Matthew Friestedt, Marc Treviño, and Melissa Sawyer are partners at Sullivan & Cromwell LLP. This post is based on a Sullivan & Cromwell memorandum by Mr. Friestedt, Mr. Treviño, Ms. Sawyer, and Heather L. Coleman.

Summary

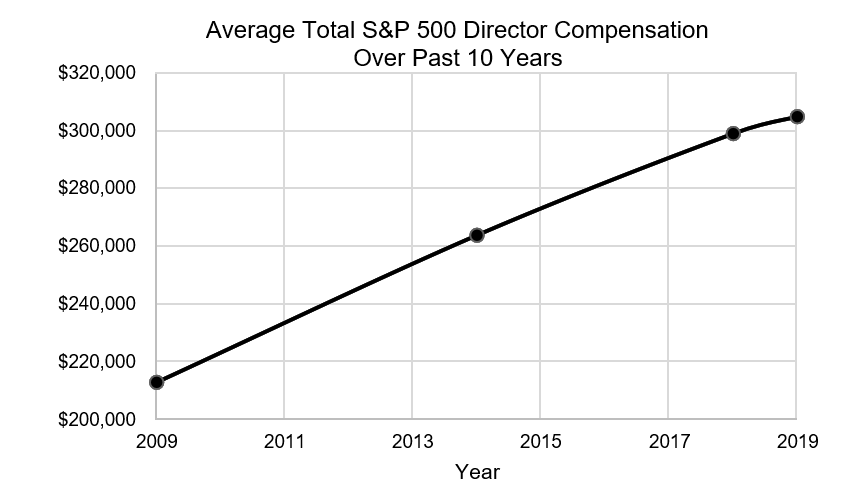

Over the last 10 years, average U.S. public company director compensation has increased steadily, in part due to changes in board composition and governance that have increased the number and significance of board leadership positions held by non-executive directors. Over the same period, the average number of hours of work performed by directors has also increased, while the average number of board meetings and size of boards have remained stable. Future director compensation may be influenced by many variables, including the effects of the COVID-19 pandemic and dynamic regulatory change in certain industries. So when setting director pay, companies should remain flexible. While peer company benchmarking can be informative, no single approach to director compensation works for every company.

Recent Director Compensation Data

Total Compensation. The total average compensation for S&P 500 non-employee directors from May 16, 2018 through May 15, 2019 was $304,856, as calculated by Spencer Stuart. The total mean compensation for Russell 3000 companies was $167,013, based on 2019 disclosure documents. The total average director compensation reflects a steady increase when compared to previous years. In 2014, the total average director compensation for S&P 500 companies was $263,748, and in 2009 it was $212,750. Even when accounting for inflation, total average director compensation has increased since 2009; similarly, the average annual additional director cash retainer increased every year except from 2018 to 2019.

Retainers and Meeting Fees. In 2019, the average annual cash retainer for S&P 500 directors was $126,200. This reflects an increase of 18% over the previous five years—in 2014, the average was $107,383, in 2009, $75,893 and, in 2004, $49,727. Only 9% of S&P 500 companies paid directors for attending board meetings, and only 12% paid directors for attending committee meetings. However, some S&P 500 companies pay a meeting fee in lieu of a retainer and cap directors’ aggregate meeting fee opportunity at a specified amount.

Equity Compensation. 77% of S&P 500 boards grant directors equity in addition to cash retainers, representing a slight decrease from 10 years ago, when 79% of such boards granted stock. Additionally, 37% of S&P 500 boards granted stock options in 2009; whereas, only 11% do today. Stock awards represent 57% of total average director compensation for S&P 500 companies, and option grants represent 3%.

Retainers for Service as Committee Chairs. 97% of the S&P 500 boards grant an additional retainer to committee chairs, especially for those serving as audit or compensation committee chairs. The average additional retainer for a committee chair between May 2018 and May 2019 was $22,132, an increase of roughly 294% from 2004. Of S&P 500 companies, 46% also paid additional fees to committee members, averaging $11,854 in 2019.

Fees for Service as Chair or Lead Director. Of the 167 independent S&P 500 board chairs, 98% received an additional fee for serving as chair in 2019. The average additional board chair fee was $172,127, although the additional fees fall within a wide range (with some companies offering only $30,000 and others offering up to $656,784). Of the S&P 500 boards with a lead or presiding director (typically where the chair is not independent), 77% offered an additional fee. The average fee for lead directors was substantially lower than that for board chairs, at $39,992 in 2019. Additional compensation for board chairs and for lead or presiding directors has also risen, respectively, from $164,682 in 2014 to the current average of $172,127 for board chairs and from $29,932 (lead director) and $24,831 (presiding director) to an average of $39,992.

Other. Directors who serve on special committees, whether in connection with an M&A matter, special litigation, internal investigation or otherwise, generally receive supplemental compensation for their special committee service, but the amounts paid are scenario specific.

Observations About the Trends

The rise in director compensation over the past 10 years cannot be attributed to a single factor, but it coincides with other governance trends that may provide a partial explanation.

The Wall Street Journal, in a 2016 article titled “Three, Four, Five? How Many Board Seats Are Too Many?”, cited surveys by the National Association of Corporate Directors, which demonstrated that the average number of hours public company directors spend for each board on which they serve rose from 191 in 2005 to 248 in 2016. In addition, a 2019 study of high-performing companies with very effective boards found that the average director spent 200 hours per year working on board-related matters (excluding travel). Further, Institutional Shareholder Services’ and Glass Lewis’ overboarding policies impose a cap on the ability of directors to earn income by serving as directors at other companies, and the average tenure of directors on boards has decreased from 8.4 years to 8.0 years from 2009 to 2019. These factors have worked together to raise the opportunity cost of accepting a board seat, and likely have contributed significantly to the increase in compensation over the past decade.

Interestingly, the increase in director compensation over the last 10 years is also consistent with increases in median and average CEO compensation. Median S&P 500 CEO compensation (which includes base salary, actual bonus paid and grant value of long-term incentives) has risen, even when taking into account inflation, each year since 2009. Similarly, between 2009 and 2018, according to an Economic Policy Institute report, CEO average compensation has also risen according to two measures of compensation. When including stock options realized (along with salary, bonus, restricted stock awards and long-term incentive payouts) to measure compensation, CEO compensation grew 52.6%. When measuring compensation by tracking the value of stock options granted (along with salary, bonus, restricted stock awards and long-term incentive payouts), CEO compensation has risen by 29.4% since 2009. Although it is challenging to conclude that either increase in compensation caused the other, or that a certain factor directly influenced both, the correlation between the two is notable.

Some factors that influence director compensation have not changed substantially over the years. First, there has been little change in the number of meetings held by S&P 500 companies since 2004. The Spencer Stuart Board Index reports that the average number of meetings held by boards of S&P 500 companies in 2004 was 8.0, which is largely consistent with the average of 7.9 meetings in 2019. Similarly, the number of meetings held by committees has changed little. S&P 500 audit committees met an average of 8.4 times in 2019, a decrease of .3 compared to the average of 8.7 in 2004. The average number of meetings of compensation committees has increased since 2004 but only slightly, with S&P 500 compensation committees holding an average of six meetings in 2019 compared to 5.8 in 2004.

Second, the size of the board could be thought of as influencing director compensation. That is, if boards decrease in size, individual director compensation may rise because board work and obligations would be spread among fewer individuals. Yet, since 2004, the size of boards in the S&P 500 has remained relatively stable. In 2004, the average board size was 10.8, a number that did not change until 2019, when the average decreased very slightly to 10.7.

Factors That May Influence Future Director Compensation

Changes to the amount of work required of a director or proxy adviser policies may continue to influence director compensation in the future. However, these variables and the other factors discussed above certainly do not serve as an exhaustive list of possible influences on director compensation. There are additional factors that likely have influenced how much a director is paid today and will continue to influence compensation in the future. First, companies will often determine director compensation in part by analyzing what peer companies, and the broader market, are paying directors. From there, companies typically take into consideration company-specific factors. For example, if a company alters its board governance or committee structure, the change may affect director compensation. Further, compensation may depend on the size of a company or whether the company operates in a regulated industry. A larger corporation, like an S&P 500 company, may be willing, and able, to pay its directors more to compensate for the greater demands and complexities those individuals may face in their role as a director of a large or mega cap company. In addition, compensation of directors at companies in regulated industries may be governed by regulatory requirements. It is also possible that director compensation plans may be subject to stockholder scrutiny and that courts, in Delaware and other jurisdictions, may be asked to consider whether directors are complying with their fiduciary duties in the manner in which they set their own compensation.

COVID-19 may also impact future director compensation. An Agenda Week article, citing data from Farient Advisors, stated that, since the outbreak of the COVID-19 virus, 6% of S&P 500 companies changed board pay, with 31 cutting cash compensation and five decreasing compensation generally (which could include cash or equity). According to Semler Brossy, 194 Russell 3000 companies have announced director pay cuts. While these statistics suggest that there may be decreases in director compensation due to the COVID-19 pandemic, it remains to be seen how widespread or long term such decreases will be. A poll conducted by Pearl Meyer in April 2020 noted that 43% of respondents were considering COVID-19 in their 2020 director compensation decisions and 37% were not. The remaining 20% of respondents were unsure of how the pandemic will impact 2020 director compensation and, for those boards who have not yet formally decided, 36% are still evaluating, 26% are not making changes and 19% are considering a pay cut. Some respondents did make retroactive changes, with 20% cancelling a planned increase or temporarily reducing director compensation.

Overall, it appears that the COVID-19 pandemic, and its consequences, will be the primary influence on director compensation in the short term. However, the long-term trends described above show no signs of abating. As the effects of COVID-19 slow over time, it is these factors that will likely prevail as the greater influences on director compensation.

The complete publication, including footnotes, is available here.

Print

Print