Aniel Mahabier is CEO and Founder; Alex Co is a Research Analyst APAC; and Edna Frimpong is Lead Research Analyst EU/APAC at CGLytics. This post is based on a CGLytics report by Mr. Mahabier, Ms. Co, Ms. Frimpong, and Danai Kekatou. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

COVID-19 and the Impact on Remuneration

- 61 ASX 300 companies reduced director and/or CEO remuneration.

- 60 out of the 61 companies reduced CEO pay.

- Qantas Airways reduced board and executive

pay1, forfeited CEO and Chair salaries. - Myer CEO voluntarily suspended his remuneration.

The COVID-19 pandemic has had a severe negative impact on the global market. Australia is no exception, with nearly one million Australians losing their jobs. Amidst the crisis, various companies called on their board of directors to develop and implement crisis management strategies to maintain cash positions and ensure the health and well-being of their employees. Some companies have taken drastic measures by standing down employees or reducing executive, director, and employee remuneration to maintain liquidity.

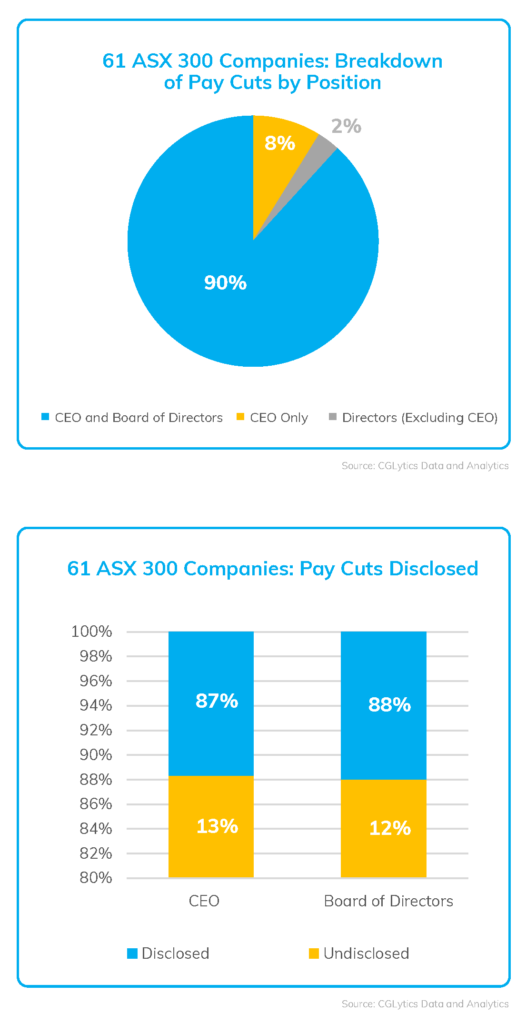

61 of ASX 300 companies reported the lowering of director and/or Chief Executive Officer (CEO) remuneration from March 2020 until the first week of August 2020. Out of the 61 companies, five companies modified remuneration for just the CEO, one for just the directors (chairman and directors excluding CEO), and 55 for both the CEO and directors. In total, 60 companies initiated pay cuts for their CEOs, and 56 companies announced pay cuts for their directors.

Out of the 60 companies that initiated CEO pay cuts, 54 of those companies provided a percentage of pay reduction while the other six did not disclose the specific percentage. In addition, 49 out of the 56 companies that initiated director fee cuts disclosed its percentage of pay reduction, while seven companies did not.

CEO Remuneration Reduction amidst COVID-19

CEO Pay Cut Components

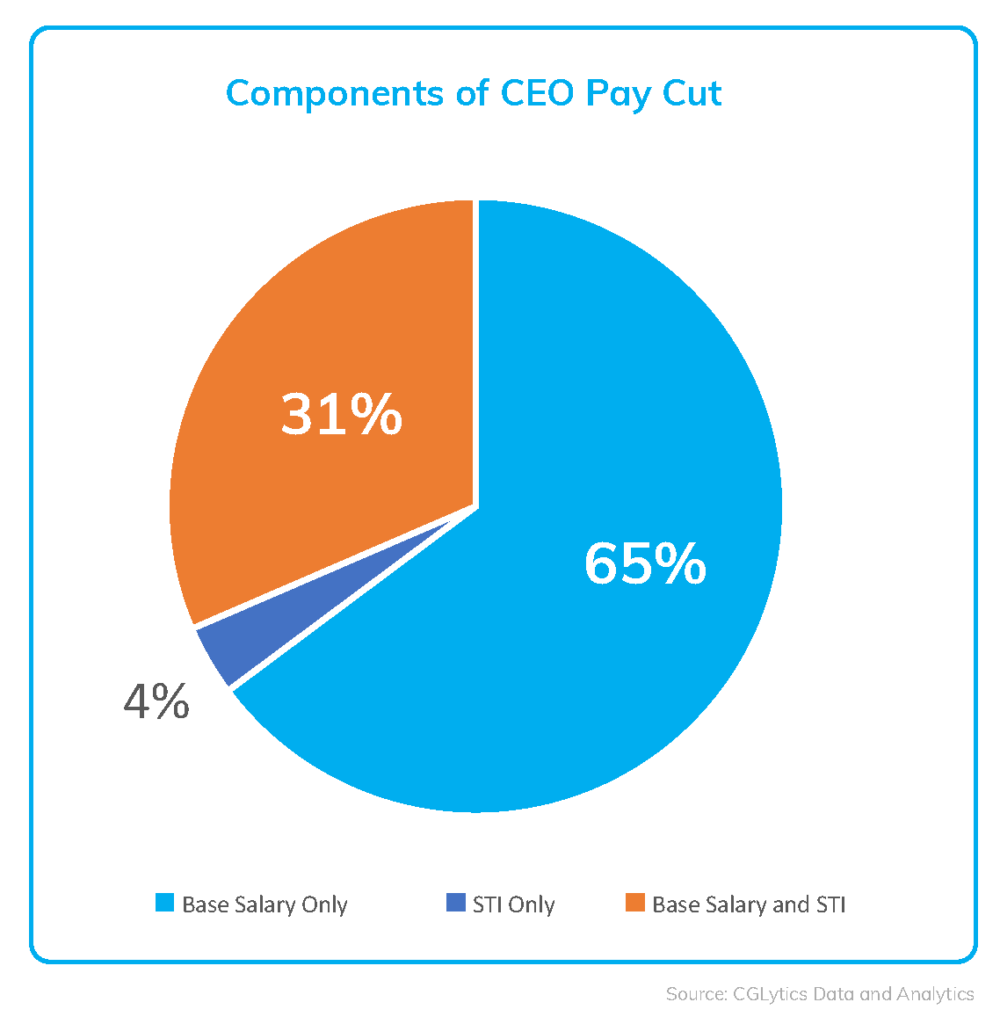

Among the 54 companies that initiated CEO pay cuts and disclosed the pay cut percentages, 35 companies reduced CEO base salaries, 17 companies reduced both the base salary and cash bonuses, and two companies cut only the cash bonus.

Nearly all companies initiated pay cuts only to their CEO base salary. However, 17 companies not only reduced their CEO salaries, but also reported a foregoing of their short-term incentives, two of them being Flight Centre and Vicinity Centres.

Flight Centre, one of Australia’s largest travel agencies, announced a 50% pay cut for senior executives and directors until at least the end of FY20. The CEO and executives of Flight Centre will also relinquish all short-term incentive components of their remuneration for the full financial year 2020. Despite announcing a strong balance sheet of AUD 1.3 billion in cash, the company announced the permanent closure of 428 stores and a request for AUD 900 million in financing.

One of Australia’s leading retail property groups, Vicinity Centres, announced not only a 20% cut of executive salaries, but also a cancellation of their FY20 short-term incentives. The effects of the pandemic on the company were still detrimental, lowering the company’s property values significantly.

However, the company received support from its shareholders as they helped raise AUD 1.2 billion through 8 institutional placement.

CEO Base Salary Reduction Only a Small Price to Pay

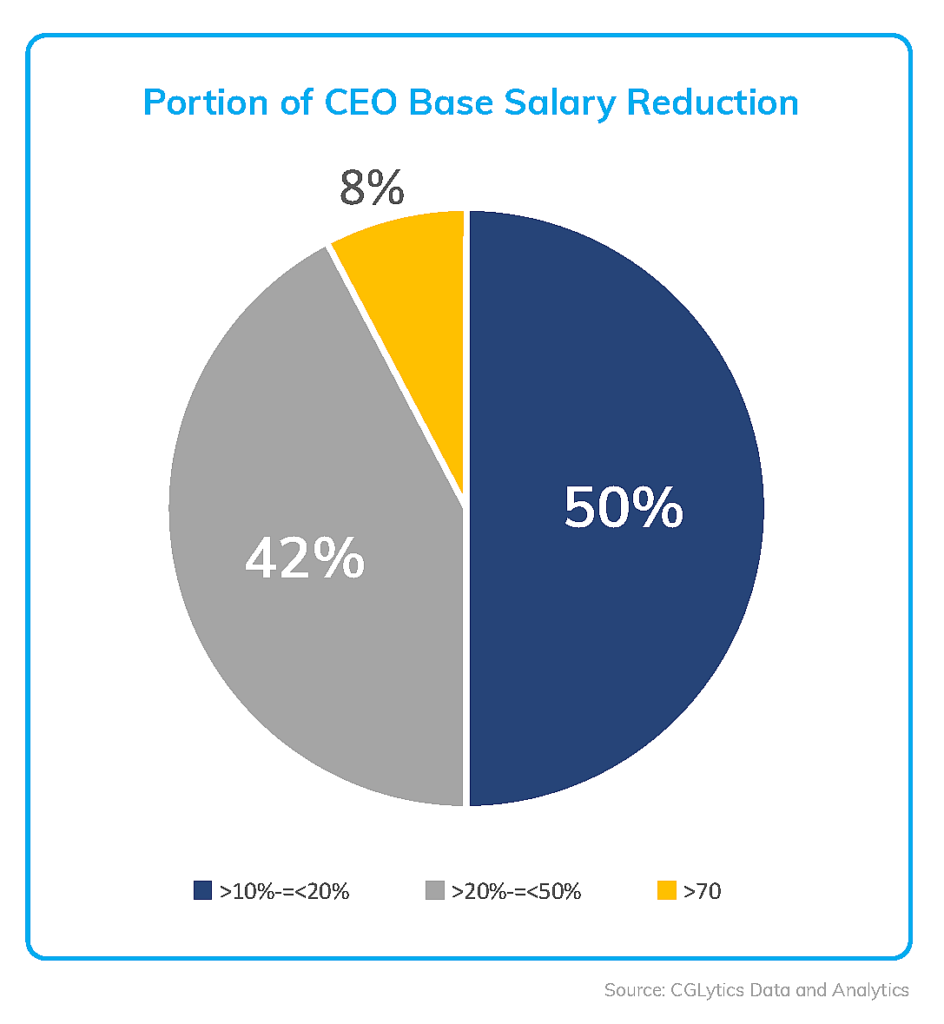

Of the companies that reported CEO base salary adjustments, 26 companies cut the salary by 10-20%, which resulted in an average cut of only 9.23% of the average CEO realised pay in 2019. 22 companies initiated pay cuts of 20-50% for an average cut of 11.91% of the average CEO realised pay in 2019. Interestingly, of the four companies that reduced CEO pay by 70% or more, the average cut was only 12.11% of average CEO realised pay in 2019.

Pay Adjustments by Industry

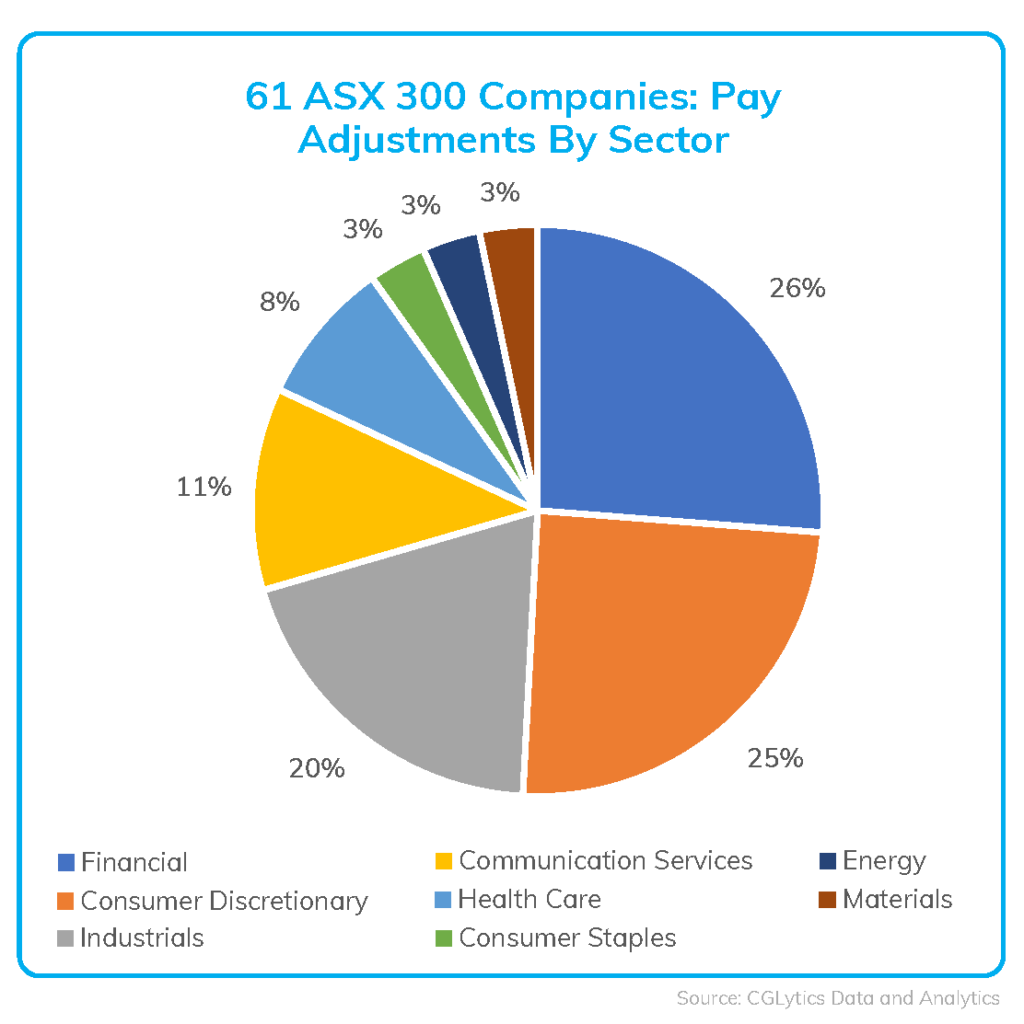

Among the 61 ASX 300 companies that reported pay cuts from March to the first week of August 2020, the largest portion (26%) came from the Financial sector, which includes real estate, capital markets, diversified financials, banks, and insurance companies. 25% of the companies with pay adjustments are from the Consumer Discretionary sector, which includes automobiles, consumer durables and apparel, consumer services and the retail industries.

The third largest sector is the Industrial sector, which includes airlines, transportation, capital goods, and commercial and professional services industries. While the repercussions of the COVID-19 pandemic affected many different industries, the airline sector arguably suffered the most. Airline giant Qantas Airways released a statement revealing its intention to cut costs and maintain liquidity for the next six months.

The airline company stood down over 25,000 employees and secured AUD 550 million in debt funding. Qantas CEO, Alan Joyce, and Chairman, Richard Goyder, have forgone their full salaries for the financial year, with board members and group executives taking a 30% cut in remuneration. Although the Australian government has begun easing some restrictions, the resumption of international and domestic air travel remains uncertain.

The retail industry has also taken a significant hit, with more than 40,000 retail workers stood down. One of Australia’s largest retail stores, Myer, stood down 10,000 store and store support staff in early March 2020. Myer’s CEO and Managing Director John King and the executive team have voluntarily suspended their remuneration during this difficult period. Despite the closure of its brick-and-mortar stores, Myer has seen a substantial increase in online sales, which has allowed for the return of 20% of stood down employees.

Company Pay Cuts Do Not Reflect Well

- Pay cuts represents only 1.29% of ASX 100 projected CEOs realised remuneration for the financial year 2020.

- For the ASX 300, pay cuts and or adjustments is estimated to represent only 2% of CEO realised remuneration.

CGLytics data and analysis reveals that the combined CEO pay cuts initiated by the 54 companies in the ASX 300 is anticipated to account for 11.34% of the 54 companies’ combined projected CEO realised pay. Despite the appeal of executive pay cuts, they make up a small portion of what executives receive throughout the year. A well-meaning but insignificant percentage of executive pay cuts against their total remuneration can cause concern for shareholders, especially for companies that have resorted to laying off employees and closing stores.

Executive Pay Landscape in Australia

CGLytics has reviewed the ASX 300 CEOs’ total realised pay during the 2019 proxy season from annual report disclosures. The analysis sheds light on the top five highest paid CEOs based on their total realised pay, which is calculated as the total of total fixed remuneration, realised short-term incentives and realised long-term incentives.

Highest Paid CEOs in 2019

| IDP Education Limited | AUD 52 million |

|---|---|

| CSL Limited | AUD 38 million |

| ResMed Inc. | AUD 29.5 million |

| Emeco Holdings Limited | AUD 26.3 million |

| Macquarie Group Limited | AUD 26.2 million |

- IDP Education CEO Mr. Andrew Barkla received 3.4 million options from a 2016 sign-on bonus, 15 vested in 2019.

- CSL Limited CEO Mr. Paul Perreault’s total realised pay increased by more than 300% from 2018 to 2019.

- ResMed Inc. CEO Mr. Michael Farrell’s 2019 total realised remuneration increased by 6% from 16 2018.

- Emeco Holdings CEO Mr. Ian Testrow’s base salary increased by 12% from 2018 to 2019.

- Macquarie Group CEO Ms. Shemara Wikramanayake is Australia’s highest-paid female CEO.

Evolution in Pay Components

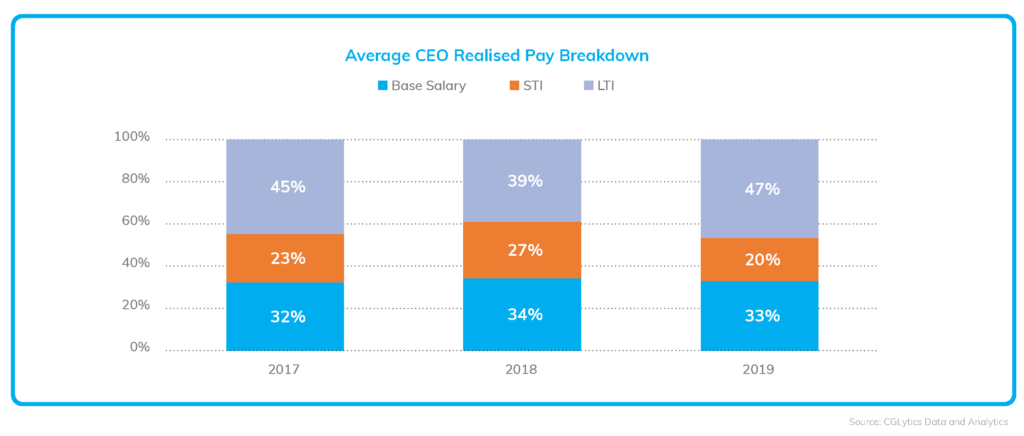

- LTIs are the largest component of CEO remuneration.

- 2019 had an LTI to STI ratio of 2.28, an 8.4% increase from 2017.

Shareholders have been challenging boards to create CEO remuneration mixes that incorporate long-term incentives (LTI) as the largest component of executive remuneration18. CGLytics data suggests that LTIs form the largest component of an ASX 300 CEO’s total remuneration, revealing an increase of 8.4% from 2017 to 2019. Furthermore, the short-term incentive (STI) component has faced a decline of 5.3% from 2017 to 2019. The base salary portion had no increase from 2017 to 2019.

AGM “Strike” Highlight

- 24 companies received a strike in 2019 compared to 20 in 2018.

- Ramsay Health Care received a strike due to unclear and excessive STI outcomes.

Proxy advisory firm Glass Lewis reported that there has been a trend of an increasing number of “strikes” against the adoption of remuneration reports, with 24 strikes in 2019 compared to 20 in 2018. Reasons for shareholders voting against remuneration reports include unreasonably high STI outcomes and unclear ground targets for performance measures.

Ramsay Health Care dodged a first-strike against the adoption of its remuneration report during its 2018 Annual General Meeting (AGM), with a 24.88% vote out of the 25% required for a first strike. Chairman Michael Siddle was “disappointed” by the shareholder decision as he believed that executives were not paid excessively. However, Mr. Siddle agreed to review the company’s remuneration policies by receiving advice from both shareholders and proxy advisors for the upcoming year in 2019.

Unfortunately, Ramsay Health Care was one of the 24 companies that acquired a first strike against the adoption of its remuneration report during its 2019 AGM. 29.23% of its shareholders voted against the report despite the board members having reframed the report for the 2019 financial year. The board introduced a simplified STI scorecard dubbed the “Ramsay Way” which outlined five key performance metrics: financial performance, global strategy execution, people, consumer, and quality. Shareholders rejected the report on grounds that the five performance metrics were vague and difficult to measure. Furthermore, despite having extended the STI deferrals for executives, the company still paid out almost the entire STI amount available for the financial year.

Mr. Rod McGeoch, the current chair of the remuneration committee, stated that the company put much effort into integrating KPMG’s recommendations into Ramsay Health Care’s remuneration policies. Mr. McGeoch also announced that the company would take into consideration non-core items such as restructuring and lease expenses when measuring earnings per share outcomes. Mr. Siddle has acknowledged that the manipulation of core/non-core items is a risk, and will review such considerations again for the company’s 2020 remuneration report.

CEO Pay for Performance Review

Three-year Pay for Performance Review

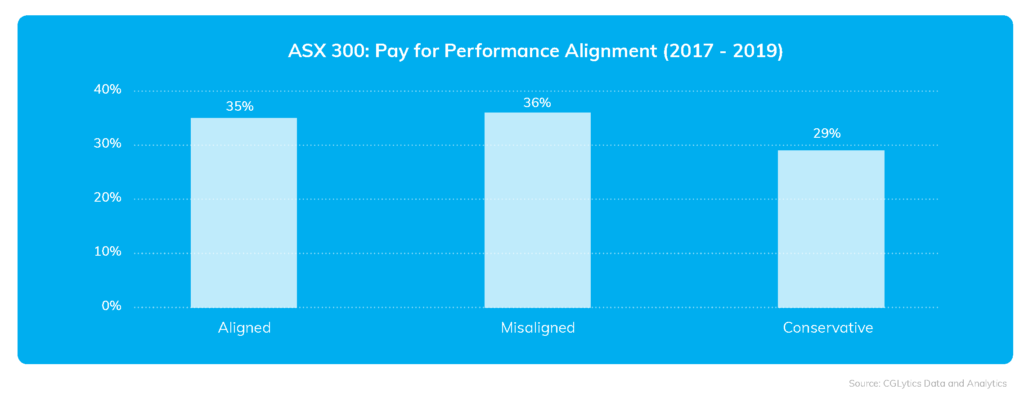

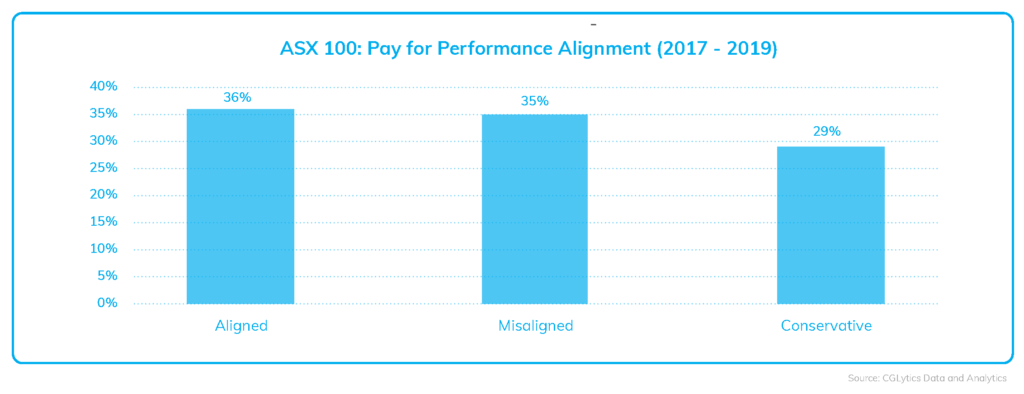

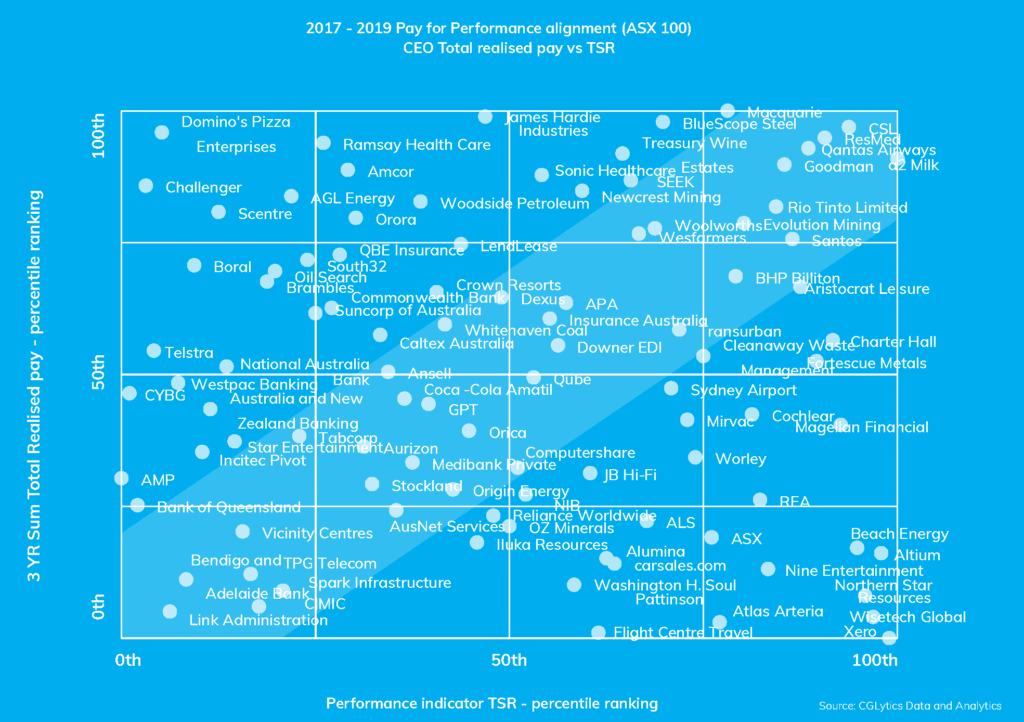

The CGLytics Pay for Performance software tool shows the relative positioning of both ASX 300 and ASX 100 companies from 2017 to 2019 and compares the CEO’s three-year total realised pay against the company’s three-year Total Shareholder Return (TSR).

ASX 300

- 35% of ASX 300 companies have an aligned relative positioning over three years.

- 36% of companies have a misaligned pay practice, wherein the CEO total realised pay is relatively higher than the company TSR (performance).

- 29% of companies have a conservative pay practice, wherein the CEO total realised pay is relatively lower than that of the company TSR.

ASX 100

- 36% of ASX 100 companies have an aligned pay practice over three years.

- 35% of companies have a misaligned pay practice.

- 29% of companies have a conservative pay practice.

CEO Three-Year Pay for Performance Positioning (ASX 100)

CGLytics analysis reveals Downer EDI is the best-aligned company on the ASX 100 as of 2019, positioned in the 56th percentile ranking for both CEO total realised remuneration and company TSR performance. Shareholders showed strong support for the 2019 remuneration report, receiving 97% approval. One of the highlights indicate that the company’s TSR, an LTI performance metric of the remuneration policy is 85.2% higher compared to that of the ASX 100 median comparator group. As a result, Downer EDI vested 100% of its LTI awards.

Sonic Healthcare

One company that displayed misalignment is Sonic Healthcare Limited. The healthcare firm is in the 88th percentile of CEO remuneration but only in the 53rd percentile of company TSR performance. Sonic Healthcare also received a first strike after a 25.56% vote against the adoption of its remuneration report during its 2019 AGM. Glass Lewis stated that the healthcare company awarded above target STI bonuses because of its high EBITDA growth. Despite the policy to exclude acquisitions from EBITDA growth, the company included the acquisition as a part of their decision to pay out STI bonuses. The company would not have met the STI bonus targets if they had adhered to company policy.

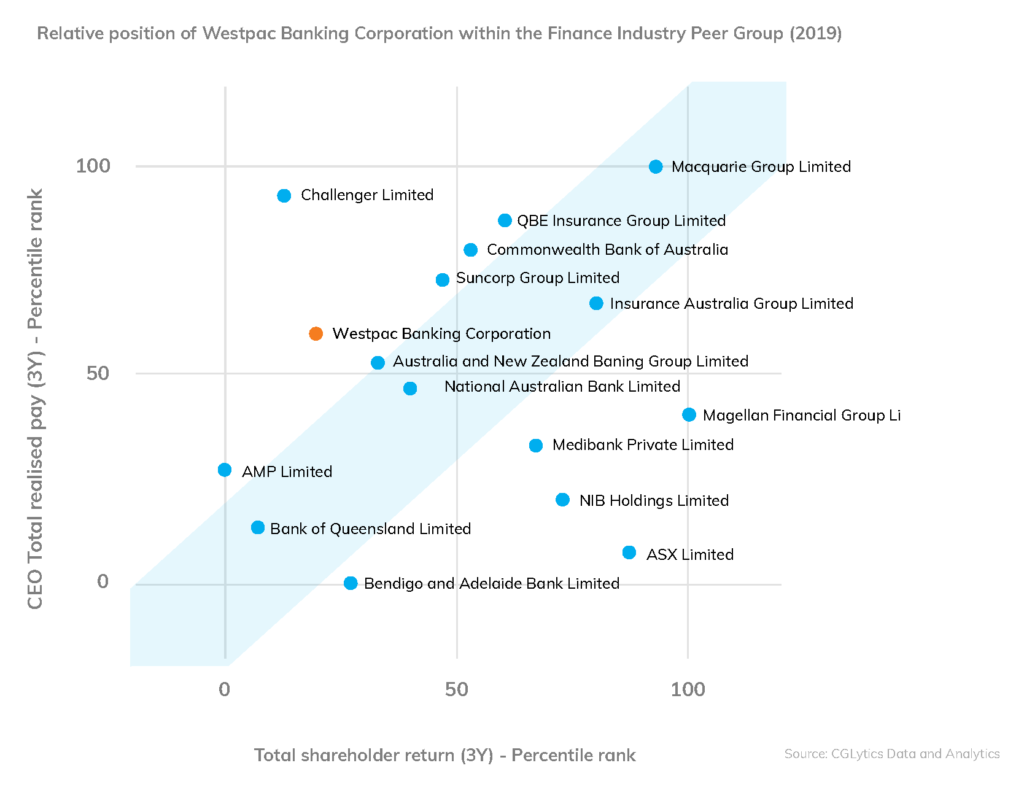

CEO Three-year Pay for Performance Positioning (Finance Industry)

Westpac

After the Royal Commission into misconduct in the banking, superannuation, and financial services industry, CGLytics analysed the pay for performance positioning of Westpac against the finance industry within the ASX 100 over three years. The most aligned bank is the National Australia Bank, where its CEO’s total realised pay is in the 47th percentile and company TSR performance is in the 40th percentile.

Westpac Banking Corporation reveals pay for performance misalignment, with CEO remuneration in the 60th percentile while company TSR is in the 20th percentile. Westpac faced several class actions, scandals, and scrutiny from the Australian Transaction Reports and Analysis Centre (AUSTRAC) in 201928. Westpac’s CEO did not receive an STI bonus, and even forfeited his 2016 LTI award. This did not stop shareholders from going against the adoption of the company’s remuneration report, recording a second-strike during the 2019 AGM30.

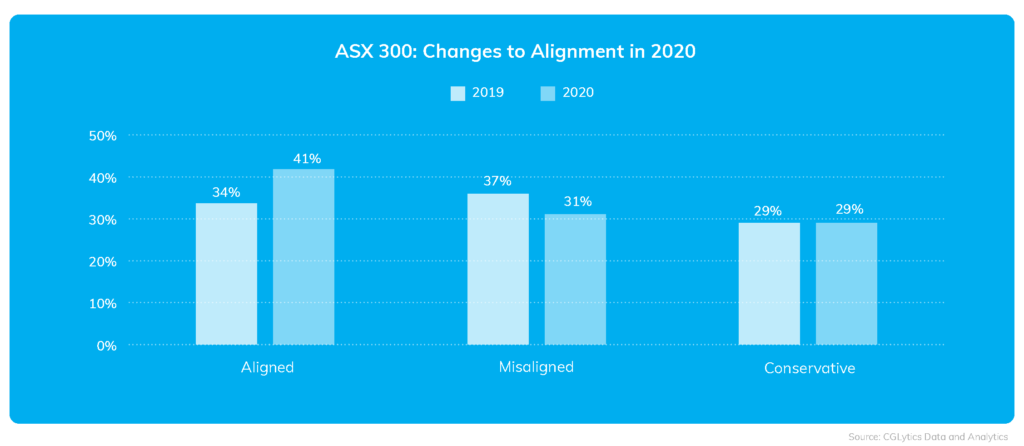

Projected CEO Pay for Performance Alignment after COVID-19 Adjustments

ASX 300

CGLytics has compared the 2019 pay for performance of ASX 300 companies against the projected 2020 relative positioning (again using CEO total realised pay against TSR). The FY20 figures used in the study is the total realised pay after the COVID-19 pay cuts and compared against the companies’ year-to-date TSR. It is revealed that there is an 21% increase of companies that show an alignment in FY20. An increase in aligned companies with the total shareholder return could be a consequence of the pay cuts made during the year. The analysis also reveals a 16% decrease of companies that are misaligned. Conservative pay practice remains unchanged.

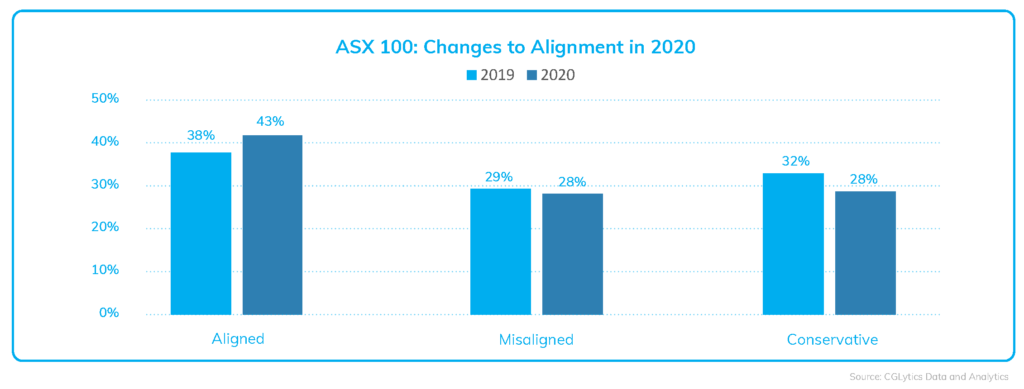

ASX 100

CGLytics has completed the same CEO pay for performance projection for ASX 100 companies following pay reductions for FY20, utilising year-to-date TSR. The analysis reveals a 13% increase of companies showing alignment in FY20 and a 3% decrease of misaligned companies, potentially due to the pay cuts. Lastly, there is a 13% decrease in conservative pay practice.

Predictions for the Australian Remuneration Landscape in 2020 and Beyond

Australia Called to Disclose CEO Pay Ratio

- Australia’s top CEOs are paid 78 times more than the average employee31.

Major markets recently updated their reporting requirements on executive remuneration. In January 2019, the House of Commons Business, Energy and Industrial Strategy Committee in the UK introduced the requirement for public companies with more than 250 employees to disclose the ratio of CEO to employee pay. Companies must annually disclose the ratio of the CEO pay to the median, lower quartile, and upper quartile remuneration of their employees based in the UK.

Shareholders voiced the need for listed companies to disclose the ratio of their CEO to average employee pay to ensure transparency. Recent reports show that the rate of pay increase of ASX 100 CEOs was more than four times that of an average worker.

This could lead Australian stakeholders to show concern regarding the disproportionate income between CEOs and average workers and urge regulators to implement requirements similar to that of the UK.

Change in Incentive and Performance Measures

Executive remuneration has always been an area of interest for regulators, proxy advisory firms and shareholders, especially when efforts are made to align remuneration structures with long-term objectives. ASX 300 companies have shown a gradual shift in remuneration policies, with the composite LTI/STI ratio at 2.28 in 2019 compared to 1.94 in 2017. Furthermore, LTI awards assist in retaining executives. A survey completed by the Australian Human Resources Institute (AHRI) presented data indicating Australian companies spend an additional AUD 20 billion per year due to staff turnover.

- According to the Australian Institute of Company Directors (AICD), shareholders are in favor of extending performance periods for LTIs.

Investors are looking at the connection between CEO pay and a company’s overall performance. Board of directors are slowly integrating non-financial metrics into CEO remuneration, with company culture and Environmental, Social and Governance (ESG) factors counting towards CEO performance.

A recent study on the FTSE 350 shows that companies that combine both financial and non-financial measures in CEO incentives better align CEO bonuses with shareholder interests.

- A 2017 study completed by the Responsible Investment Association Australia (RSIAA) showed that assets managed under an ESG reached AUD 866 Billion, up 37% from 2016.

Addressing Social Issues

Shareholders and other stakeholders previously criticised companies mainly on their financial outcomes. However, the increasing demand for accountability and corporate social responsibility is forcing companies to address issues that go beyond their everyday operations. Companies must now address a range of issues such as climate change, gender diversity on boards, and ethnic diversity especially in light of the Black Lives Matter movement.

- According to a 2016 AICD report, there are no indigenous CEOs in Australia and 75% of CEOs are of white ethnicity. Out of the 2,500 executives that participated in the survey, 97% are white.

In May 2020, Rio Tinto’s demolition of ancient rock shelters revered by the Australian Indigenous community sparked outrage from the media and stakeholders. The company has since issued an apology and has begun working closely with Indigenous leaders to regain its trust with the groups most affected. This incident has been a driver for more representation and power given to Indigenous people.

Moreover, the media and stakeholders are concerned that there is not enough ethnic diversity in the Australian corporate environment. Statistics indicate that 93% of CEOs and 70% of board members are all from an Anglo-Celtic heritage in Australia. One of the solutions considered is another implementation of quotas and targets to force boards to include and represent minorities in corporate Australia. CGLytics offers the broadest and deepest global compensation data set for reviewing corporate executive remuneration plans, assessing Say on Pay vote proposals and performing benchmarking analysis.

The complete publication, including footnotes, is available here.

Print

Print