Jackie Cheung is Senior Vice President, Governance, and Victor Guo is President at FrontLine Advisors Inc. This post is based on a Frontline report by Mr. Cheung, Mr. Guo, Dexter D. S. John, and Susy Monteiro. Related research from the Program on Corporate Governance includes Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here).

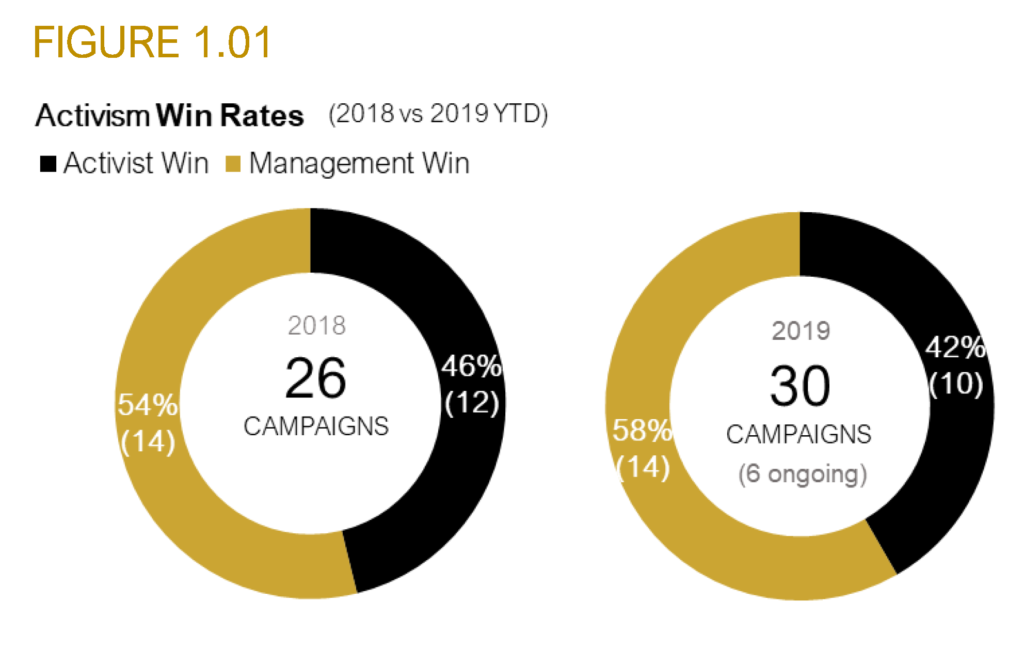

2019 has been another record year for shareholder activism in Canada. In all of 2018, we tracked 26 activism campaigns (excluding hostile bids) whereas 2019 year-to-date, we have seen an additional four campaigns, bringing the count up to 30 in total.

In 2019, management won 58% of all campaigns (versus 54% in 2018) while activists won 42% (46% in 2018). We see this as a relatively stable trend year-over-year (see Figure 1.01).

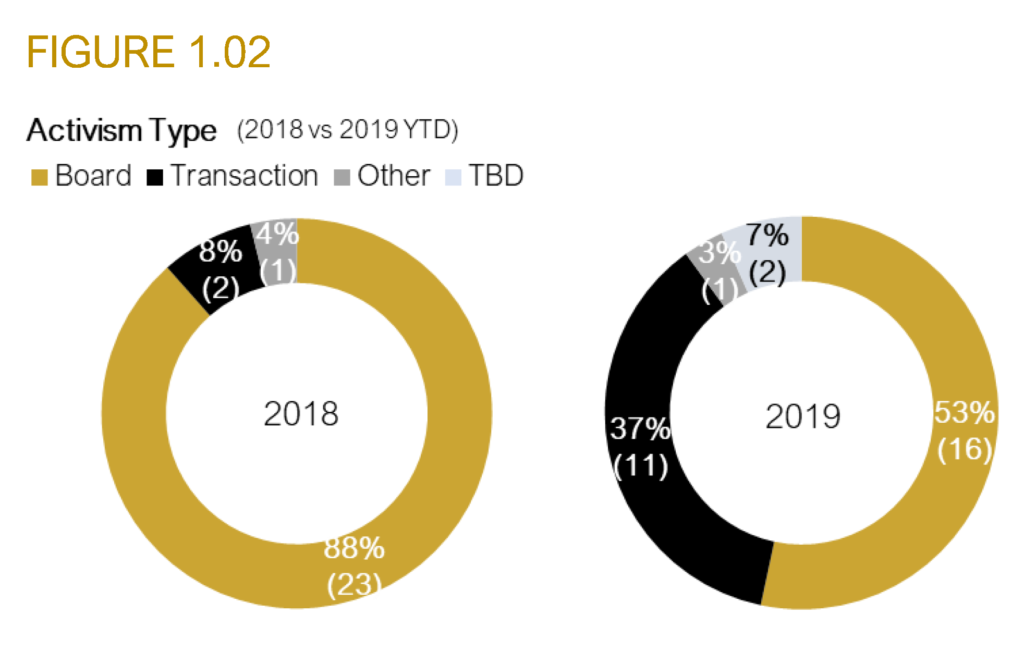

Notably, in 2019, board-related activism accounted for 53% of all campaigns versus 88% in 2018 (see Figure 1.02). The decline in board-related campaigns as a proportion of total campaigns is offset by the increase in transactional activism. Transactional activism continues to rise, representing 37% of all campaigns in 2019 compared to 8% in 2018.

Marquee transaction-related campaigns this year include Mr. Keith Piggott’s attempt to block Core Gold Inc.’s proposed arrangement with Titan Minerals Ltd., Catalyst Capital Group Inc.’s (“Catalyst Capital”) attempt to block Hudson’s Bay Co.’s take-private offer by an insider consortium, and Group Mach Inc.’s (“Group Mach”) opposition to Transat A.T. Inc.’s (“Transat”) acquisition by Air Canada.

We have observed a somewhat novel tactic, the use of “mini-tender” offers as a way to block certain transactions. These types of tenders are different from traditional takeover bids in a sense that they are an offer made to all shareholders but structured in such a way that avoids the triggering of the takeover bid rules. Catalyst Capital, a Canadian private equity firm, had launched a mini-tender for approximately 10.75% of Hudson’s Bay Co.’s shares outstanding to accumulate a position in hopes of thwarting an insider take private bid.

Similarly, Group Mach had launched a mini-tender offer to acquire 19.5% of Transat’s shares, hoping to potentially block Air Canada’s acquisition of the company. In conjunction with the “mini-tender”, Group Mach had required tendering shareholders to appoint Group Mach representatives as its nominee and proxyholder in order to vote against the approval of the transaction at the special meeting in connection with the Air Canada acquisition. Ultimately, the Tribunal administratif des marchés financiers (the applicable Quebec regulator) issued a decision to cease trade the “mini-tender”. Despite being cease traded, the “mini-tender” achieved its objective in that Air Canada ultimately announced that it would increase its offer price. The fact that the “mini-tender” was cease traded does not categorically rule out future uses of this strategy and it remains to be seen whether the “mini-tender” to block transactions will become a wide-spread strategy used in transactional activism.

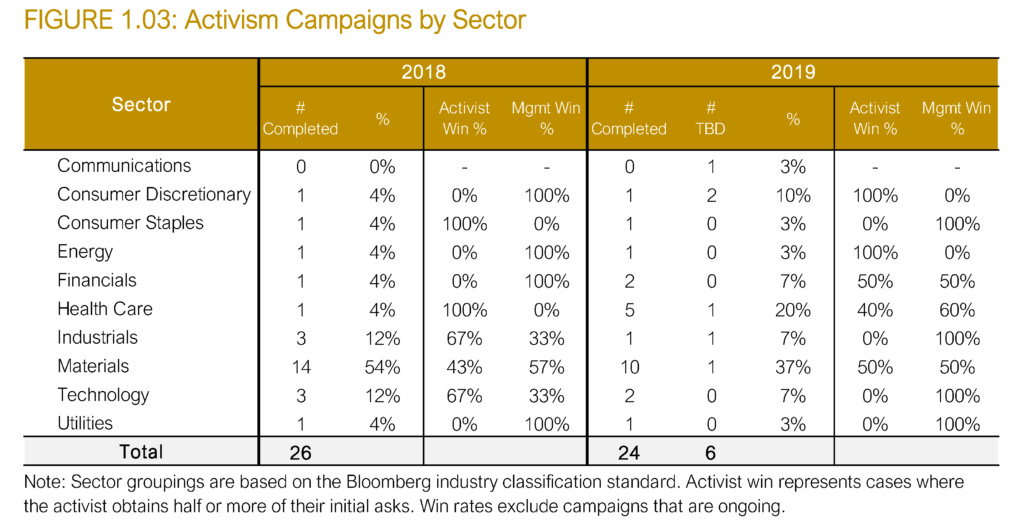

Activism by Sector

In 2019, the “materials” sector was the most active with 11 campaigns year-to-date representing 37% of total campaigns versus 54% in 2018 (see Figure 1.03). The second most active sector was “health care” with 6 campaigns year-to-date representing 20% of all campaigns versus 4% in 2018. The uptick in “health care” activism is partially attributable to increased activity in the cannabis space (at Ascent Industries Corp. and HEXO Corp.). As institutional capital flows into this area and the industry continues to mature, we see an undeniable need for cannabis companies to be proactive in patching up weaknesses that could leave it vulnerable. One such area is improved corporate governance, a target area typically used by activists as springboard to a campaign.

Activists by Country

This year, we have also observed an increase in campaigns initiated by international activists outside the U.S. and Canada, representing 27% of all campaigns thus far compared to 4% in 2018. The prolific rise of international activists may partially be attributable to the anecdotal experience that Canada can be seen as a haven for shareholder activism. However, in the last two years, international activists were only successful 22% of the time whereas Canadian and U.S. activists were successful 47%. We believe that international activists face real challenges when mounting a campaign in Canada. For example, the unique jurisdictional and regulatory factors, shareholder apathy for international nominees and time-zone differences are all contributing factors that may deter their chances for success.

What counts as an activism campaign?

We count all public initiations by shareholder(s) in opposition of management as a campaign. This includes but is not limited to the requisitioning of a shareholder meeting, announcement of the intent to launch a campaign to replace directors or otherwise oppose management in anyway and filing of activist materials opposing or soliciting against management. We do not include unsolicited hostile takeover bids as part of the activism campaign data. We count campaigns based on their contested meeting date. If the campaign is resolved prior to the meeting being announced or set, we use the next closest meeting date when that date becomes available.

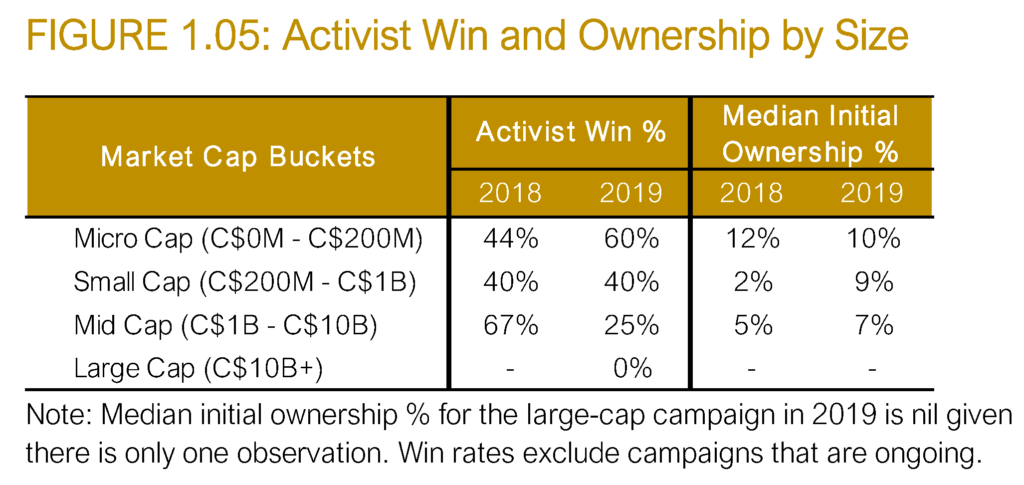

Activist Target Size

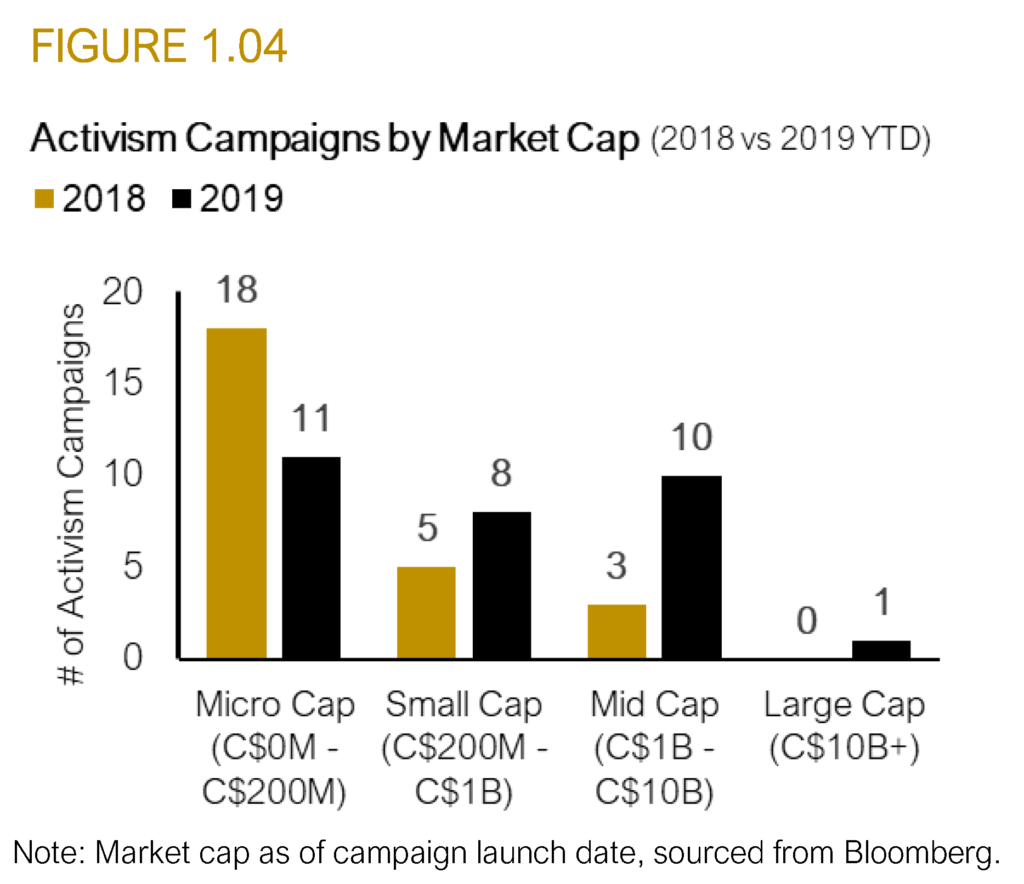

Despite mid cap activism rising, its activist success rate has declined from 67% to 25% year-over-year, whereas micro cap activist success rate has increased from 44% to 60% over the same period (see Figure 1.05). Initial activist ownership percentages are smaller when considering mid cap versus micro cap campaigns but median initial ownership has increased for small and mid cap campaigns year-over-year which may point to activists becoming more serious by building a larger toe-hold position prior to and at launch.

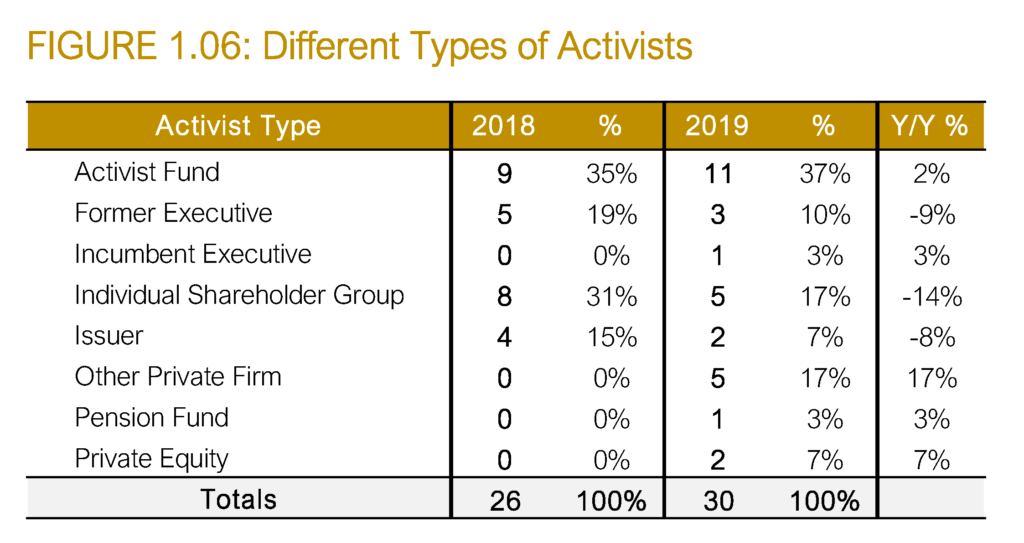

Activist Type

The most prominent type of activist remains professional activist funds representing, 37% of all campaigns in 2019 versus 35% in 2018 (see Figure 1.06). Individual shareholders initiated 17% of all campaigns, down from 31% in 2018. We have also seen an increase of other private firms engaging in activism. These are typically private long-term strategic shareholders engaging in reluctant, first time activism in order to protect their investment. Interestingly, of the three campaigns launched by such long-term strategic shareholders in 2019, none were successful, proving the adage that experience counts in the proxy fight space.

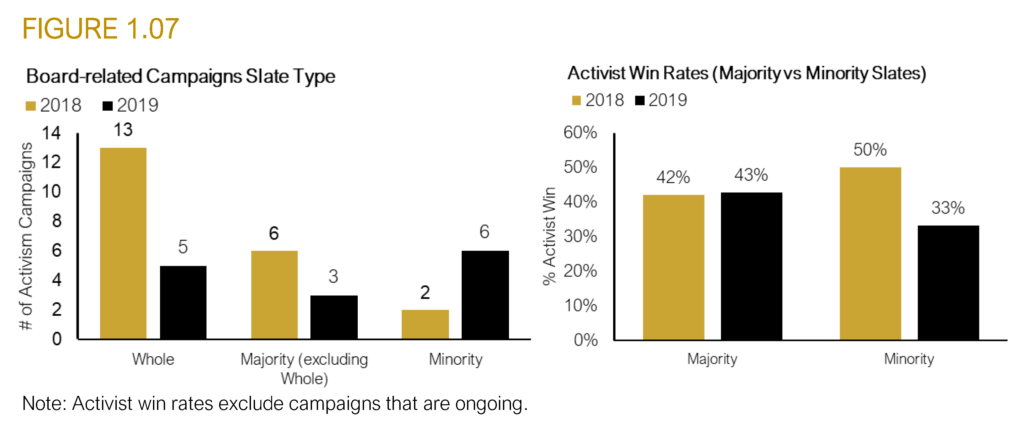

Short Slate or Full Control?

While there have been 16 board-related campaigns in 2019, only 14 of them involved the actual nomination of directors (two were withhold campaigns). Comparatively, in 2018, there were 23 campaigns that were board-related and among them, 21 involved the nomination of directors (two were withhold campaigns). Analyzing the campaigns where director nominations were involved, we see that activists favoured minority slates in 2019 as compared to majority slates (see Figure 1.07). However, there appeared to be an inverse relationship between the choice of slate type and activist success rates. While the use of majority slates declined, the success rate of majority slate campaigns increased slightly from 42% to 43% year-over-year. Conversely, there is an increase in the use of minority slates but a decline in success rates from 50% to 33% year-over-year.

From an activist perspective, the tactical selection of majority versus minority slates can be driven by a variety of factors. Often, it comes down to whether or not the activist believes that a minority board control position can effect the level of change they desire. An important implication to going the majority board control route is that both proxy advisors Institutional Shareholder Services Inc. (“ISS”) and Glass, Lewis & Co. LLC (“Glass Lewis) have significantly higher hurdles and requirements to prove the case for change when the objective is to replace a majority of the board. From our experience, it is also sometimes difficult to build a stellar slate of activist nominees. These are all considerations that activists must deliberate on prior to launching a successful activism campaign.

Expert Insights

“In recent guidance, the SEC stressed the importance of investment advisers’ voting responsibly on behalf of their clients and taking reasonable steps to ensure that the use of advice provided by proxy advisory firms is consistent with the investment advisers’ duties to their clients.

These include taking steps where an investment adviser becomes aware of potential errors, incompleteness or methodological weaknesses in the proxy advisor’s analysis. This guidance could have interesting effects during a proxy contest, among other circumstances.”

– Simon A. Romano, Partner, Stikeman Elliott LLP

Board-related Campaign Tactics

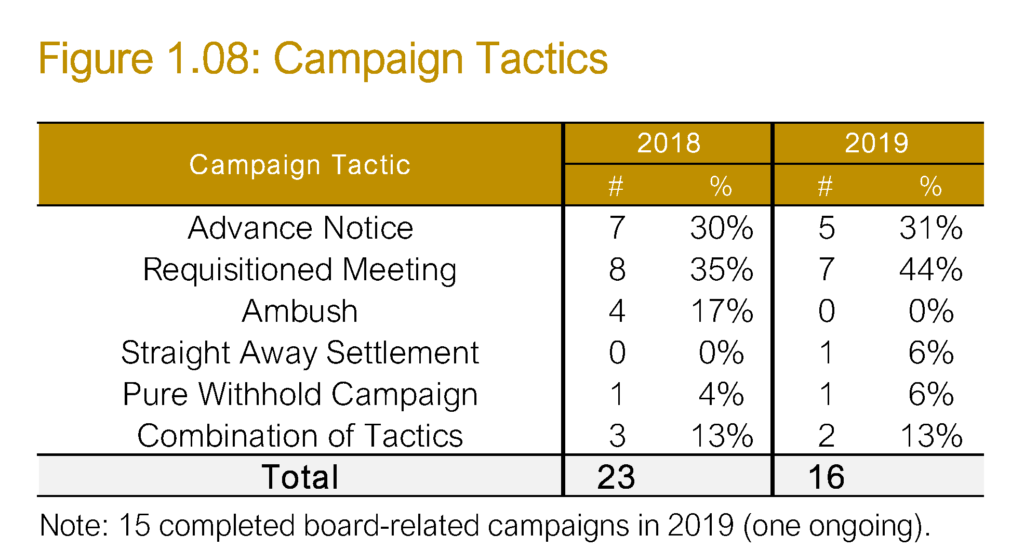

On a high level, the activist overall success rate for the 15 completed board-related campaigns (one ongoing) in 2019 was 40% compared to 43% for the 23 completed board-related campaigns in 2018.

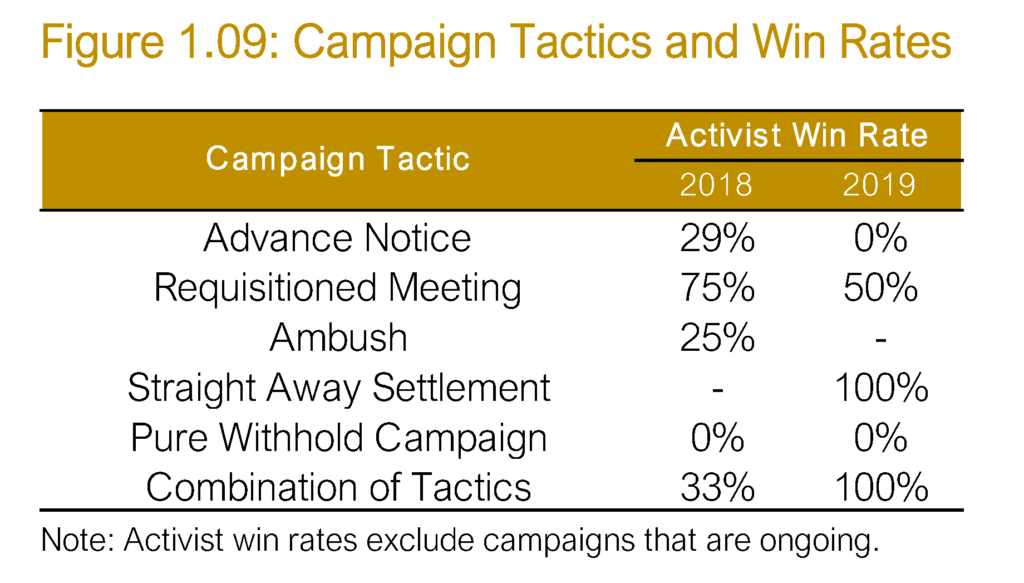

In the past two years, requisitioned meetings are the most popular tactic to put forth a slate of directors at a contested meeting, followed by the use of advance notice to nominate directors (see Figure 1.08).

While four ambush campaigns occurred in 2018, none took place in 2019. Ambushes were historically popular prior to the advent of advance notice provisions. In these cases, an activist puts forth a slate to contest the existing incumbent directors either through nominations at the floor or through the filing of a dissident circular to solicit votes for an opposing slate.

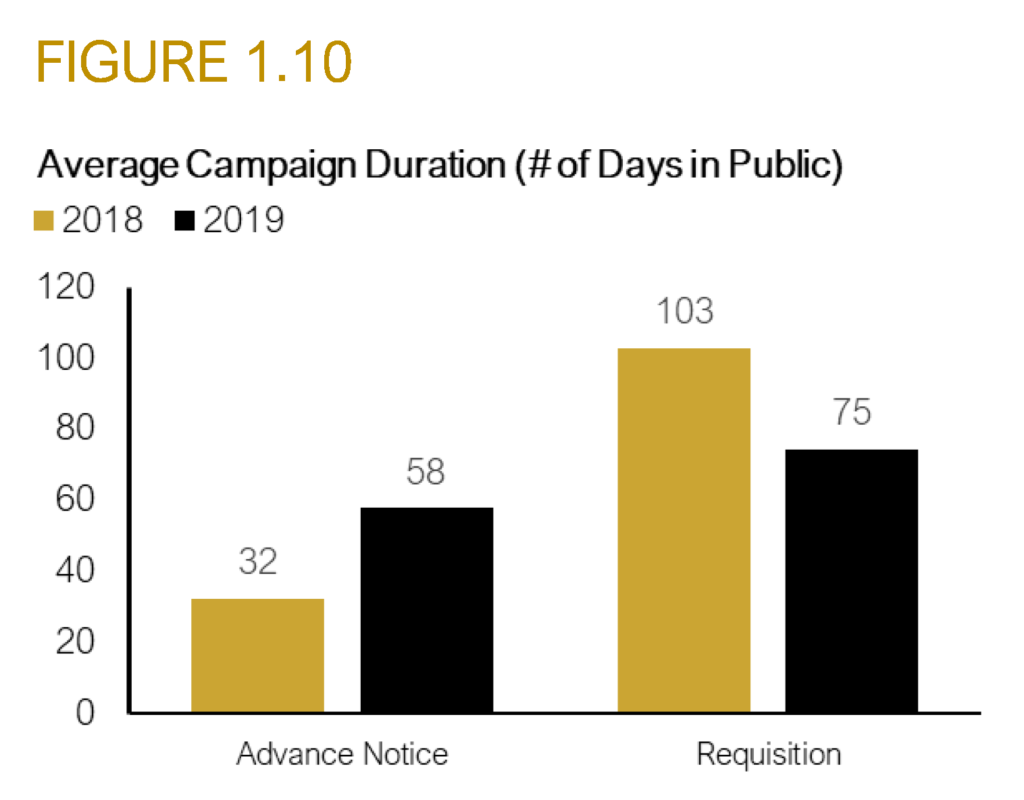

In terms of activist win rates, requisitioned meetings are much more successful compared to pursuing board campaigns via advance notice (see Figure 1.09). This intuitively makes sense given that the minimum share ownership threshold to requisition a shareholder meeting is 5% whereas no such threshold exists for activists pursuing a campaign through advance notice. Moreover, activists who select the requisitioned meeting route are generally more serious and confident given the strong likelihood of a protracted campaign which can lead to a significant increase in campaign costs. On average, requisitioned meetings campaigns to replace the board lasted 1.3x longer in 2019 and 3.2x in 2018 compared to advance notice campaigns (see Figure 1.10).

The longer public campaigns associated with requisitioned meetings, provide both sides with ample time to make their respective cases. In these cases, the activist would have more lead time to demonstrate their ongoing dialogue with management. When a campaign is launched at the late stage, as is often the case in advance notice campaigns, shareholders may not have time to fully digest the activists’ plan, should there be one. In terms of perception, shareholders may deem such campaigns to be abrupt given the usual late stage of the launch in conjunction with advance notice which is typically slightly more than one month prior to the annual meeting date.

Requisitioned Meetings when Replacing Directors

Of the seven requisitioned meetings called for the purpose of board replacement in 2019 (excluding campaigns that used a combination of shareholder meeting requisition and other tactics), only three meetings were actually called pursuant to the original meeting requisition (at Ascent Industries Corp., Kuuhubb Inc. and Guyana Goldfields Inc.). In all three of these cases, the requisitioned meetings were combined with the scheduled annual meeting. Based on public information, management called the meetings 114 days on average after the original requisition. In the remaining four cases, the requisitioned meetings were not called by management due it being invalid or the shareholder action being settled.

Comparatively in 2018, of the eight requisitioned meetings, six meetings were actually called by management, with two being called by the activist themselves when management refused to provide a response to the requisition. Only three of the eight meetings were combined with a scheduled annual meeting. Based on publicly available information, management called the meetings 103 days on average after the original requisition (excluding an outlier in the case of target company Robix Environmental Technologies Inc. where the concerned shareholders called the meeting themselves after management ignored their original requisition for almost two years).

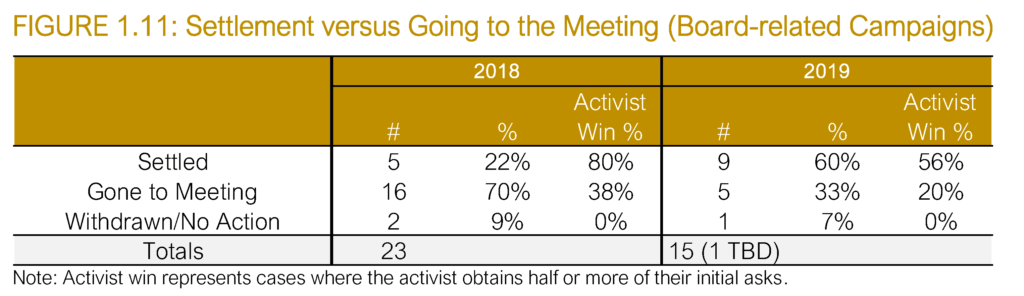

Settlement versus Going to the Meeting

In 2019, it would appear that 60% of board-related campaigns settled prior to reaching the meeting date stage compared to 22% in 2018. Settlement is defined as a public record whereby the activist and management have reached an agreed upon resolution prior to the meeting. The increase in settlement rate coincides with a decline of campaigns going to the meeting from 70% in 2018 to 33% in 2019 (see Figure 1.11).

We see that while activists are more prepared to settle rather than rely on a vote (settlements increased to 60% in 2019), they are compromising their settlement and accepting less than what they originally sought (activist win declined to 56%).

Activists are also settling earlier, with the settlement occurring 71 days on average prior to the next scheduled meeting date in 2019 rather than 50 days in 2018.

Expert Insights

“While activism remains robust in the Canadian market, we are seeing more board-related activist demands settled before a public proxy solicitation campaign by both sides. Boards are increasingly opting to mitigate perceived risk by negotiating settlements where the activist receives a minority of board seats, and offers a time-limited standstill. As activists often don’t represent shareholders as a whole, and may have short-term interests inconsistent with the interests of other shareholders, it remains to be seen whether early settlements promote stability or instead provide a platform for further agitation inside the company.”

– Robert W. Staley, Partner, Co-Head, Shareholder Activism & Critical Situations, Bennett Jones LLP

Prevalence of Universal Proxies

A universal proxy is an alternative to the traditional form of proxy used in contested director elections. A universal proxy allows securityholders to pick-and-choose from a combination of the management and activist nominees as listed on one form of ballot.

In 2019, of the five cases where the activist filed their own ballots in contested director elections, four utilized the universal proxy representing 80% of the cases.

Comparatively in 2018, of the nine cases where the activist filed their own ballots, only two of them were universal proxies representing 22% of cases. Evidently, activists have favoured the universal proxy this past proxy season. However, it appears that management still prefers the use of the traditional ballot. Of the four cases where the activist opted for the universal proxy in 2019, we only saw one instance where management also used a universal proxy (Methanex Corp.). In both of the cases where an activist used a universal proxy in 2018, management opted for the traditional proxy.

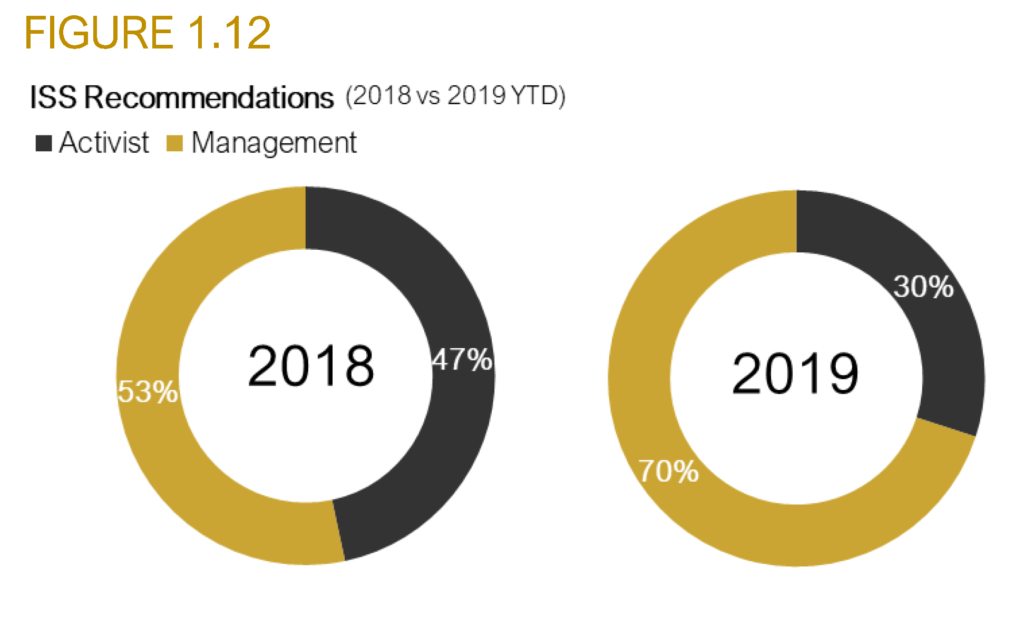

Proxy Advisor Recommendations

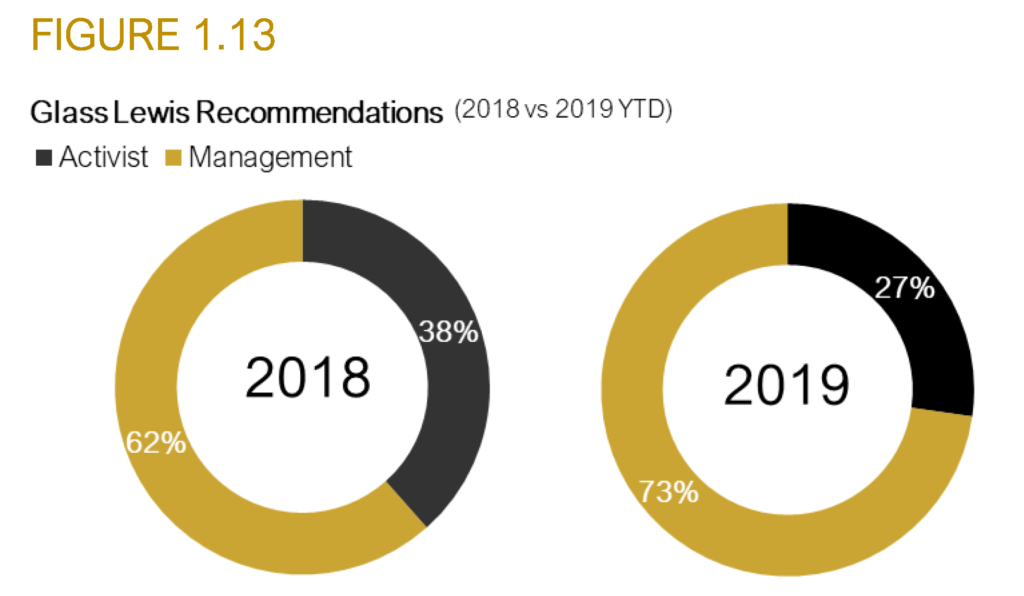

Tracking proxy advisor recommendations where available on contested meetings, ISS had supported management 70% of the time in 2019 as opposed to 53% in 2018 (see Figure 1.12). Conversely, Glass Lewis supported management 73% of the time in 2019 compared to 62% of the time in 2018 (see Figure 1.13).

In board-related campaigns, ISS supported the activist 33% of the time in 2019 versus 54% in 2018. Glass Lewis supported the activist 43% of the time in board-related campaigns in 2019 compared to 45% in 2018. For transactional campaigns, ISS supported the activist 25% of the time in 2019 and 0% in 2018. Glass Lewis supported the activist 0% in both 2018 and 2019 for transactional campaigns. Evidently, it appears that activists have not been very successful in obtaining proxy advisor support for transactional campaigns over the past two years.

A Study of Total Shareholder Returns

The question often asked of us is what impact, if any, would an activist have on a target company’s shareholder return during an active campaign. To address this, we tracked the public launch and resolution dates for the 50 completed campaigns between 2018 and 2019 (six additional ongoing) to determine the cumulative total shareholder returns (“TSR”) experienced.

We find that the average TSR experienced during the campaigns was -5.25% (median: -1.96%) across the 50 targeted companies. While we understand that due to campaign duration differences, the cumulative TSR data is not entirely comparable across campaigns, we observe that generally speaking, during shareholder campaigns over the past two years, TSRs were slightly negative.

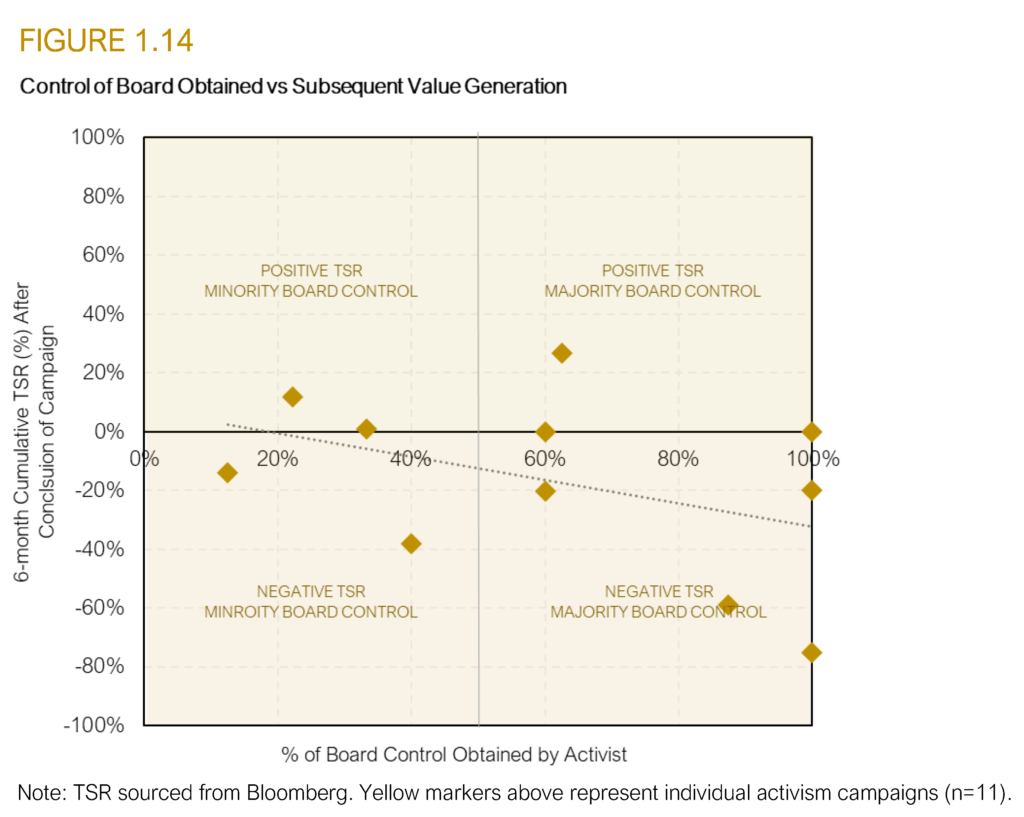

Another often sought-after statistic is whether the activist can generate positive shareholder value after placing their directors on the board. Looking solely at 2018 (there is insufficient TSR data subsequent to the recently completed campaigns in 2019), we observe 11 instances where an activist was able to obtain varying degrees of board control ranging from 13% to 100% (see Figure 1.14). For these target companies, average returns generated six-months subsequent to the conclusion of the activist campaign was -17% (median: -14%). Our findings suggest that there is a slight negative correlation between short-term TSR subsequent to the campaign and the percentage of board control obtained.

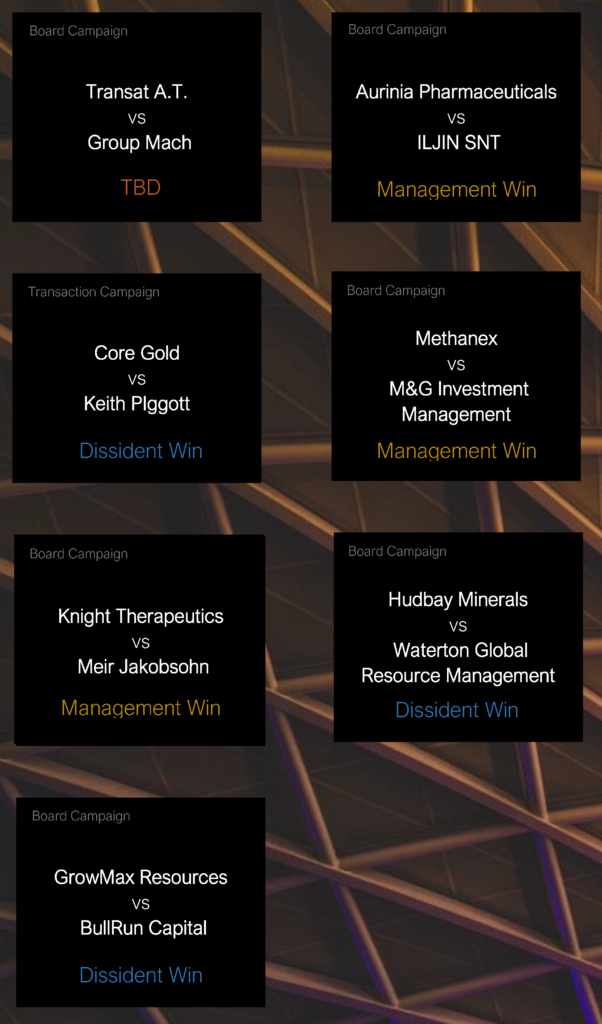

Key Activist Campaigns that Went the Distance in 2019

Note: Going the distance is classified as when the activist files its own information circular.

The complete publication, including footnotes, is available here.

Print

Print