Brigid Cremin Rosati is Director of Business Development; Edward Greene is Managing Director; and John Carroll is Institutional Services Associate at Georgeson LLC. This post is based on a Georgeson/Proxy Insight publication.

We are pleased to present the 2018 Annual Corporate Governance Review. For the second year in a row, Georgeson partnered with Proxy Insight on the coordination of voting data and analytics. Proxy Insight was instrumental in sourcing the annual meeting and proxy voting data contained in this report.

New This Year

The 2018 report provides a comprehensive review of relevant corporate governance issues covering five sections: shareholder proposals on governance issues, shareholder proposals on environmental and social and issues, director elections, say-on-pay proposals and CEO pay ratio disclosure.

Based on reader feedback and trends in the current market, we have expanded our review of environmental, social and governance shareholder proposals that were the subject of a vote during the period July 1, 2017 through June 30, 2018. Consequently, this year we are providing additional information detailing voting decisions by institutional investors related to employment diversity shareholder proposals.

We have also added in a new section on institutional investor support for the election of directors year-over-year since 2015. Please see Part 3 for institutional investor voter support for elections of directors from major U.S. and international investment firms.

Finally, we have included a new section related to 2018 CEO pay ratio disclosure. With effect from this year, U.S. public companies are required to disclose their CEO pay ratio in their proxy statements. We have captured ratio trends across sectors for the Russell 3000 in Part 5 of the complete publication.

Summary of Report Sections

Throughout the complete publication we have included analysis of each section to give readers a substantive overview of the voting outcomes contained in that particular report part.

Shareholder Proposals, Report Parts 1 and 2

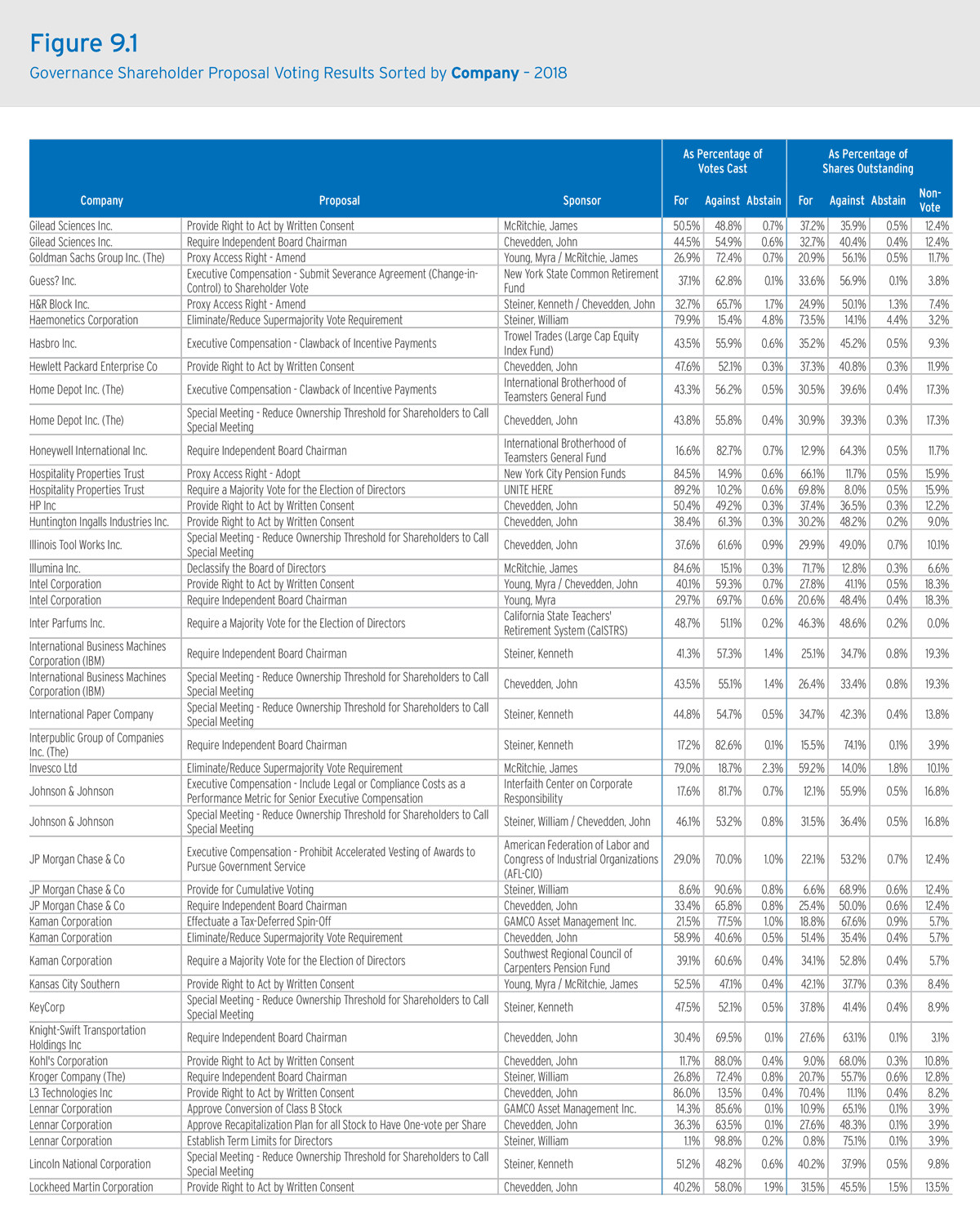

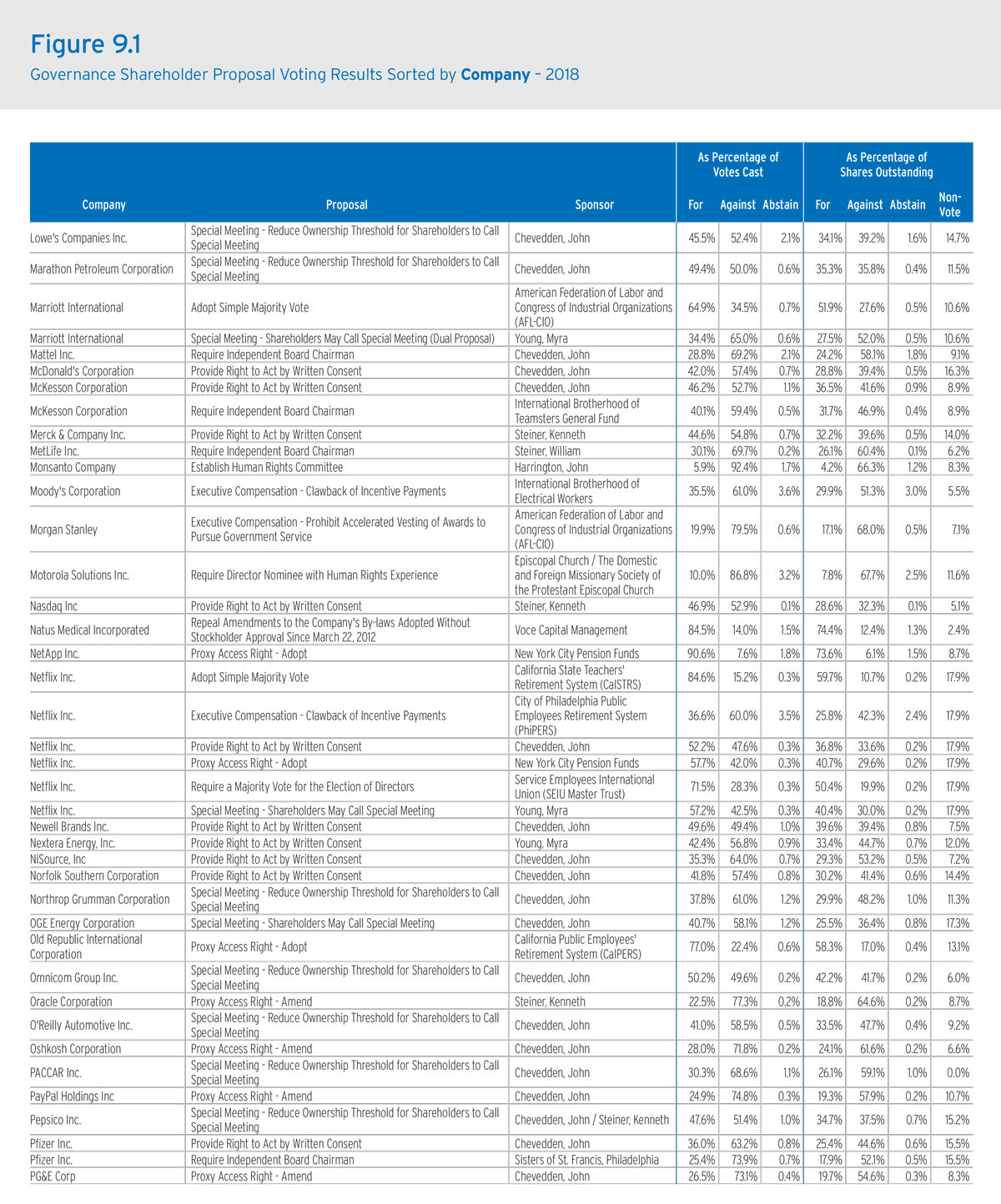

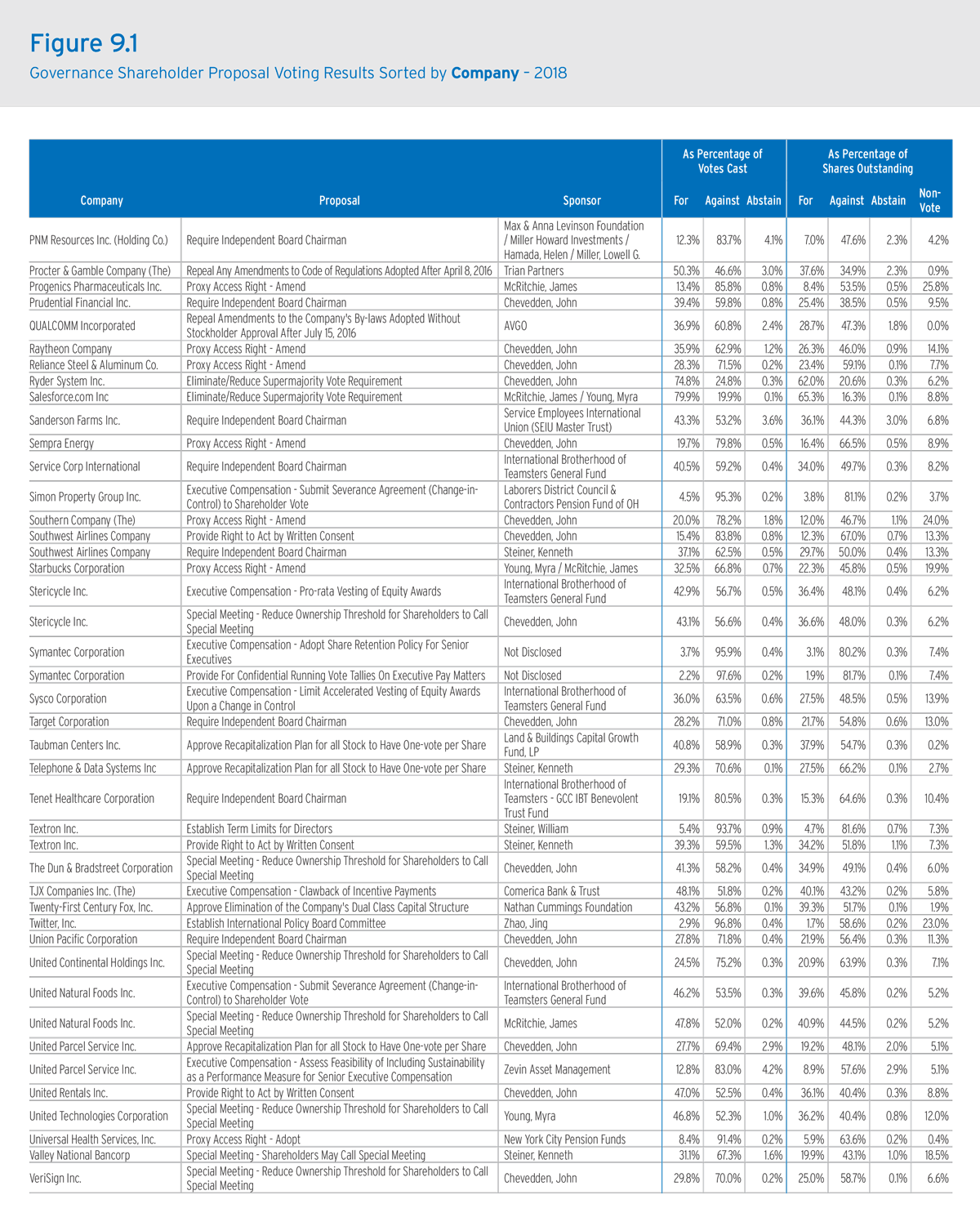

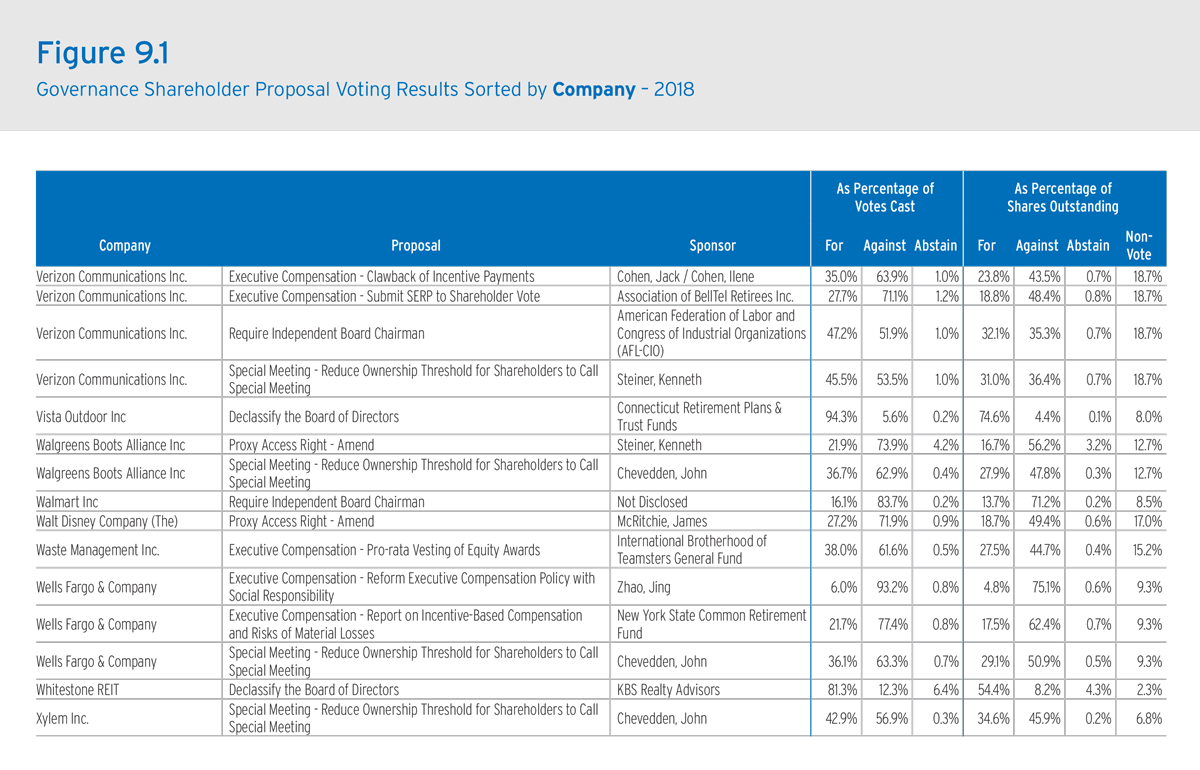

These sections include shareholder proposal information related to companies that 1) are members of the S&P 1500 Index (as of May 1, 2018) and 2) held annual meetings July 1, 2017 through June 30, 2018. We obtained the number of votes cast for, against, withheld, abstained and broker non-vote from our research partner, Proxy Insight, citing publicly available sources.

We then calculated for each proposal:

- The votes cast “For” and “Against” as a percentage of shares voted in the quorum.

- The votes cast “For” and “Against” as a percentage of the company’s total outstanding shares as of meeting record date.

In Part 1, information on shareholder proposals withdrawn or omitted was gathered with the assistance of ISS Corporate Solutions.

In Part 2, Figure 21, we have summarized 2018 definitive vote detail results for the largest U.S. and foreign institutional investors (measured by assets under management) voting decisions on a shareholder proposal related to employment diversity reporting.

Director Elections, Report Part 3

The director election data is a year-by-year review based on US companies in the Russell 3000 from 2015-2018. The “For” (%) is based on the percentage of times an investor voted “For” a director election proposal. This data is gathered from publicly disclosed investor voting decisions, including N-PX public filings.

Say-on-pay, Report Part 4

This section details vote outcomes for companies that 1) are members of the S&P 500 Index (as of May 1, 2018) and 2) held annual meetings July 1, 2017 through June 30, 2018. We obtained the number of votes cast for, against, withheld, abstained and broker non-vote from our research partner, Proxy Insight, citing publicly available sources.

We then calculated for each proposal:

- The votes cast “For” and “Against” as a percentage of shares voted in the quorum.

- The votes cast “For” and “Against” as a percentage of the company’s total outstanding shares as of meeting record date.

In Figure 24, the year-by-year review is based on the percentage of times an investor voted “For” a say-on-pay proposal for companies in the S&P 500 index. We gathered the data from publicly disclosed investor voting decisions, including Form N-PX public filings.

CEO Pay Ratio, Report Part 5

The CEO pay ratio data provided is based on companies which are members of the Russell 3000 (as of June 27, 2018). The table provides the highest and lowest values in each sector, as well as the average and median values.

Other Notes

Proxy Insight and Georgeson’s data collection and calculation methodologies ensure the accuracy and comparability of our statistics from company to company and from year to year. We thereby avoid the anomalies that result from companies’ and sponsors’ inconsistent treatment of abstentions and broker non-votes.

Calculations of percentage of votes cast may not equal 100 percent due to rounding.

Georgeson has collected and published statistics on corporate governance proposals since 1987, the year institutional investors first sponsored shareholder proposals.

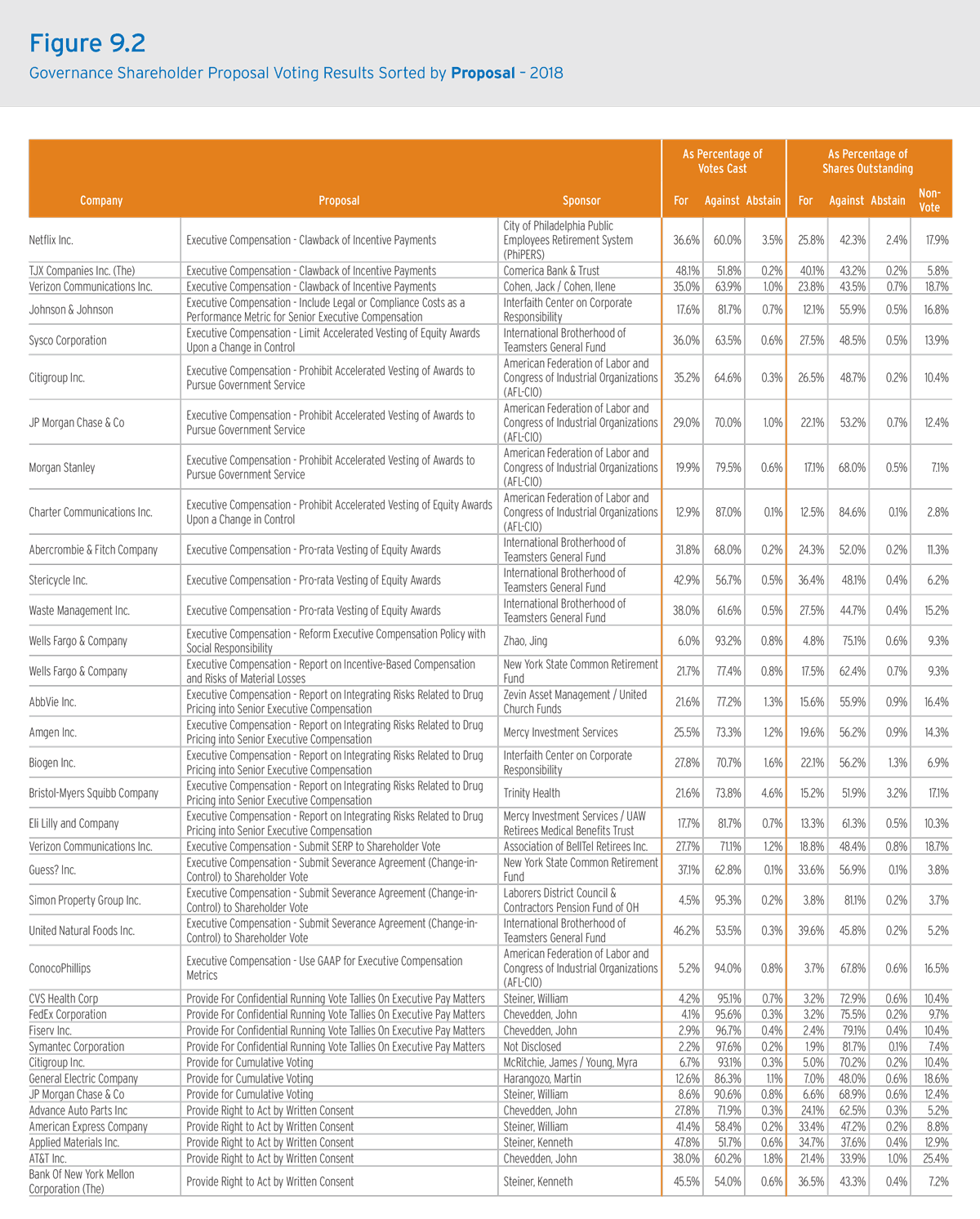

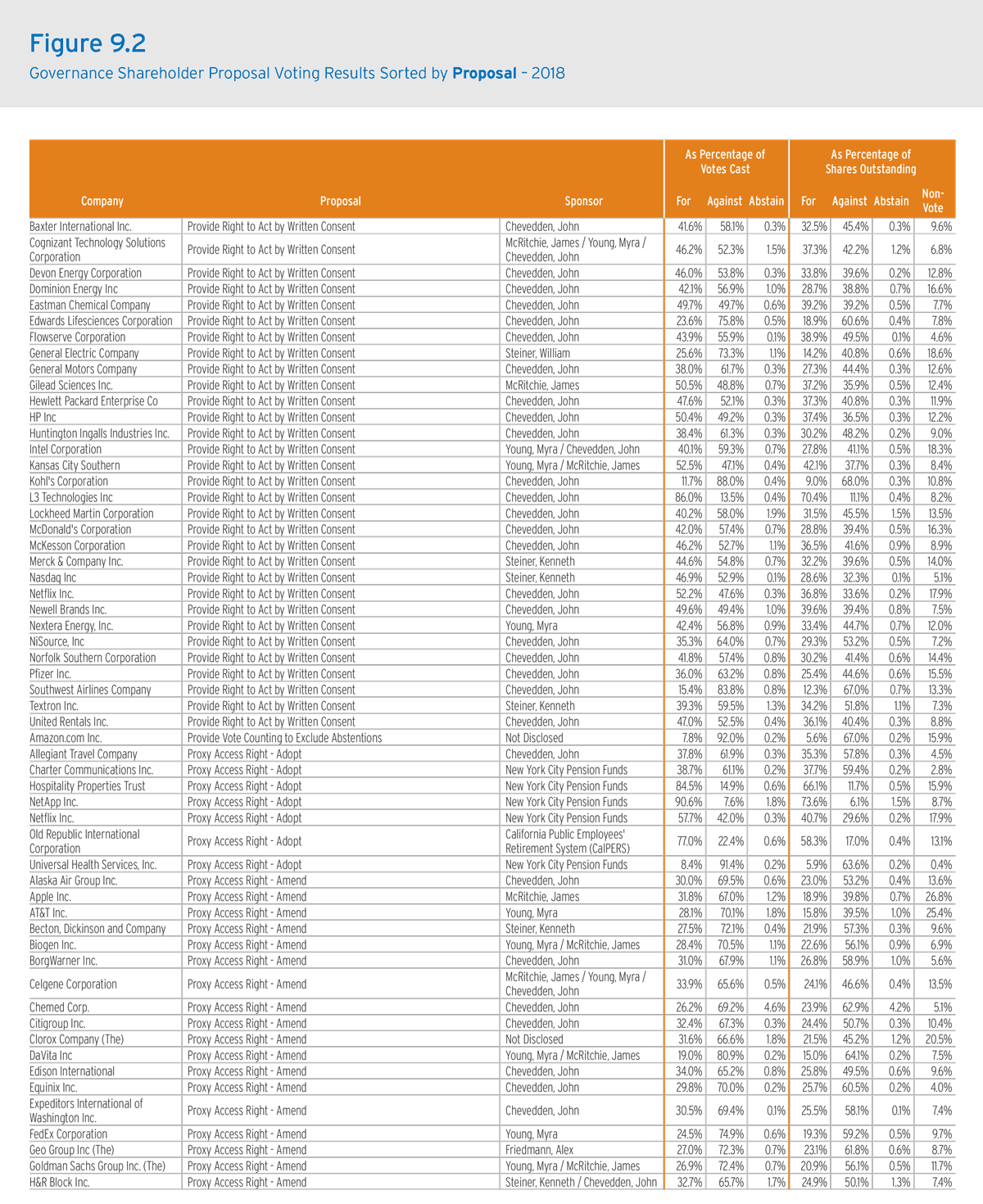

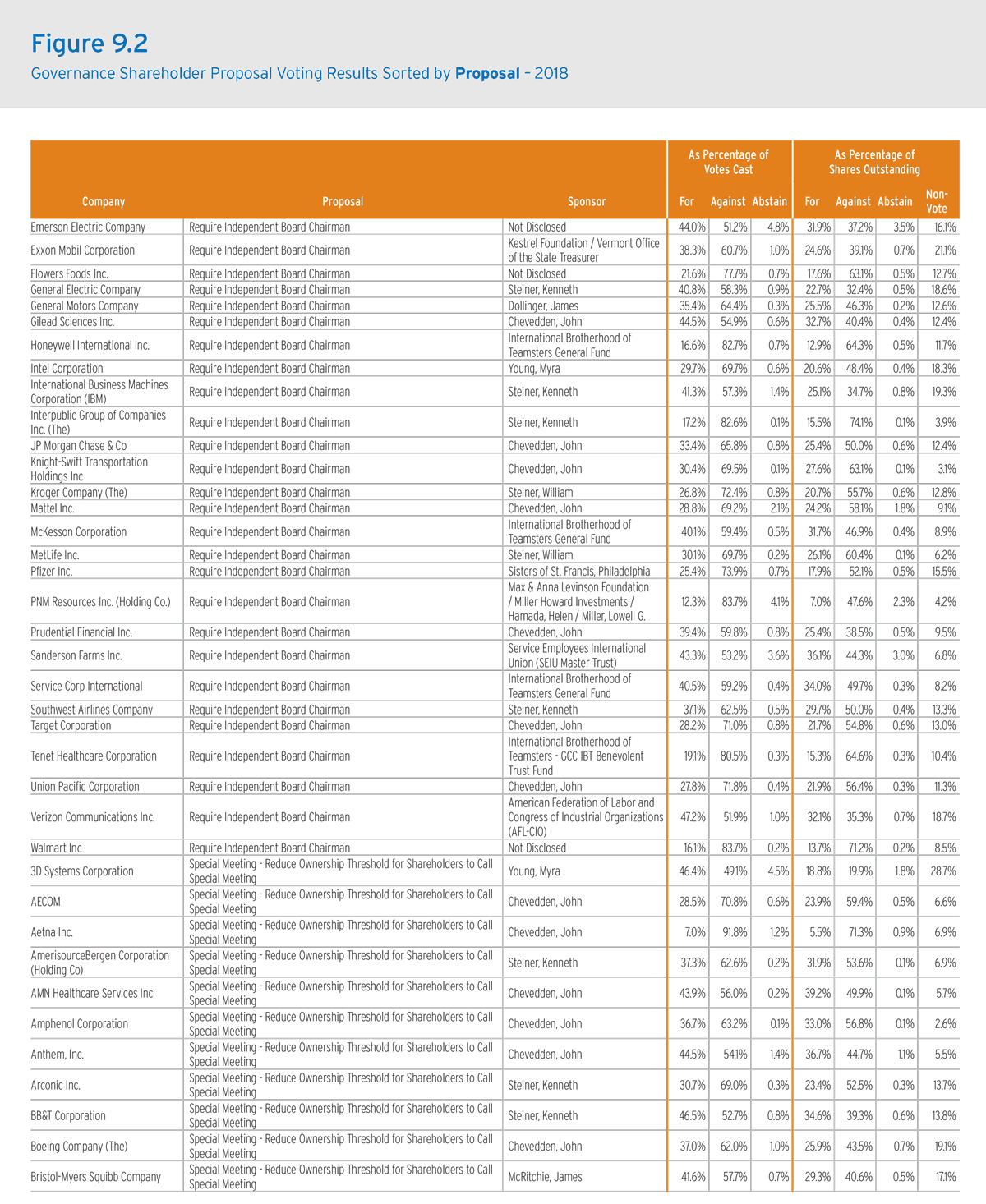

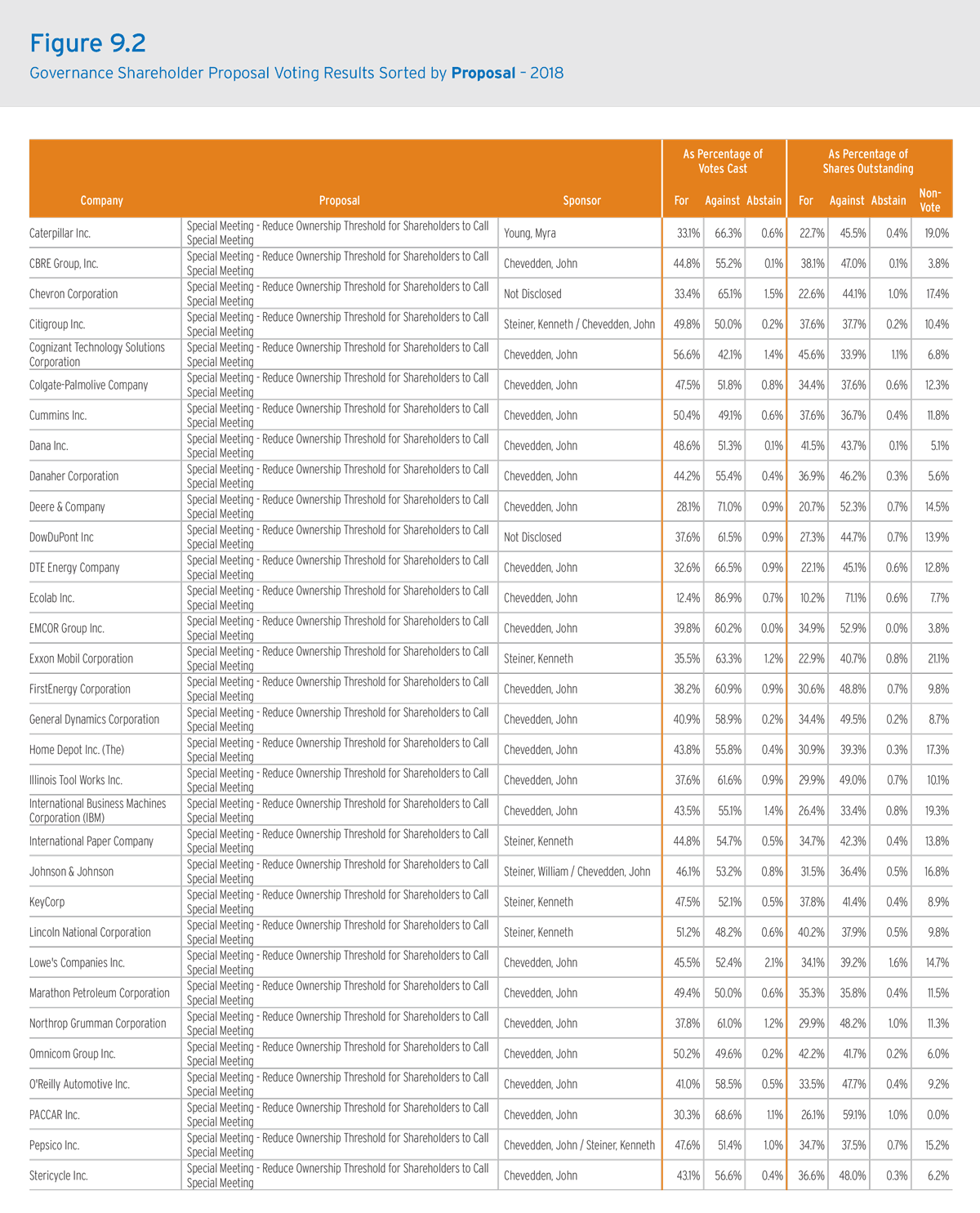

Shareholder Proposal Voting Results—Governance

This section details:

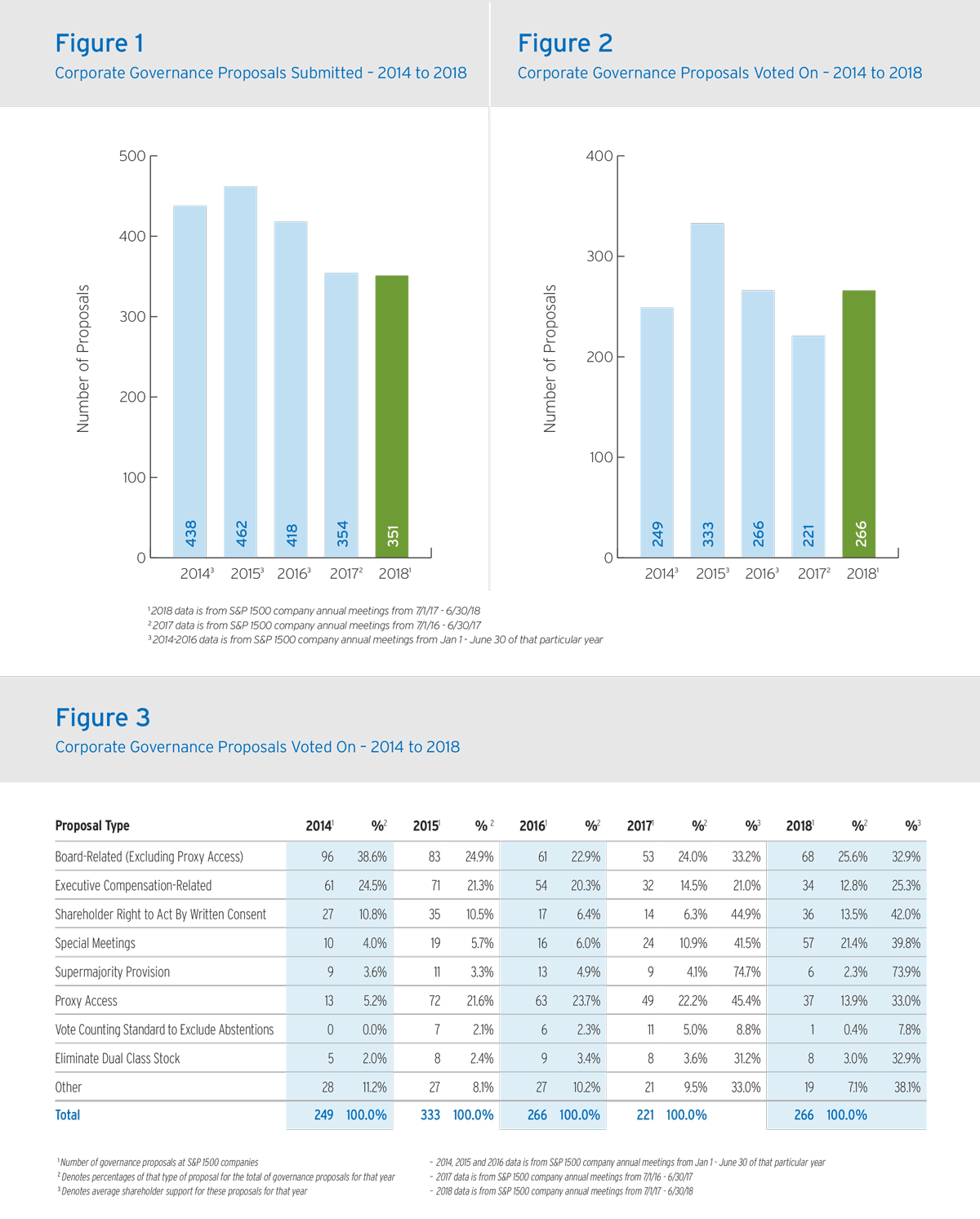

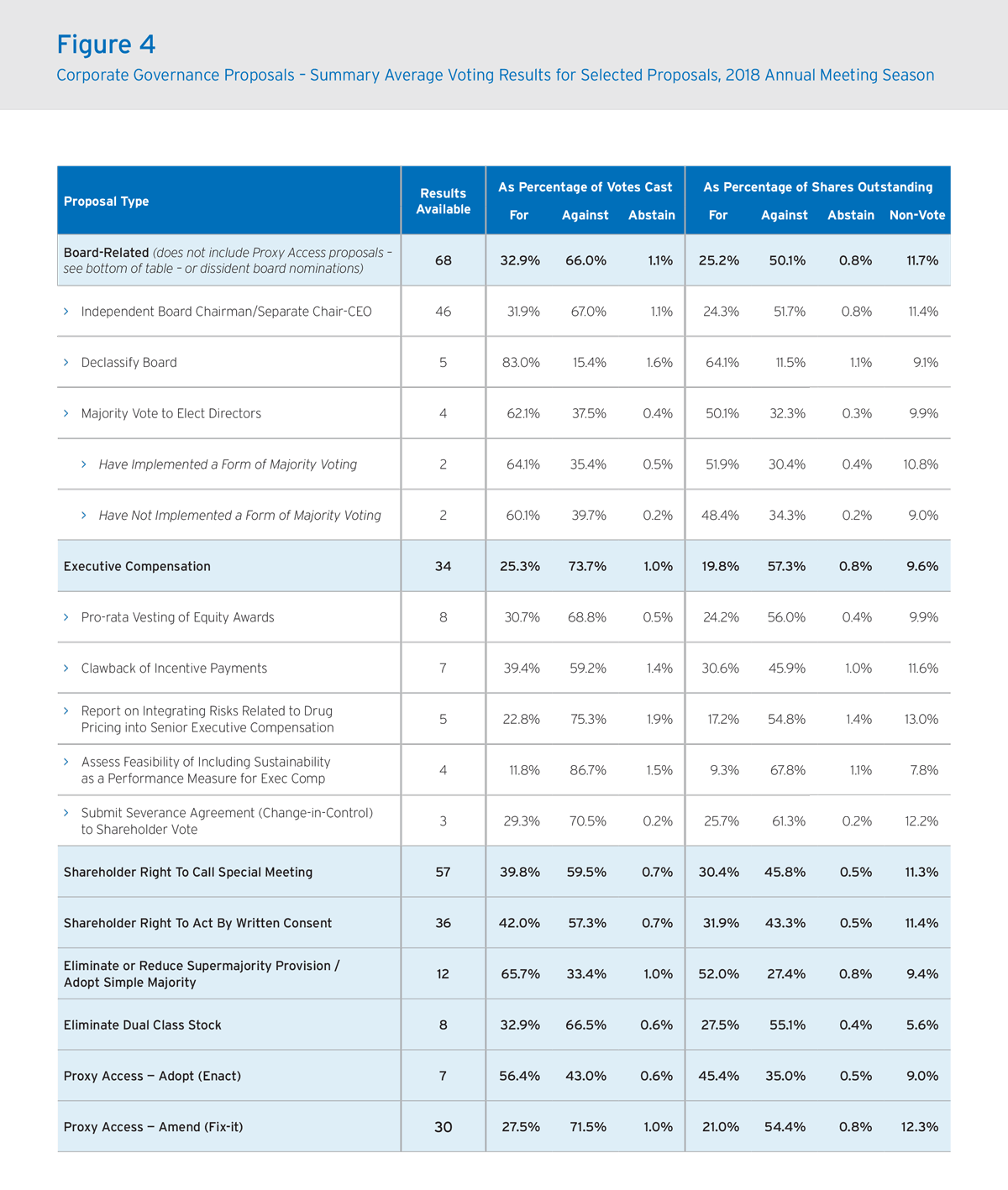

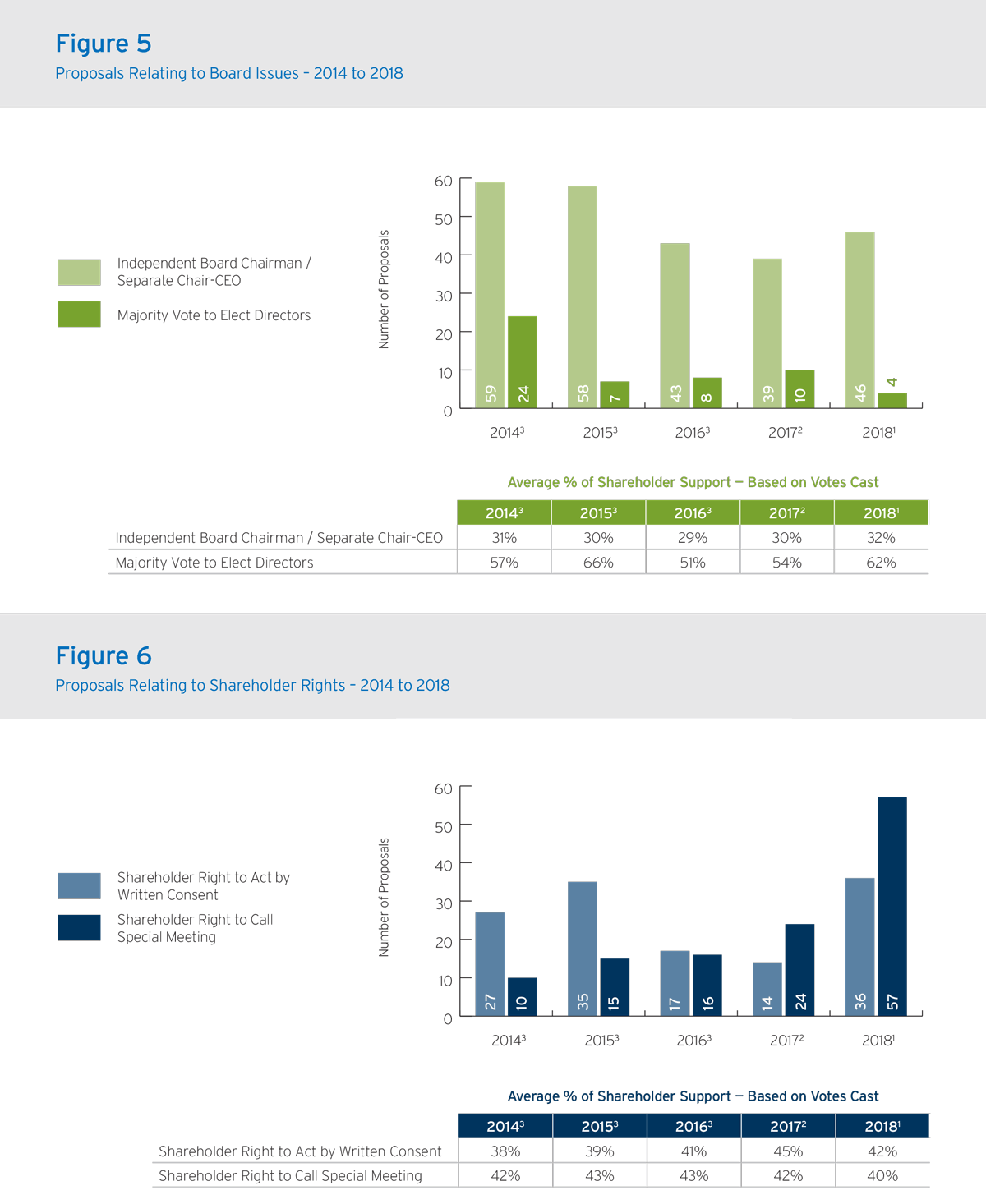

- Historical support for governance proposal types (Figures 1 – 7)

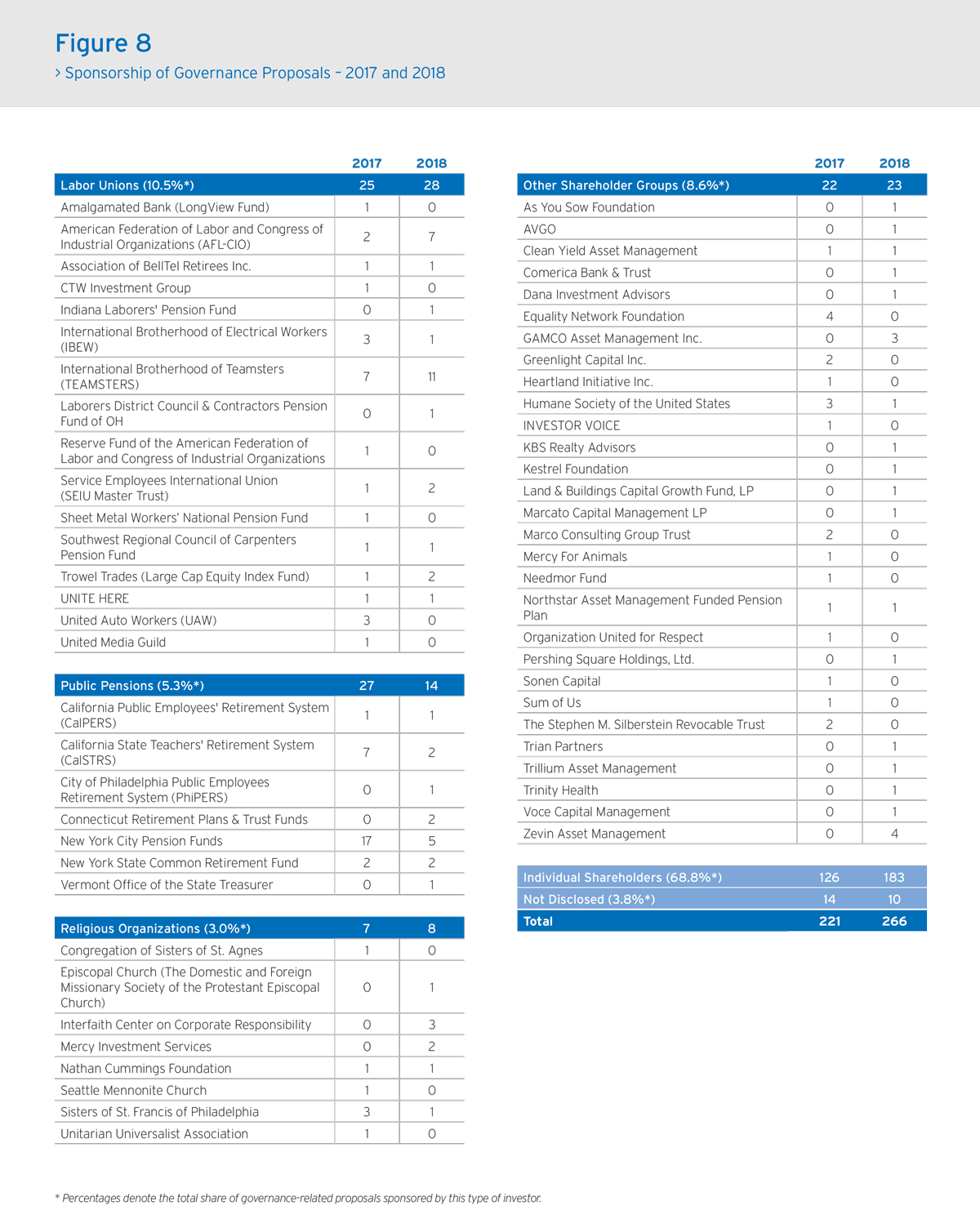

- The universe of proponents for governance shareholder proposals (Figure 8) and;

- Voting results on governance shareholder proposals (Figures 9.1—9.3).

Overview

There was a significant increase in the number of governance-related shareholder proposals that were the subject of a shareholder vote in 2018, [1] up 45 to 266 in total (see Figure 2). This growth was driven principally by increases in two proposals (see Figure 3).

- Shareholder right to act by written consent—total of 36 voted on, up from 14 in 2017

- Shareholder right to call a special meeting—total of 57 voted on, up from 24 in 2017

Support for these two proposal types has remained consistently high over the last five years. Additionally, issuers have often changed their governing documents to address such matters in the aftermath of receiving majority votes in favor.

The success of these two proposals is also connected to its sponsors, many of whom are well-versed in the U.S. Securities Exchange Act’s shareholder proposal process.

The sponsors are:

- John Chevedden:

- Written consent proposal: Mr. Chevedden was sponsor or co-sponsor of 26 of 36 the proposals

- Special meeting proposal: Mr. Chevedden was sponsor or co-sponsor of 39 of the 57 proposals

- Steiner Family:

- Written consent proposal: The Steiner family was sponsor or co-sponsor of 7 of the 36 proposals

- Special meeting proposal: The Steiner family was sponsor or co-sponsor of 12 of the 57 proposals

Of the 266 governance shareholder proposals that were the subject of a shareholder vote this proxy season, board-related proposals were the most popular measure, accounting for approximately 26% of all governance proposals. This category attracted an average level of support of approximately 33%. Below is a summary of key trends:

- Separate role of CEO/Chairman. This topic continues to be one of the most popular governance proposals. In the 2018, 46 such proposals were the subject of a shareholder vote. However, support has hovered around 30% for the past five years, as successful and/ or founder-CEOs have been effective in defending their dual roles.

- Require majority vote to elect directors: As this proposal continues to attract a majority vote at company meetings, the number of submissions has continued to fall year-over-year, indicating proactive adoption of majority voting procedures.

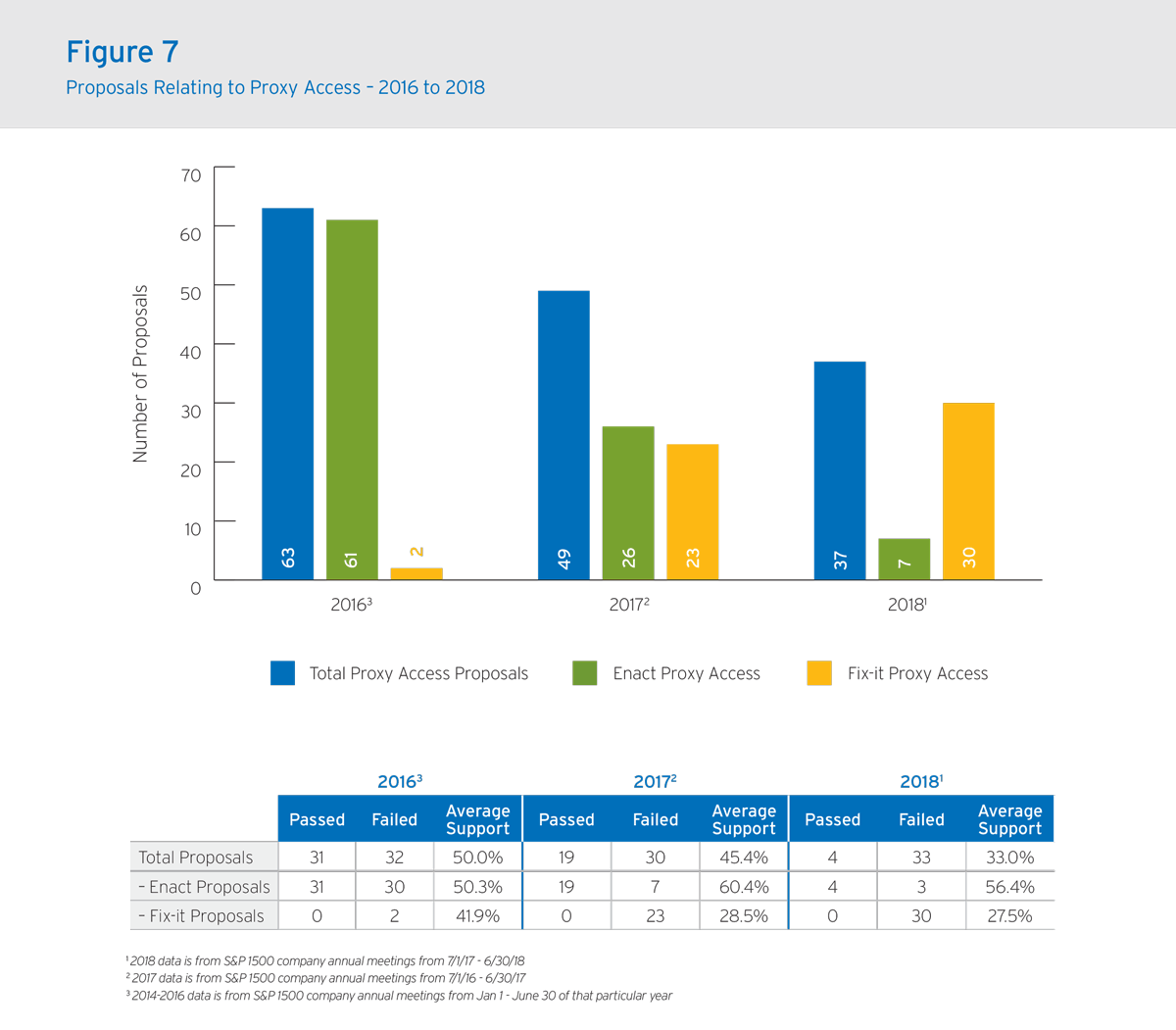

Proxy Access (see Figure 7)

In 2018, the total number of proxy access proposals, inclusive of both enact and fix-it types, that were the subject of a shareholder vote decreased by 12 from 2017. Moreover, this year was first time that fix-it proposals outnumbered enactment measures. However, all 30 fix-it proposals failed to attract a majority of votes in favor.

Notwithstanding the reduction in the number of enactment proxy access proposals, these measures attracted a higher level of support than fix-it proxy access proposals. This trend suggests that shareholders may be coalescing around best practices. The New York City (NYC) Comptroller’s Office has been the most successful and prolific proponent of enactment proposals. Based upon our review of annual meeting results, the specific provisions of the NYC enactment proposals attract significant shareholder support. These provisions include:

i) The opportunity for shareholders to nominate candidates for two (2) board seats or 25% of the total number of board seats, whichever is greater; and

ii) The nominator (or group of shareholders comprising the nominator) be a shareholder for at least the previous 3 years while holding at least 3% of the issuer’s stock over the entirety of that period.

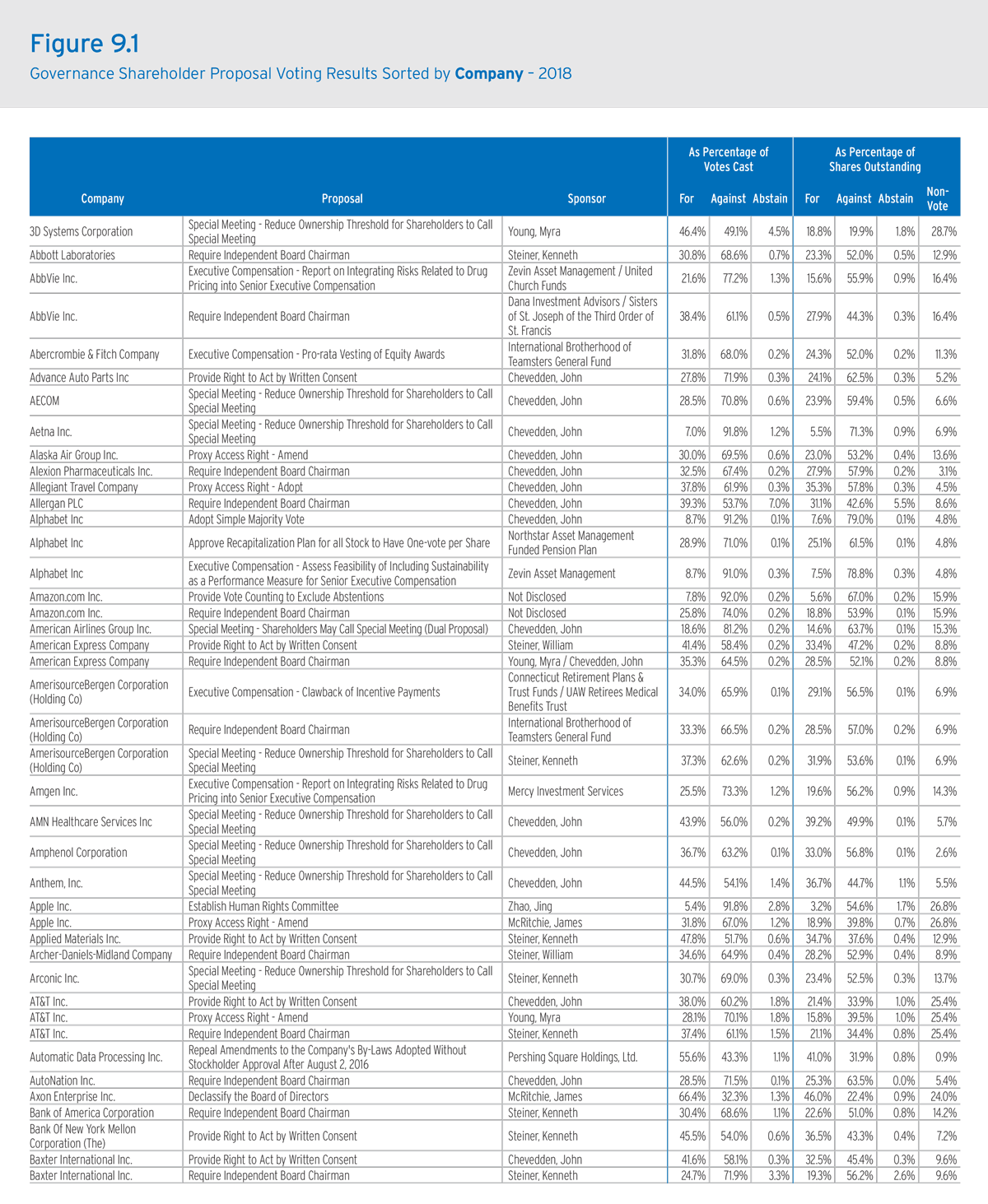

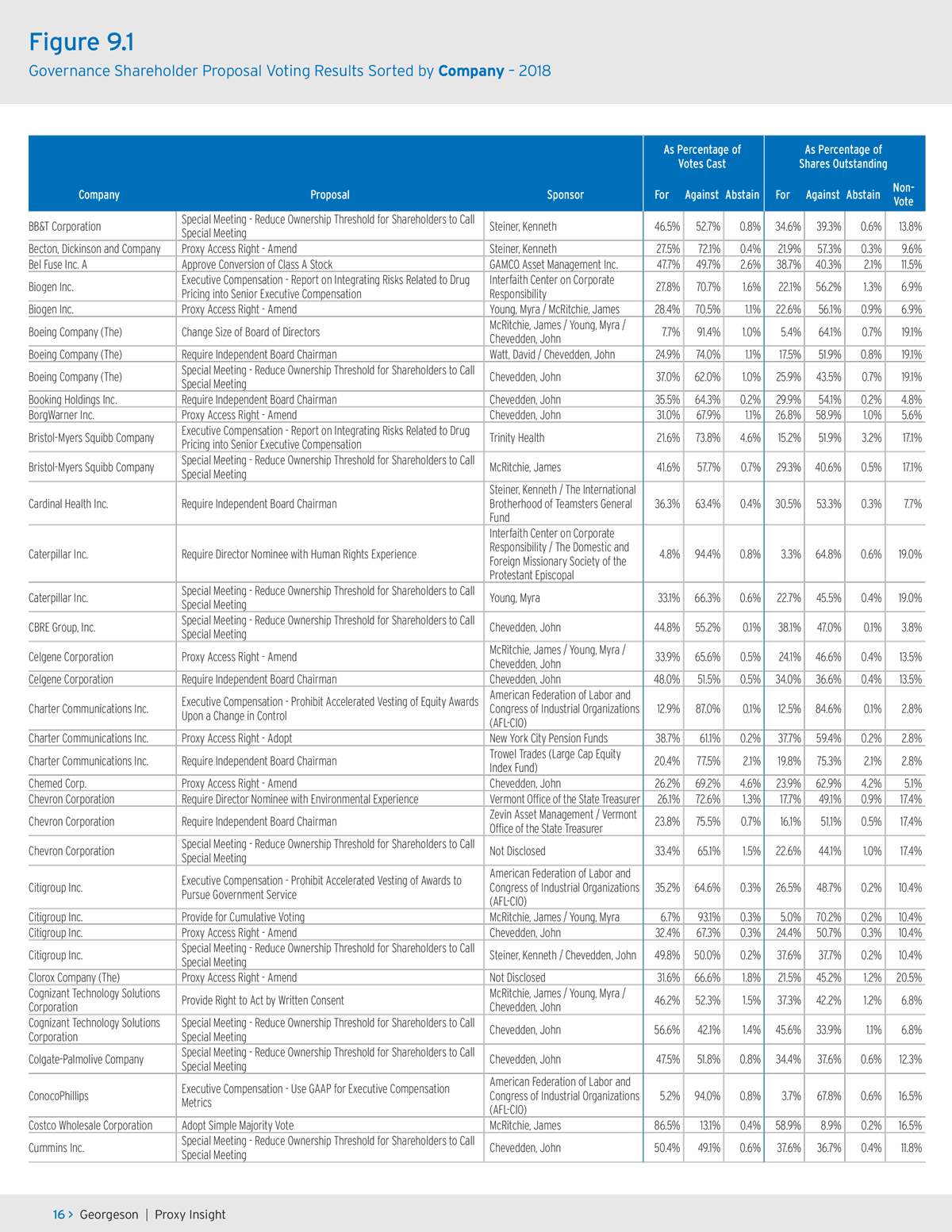

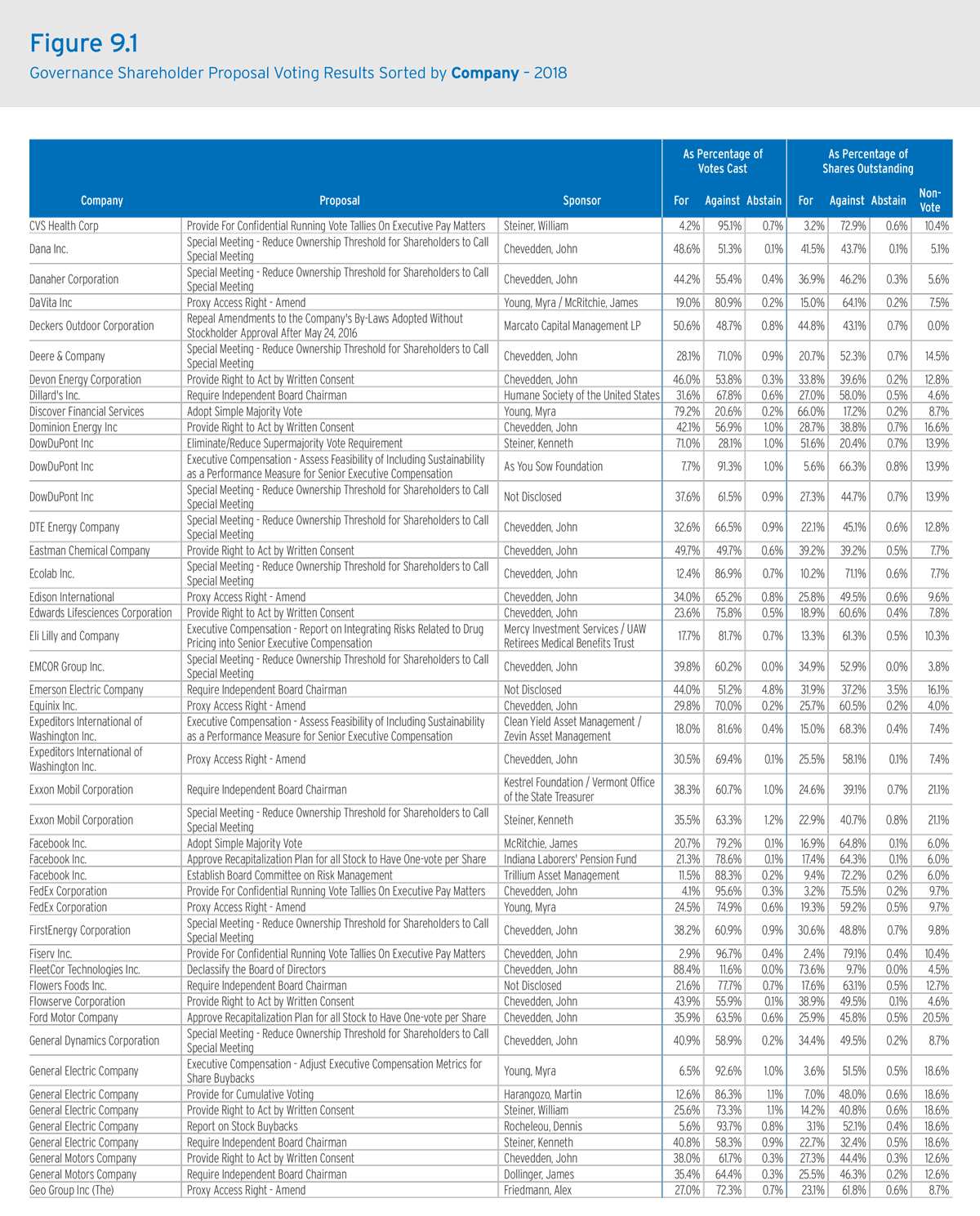

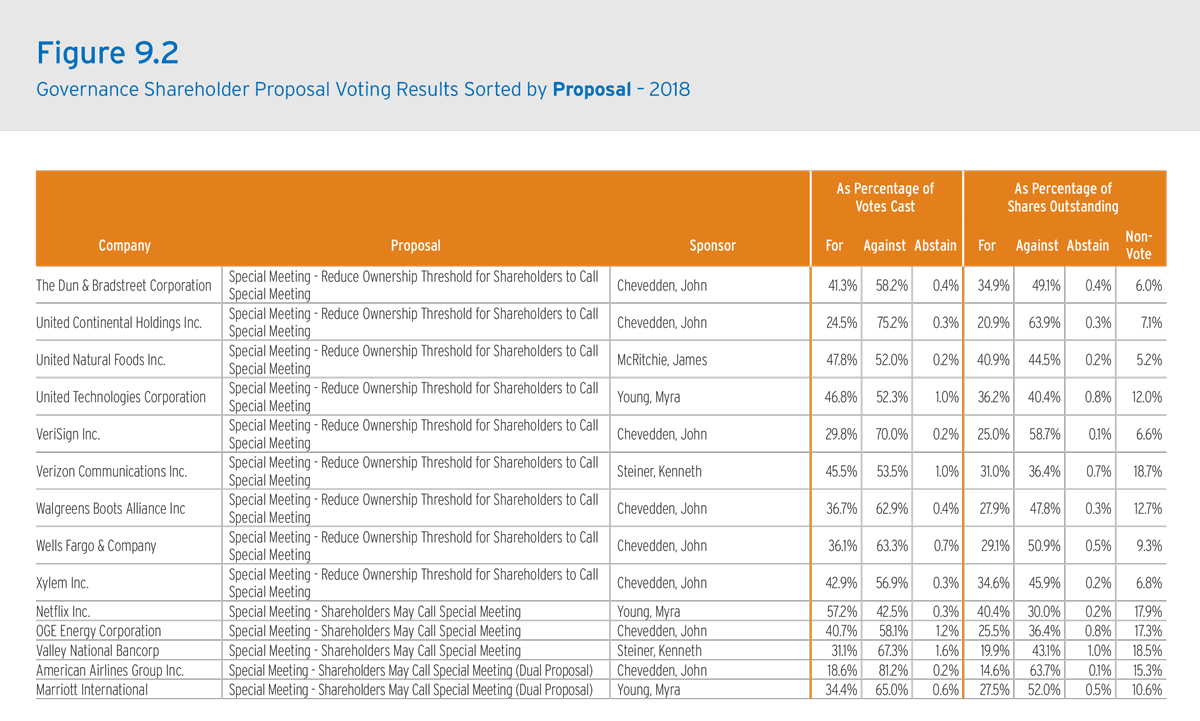

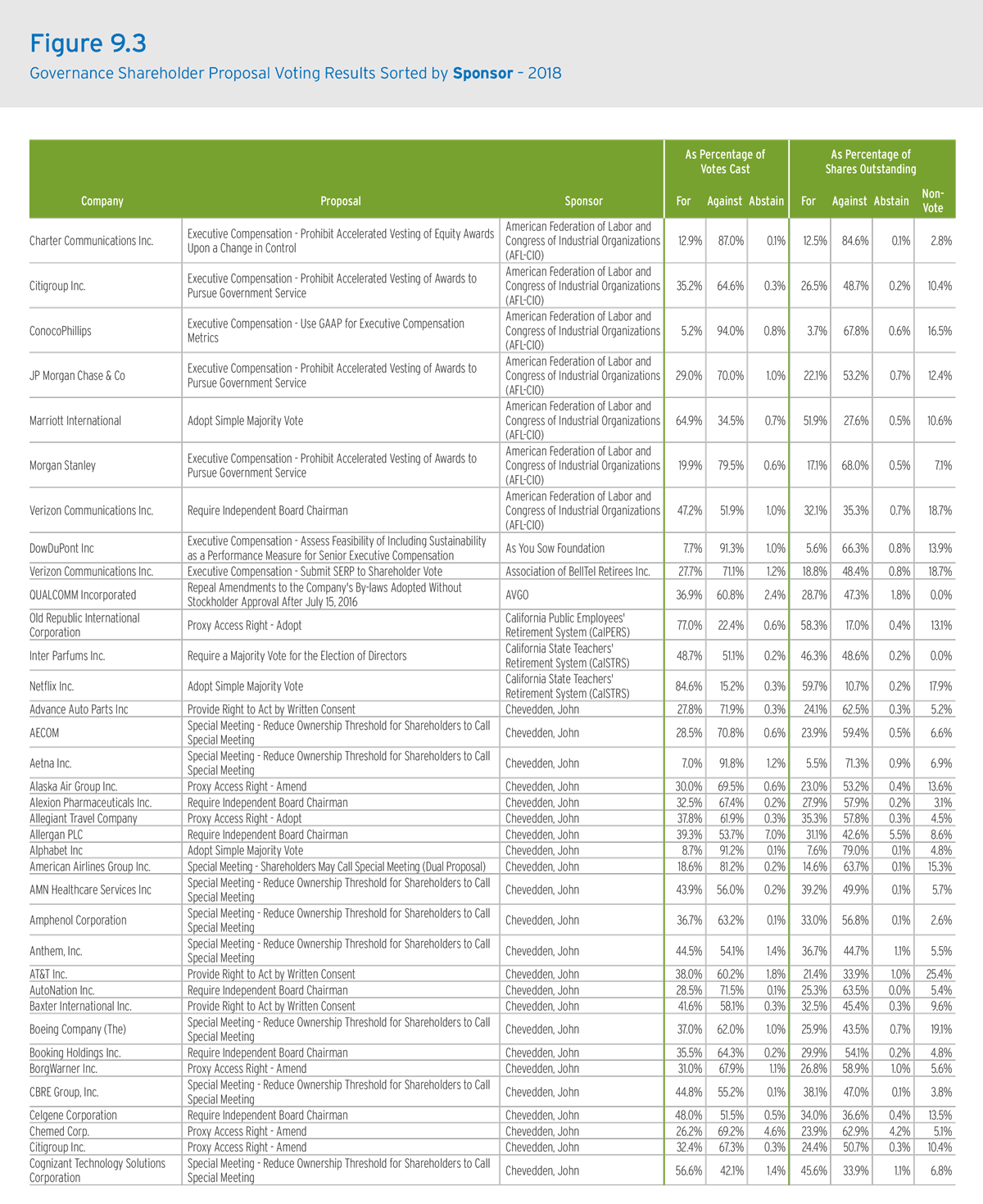

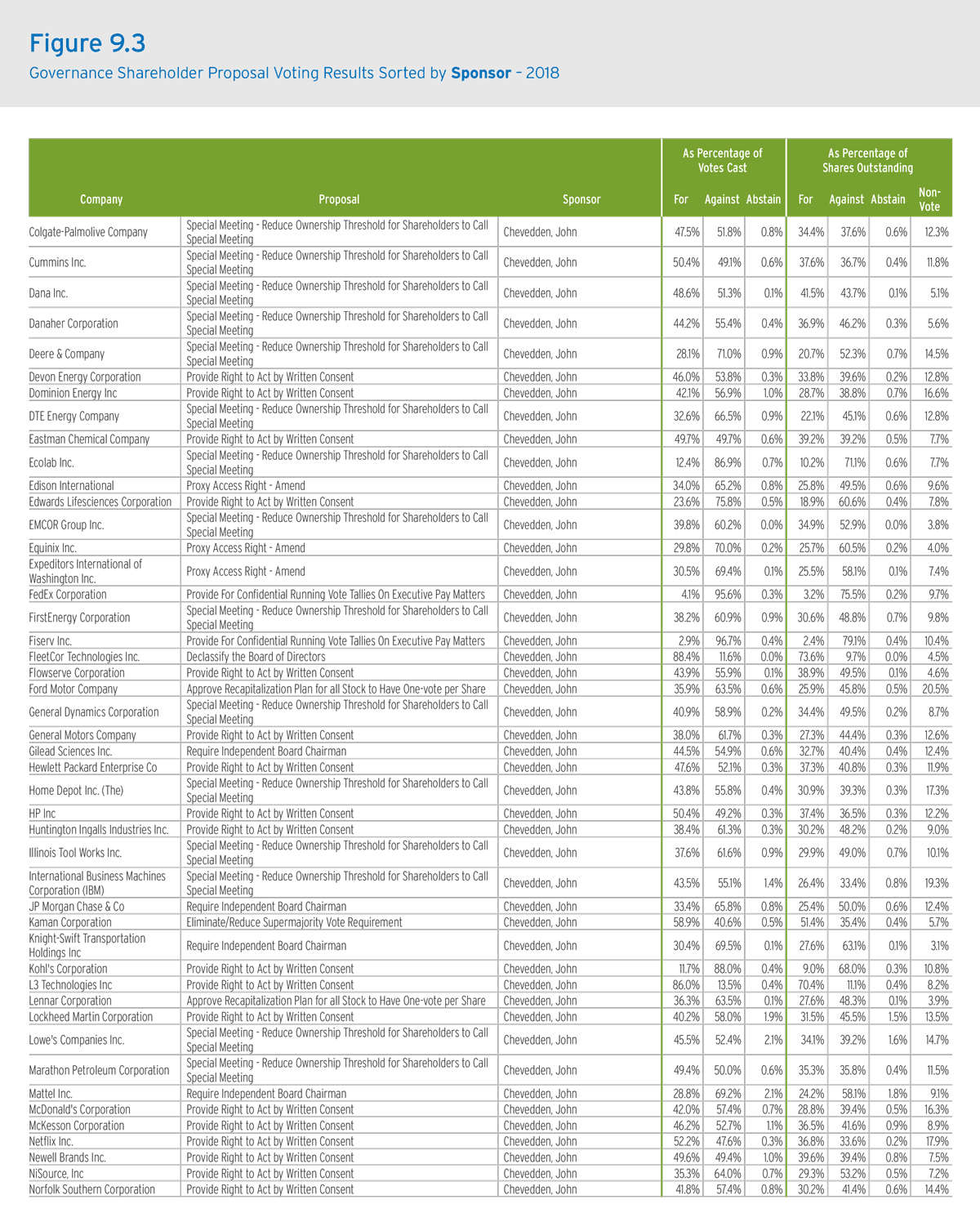

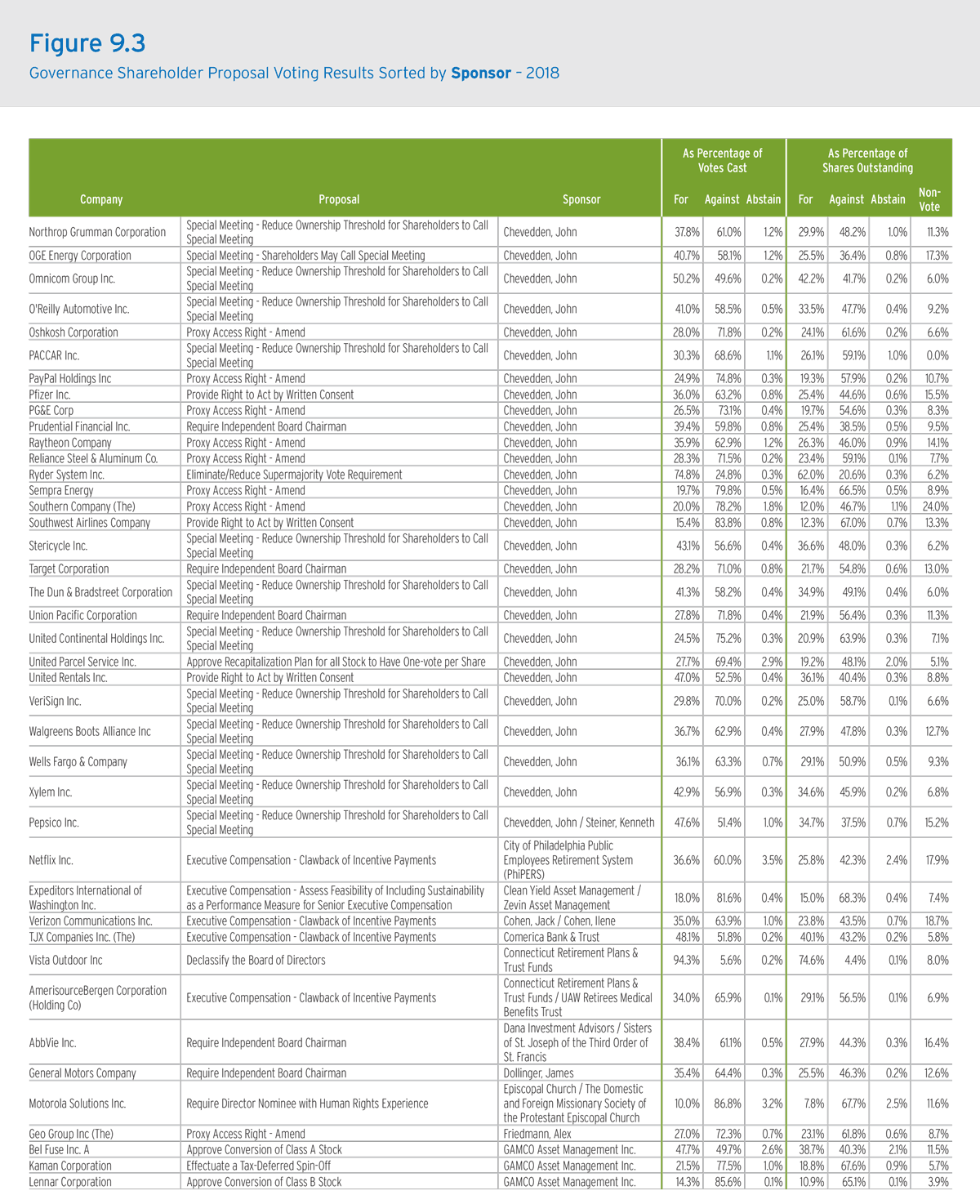

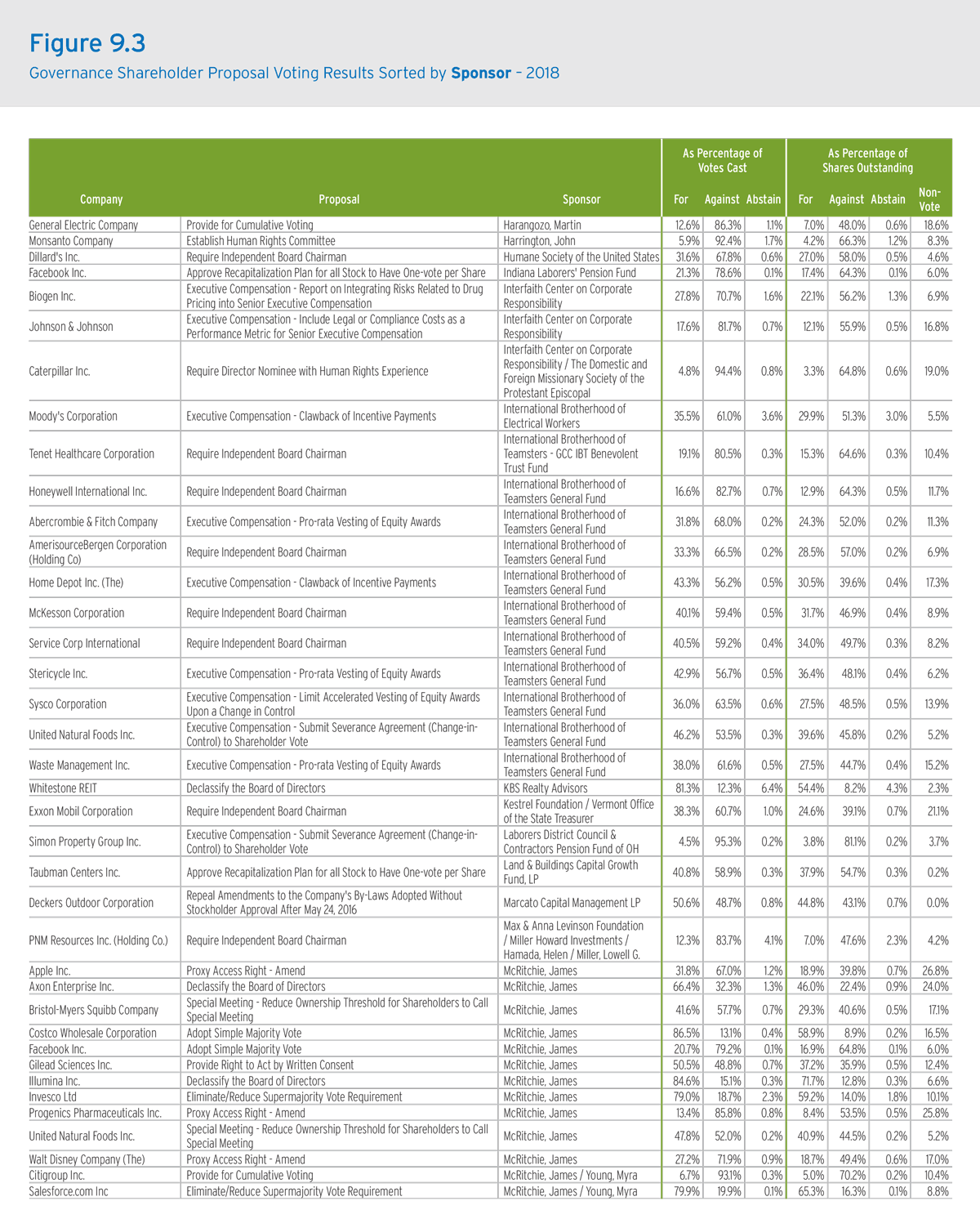

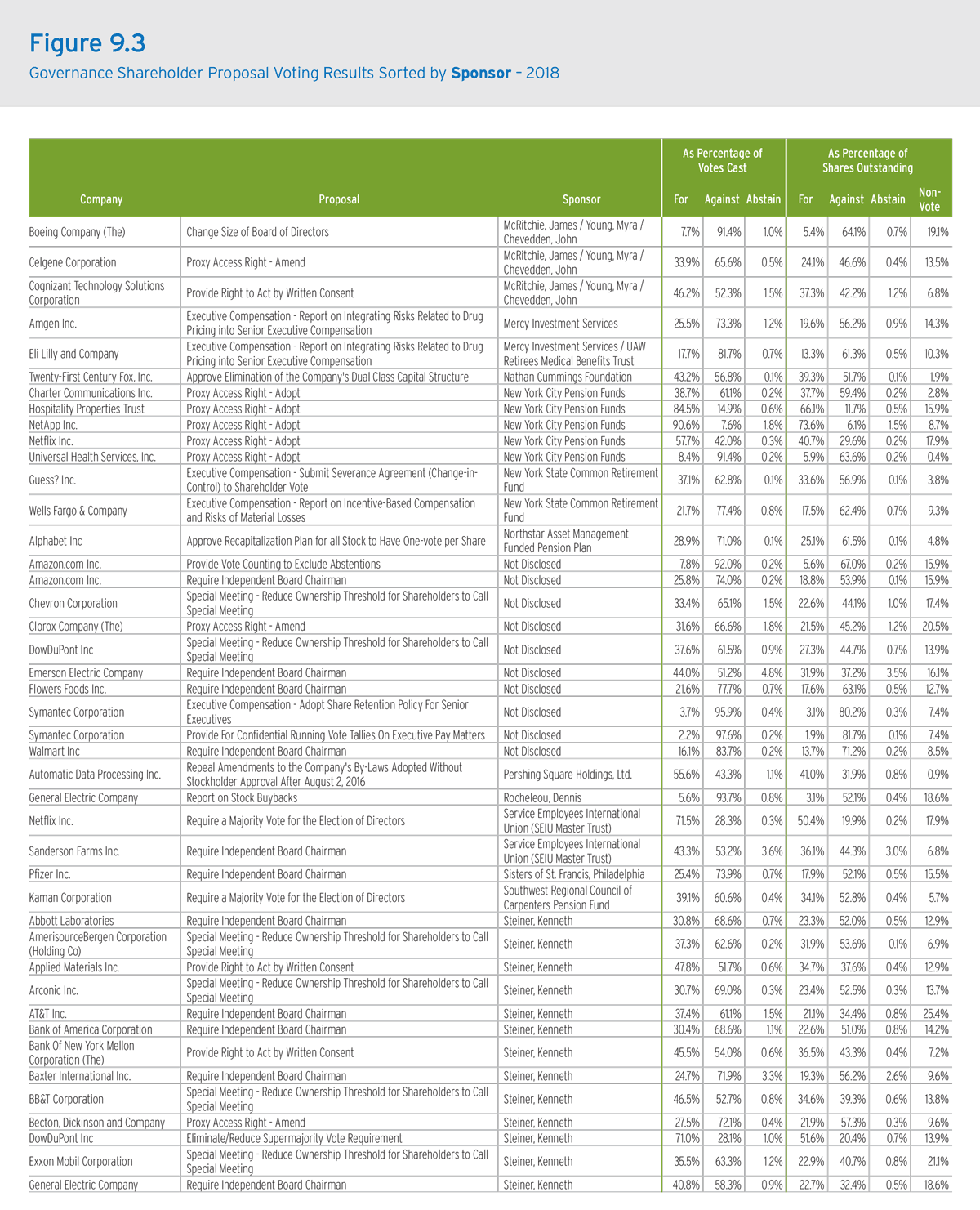

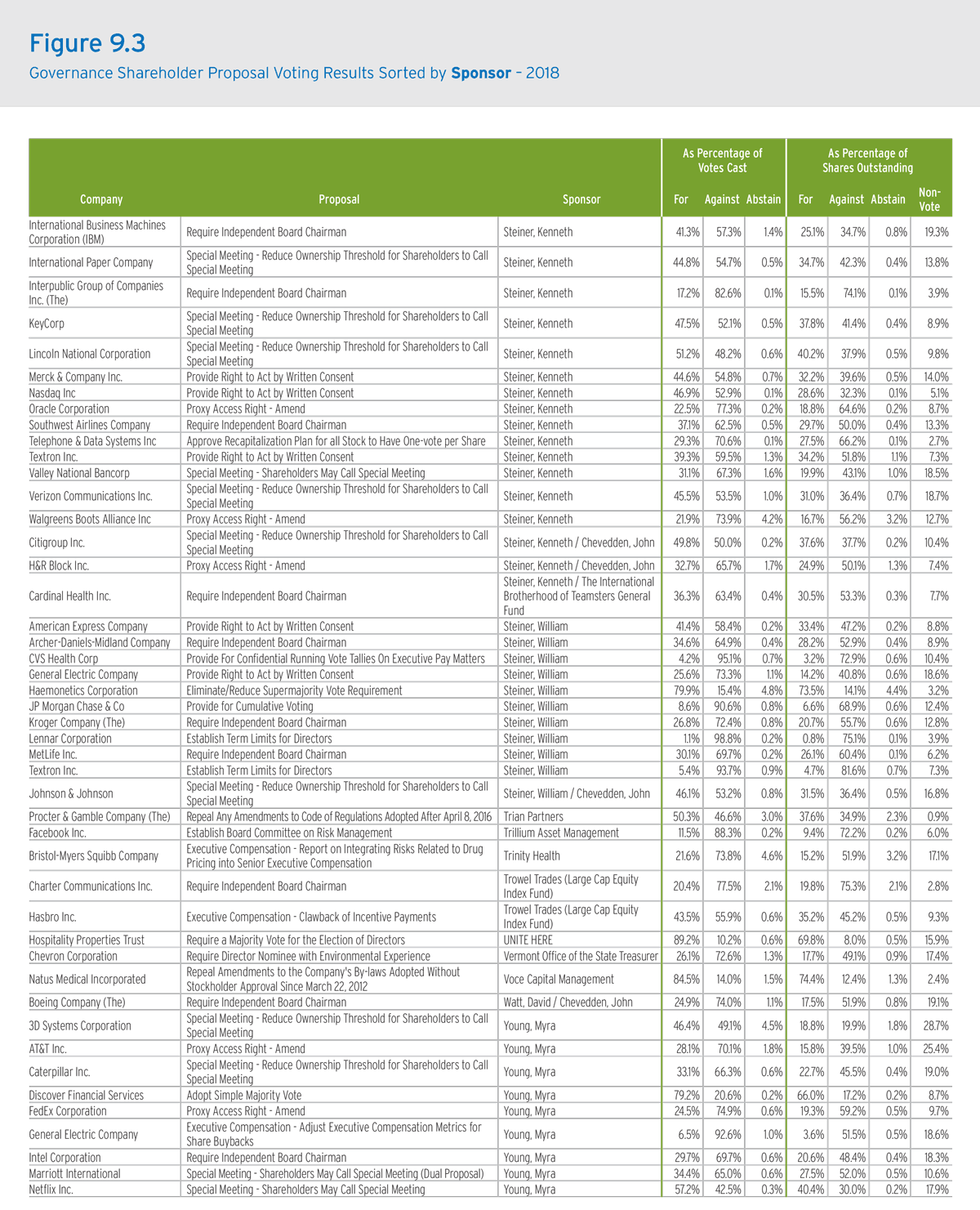

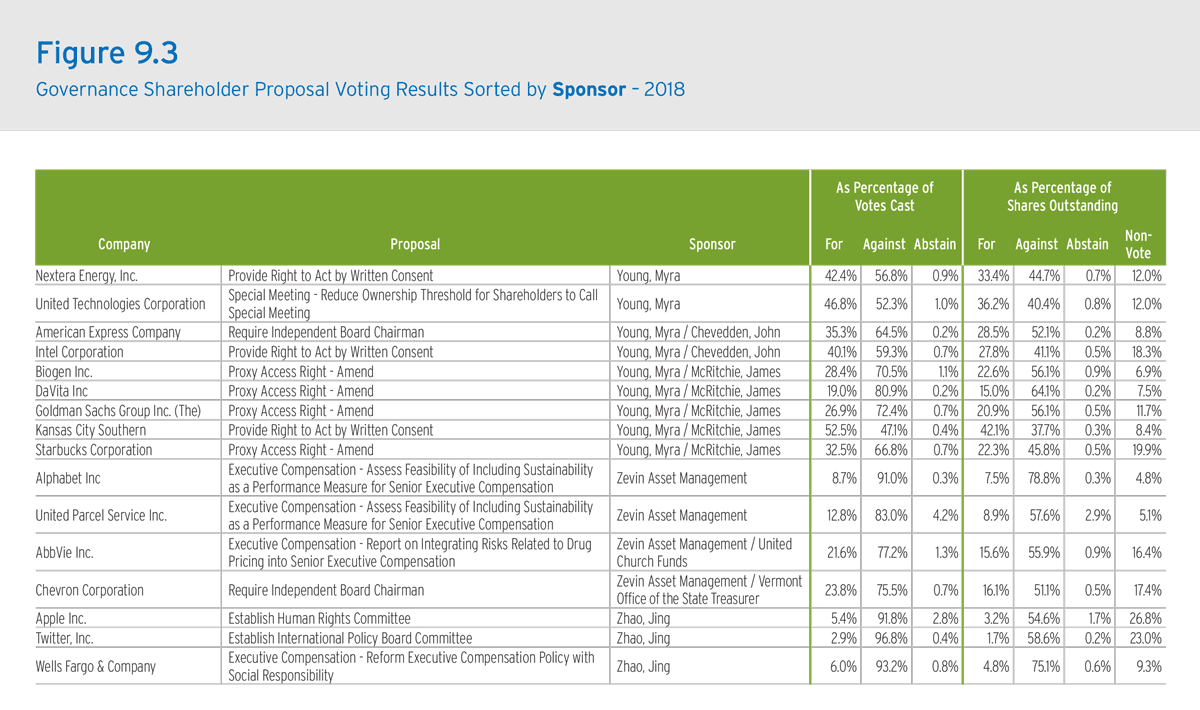

Figures 9.1, 9.2 and 9.3 detail the entire universe of governance shareholder proposals that were the subject of a shareholder vote, organized by company, proposal type and sponsor.

The complete publication, including footnotes, is available here.

Endnotes

1When referencing ‘2018’ or ‘this year’, we are referring to the reporting period July 1, 2017 through June 30, 2018.(go back)

Print

Print