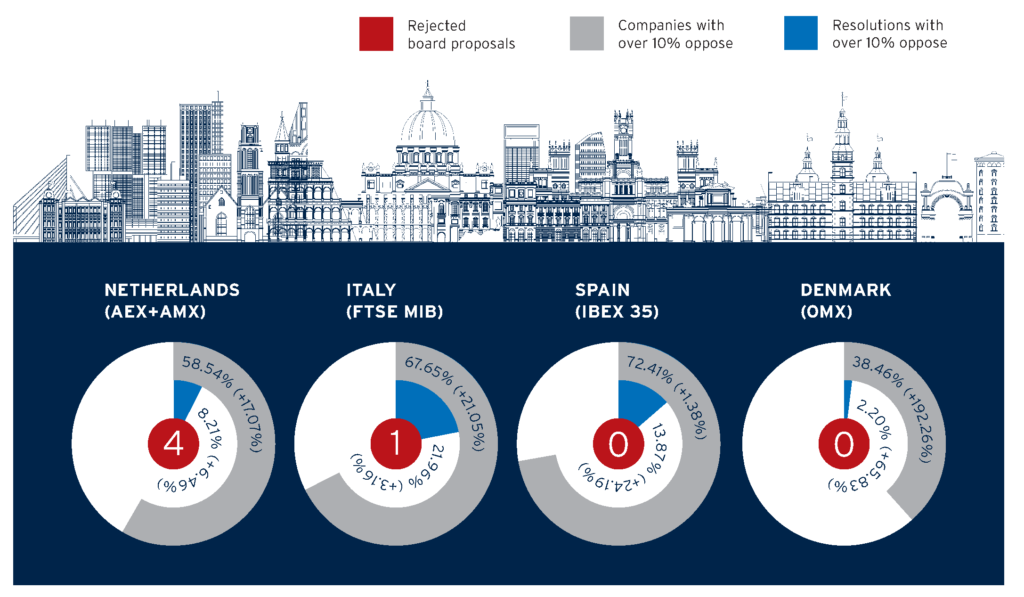

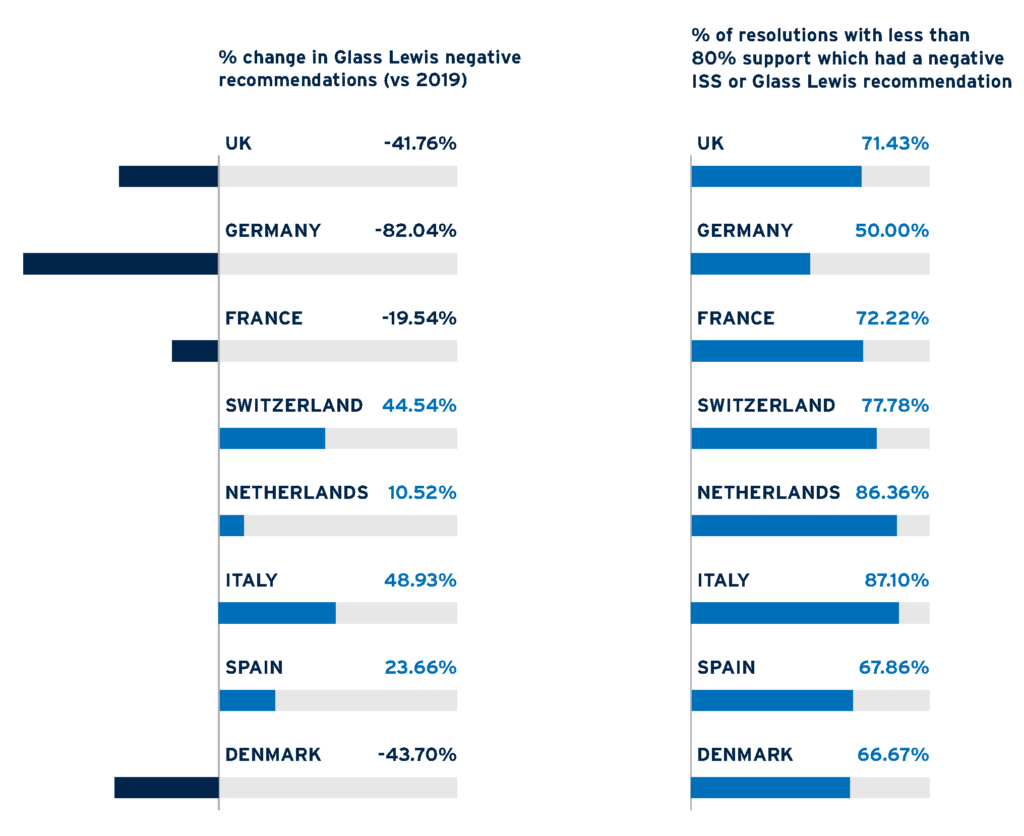

Key Figures

Key Trends

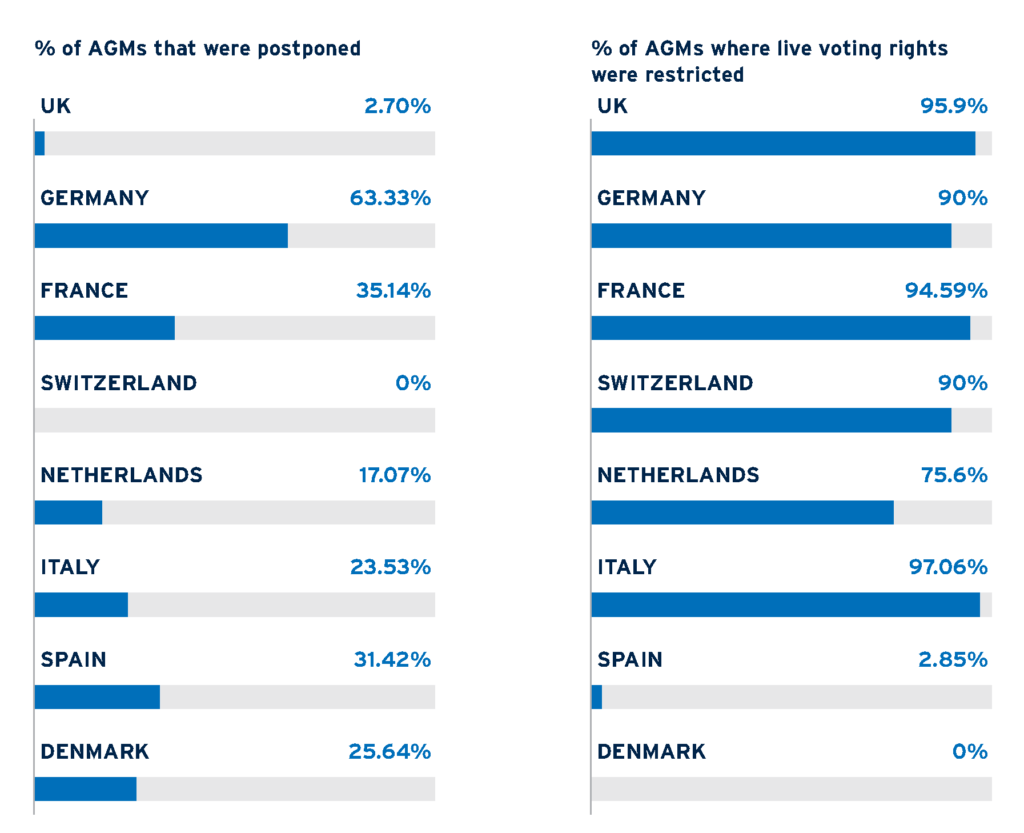

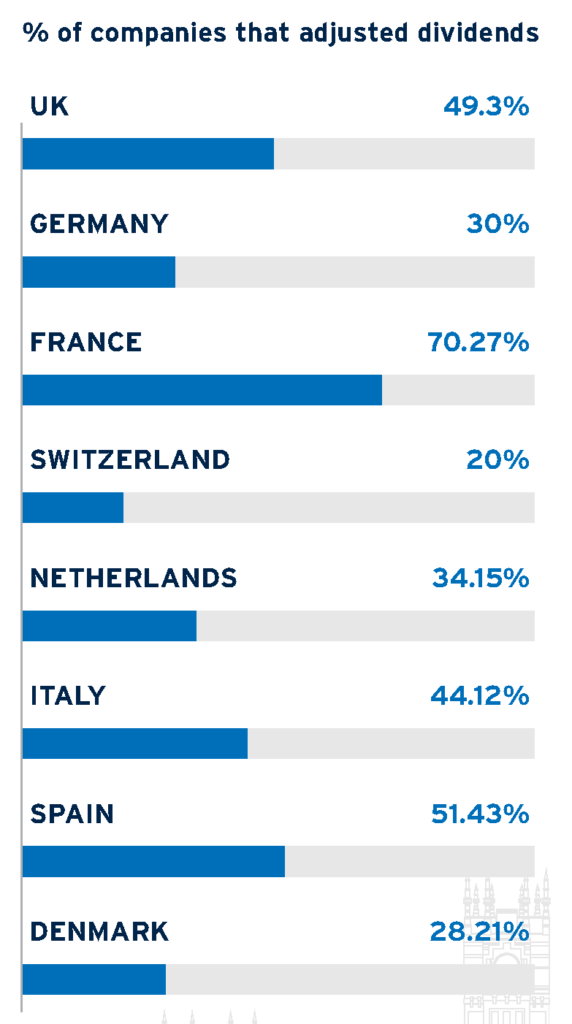

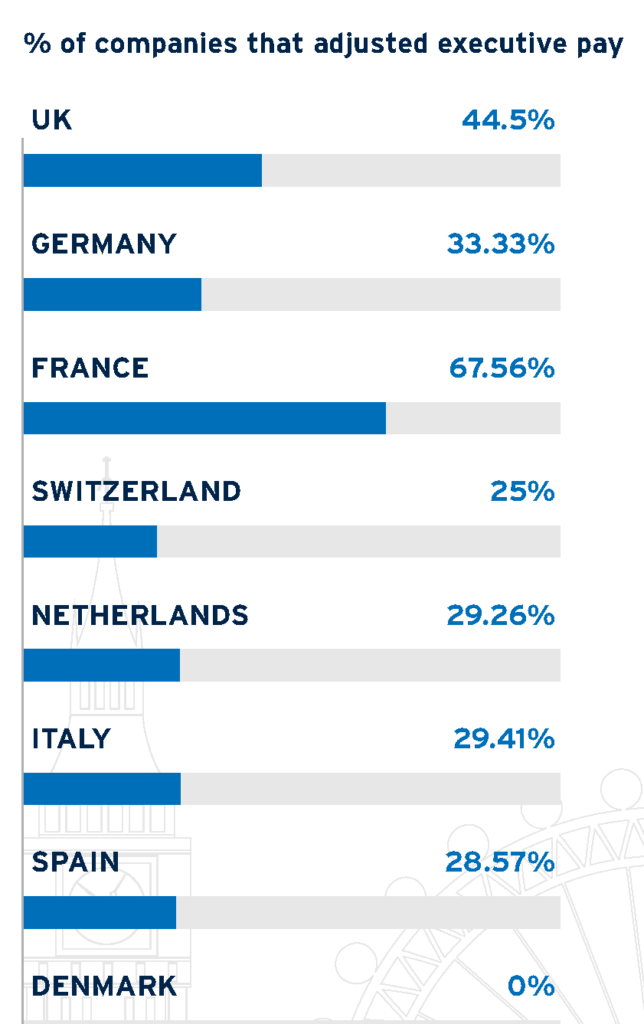

- The COVID-19 outbreak had a major impact on the 2020 AGM season, causing many AGMs to be postponed, live voting rights to be restricted, and changes to dividend and remuneration proposals.

- SRD II has been introduced across most of the EU from the 2020 AGM season; this has affected the Netherlands in particular, which previously did not have annual remuneration votes.

- Germany delayed implementation of the SRD II remuneration vote requirements to the 2021 AGM season. Therefore, it remained the last major market in Europe with no annual vote on remuneration.

- Across the seven main European markets, 79.6% of AGMs had live voting rights (cast during the meeting) restricted, both physically and virtually.

- Executive remuneration continues to be a flashpoint for investors across all major European markets. However, across the European markets covered, there was a calibrated 9% reduction in contested remuneration votes from 2019.

- Director elections remain an area of focus and negative votes. However, across the European markets covered, there was a calibrated 24% decrease in contested director elections from 2019.

Executive Remuneration

Executive remuneration continues to be an important area of focus for many investors.

- The EU’s revised Shareholder Rights Directive introduced annual remuneration votes across the EU from the 2020 AGM season. The market most affected by this change has been the Netherlands, where only a minority of companies (33.33%) held votes on executive remuneration in 2019, while this year every company has put forward a remuneration vote. Germany remained the only major European market without a mandatory annual remuneration vote during the 2020 AGM season.

- In the UK (FTSE 100) dissent over remuneration policy and LTIP votes has increased, resulting in 14 such resolutions being contested (10%+ opposition) in 2020, compared to 11 in 2019 and 8 in 2018. However, it should be noted that across the 2020 season, 58 remuneration policy votes were put forward compared to only 19 in 2019. Therefore, considering only remuneration policy votes and calibrating for the total number of resolutions put forward, there was a decrease of 50% in contested proposals (10%+ opposition). Regarding remuneration report votes, dissent has decreased with only 12 remuneration reports being contested (10%+ opposition), a 43% reduction compared to 2019 on a calibrated basis. This represents the lowest level of opposition on remuneration reports since 2015.

- In Germany (DAX), 25% of remuneration system votes were contested (10%+ opposition) during the 2020 AGM season. It should be noted that only 8 companies put forward an executive remuneration vote in 2020.

- In France (CAC40), 66 remuneration proposals were contested (10%+ opposition) representing 27.7% of the total. Remuneration proposals are the most contested resolution category in France. However we note that opposition over remuneration proposals, calibrated for the total number of resolutions put forward, decreased by 30% compared to 2019. It should be noted that given the way SRD II has been implemented in France, overall 238 remuneration proposals were put forward in France during the 2020 season (against 175 in 2019 and 160 in 2018). Finally, we note that almost every proposed severance payment agreement was contested (9 out of 10), which represents a 170% calibrated increase compared to 2019.

- In Switzerland (SMI), remuneration report votes were contested (10%+ opposition) in 59% of cases (10 out of 17). Compared to last year and calibrating for the total number of resolutions put forward, there was a 9% decrease in contested remuneration report votes. However, this continues to be the highest level of contested resolutions for remuneration proposals across all markets.

- In the Netherlands (AEX and AMX), 19 remuneration proposals out of 118 were contested (10%+ opposition), representing 22.4% of the total. It should be noted that, given the implementation of SRD II, there was a 247% increase in the number of remuneration proposals put forward compared to 2019.

- In Italy (FTSE MIB), remuneration-related proposals continue to be the most contested resolution type (10%+ opposition) for the sixth year in a row within the FTSE MIB. In particular, 44% of the remuneration policy votes and 48% of remuneration report votes were contested by shareholders during 2020 proxy season. After Switzerland, Italy has the highest rate of contested remuneration proposals across all the countries covered.

- In Spain (IBEX 35), 22 remuneration proposals were contested (10%+ opposition) representing 30% out of the total. Remuneration-related proposals remain the second most penalized topic among investors at AGMs. Compared to 2019 and calibrating for the total number of resolutions put forward, there was an 11% increase in remuneration proposal opposition.

- In Denmark (OMX Large Cap) remuneration continues to be the most contested resolution type representing 73% of the total contested resolutions. Compared to 2019, and calibrated for the total number of resolutions put forward, there was a 120% increase in contested (10%+ opposition) remuneration proposals.

Director Elections

Director elections continue to grow as an area of focus and negative votes.

- In the UK (FTSE 100), since 2019 there has been a 15% increase in the proportion of director elections that were contested (10%+ opposition).

- In Germany (DAX) 12 director election resolutions out of 62 were contested (10%+ opposition) representing 19.4% of the total. It should be noted that the number of director election proposals and the number of discharge proposals considered are significantly lower compared to last year (partly due to the number of AGMs postponed as a result of the COVID-19 outbreak).

- In France (CAC40), 14% of the total number of contested (10%+ opposition) proposals was related to director elections, representing the third most contested resolution type across the index. However, compared to last year and calibrating for the total number of resolutions put forward, there was a 14% decrease in the director elections that were contested by shareholders. This was the second consecutive year in which contested director elections saw a decrease in France, and, compared to 2018, there has been a 48% calibrated reduction in the contested director election resolutions.

- In Switzerland (SMI), directors receiving more than 10% opposition continues to be the most contested resolution type within the SMI, representing 34% of all contested proposals in 2020. Compared to 2019 and calibrating for the total number of resolutions, there was a 53% increase in the number of contested director elections and a 101% calibrated increase in the number of contested compensation committee elections.

- In the Netherlands (AEX+AMX) 6 director election resolutions out of 132 were contested (10%+ opposition) representing 4.5% of the total. Compared to last year, this represents a 22% calibrated decrease in contested director elections.

- In Italy (FTSE MIB), 20% of the total director elections were contested (10%+ opposition) by shareholders during 2020 AGM season.

- In Spain (IBEX 35), director elections continue to be the most contested (10%+ opposition) resolution type, representing 39% of the contested proposals brought forward during the 2020 AGM season. Compared to 2019, this represents a 29% calibrated increase in contested director elections.

Impact of COVID-19 on the AGM season

As the COVID-19 pandemic was gaining pace in Europe at the beginning of the 2020 AGM season, companies made efforts to adjust the logistics of their annual general meetings to take into account the public health concerns resulting from large gatherings, while at the same time complying with the legislative and regulatory requirements that safeguard, to the extent possible, shareholder voting rights.

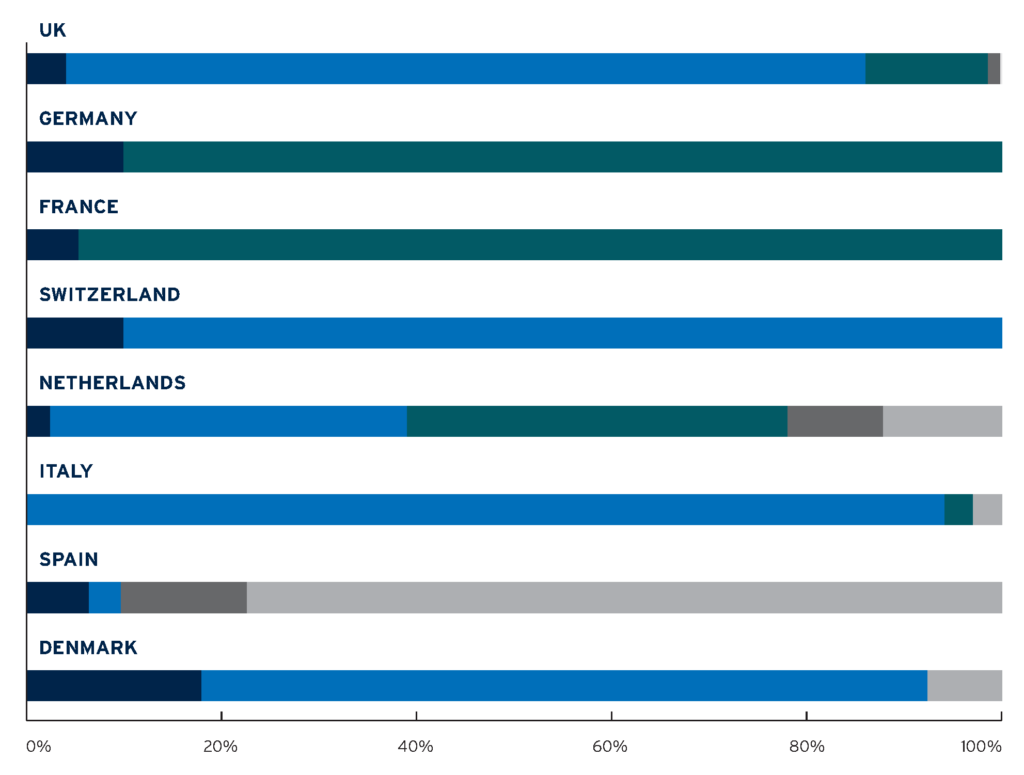

AGM Types and Restricted Live Voting Rights

In this year’s season review we have reviewed the types of AGMs that took place and the implications of these new formats for shareholders. Most interestingly we note the extent to which temporary public health requirements led companies to restrict the live voting rights (physical or virtual) that shareholders are normally entitled to.

Notably, European markets have reacted differently to the challenges posed by the pandemic and both companies and the regulatory environment have followed a local approach. In Italy, for example, shareholders were barred from attending AGMs and could only attend by granting a proxy to an appointed representative (rappresentante designato) who would act as proxy for all shareholders. In the Netherlands, the government provided that where attendance at the meeting was barred shareholders had the right to follow the meeting via electronic means and submit questions on the items on the agenda up to 72 hours before the meeting. In Switzerland, from mid-March onwards, shareholders were also banned from attending AGMs and were provided with the choice to exercise their voting rights in writing, electronically or through a proxy.

While responses to COVID-19 have been diverse across Europe, most countries have reacted by introducing restrictions on shareholder attendance at the annual general meeting and companies have swiftly adapted by holding meetings, sometimes in uncertain and developing frameworks—such as in the UK where definitive legislation facilitating remote participation only came into force in June 2020—and held their meetings in various different formats, ranging from restricted physical attendance to virtual-only meetings. Further details on each market approach to holding AGMs during COVID-19 can be found under the relevant market’s Corporate Governance Developments section throughout the complete publication.

| Physical

Investors were able to attend the meeting location and vote in person without any restrictions. |

|

| Physical (restricted)

Investor attendance at the meeting location (and voting in person) was restricted/discouraged (due to COVID-19). No live virtual voting was available. |

|

| Webcast only

Investors were not able to attend the meeting location nor were they given the opportunity to cast live votes electronically during the meeting from a different location. However, they could follow the meeting live through a webcast. |

|

| Hybrid (restricted)

Investors could choose to either attend the meeting in person (but attendance at the meeting location and voting in person was restricted/discouraged due to COVID-19), or to cast live votes electronically during the meeting from a different location. |

|

| Virtual

Investors could not attend the meeting in person but could cast live votes electronically during the meeting from a different location. |

Effect on Dividend Distribution

Another clear impact of the pandemic across listed companies in Europe was on the distribution of dividends. Most companies across Europe were impacted by lockdowns and, as such, profit distributions have seen major disruption as many companies chose to either cancel, postpone, or reduce their expected dividend distribution. We have reviewed whether any change was made to dividend distribution due to COVID-19. In this regard, we note that “adjusted” includes reduced, delayed, suspended and cancelled dividends or any other dividend policy change due to the COVID-19 pandemic.

While the approach on dividends was fragmented, some industries received guidance on the distribution of dividends during the pandemic with the aim of preserving healthy balance sheets in tumultuous times. In Europe, the ECB has issued guidance requesting banks not to pay dividends for financial years 2019 and 2020 until 1 January 2021 at least in order to boost capacity to absorb losses and support lending. The ECB was joined in Italy by the Bank of Italy which issued its own recommendation to refrain from making dividend distributions at least until 1 January 2021. Another example is in Switzerland where the Swiss Financial Market Authority FINMA urged Swiss-domiciled companies to re-consider their dividend proposals. Further details on legislative action on dividends distribution can be found under the relevant market’s Corporate Governance Developments section of the complete publication.

Adjusting Executive Remuneration

On the other hand the remuneration of executives also took a hit. As shareholder saw their payouts reduced or cancelled in many instances, and as employees were furloughed, made redundant, or saw their pay reduced, Boards have often taken steps to apply temporary reduction in executive pay (in various forms). We have reviewed whether any executive pay changes were announced in connection with the COVID-19 pandemic.

While some markets implemented measures to ban certain types of distributions many companies across the markets surveyed implemented changes to executive remuneration – ranging from salary reduction for executives to elimination of annual bonuses – without regulatory intervention. On the other hand, investors and proxy advisors have become increasingly focused on the idea that where dividends or workers were affected by the pandemic then executive directors should “share the pain” as well.

The complete publication, including footnotes, is available here.

Print

Print