Subodh Mishra is Executive Director at Institutional Shareholder Services, Inc. This post is based on an ISS Analytics publication by Marie Clara Buellingen and Mikayla Kuhns, ISS Custom Research, and Kosmas Papadopoulos, CFA, ISS Analytics. Related research from the Program on Corporate Governance includes Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here) and Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

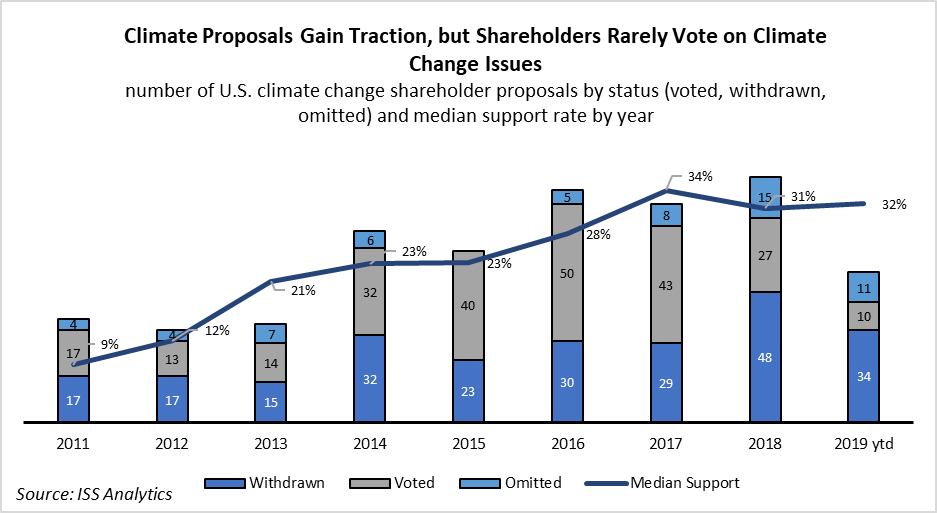

While many institutional investors place climate change as a priority issue among their investment stewardship initiatives, it can be especially challenging to systematically incorporate climate change into proxy voting and engagement strategies. Companies’ annual meeting agendas rarely include proposals dealing directly with climate change issues. Only a small minority of companies—typically large firms in energy-intensive sectors, mainly in the U.S.—may receive climate-related shareholder proposals. Further, many shareholder proposals dealing with climate issues do not make it to the ballot, as they are either withdrawn by proponents or may be omitted by companies. Voting on climate issues can thus be a reactive exercise largely outside the control of the investor. However, climate change is a systemic risk affecting all sectors of the economy, all markets, and large and small companies alike. Investors who view climate change as a risk and look to incorporate climate-related considerations in their engagement and proxy voting need to conduct a review of their portfolio companies and assess the various actions they would like to take in relation to climate risk or impact.

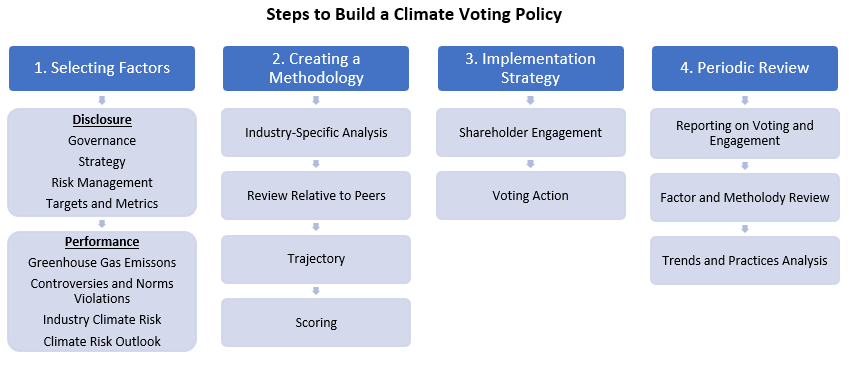

In this post, we provide a framework for investors looking to build a proactive proxy voting and engagement policy based on climate change criteria, following four key steps:

- Identifying portfolio priorities and selecting relevant factors related to climate change risks and opportunities based on an assessment of company disclosure and performance;

- Creating a methodology for ranking and prioritizing portfolio companies based on climate-related concerns for engagement and voting;

- Implementing a voting and engagement strategy; and

- Periodically reviewing and revising the climate change stewardship program.

Recognizing the need of many investors for a comprehensive climate assessment tool for the purposes of investment stewardship, ISS is launching a new ISS Custom Climate Voting Service, which uses ISS ESG’s extensive climate data and proprietary research, allowing investors to assess a range of climate-related factors for the purposes of proxy voting. In addition, select ISS Benchmark and Specialty Policy research reports will include the ISS Climate Awareness Scorecard in the future, giving investors a comprehensive climate risk profile of the companies under review.

Climate Change Risk Awareness is Growing

Many companies, investors, policymakers, and members of the public are increasingly recognizing climate change as a significant economic as well as environmental threat. Since the 2015 Paris Agreement, most governments and regulators face increased pressure to curb carbon emissions to avoid average global warming of more than two degrees Celsius (or lower) compared to pre-industrial levels. Investor interest in climate change issues and risks has also grown. The volume of shareholder proposals seeking better disclosure, risk oversight, and risk mitigation related to climate change has risen significantly, as have the average support rates for such proposals.

But even as climate risk awareness is growing, most shareholders will rarely have the opportunity to vote on climate change issues directly. In the U.S., shareholder proposals on climate change are typically concentrated in certain industries, and, like most shareholder proposals, they are generally filed at large-capitalization companies (historically, more than three-quarters of these proposals have been filed at S&P 500 companies). In addition, the majority of climate proposals are typically either withdrawn by proponents or omitted by companies (through the SEC’s 14a-8 no action relief process); consequently, relatively few climate-related resolutions make it to the ballot. Outside the U.S., shareholder proposal filings are in general less common, and climate-related proposals are even rarer.

The high percentage of withdrawn proposals in the U.S. signifies a positive development for climate change risk-aware investors, as companies appear more willing to engage and disclose information that satisfies the original proponents. That said, proposal filings and the agreements that lead to proposal withdrawals reflect the specific views and requests of the filer. For investors with their own specific approaches to climate risk, not all climate-related proposal filings will necessarily align with their views.

An effective voting policy on climate change is likely to require a climate risk assessment of the investor’s entire portfolio, which would allow for the evaluation of companies on a standalone basis and independent of shareholder proposal filings. Because general meeting agendas rarely address climate change issues directly, a voting policy on climate is likely to need to expand to regular ballot items, such as director elections, discharge of directors, or the approval of financial statements.

Creating the Framework of Analysis for a Climate Policy

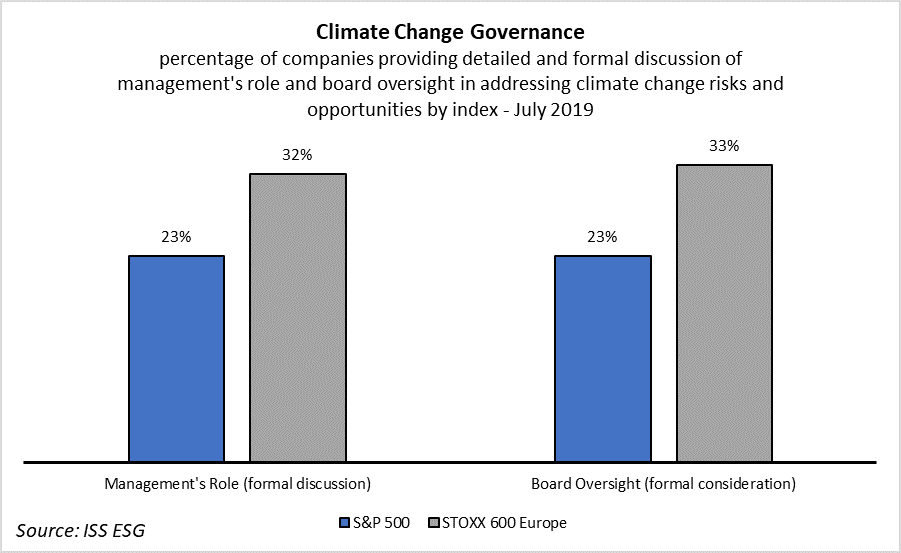

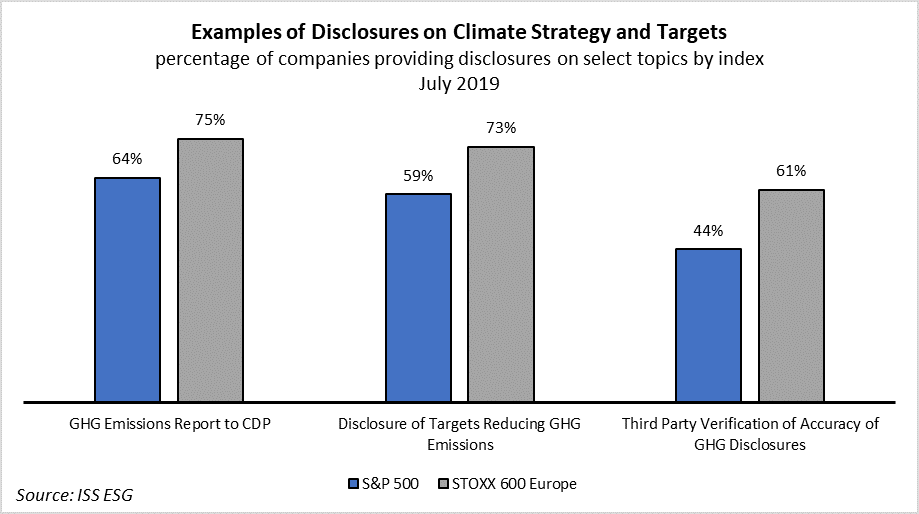

The key areas for evaluating companies’ management of climate change risks are climate-related disclosure and climate-related performance. Robust and consistent disclosures, especially those linked to recognized international climate standards, allow for more informed assessments and benchmarking by investors across industries and markets. Assessing performance on climate change relies primarily on available company disclosures and ideally encompasses both quantitative and qualitative components of climate risk assessment.

In the absence of legal minimum disclosure requirements on climate-related factors globally, established frameworks of voluntary disclosure and analysis may serve as the foundation for determining which factors to consider and how to approach each factor. Such frameworks of voluntary disclosure include multi-stakeholder initiatives like the Task Force on Climate-related Financial Disclosures (TCFD), the Global Reporting Initiative (GRI), the CDP, and the standards set by the Sustainability Accounting Standards Board (SASB). These frameworks are increasingly gaining traction with investors and companies alike, thus enabling a more holistic evaluation of companies across many markets and sectors.

Assessing Climate Change Disclosures

Disclosures on climate change-related factors and risks can cover a wide range of topics and perspectives. Depending on levels of disclosure and the data available, material topics disclosed can be categorized into four general areas, such as those outlined in the TCFD pillars:

Climate Change Governance. Climate change governance may include a variety of practices, such as whether the company has provided a detailed explanation of the board’s or management’s involvement in addressing climate change risks and opportunities, or the extent to which a company has established an overarching policy related to climate change.

Climate Change Strategy. Disclosures on a company’s climate change strategy vary in scope and depth. Some disclosures may include information on how the company operationalized its climate change policy or information on how climate change may impact the company’s business strategy and financial planning. Other strategy disclosures may be more specific, discussing, for example, whether the company has developed a strategy to improve the fuel efficiency of its vehicles (where applicable), or the extent to which the company’s greenhouse gas (GHG) reduction targets are aligned with the Paris Agreement goal of keeping global temperatures below two degrees Celsius compared to pre-industrial levels.

Climate Change Risk Management. To the extent that a company has a climate change risk management program, these disclosures may be assessed on the basis of how the company’s processes are integrated into its overall risk management program. In addition, investors may review how frequently the company monitors its relevant procedures.

Climate Change Targets and Metrics. Companies provide disclosures on emissions and other climate-related metrics in varying levels of detail. Some companies set specific targets towards improving on these metrics.

A first level of review could consider whether companies disclose metrics and targets. Further, the assessment could consider how detailed the disclosure is: whether the company discloses its total direct and indirect emissions, or whether the company provides other metrics related to climate change risks.

Assessing Climate Change Performance

Building on available disclosures, investors can conduct both qualitative and quantitative assessments of company performance in relation to climate change risk. Such performance can be measured based on the company’s level of preparedness and adaptability, its greenhouse gas footprint and relative greenhouse gas intensity, and risk exposure based on the company’s business activities. Below, we list a few examples of climate performance indicators, drawing from several of ISS’ product offerings and databases related to climate and carbon risk.

Greenhouse Gas Emissions (GHG). An emissions assessment could evaluate the company’s emissions compared to peers or regulatory requirements (where applicable). GHG emissions assessments (typically expressed in carbon dioxide equivalents or CO2e) may consider the overall GHG footprint of the company, the company’s GHG emissions intensity (measured as total emissions divided by revenue) against its peers, whether GHG emissions are increasing or decreasing over time, or whether emission reductions are in line with stated goals. As disclosure standards of emissions data vary from company to company (or data is simply not available for some), models can also be used to verify or estimate emissions.

Controversies and Norms Violations. A company’s involvement in environmental controversies and how the company responded to such controversies may offer a significant insight into its climate change performance. For instance, investors may look for potential flags related to adherence to global norms on environmental protection, production of hazardous substances, or the company’s involvement in air, water, and soil pollution.

Industry Climate Risk. Some companies may be more vulnerable to the future implications of climate change given the nature of their businesses or the location of their operations. Do companies consider the potential business consequences of global warming? Are companies pursuing opportunities to become more sustainable and climate-conscious, and less susceptible to the potential risks for their business? A combination of risk factors can be utilized to review companies’ and investors’ short-term, long-term, and transitional risks associated with climate change and the potential effects of global warming. Regulatory risk can also factor heavily here.

Climate Risk Outlook. Forward-looking indicators of climate risk performance may include the company’s corporate policies and strategy on climate change and climate change preparedness and resilience in general. This type of analysis might include GHG emissions inventory and GHG reduction targets and plans. Additional forward-looking factors may include impacts of the company’s product portfolio to mitigate climate change risk, contributions to sustainable energy use, and energy management.

Building a Climate Change Assessment Methodology

Once an investor has selected which factors to use as part of their climate change risk assessment, the next step in the policy development process is usually to create or agree on an assessment methodology.

Industry-Specific Analysis. Climate risk is unevenly distributed across different industries. Based on the potential risks, respective emissions data, or other key performance metrics, investors might prioritize specific industries based on their overall level of perceived climate change risk, or they may decide to place more emphasis on certain business activities within industries. The decision to take an industry-specific or a business activity-specific approach will influence which factors the investor will want to consider at each company.

Review Relative to Peers. Even within the same industry, companies’ performance on climate change issues can vary dramatically. An assessment relative to peers can be useful in identifying best practices and setting appropriate benchmarks by peer group. A combination of relative and absolute thresholds may enable investors to achieve their desired effect, for example by identifying high-priority concerns that can be addressed by a combination of voting and engagement to encourage companies to improve their practices.

Trajectory. When assessing climate-related performance, the methodology could also look for improvements, stagnation, or credible commitment to future improvements. Developing a cohesive methodology that accounts for multiple parameters may be at the center of achieving an impactful policy for climate change voting and/or engagement.

Scoring. By considering a company’s performance relative to peers and in terms of its trajectory, investors can make holistic evaluations by rating or ranking companies via a scoring system. They can then determine which companies they consider as leaders or laggards in their respective industries, based on chosen thresholds and metrics. In addition to relative comparisons, company scoring may be based on absolute performance metrics.

Engagement and Voting

After having decided the assessment factors and scoring methodology, investors will then need to determine what to do with the companies not meeting expectations or underperforming their peers. Underperformance compared to peers may not necessarily result in taking immediate action. Having a comprehensive assessment of a company’s climate exposure allows for a nuanced approach – which can range from continued monitoring of a company’s progress to engagement and to voting action.

Shareholder Engagement. Various engagement approaches by investors include direct meetings or other discussions with companies, writing letters to specific companies or industry leaders, or joining other investors that partake in collective engagement or shareholder proposal filing on climate-related issues.

Voting Action. Investors may also choose to extend their climate change assessments into actionable voting strategies. In terms of proxy voting, several pathways are available. Some issues might warrant voting action immediately, while other factors may become a point of escalation for the investor after a period of monitoring and engagement. For instance, if a company’s score is below its peers but it has made significant improvements, some investors may decide to take the company’s progress into consideration and hold off on taking direct voting action.

Importantly, when deciding to take voting action, investors will have to consider which agenda proposals may be suitable for signaling their concerns, since there are normally no management proposals dedicated to climate change risks (“say on climate”). Depending on market practices and norms, different proposal types may be considered more suitable than others. For example, for companies with the highest risk or worst scoring, investors may vote against the election or discharge of directors. This targeting could be aimed at specific directors or follow a cascading hierarchy depending on who is up for election or the severity of the identified climate risk. The approval of financial statements is another possible additional voting option in some markets.

Periodic Review of Climate Change Program

As with any stewardship program and proxy voting policy, a periodic review can be helpful in assessing priorities, updating policies based on changing practices or recent developments, and understanding the overall effectiveness of the investor’s approach. Reporting (internally or externally) on climate change stewardship activities may be a critical component of the annual review, and investors can measure and communicate the scope, effort, and effectiveness of their voting and engagement on climate issues. As company practices, regulation, and perceived risks change, a periodic recalibration of factors, the scoring methodology, and engagement and voting strategies will likely be necessary.

ISS Services to Assist with Climate Change Voting

This post provides a roadmap to integrate climate change into voting and engagement policies depending on investor priorities, developments in the market, and the trajectory of portfolio companies. Building a climate change policy can be a complex process taking into consideration multiple factors and analytical approaches. The objectives of individual stewardship programs will determine which factors or which methodology is most suitable to achieve those goals. Investors can design their own methodology or leverage tailored solutions.

To help investors meet the challenges of implementing a climate risk strategy for their portfolio companies, ISS recently launched the ISS Custom Climate Voting Service, providing investors with a way to take their climate philosophies and put them into action through proxy voting and engagement. The ISS Custom Climate Voting Service uses ISS ESG’s extensive climate data and proprietary research, and draws on widely recognized and accepted frameworks, such as the TCFD, to allow clients to assess a range of different climate-related factors for voting at their portfolio companies.

In addition, in response to growing investor interest for more integrated climate-related data, ISS has introduced the new ISS Climate Awareness Scorecard, which will appear in a range of select ISS Benchmark and Specialty policy research reports. The ISS Climate Awareness Scorecard distills and harmonizes publicly available data and ISS proprietary analysis on a company’s climate change-related disclosures, practices, and performance record, including its industry risk group.

Both the ISS Custom Climate Voting Service and the ISS Climate Awareness Scorecard draw on other ISS data and analysis offerings such as ISS ESG Climate Solutions, the ISS ESG Carbon Risk Rating, and ISS ESG Norm-Based Research. ISS ESG tracks more than 200 proprietary data points on climate disclosure indicators, aligned with TCFD disclosure requirements.

Print

Print