Zacharias Sautner is Professor of Finance at Frankfurt School of Finance & Management. This post is based on a recent paper authored by Professor Sautner; Laurence van Lent, Professor of Accounting and Economics at Frankfurt School of Finance and Management; Grigory Vilkov, Professor of Finance at Frankfurt School of Finance & Management; and Ruishen Zhang, Ph.D. candidate at the Accounting Department of Frankfurt School of Finance and Management.

Climate change has started to significantly affect a large number of firms in the economy. A challenge for investors, regulators, and policy makers lies in the difficulty to properly quantify firm-level exposure to climate change, with respect to the associated risks but also in terms of the opportunities that come with it. Complications stem from different sources.

- First, the effects of climate change on firms are highly uncertain.

- Second, the effects of climate change are likely to be heterogeneous across firms, even among firms within the same industry.

- Third, there exists no common understanding about how to reliably quantify firm-level climate change exposure.

While a firm’s voluntarily disclosed carbon emissions are gaining some traction as an exposure measure, this data exists only for a limited and selected sample. What’s more, disclosed emissions reflect historic rather than future business models of firms, and they do not allow the distinction between “good” and “bad” emissions. These challenges are severe and they have the potential to impede the reallocation of resources from “brown” to “green” firms. Furthermore, the lack of a firm-level exposure measure may contribute to the potential mispricing of climate risks and opportunities, and it complicates the development of financial instruments that allow market participants to hedge the effects of climate change.

In our paper, we use transcripts of earnings conference calls to construct time-varying measures of firm-level exposure to climate change. To construct our measures, we introduce a novel method that can identify word combinations that signal climate change conversation in conference calls. Our method adapts the machine learning keyword discovery algorithm proposed by King et al. (2017) to produce four (related) sets of climate change bigrams: the first set captures climate change aspects broadly defined, while the remaining three sets cover specific climate topics, that is, opportunity, physical (e.g., sea level rises, natural disasters), and regulatory shocks (e.g., carbon taxes, cap and trade markets).

Our exposure measures count the frequency with which certain climate change bigrams occur in the transcript, scaled by the total number of bigrams in the transcript. We construe these measures as indicating the occurrence of climate change events or shocks at the firm. Our method also allows us to construct measures of the first and second moment associated with these shocks. In other words, whether the events represent (in expectation) good or bad news to the firm and whether the shocks are uncertain. For the first moment, we construct “sentiment” measures, which count the relative frequency of climate change bigrams that occur in the vicinity of positive and negative tone words. For the second moment, or “risk” measures, we count the relative frequency of climate change bigrams mentioned in the same sentence as the words “risk” or “uncertainty” (or their synonyms). Our sample contains more than 80,000 annual observations originating from more than 10,000 unique firms in 34 countries over the period 2002 to 2019.

Top bigrams associated with exposure to climate change opportunities refer to new (green) technologies, such as electric vehicles. Top regulatory bigrams are reminiscent of regulatory and/or governmental interventions associated with climate change and the goal to reduce carbon emissions. Top bigrams linked to the exposure to physical shocks include words pairs related to hurricanes, desalination, or draughts. We validate our approach by examining individual text fragments taken from the point in the transcripts identified by our algorithm as the moment when participants discuss climate change, and we verify that the call fragments are indeed centered on salient climate issues.

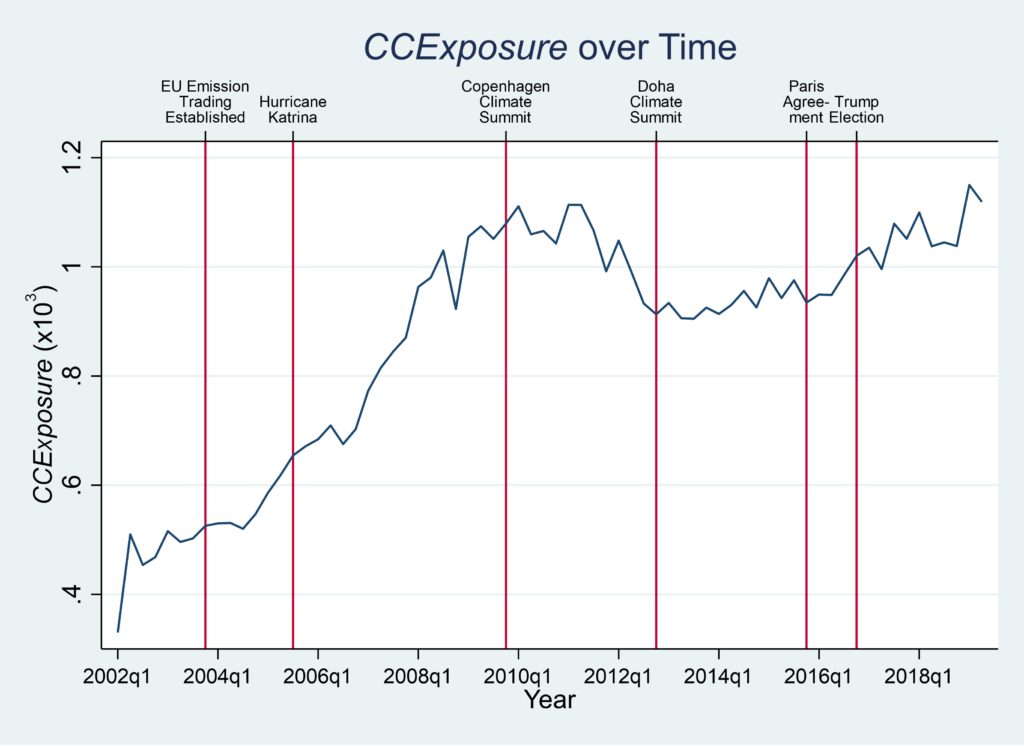

The time-series dynamics for the broadly-defined exposure measure (Figure 1) reveals that discussions of climate change issues increase remarkably over time until around 2011. Perhaps surprisingly, this rise starts already in the mid 2000s. There is some modest decline up to the largely unsuccessful 2012 Doha Climate Summit, with a leveling off at a high level (compared to the years before 2011) in the subsequent years. We observe a renewed increase in climate change exposure since the Paris Agreement in 2015 and the 2016 Trump election. Climate change exposure reaches its highest overall level at the end of the sample in 2019.

Figure 1: Time-series Evolution of Climate Change Exposure

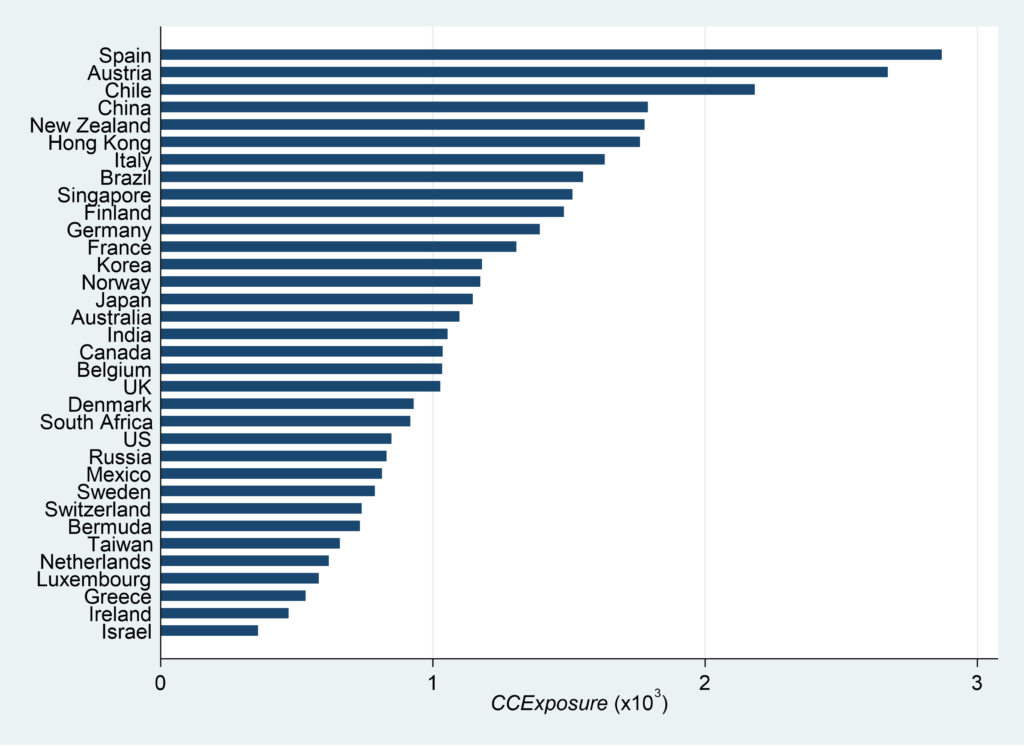

The sectors with the highest overall exposure to climate change are Electric, Gas & Sanitary Services (i.e., utilities), followed by Construction and Coal Mining. Utilities top the exposure ranking for both opportunity and regulatory shocks, which signifies that utilities face both opportunities (e.g., renewable energy) and regulatory risks (e.g., carbon taxes) related to climate change. Physical climate change exposure is highest for the sectors Paper & Allied Products, Heavy Construction, and Insurance. For all of our measures we find large within-industry variation, indicating that firms will benefit or suffer in various degrees from climate change. Further, exposure to climate change varies substantially across countries (Figure 2), and we document reasonable associations between our exposure measures and country-year level proxies for the regulatory and physical impacts of climate change.

Figure 2: Cross-country Distribution of Climate Change Exposure

Between 70.4 and 96.8% of variation in our exposure measures plays out at the firm level (rather than at the level of the country, industry or over-time), only half of this firm-level variation is persistent, suggesting that, within an industry over time, different firms are exposed to climate change. We then compare the results of this analysis with a similar decomposition exercise for a firm’s carbon intensity (emissions scaled by assets) as well as the ISS Carbon Risk Rating. The firm-level variation for carbon intensities and the ISS measures are substantially smaller, especially compared to our topics-based measures. Two-thirds of the variation in the ISS ratings is persistent. Carbon intensities, which are increasingly used in the finance literature, are driven mostly by industry fixed effects.

Our climate change exposure measures, on the one hand, and the carbon intensity and ISS measures, on the other hand, overlap to some extent–as expected given that all aim to capture dimensions of climate change exposure of firms. Carbon intensities appear to correlate mostly with our measures of opportunity and regulatory shocks. The ISS rating reflects our measures of opportunities more than those of regulatory or physical events. Together with the variance decomposition results, this suggests that both of these alternatives are more specialized than our (more comprehensive) measure.

We also explore the role of important economic factors that prior work has identified as potentially being related to firm-level climate change exposure. First, times of higher climate change attention in the media are associated with a rise in firms’ exposures to regulatory and physical climate shocks, while attention is unrelated to opportunity shocks. A reason for the asymmetry in results could be that the media is paying more attention to environmental rules and physical threats to economic activity than to the opportunities climate change might offer to businesses. Participants in conference calls that follow the media may therefore have a higher propensity to address such topics.

Second, firm-level institutional ownership is negatively related to climate change exposure. This effect is particularly strong in the recent years and it originates primarily from a negative association between institutional ownership and exposure to regulatory and opportunity shocks. This finding is consistent with an interpretation whereby institutional investors started to underweight (or divest) firms with high climate change exposure, apparently without distinguishing much between firms with upside and downside exposures.

In a last step, firm exposure to regulatory shocks is negatively associated with valuations changes. We can document such an effect only for the second half of the sample, i.e., the years during which climate change exposure attains relatively high levels (since 2011). At the same time, we cannot detect that changes in firm valuations reflect firm-level exposures to opportunity shocks.

The complete paper is available for download here.

Print

Print