Cyrus Taraporevala is President and CEO of State Street Global Advisors. This post is based on an SSgA letter from Mr. Taraporevala to board members, and on an additional guidance memorandum by Rakhi Kumar, SSgA Senior Managing Director and Head of ESG Investments and Asset Stewardship; Benjamin Colton, SSgA Vice President and Head of Asia Pacific; and Caitlin McSherry, SSgA Assistant Vice President and ESG Analyst.

As one of the world’s largest investment managers, we engage with companies in our investment portfolios as part of our fiduciary responsibility to maximize the probability of attractive long-term returns for our clients. Unlike our active investment strategies where we can sell a company’s stock when we disagree with management, in our index-based strategies we own the company’s stock for as long as it is included in the index. Therefore we engage as long-term investors through our asset stewardship practice on those issues that impact long-term value.

Our focus in recent years has been on good governance and other practices that affect a company’s ability to generate positive returns for investors over the long run. Those issues span a variety of environmental, social and governance (ESG) topics material to sustainable performance. We approach these issues from the perspective of long-term investment value, not from a political or social agenda (aka ‘values’). This distinction is especially important to understand in light of growing concerns about the influence of large index managers. It is the focus on long-term value that drives our engagement around effective, independent board leadership; board quality, including cognitive diversity enhanced by better gender diversity; and environmental sustainability.

We also believe in the importance of full transparency in terms of the issues we choose to highlight in our asset stewardship practice, why we consider them important for investors and how we suggest companies address them. We regularly publish our views on important stewardship issues, join forces with other institutional investors to document best practices, and summarize our engagements and voting actions in our annual stewardship report. We also take the opportunity each year ahead of proxy season to communicate our stewardship focus for the coming months, which is why I am writing to you today.

This year we will be focusing on corporate culture as one of the many, growing intangible value drivers that affect a company’s ability to execute its long-term strategy. We acknowledge that corporate culture, like many other intangible assets, is difficult to measure and manage. However, we also recognize that at a time of unprecedented business disruptions, whether in the form of technology, climate or other exogenous shocks, a company’s ability to promote the attitudes and behaviors needed to navigate a much more challenging business terrain will be increasingly important. We all know the old chestnut that culture eats strategy for breakfast, but studies show that intangibles such as corporate culture are driving a greater share of corporate value, precisely because the challenges of change and innovation are growing more acute.

The Importance of Corporate Culture

The global accounting firm EY recently found that “intangible assets” such as culture average 52% of an organization’s market value (and in some sectors as much as 90%). Researchers have documented that in the US and UK now, more value is driven by intangible, rather than tangible, assets. [1] However, through engagement we have found that few directors can adequately articulate their company’s culture or demonstrate how they assess, monitor and influence change when necessary.

Investors and regulators are paying attention as well, as flawed corporate culture has resulted in high-profile cases of excessive risk-taking or unethical behaviors that negatively impact long-term performance. The Embankment Project for Inclusive Capitalism, which we participated in, found that key issues aligned to corporate culture, such as human capital management; represent important areas for value creation going forward. However, it also found that the relationship between financials and human capital issues such as retention rates, employee satisfaction, and pay differences is “not yet widely understood” and “much harder to communicate to investors than quarterly earnings.”

Indeed, we have found that boards sometimes fail to adequately ensure that the current corporate culture aligns with corporate strategy. This is especially important in times of crisis or strategic change, such as the transition of a CEO or during mergers and acquisitions or strategic turnarounds. These are critical inflection points during which a lack of focus on culture can delay, or even derail important strategic objectives and pose existential challenges for management.

Helping Boards Align Culture and Strategy

Since we recognize both the importance and difficulty of aligning culture and strategy, we have created the attached framework to help companies begin to address the issue by 1) conducting an analysis to determine whether culture and strategy are aligned; 2) implementing mechanisms to influence and assess progress; and 3) improving reporting that can help directors discuss their role in influencing and monitoring corporate culture.

To be clear, we do not believe it is the responsibility of the corporate board to manage a company’s culture—that is the responsibility of senior management. Nor do we believe changing corporate culture is easy or that there is a one-size-fits-all answer for all companies. Clearly different companies, sectors and business strategies will require different approaches. Further, sometimes indicators such as high employee turnover can actually be a sign that a much-needed cultural change is afoot.

However, we do believe that this is a material issue that must be addressed by companies and investors. By engaging on this topic in a more rigorous and structured way and by elevating these issues to boards, we believe we can help improve the overall governance quality of listed companies over the long term. As such, you should expect to discuss this issue with our asset stewardship team during their engagements over the next year.

Focused on the Long Term

Ultimately, better understanding how businesses across the globe are aligning corporate culture with strategy will improve how we analyze our portfolio companies in the years ahead. We believe that at a time of historic disruption, increased focus on corporate culture and how it supports strategy is essential to sustainable, long-term value creation.

That is good for investors, good for the quality of the indices on which so many investment portfolios are based, and good for our shared prosperity.

Sincerely,

Cyrus Taraporevala

President and CEO of State Street Global Advisors

* * *

Aligning Corporate Culture with Long-Term Strategy

Key Takeaways

- Corporate culture is critical to the long-term success of a company. When aligned with long-term strategy, corporate culture can help enable organizations to achieve their goals and differentiate them from competitors; when misaligned with long-term strategy, corporate culture can hinder performance. [2] [3]

- We believe that the board plays an important role in assessing and monitoring corporate culture, and that senior management plays an instrumental role in defining and shaping corporate culture.

- Despite the importance of corporate culture, we have found that few directors can adequately articulate a company’s culture and demonstrate how they oversee and influence change when necessary; this is partly because corporate culture, as an intangible asset, is difficult to measure. [4]

- Based on insights gleaned from years of engagement, we have developed a framework to help guide directors and senior management through this complex process.

- We call on boards to proactively review and monitor corporate culture, evaluate its alignment with strategy, and incentivize management to take corrective action, if necessary.

- Finally, given growing investor interest in this area, directors and senior management should be prepared to discuss the management of human capital in the context of corporate culture as a driver of long-term value.

Corporate culture plays a critical role in the long-term success of a company. [5] [6] There are many examples in recent years where excessive risk-taking, aggressive sales practices and/or unethical behaviors, which negatively impacted long-term company performance, were attributed to flawed corporate culture.

Senior management plays an instrumental role in defining and shaping corporate culture within an organization. Through our engagement efforts over the past few years, we have explored how corporate culture enables a company’s ability to achieve its business goals. We recognize that there is no one-size-fits-all culture. Companies have different business models, strategies and histories and therefore have different cultures. However, we have found that an effective corporate culture is one that is aligned with the company’s long-term strategy, reflected in the executive incentive structure and motivational for employees. Consequently, we believe that culture requires due consideration and oversight by the board. Yet, during engagement, we have found that few directors can adequately articulate a company’s culture and demonstrate how they assess, monitor and influence change when necessary. [7]

What is Corporate Culture?

Corporate culture encompasses a broad range of shared attitudes shaping the behaviors of individuals as a group across an organization. It allows employees to identify with their organization and differentiates companies from competitors. It is closely associated with human capital management.

Growing Regulatory and Investor Interest in Corporate Culture

In June 2018, the U.K. Financial Reporting Council affirmed the importance of culture by formalizing the board’s role in aligning corporate culture with the company’s purpose, values and strategy in the revised U.K. Corporate Governance Code. [8] Boards in the U.K. are now expected to assess and monitor culture and seek assurance that management has taken corrective action to fix any misalignment. In October 2017, the National Association of Corporate Directors in the U.S. issued a Blue Ribbon Commission Report on Culture as a Corporate Asset to help guide its members on this matter. [9]

Recognizing the importance of this issue, State Street Global Advisors will focus on corporate culture as a priority engagement topic in 2019. We call on boards to proactively review and monitor corporate culture, evaluate its alignment with strategy, and incentivize management to take corrective action, if necessary.

In this paper we:

- Explain the need for board involvement and oversight of corporate culture

- Provide a framework for companies to evaluate the alignment of corporate culture with its long- term strategy and for directors to guide senior management in its implementation

- Provide examples of some best practices related to culture that we have identified through engagement

The Board’s Role in Assessing and Monitoring Corporate Culture

It is important when setting strategy and overseeing its implementation for the board to expand its oversight function to include assessing and monitoring culture. However, we observe that boards sometimes fail to adequately ensure that the current corporate culture matches expectations and is aligned with the company’s strategy. This can be particularly true in times of crisis or strategic change, such as the transition of a CEO or during mergers and acquisitions (M&A) or strategic turnarounds. The lack of focus on culture can delay or even derail important strategic objectives and pose unanticipated challenges for management. For example, potential employee turnover and operational impacts associated with changing corporate culture can lead to challenges for management teams trying to implement strategic changes. Even in relatively stable times, culture can shift and fall out of line with strategy undetected if it is not actively monitored.

While senior management plays a more direct and influential role in defining and shaping corporate culture within an organization, board oversight is still needed. Oversight of corporate culture is inherently complicated in that, as an intangible, culture can be difficult to articulate or change. Further, changing corporate culture takes time and is often a multi-year exercise, the results of which are difficult to monitor. This is precisely why boards need to proactively consider culture in the context of strategy. For example, we came across a high-performing company with a strong and distinct culture that has built its brand and strategy to leverage the benefits it perceives from that culture. The board sees it as focusing on what they know the company (and its people) can do well. Given the close interplay between culture and strategy at this company, the board is acutely aware of and seeks to preserve the company’s culture.

Engaging on Corporate Culture. When engaging with directors and management on corporate culture, we seek to understand the following:

- Can the director(s) articulate the current corporate culture?

- What does the board value about the current culture? What does it see as strengths? How can the corporate culture improve?

- How is senior management influencing or effecting change in the corporate culture?

- How is the board monitoring the progress?

Our questions are aimed at gathering insights into the board’s understanding of the behaviors that are inherent to the organization and their assessment of whether these behaviors support or challenge the company’s strategy. If changing culture is identified as a key goal, we look to see how the board is monitoring and rewarding the change. We find that directors often understand the value of culture and prioritize changing culture, and in some cases even incorporate it, where appropriate, as a driver of executive compensation.

A Framework for Assessing and Monitoring Corporate Culture

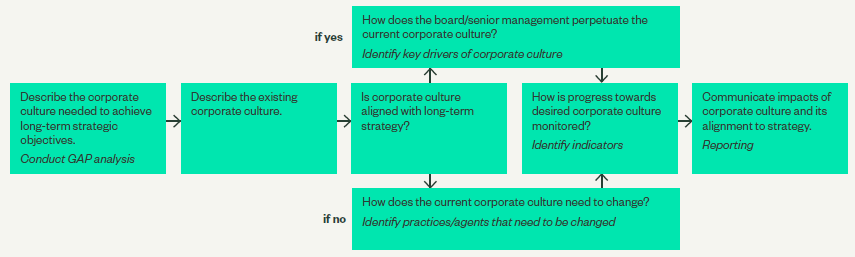

Based on insights gleaned from years of engagement, we have developed a Framework for Assessing and Monitoring Corporate Culture (see Figure 1) that we hope will help guide directors and senior management on this important matter. Under this framework, we suggest that senior management with oversight from the board undertake three key exercises: Comparative Analysis, Implementation and Reporting. In addition, we have also provided examples of how some companies have addressed these issues. Neither this framework nor these examples are meant to be prescriptive; rather they are tools and illustrations to help boards develop their own approach to incorporating culture into long- term strategy.

Figure 1: Framework For Aligning Corporate Culture with Long-Term Strategy

Source: State Street Global Advisors.

Phase 1: Comparative Analysis

As a first step, a company should consider the alignment of the current company culture and long- term strategy by conducting a comparative assessment, such as through a gap analysis. If aligned, identify how to perpetuate the current corporate culture by identifying the key drivers. If misaligned, determine the desired culture and identify the practices or agents that must change. The analysis should contemplate corporate culture in the context of the company’s long-term strategy, as meaningful changes may take many years to occur.

For example, the board of an underperforming company on the brink of bankruptcy, through its new CEO, successfully managed to change culture that resulted in the company gaining a leadership position in the industry. The CEO sought to change corporate culture and promote innovation as part of a strategic turnaround. However, the existing culture at the company focused on fault finding and finger pointing among executives, which was contrary to the desired vision of a cohesive and solutions-oriented workforce. Recognizing the gap between the existing and desired behaviors among executives, the CEO focused on making executive meetings a safe environment where information could be shared without blame. This facilitated more timely identification of problems and allowed for collaboration among the group.

We have also come across companies that as part of transformative M&A strategies conduct gap analyses between the cultures of their existing and new businesses. The gap analysis process helps identify behaviors that are desirable for the success of the new company and allows the board and management to encourage these behaviors among the employees.

Phase 2 Implementation

After analyzing the corporate culture and its overlap with long-term strategy, mechanisms to influence and monitor progress can be identified and implemented. Boards together with senior management should consider identifying indicators reflecting the desired culture. In the context of rewards systems, culture-related indicators could be aligned with incentives, where appropriate. Senior management is the most influential agent for cultivating corporate culture and should take the leadership in its implementation throughout the organization. The board and senior management should be aligned and implementation expectations should be clearly understood.

For example, some companies have identified characteristics of human capital management (HCM) that help gauge their corporate culture. They monitor factors such as employee turnover, retention rates, employee satisfaction survey results, diversity & inclusion dimensions, and pay differences among their employees across divisions and job functions.

Phase 3 Reporting

Finally, communication channels across the organization should be established to better influence corporate culture in an effective and consistent manner. The U.K. Financial Reporting Council stated that annual reports should “explain the board’s activities and any action taken” pertaining to assessing and monitoring culture, as well as, “include an explanation of the company’s approach to investing in and rewarding its workforce.” [10]

We have found through our engagement and market observations that this is a challenging area for boards and management teams to report on. We have found few companies that can effectively communicate their board’s involvement in influencing culture. However, given growing investor interest in this area, directors should also be prepared to discuss their role in influencing and monitoring culture at the company.

Conclusion

Boards have been grappling with the difficult task of overseeing corporate culture. As a starting point, we believe that the simple framework presented in this paper will help guide directors and senior management as they tackle this complex issue. We hope that prioritizing corporate culture in our stewardship program and providing transparency into our approach to engagement on this topic will lead to meaningful conversation about an intangible, yet critical component to the long-term success of a company.

Endnotes

1Jonathan Haskel and Stian Westlake, Capitalism Without Capital: The Risk of the Intangible Economy, (Princeton University Press, 2017). (go back)

2Financial Reporting Council. Corporate Culture and the Role of the Board: Report of Observations. London, U.K., 2016. (go back)

3The National Association of Corporate Directors. Report on NACD Blue Ribbon Commission on Culture as a Corporate Asset, 2017.(go back)

4State Street Global Advisors. (go back)

5Kotter, John P., Heskett, James L. Corporate Performance and Performance, 2008. (go back)

6Sorensen, Jesper B. The Strength of Corporate Culture and the Reliability of Firm Performance, March 2002. (go back)

7State Street Global Advisors. (go back)

8Financial Reporting Council. The UK Corporate Governance Code. London, U.K., July 2018. (go back)

9The National Association of Corporate Directors. Report on NACD Blue Ribbon Commission on Culture as a Corporate Asset, 2017. (go back)

10Financial Reporting Council. The UK Corporate Governance Code. London, U.K., July 2018. (go back)

Print

Print

One Comment

The key is an ability to measure the culture with data from each segment of the business. The measurement system cannot be “fluffy” but based on what is the 6 business system common to every business. This becomes the measurable definition of culture. Love the article