Blair Jones and Greg Arnold are managing directors and Justin Beck is a consultant at Semler Brossy Consulting Group LLC. This post is based on a Semler Brossy memorandum by Ms. Jones, Mr. Arnold, Mr. Beck, and Annie Chen. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

Observations

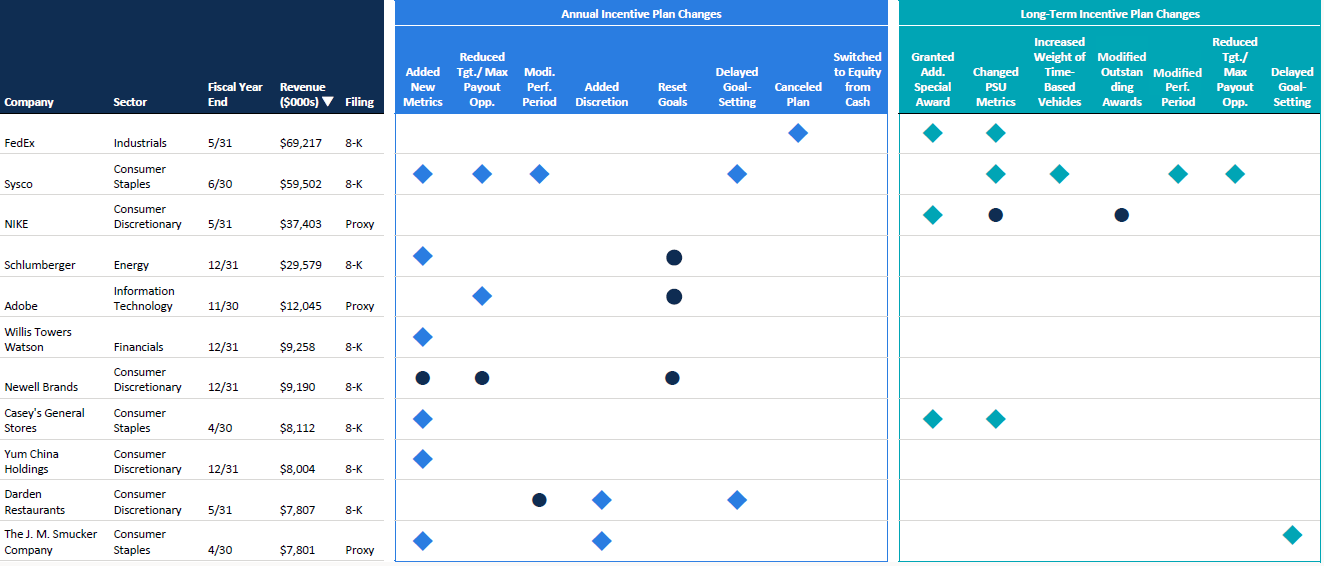

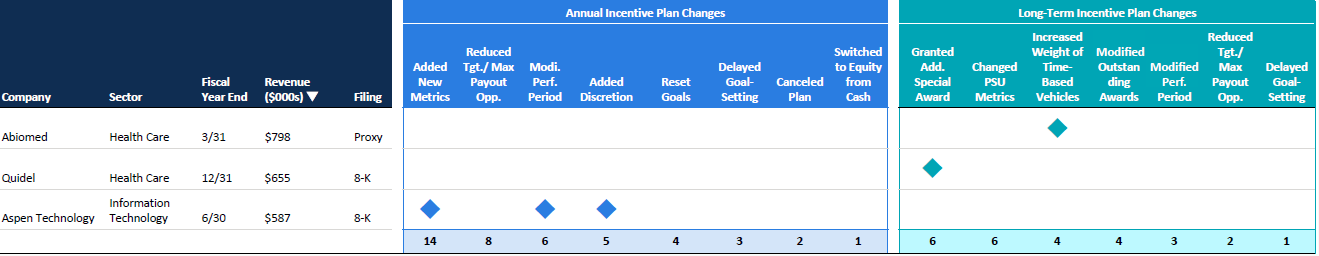

- From June 1st to August 7th, 25 Russell 1000 companies announced changes to their current or go-forward incentive programs to address Covid-19’s impact:

- Ten companies made changes to current, in-process incentive plans

- Annual incentive plan: Schlumberger, Adobe, Newell Brands, Darden Restaurants, Hess, Lamb Weston, Lions Gate Entertainment, Sabre, and WEX

- PSUs: NIKE, Lamb Weston, Sabre, and WEX

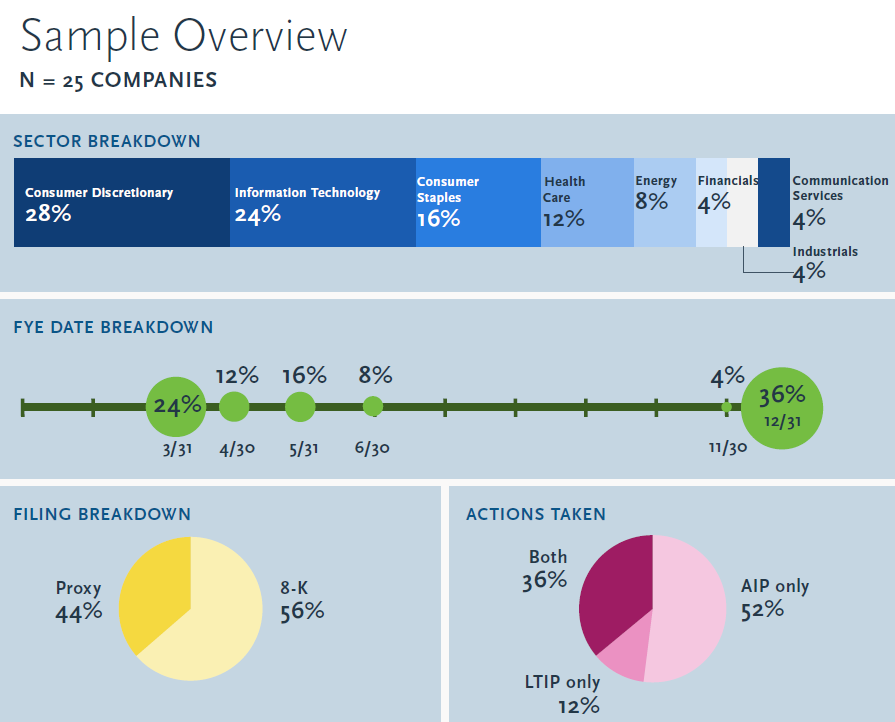

- Consumer Discretionary (28%) and Information Technology (24%) companies make up roughly half the sample

- Announcements have been made more often in 8-K filings (primarily 12/31 FYE companies with an in-process FY) than proxy filings (primarily 3/31 FYE companies with a recently started FY)

- About half the sample announced changes to their annual incentive plan only and about one-third announced changes to both the annual and long-term incentive plans

- 40% of companies in the sample previously announced temporary reductions to executive base salaries as an immediate response to Covid-19

Annual Incentive Plan Changes: Covers Current and Go-Forward Plans

Observations

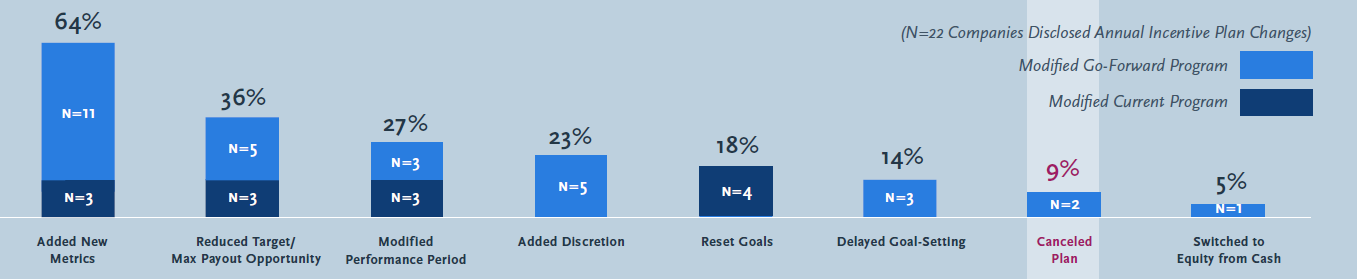

- The most common change to the annual incentive plan has been to add new metrics (64%); commonly added metrics have been cash flow, EBITDA, or strategic/ operational health measures

- About one-third of the companies (36%) reduced target or max payout opportunities

- Six companies modified the annual incentive performance period (typically to measure partial year performance) and five companies explicitly added Committee discretion to determine payouts (although, this approach may be more prevalent in practice given the qualitative measurement of certain additional metrics)

- Four companies reset performance goals based on updated forecasts and three companies delayed goal-setting

Canceled Plan

- FedEx (5/31 FYE) disclosed that it will not have an annual incentive plan for executive officers

in FY21 - Capri Holdings (3/31 FYE) disclosed that it suspended its annual incentive plan for FY21 and will use discretion to determine whether additional payments are warranted based on actual performance for FY21; in addition, the company disclosed changes to the performance metrics and goal-setting process that will be implemented when the plan is reinstated post-FY21

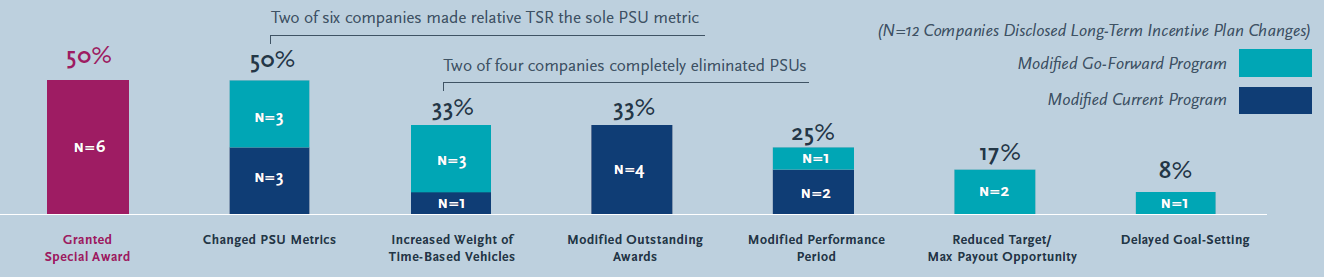

Long-Term Incentive Plan Changes: Covers Current and Go-Forward Plans

Special Retention and Recognition Awards

- Six companies granted special awards meant to retain or recognize select NEOs

- Three companies granted special awards to all NEOs (including CEO) in recognition of the challenging period

- Two companies granted a recognition award to one specific executive (non-CEO executive)

- One company (NIKE) paid a discretionary cash bonus ranging from $2.2M to $6.8M for all NEOs (including CEO) to make up for Covid-19’s impact on recent

incentive payouts

Observations

- Six companies switched their PSU design to metrics that are (i) more focused on operational health (e.g., cost reduction); or (ii) more easily forecasted

- Four companies adjusted the long-term incentive vehicle mix to a higher weighting on time-based vehicles (i.e., RSUs or stock options); two companies eliminated PSUs entirely

- Four companies disclosed modifications to in-flight awards’ performance goals and three companies disclosed a reduction to the performance period (e.g., two years instead of three)

- Two companies reduced target and/ or max payout opportunities and one company (J.M. Smucker) disclosed delaying goal-setting for its PSU grant from June to August

Case Studies: We Highlight Three Companies with More Extensive Actions Below

| Company | Nike |

|---|---|

| Filing | 7/24/20 |

| FYE Date | 5/31 |

| Industry | Consumer Discretionary |

| COVID Incentive Actions

Annual & Long-Term Incentive Plans

|

|

| Company | Capri Holdings |

|---|---|

| Filing | 7/22/20 |

| FYE Date | 3/31 |

| Industry | Consumer Discretionary |

| COVID Incentive Actions

Annual Incentive Plan

Long-Term Incentive Plan

|

|

| Company | WEX |

|---|---|

| Filing | 6/29/20 |

| FYE Date | 12/31 |

| Industry | Information Technology |

| COVID Incentive Actions

Annual Incentive Plan

Long-Term Incentive Plan

Additional Actions

|

|

Sample Detail (N=25 companies)

Print

Print