Lars Oxelheim is Professor of International Business and Finance at the University of Agder. This post is based on a blog post by Professor Oxelheim; Rosita P. Chang, Professor of Finance at the University of Hawaii at Manoa; Jack C. DeJong, Jr., Professor of Finance at Nova Southeastern University; Robert Doktor, Professor of Management at the University of Hawaii at Manoa; and Trond Randøy, Professor of International Business and Finance at the University of Agder.

The negative aspects of large CEO pay and the associated incentives have been a hot political issue in many countries. Our research identifies some positive aspects of CEO incentives in a broader economic/societal context that have been overlooked. In a five-year longitudinal study across major free-market nations in Asia, Europe, and the Americas, we find when a higher proportion of CEOs in a nation receive incentives, that nation’s GDP increases significantly in the following years, independent of the incentives monetary value. That is, in nations where a CEO incentive compensation is more frequently employed, these nations exhibit relatively more robust economic growth in the years that follow. It appears ubiquitous CEO incentives may result in future positive societal benefits at the macroeconomic national level.

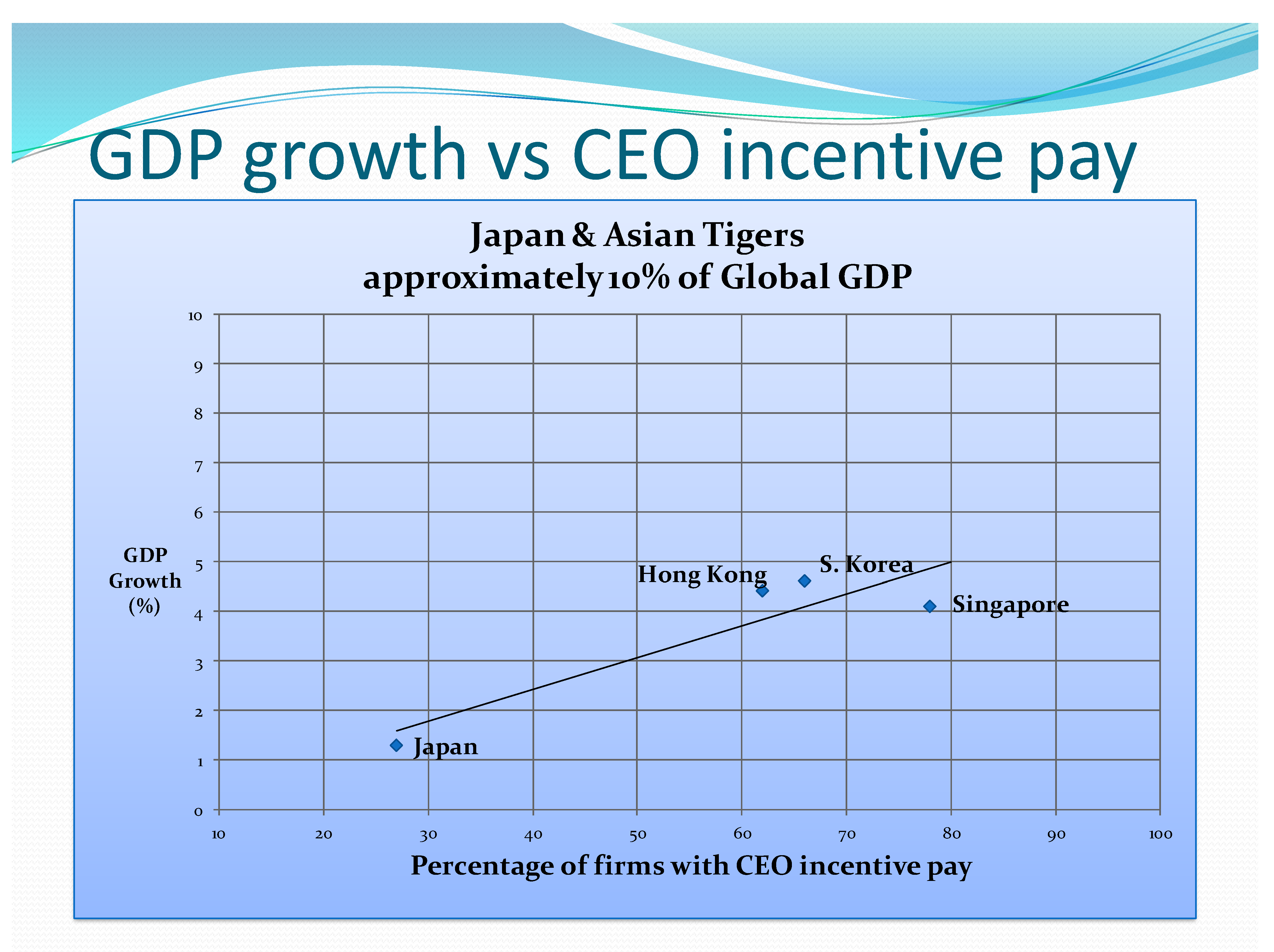

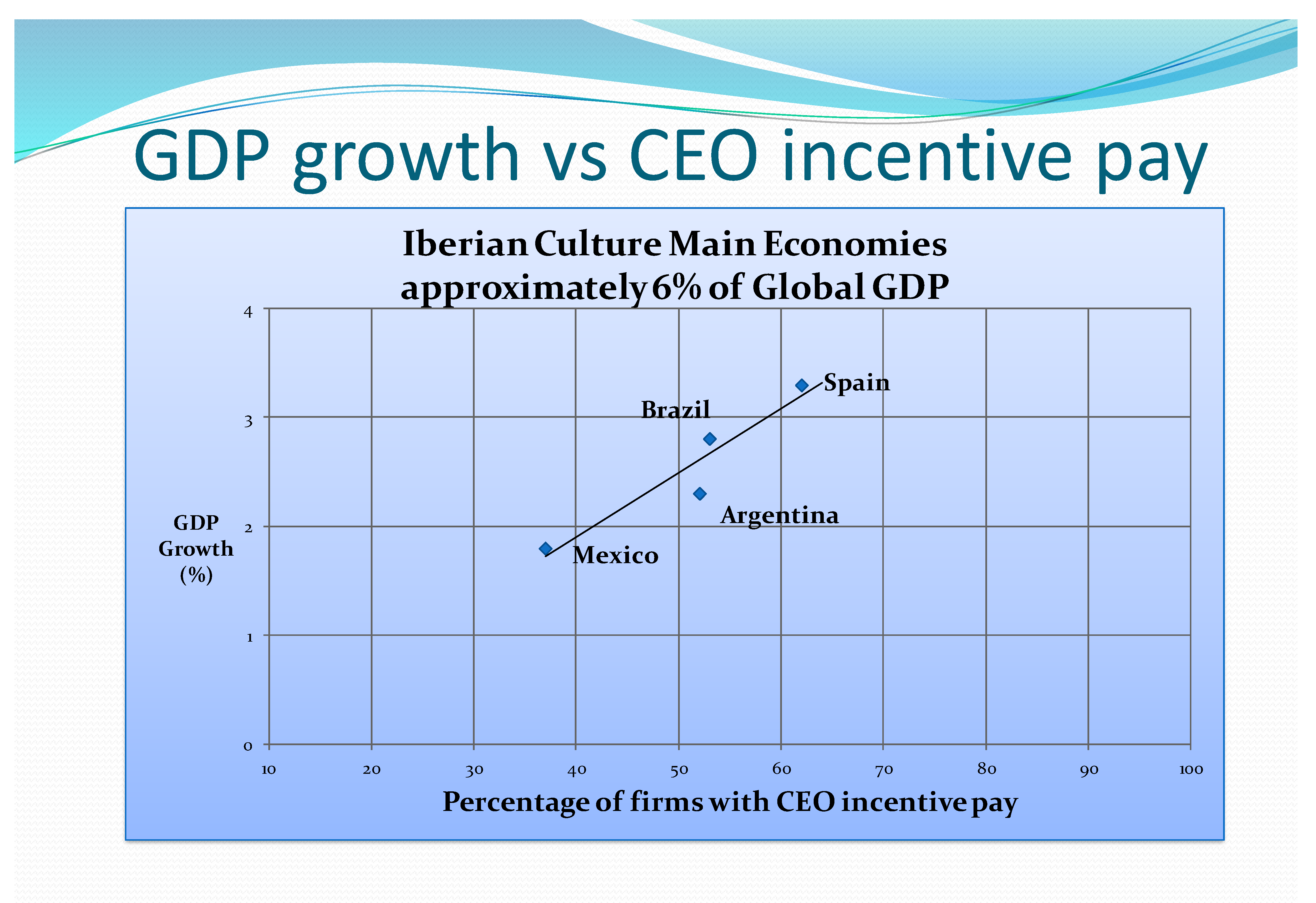

Graphs 1, 2 & 3 demonstrate a strong positive relation between the proportion of CEOs who receive incentives in a nation and the follow-on GDP growth of that nation. The data on which we based our research was collected during a five-year period and made publicly available by Towers & Perrin consultancy. Graph 1 shows the results for highly industrialized nations of North America and Western Europe. Graph 2 yields similar results for Japan and three Asian Tigers. Graph 3 demonstrates the same trend for the Iberian nations (our term for Spanish and Portuguese speaking societies in our data). All three graphs show the same trend: More CEOs receiving incentives; more national economic prosperity in future years. For a more detailed analysis of the data see C. Campbell, R. P. Chang, J. C. DeJong, Jr., R. Doktor, L. Oxelheim and T. Randøy, The impact of CEO long-term equity-based compensation on economic growth in collectivist versus individualist countries.

Graph 1

Graph 2

Graph 3

Culture appears to play an important role in these results. Notice that there exists a greater propensity to offer CEO incentives in America and much of Europe than in either the Asian or Iberian culture nations. Culture is a complex concept and there may be many and varied reasons for these differences. None-the-less, in all three regions the same result occurs: More frequently offered incentives; more follow-on societal prosperity. The significance of this is simply: Incentives, even CEO incentives, are a good thing for society when administered intelligently. Proposals to eliminate all CEO incentives may be socially dysfunctional, rather re-thinking the design of incentives certainly may be appropriate.

When a CEO in one firm receives equity-based incentives this may lead to changes in the behavior of CEOs of rival firms, and to a positive spillover effect on these other CEOs and their firms’ performance. Rival CEOs may be motivated to imitate the behaviors of the rewarded CEO in anticipation of also receiving similar equity-based incentives. The effects of the CEO incentives cascade through the economy as CEOs and/or aspiring CEOs are motivated to make wealth-creating economic decisions. While the relation between CEO incentives and the financial performance of a CEO’s firm has been found by past research to have a weak link, our study posits that aggregate firm performance within a country may be enhanced by ubiquitous implementation of CEO pay incentives within that country. That is, the existence of CEO incentive compensation not only influences firms’ executives who receive these incentives, but also motivates executives in competing firms, enhancing the competitive rivalry, and stimulating national economic prosperity.

We have termed this between-firm dynamic: Vicarious Agency. That is, the agency dynamic is learned by rival CEOs not by direct experience, but through observation of the behavior of other CEOs and the consequences of that behavior. Drawing from Social Learning Theory (Bandura, A. 1971. Social Learning Theory. New York: General Learning Press), this is an example of vicarious learning; therefore we have termed it: Vicarious Agency. While we argue there is a positive relation between the prevalence of CEO long-term pay incentives and GDP growth, it is important to stress that our study is not about levels of incentives and does not imply a positive relation between the level of CEO pay and GDP growth. Our CEO pay data is a frequency count of the relative number of CEOs receiving long-term incentive pay, and therefore does not reflect the magnitude of incentive pay. We highlight this because excessive CEO pay has become a major media issue, and there are numerous efforts by diverse groups to dampen executive pay.

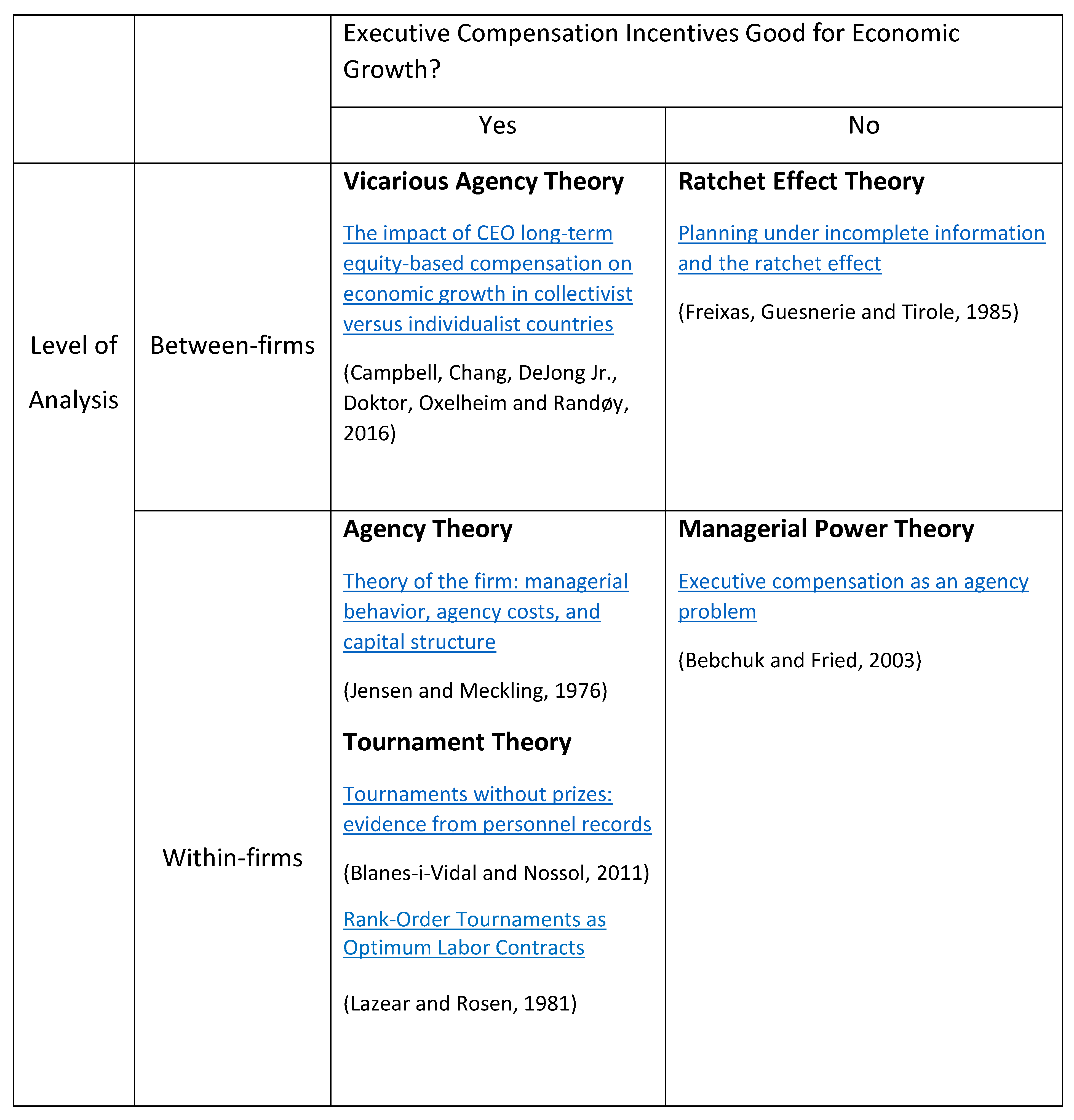

Figure 1: Conceptual categorization of executive pay theories and proposed economic growth effects

Figure 1 displays the relationship of our construct of Vicarious Agency to the major conceptual categorizations of the impacts of executive pay incentives found in the literature. Our finding supports a view that, in general, CEO performance incentives are a good instrument that enhances economic growth. These findings have implications for both corporate decision-makers (particularly compensation committees) and public policy-makers. The study suggests that national economic growth may be positively linked to the frequency of firms offering CEO incentive pay in that nation.

Print

Print