Even though a proposal receives only a fraction of shareholder support, it may still be the best available opportunity to bring more foresight to investors, board, and management on an issue that may eventually prove costly to a company. Only a small portion of investors may be exercising prescience on risk management or governance issues that will, in fact, prove to be material for the long-term well-being of the company.

In the roundtable discussion and correspondence, corporate representatives have been implying that 3% or 5% of investors supporting a proposal is insignificant, such that the resubmission thresholds should be altered to disallow this minority from having the ability to require continued debate and attention to an issue on the annual proxy. Yet, recent developments at Monsanto demonstrate that a subgroup of this size may be prescient in their divergent or contrarian perspective. Allowing them to bring continuing attention and debate could mean the difference between a company that succeeds, and one which fails to take in crucial input beyond the insular boardroom and executive suites.

In 2016, shareholder John Harrington, the president of Harrington Investments Inc., filed a proposal at Monsanto regarding health risks from the company’s flagship weedkiller Roundup. The proposal noted “an increasing number of independent studies assessing the toxicity of glyphosate, the active ingredient in Roundup, associate it with cancer, birth defects, kidney disease, and hormone disruption, causing world-wide concern about its safety”. The proposal requested that the company issue a report assessing the effectiveness and risks associated with the company’s policy responses to public policy developments intended to control pollution and food contamination from glyphosate, including but not limited to the impact of recent reclassification of glyphosate as “probably carcinogenic,” and quantifying potential material, financial risks or operational impacts on the Company in the event that proposed bans and restrictions are enacted.

The proposal highlighted that there were very high stakes for investors:

Combined with “Roundup Ready” crops, almost our entire revenue stream is based on one product which, until recently, has enjoyed a measure of regulatory leniency. However, an October 2014 report by the U.S. Government Accountability Office reporting a lack of testing of glyphosate residues in food by the Food and Drug Administration and the March 2015 reclassification by the International Agency for Research on Cancer of the World Health Organization of glyphosate as “probably carcinogenic to humans” may substantially increase overall legal and financial risk, damaging our company’s name brand and corporate reputation.

The proposal was vigorously opposed by the company, which asserted that the new World Health Organization position presented a minority view among the scientific community that the company disagreed with. On its 2016 vote, the proposal received 5.3% voting support. Refiled in 2017, it still only received 5.5% support. Because this amount is less than the current 6% threshold, the proposal would not have been eligible for resubmission in 2018. Yet, this relatively small group of shareholders had been prescient in identifying a material issue.

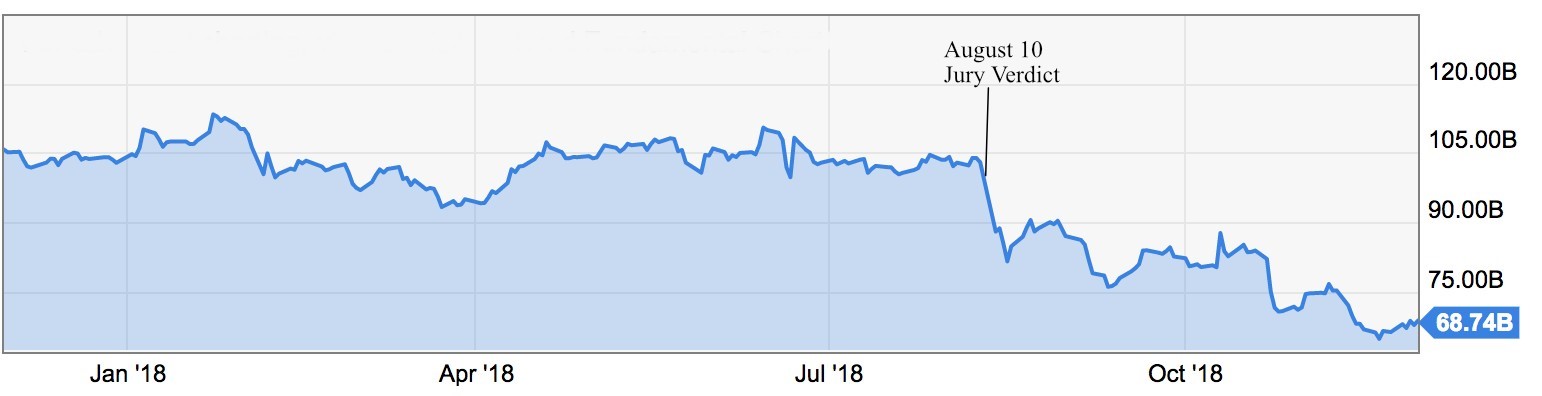

Only two months after Monsanto was acquired by the German pharmaceutical company Bayer in June 2018, a jury granted a $289 million award in a suit alleging public health threats and cancer of a plaintiff caused by Roundup. This news sliced billions of dollars from Bayer’s valuation. Bayer’s market capitalization has descended steeply in the following months, from $99.1 billion as of August 10, 2018 (the date of the jury verdict), to $64.8 billion as of November 20, 2018.

Figure 1 Bayer Market Capitalization Before and after the Jury Verdict

The litigation continues to grow. According to the Wall Street Journal, in August 2018 there were 8700 plaintiffs; by the end of October 2018 there were 9300 plaintiffs. Even though the jury award was later reduced to $40 million, the potential payouts on this litigation are capable of exceeding the entire market capitalization of Bayer.

Monsanto has employed a “circling the wagons” strategy on glyphosate by working to discredit the scientists and international scientific bodies that have found glyphosate risks. Academic reviews of the company documents released in the litigation have uncovered questionable strategies deployed by the company. This includes evidence that “independent” studies on glyphosate had been ghostwritten by the company’s own staff, that the company had attempted to interfere with journal publication, and had gone to extraordinary lengths to influence the Environmental Protection Agency’s regulatory analysis.

One may debate why only 5% of the investors supported additional disclosure on this issue. Perhaps many were hopeful that the circle the wagons strategy would continue to work well, as it had in the past. Some may have simply believed the company’s assertions. But it must be said that given the potential for 5% of investors to prove this prescient in regard to long-term material issues, it should be recognized that removing a proposal from the proxy may bury a long-term material issue that is in the best interests of all investors if it is allowed to be perpetuated on the proxy. It would not seem in the interests of investors or the capital markets for the SEC to so truncate the opportunity for the prescient investors to persuade others of real risk factors.

When a company is circling the wagons to defend against product liability litigation, the outcome often leaves the company’s shareholders in the dark as to the substantial downside risks obfuscated by this approach. The shareholder proposal sought a more balanced discussion of the potential downsides and liabilities should the circle the wagons approach fail to fend off the increasing likelihood of litigation and an emerging scientific view finding greater risk. Instead of providing a balanced discussion of downside risks, the company’s response was to hyper-focus on discrediting the science.

As a result, “Bayer’s reputation with investors has been diminished,” said Markus Mayer, an analyst with Baader Bank. “The latest increase in the number of cases highlights the challenge for Bayer to assuage investor concerns that its acquisition of Monsanto this year had burdened the pharmaceutical and chemicals company with a problem that could take years to resolve and could weigh on its share price for some.” “The market doesn’t know how this story will end, no one wants to get in right now.” The Company’s former CEO has noted that the lawsuits will occupy the company beyond 2021 as they work their way through the courts.

The author provided legal support to John Harrington on the Monsanto proposal mentioned in this post.

The full comment letter is available here.

Endnotes

1Krimsky, S. & Gillam, Roundup litigation discovery documents: implications for public health and journal ethics, C. J Public Health Pol (2018) 39: 318. https://doi.org/10.1057/s41271-018-0134-z(go back)

2Ruth Bender, Bayer Hit by More Lawsuits Over Safety of Roundup Weedkiller, Bloomberg, November 13, 2018.(go back)

3Ruth Bender, Bayer Pursued Monsanto Despite Weedkiller Suits and Executive’s Concern, Bloomberg News, Nov. 25, 2018.(go back)

The Prescience of 5% of Investors: A Monsanto Case Study

More from: Sanford Lewis, Shareholder Rights Group

Sanford Lewis is Director at the Shareholder Rights Group. This post is based on a Shareholder Rights Group publication by Mr. Lewis, and was adapted from comments submitted by the Shareholder Rights Group to the Securities and Exchange Commission in response to remarks made at the SEC’s Roundtable on the Proxy Process.

Even though a proposal receives only a fraction of shareholder support, it may still be the best available opportunity to bring more foresight to investors, board, and management on an issue that may eventually prove costly to a company. Only a small portion of investors may be exercising prescience on risk management or governance issues that will, in fact, prove to be material for the long-term well-being of the company.

In the roundtable discussion and correspondence, corporate representatives have been implying that 3% or 5% of investors supporting a proposal is insignificant, such that the resubmission thresholds should be altered to disallow this minority from having the ability to require continued debate and attention to an issue on the annual proxy. Yet, recent developments at Monsanto demonstrate that a subgroup of this size may be prescient in their divergent or contrarian perspective. Allowing them to bring continuing attention and debate could mean the difference between a company that succeeds, and one which fails to take in crucial input beyond the insular boardroom and executive suites.

In 2016, shareholder John Harrington, the president of Harrington Investments Inc., filed a proposal at Monsanto regarding health risks from the company’s flagship weedkiller Roundup. The proposal noted “an increasing number of independent studies assessing the toxicity of glyphosate, the active ingredient in Roundup, associate it with cancer, birth defects, kidney disease, and hormone disruption, causing world-wide concern about its safety”. The proposal requested that the company issue a report assessing the effectiveness and risks associated with the company’s policy responses to public policy developments intended to control pollution and food contamination from glyphosate, including but not limited to the impact of recent reclassification of glyphosate as “probably carcinogenic,” and quantifying potential material, financial risks or operational impacts on the Company in the event that proposed bans and restrictions are enacted.

The proposal highlighted that there were very high stakes for investors:

The proposal was vigorously opposed by the company, which asserted that the new World Health Organization position presented a minority view among the scientific community that the company disagreed with. On its 2016 vote, the proposal received 5.3% voting support. Refiled in 2017, it still only received 5.5% support. Because this amount is less than the current 6% threshold, the proposal would not have been eligible for resubmission in 2018. Yet, this relatively small group of shareholders had been prescient in identifying a material issue.

Only two months after Monsanto was acquired by the German pharmaceutical company Bayer in June 2018, a jury granted a $289 million award in a suit alleging public health threats and cancer of a plaintiff caused by Roundup. This news sliced billions of dollars from Bayer’s valuation. Bayer’s market capitalization has descended steeply in the following months, from $99.1 billion as of August 10, 2018 (the date of the jury verdict), to $64.8 billion as of November 20, 2018.

Figure 1 Bayer Market Capitalization Before and after the Jury Verdict

The litigation continues to grow. According to the Wall Street Journal, in August 2018 there were 8700 plaintiffs; by the end of October 2018 there were 9300 plaintiffs. Even though the jury award was later reduced to $40 million, the potential payouts on this litigation are capable of exceeding the entire market capitalization of Bayer.

Monsanto has employed a “circling the wagons” strategy on glyphosate by working to discredit the scientists and international scientific bodies that have found glyphosate risks. Academic reviews of the company documents released in the litigation have uncovered questionable strategies deployed by the company. This includes evidence that “independent” studies on glyphosate had been ghostwritten by the company’s own staff, that the company had attempted to interfere with journal publication, and had gone to extraordinary lengths to influence the Environmental Protection Agency’s regulatory analysis. [1]

One may debate why only 5% of the investors supported additional disclosure on this issue. Perhaps many were hopeful that the circle the wagons strategy would continue to work well, as it had in the past. Some may have simply believed the company’s assertions. But it must be said that given the potential for 5% of investors to prove this prescient in regard to long-term material issues, it should be recognized that removing a proposal from the proxy may bury a long-term material issue that is in the best interests of all investors if it is allowed to be perpetuated on the proxy. It would not seem in the interests of investors or the capital markets for the SEC to so truncate the opportunity for the prescient investors to persuade others of real risk factors.

When a company is circling the wagons to defend against product liability litigation, the outcome often leaves the company’s shareholders in the dark as to the substantial downside risks obfuscated by this approach. The shareholder proposal sought a more balanced discussion of the potential downsides and liabilities should the circle the wagons approach fail to fend off the increasing likelihood of litigation and an emerging scientific view finding greater risk. Instead of providing a balanced discussion of downside risks, the company’s response was to hyper-focus on discrediting the science.

As a result, “Bayer’s reputation with investors has been diminished,” said Markus Mayer, an analyst with Baader Bank. “The latest increase in the number of cases highlights the challenge for Bayer to assuage investor concerns that its acquisition of Monsanto this year had burdened the pharmaceutical and chemicals company with a problem that could take years to resolve and could weigh on its share price for some.” [2] “The market doesn’t know how this story will end, no one wants to get in right now.” [3] The Company’s former CEO has noted that the lawsuits will occupy the company beyond 2021 as they work their way through the courts.

The author provided legal support to John Harrington on the Monsanto proposal mentioned in this post.

The full comment letter is available here.

Endnotes

1Krimsky, S. & Gillam, Roundup litigation discovery documents: implications for public health and journal ethics, C. J Public Health Pol (2018) 39: 318. https://doi.org/10.1057/s41271-018-0134-z(go back)

2Ruth Bender, Bayer Hit by More Lawsuits Over Safety of Roundup Weedkiller, Bloomberg, November 13, 2018.(go back)

3Ruth Bender, Bayer Pursued Monsanto Despite Weedkiller Suits and Executive’s Concern, Bloomberg News, Nov. 25, 2018.(go back)