Ewan McGaughey is Senior Lecturer in Private Law at King’s College, London. This post is based on his recent article, forthcoming in the Seattle University Law Review.

When the Dean of Harvard Law, Robert Clark, wrote his classic text on Corporate Law in 1986, he said that if you only wanted to grasp the basics, “you must, at the very least, also gain a working knowledge of labor law.” That neglected truth might become much more significant soon, because a growing number of lawmakers are proposing federal rights for employee representation on corporate boards. The Accountable Capitalism Act, which is getting a lot of attention, would require 40% of boards in $1bn companies are employee-elected, and those companies would also get a federal charter. The Reward Work Act, which caught less attention, would require one third employee-elected boards in all listed companies.

On this forum, four posts have been sceptical about the merits of ending the shareholder monopoly on corporate governance. Summarizing a forthcoming article of mine called “Democracy in America at work: the history of labor’s vote in corporate governance“, this post sets out a positive case: (1) the evidence shows worker voice is embedded in American tradition and would expand economic prosperity, (2) worker voice now represents best corporate governance practice in the majority of OECD countries, and (3) there is no credible defense for “shareholder primacy”, because asset managers are voting on “other people’s money”: those people are usually employees saving for retirement.

(1) Worker voice is embedded in American tradition, and economically efficient

The United States has among the richest traditions of employee voice in corporate governance in the world, and it would be far more widespread if labor rights had not been continually suppressed. The opposite theory was put forward by business scholars Michael Jensen and Bill Meckling in 1979. Notoriously, they argued putting more workers on boards in Germany would make the country’s economy like Marshall Tito’s Yugoslavia. Codetermination is “less efficient than the alternatives which grow up and survive in a competitive environment”, they argued, because it was imposed by legal “fiat”. In fact, as I have written elsewhere, German codetermination was collectively bargained by unions both after WW1, and (after the Nazis abolished worker voice) again after WW2. It would have happened faster if the British occupying government had not opposed it. Codetermination came from collective bargaining, free and voluntary, when labor’s bargaining power was less unequal. Laws codified the social practice.

In the USA, the first examples of worker representation on boards emerged in the early 20th century: for instance, the Filene retail store in Boston, and 20 companies by 1919 which had adopted a House – Senate – Cabinet model of governance, known as the Leitch plan. This led Governor Calvin Coolidge to sign what is probably the world’s oldest codetermination law (outside universities) still on the statute books today. Under the Massachusetts Laws, manufacturing companies can voluntarily enable employees to elect board members. But during the Lochner era, virtually all experiment in labor voice was suppressed. So the “attainment of rule by the people” which as Louis Brandeis advocated, “involves industrial democracy as well as political democracy” was never given “a fighting chance”.

In the 1970s, as evidence was growing about the efficiency of worker participation, and more examples were spreading around the world, American labor unions began to bargain for board seats—and they used the money in pension funds to make shareholder proposals. In 1971-2, employees put forward proxy proposals at GM, Ford, the Illinois retailer Jewel, United Air Lines, and AT&T where they said (accurately) that employee representation would “provide a continuing flow of information to management” and “avoid periodic labor disruptions which place financial hardships on employees and impose losses on the company and shareowners.” All proposals faced massive opposition, although one union at the Providence and Worcester Railroad was successful in 1973 in getting an agreement for board representation. The Wall Street Journal called it a “precedent-shattering labor agreement“.

Seeing labor’s enthusiasm, the Nixon administration decided to suppress the experiments. In 1974, the SEC ruled that management could exclude shareholder proposals for employee directors, ostensibly because it would conflict with state law rights of shareholders to elect directors. But unions kept pressing: the Teamsters tried to get board seats at the brewing company Anheuser-Busch, the engineers union kept pushing at AT&T, and finally, the United Auto Workers succeeded at Chrysler. In 1979, Douglas Fraser got a collective agreement, which lasted till 1991 (showing state law was actually no barrier) for union representatives on the board. This was even more important as Chrysler restructured, because “it isn’t enough for a union to argue about plant closings or layoffs after the decision has been made.” The Reagan administration felt this needed to be halted—the Department of Justice denied clearance for the UAW to have a representative on the American Motors Corporation board in 1981. It argued this could violate the antitrust rule against interlocking directorates, without any evidence of anti-competitive effects, or that seeing any problem could be easily resolved by having local union appointees, or direct employee elections. The Federal Trade Commission thought there was no legal problem.

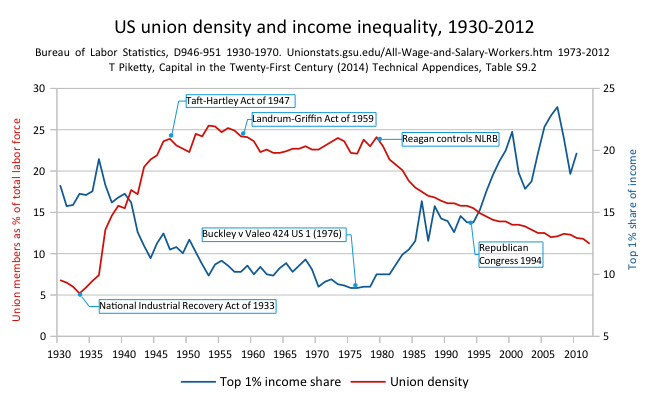

But despite all the obstacles, employees were also on boards in airlines and steel—a remarkable achievement that has not often been matched abroad. It is even more impressive because American labor rights are among the worst in the developed world. This has harmed the American economy, not made it stronger. It’s obvious that as labor has been suppressed, inequality has soared:

But also, the cutting edge empirical evidence suggests voice at work is good for employment and prosperity, and this includes the right to vote for boards. Labor rights do not harm labor, they empower us all. The most comprehensive dataset at Cambridge University’s Centre for Business Research is putting this to the test right now. Results are still in preliminary stages, but it’s becoming ever more clear that if you’re “Doing Business”, you should want an educated, empowered workforce.

In other words, the Reward Work Act and the Accountable Capitalism Act provisions on worker voice will definitely improve American economic performance, and probably restrain escalating inequality. The evidence-free assertions that employees take a “narrower and shorter-term view” of prosperity, or they are somehow “corporate insiders accountable to nobody” are not the best contributions to this debate.

(2) Worker voice now represents best corporate governance practice in the OECD

America is not alone in taking another look at labor’s vote in corporate law. The United Kingdom’s Conservative government has just passed a comply-or-explain rule requiring listed companies to put a worker on board, or adopt other employee involvement plans. The UK Labour Party, following the Manifesto for Labour Law (which I am involved with) would go further: a minimum of two worker representatives on boards, plus one-fifth of votes for workers in the general meeting of every company startup. Companies would be able to opt-out of this, until they have over 250 staff. It also proposes ensuring every pension vehicle has half-employee representation, and asset managers will only be allowed to vote shares pursuant to instructions or a policy made by representative trustees. We take the view that worker voice promotes long-term vision and sustainability. Good examples include that old corporation, the University of Oxford, which has required staff representation in governance since 1854.

Today, both a majority of European Union countries, and (with Norway) a majority of countries in the Organization for Economic Cooperation and Development have laws for staff on boards. Slowly but steadily, this practice has been growing:

The continuing success of codetermination probably has a lot to do with what was once named the “force of logic“, example and competition. Accountable corporations perform better. But also, there is a conviction that in a democratic society, people in power should be accountable to those over whom power is exercised. That principle goes for every social institution, including the corporation.

(3) Shareholder primacy has no legitimacy, because asset managers vote on “other people’s money”

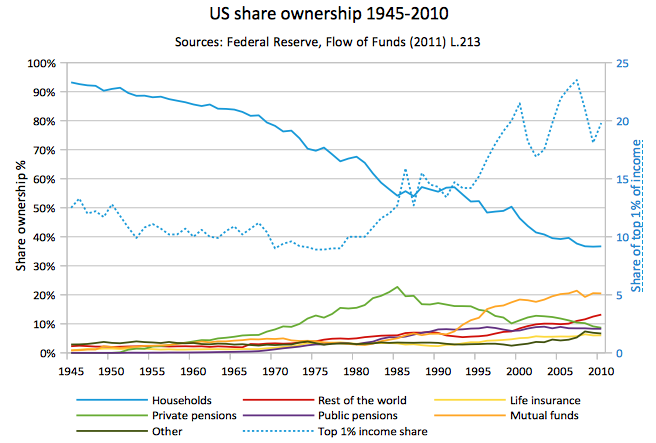

Shareholders today have no legitimacy in controlling the voting rights in the economy, because they are mostly asset managers and banks investing “other people’s money“. The money mostly comes from pensions, life insurance and mutual funds. Unlike public pensions, or labor union funds, that have democratic representation (around one-third of public pension trustees are elected), the big mutual funds that control most shareholder votes have no legitimacy. Vanguard, State Street, BlackRock, and the rest, are damaging competition, raising prices for consumers, because combined they are the largest shareholder in 438 of America’s 500 biggest companies.

Even worse, the mutual firm business model relies on using shareholder votes to make companies buy their own pension products. Since the 1970s, they have developed an awesome self-dealing industry, using their power for “smashing and scattering” people’s pensions, shifting everyone from secure defined benefit schemes, to individual 401(k) plans. The whole structure of shareholding was set on a different course in the 1980s, as collective pensions were forcibly replaced by individual accounts, dominated by mutual firms:

Mutual firms want to smash and scatter pensions because they can charge more fees on individual accounts than on collective pension funds which have bargaining power. Accountable investors—where employees or unions elect pension boards—have been pushing back, and driving all the best practices in corporate governance (including social rights, environmental protection) against tremendous odds.

These basic facts are not reflected in theories that still hold unjustified sway in corporate scholarship. To give just two examples, in 1983 Easterbrook and Fischel argued that shareholders monopolize votes because “[v]oting flows with the residual interest in the firm” and if laws do anything else “there will be a needless agency cost of management”. But this is just not true: asset managers do not have the residual interest in any firm, because they are voting on and controlling shares bought with other people’s money. In 1984, Oliver Williamson suggested that shareholders make the only “asset-specific” investments in corporations that cannot be protected without monopolizing votes for the board of directors. While workers’ interests could apparently be protected through job security, the whole capital investment is at “hazard”. But shareholders—mainly asset managers—are not making any firm-specific investments at all: they hold other people’s money. Theories of shareholder primacy are evidence-free, and even missed elementary facts on how institutional investment works when they were first written.

Most money in the stock markets comes from employees saving for retirement. Americans—like people everywhere—want to have fair pay and social security, so that they can realize their dreams. The best guarantee for those universal rights are a voice and a vote. But people do not just want to have a voice as investors as capital—though they certainly should. People also want to have voice as employees, who invest their labor. One recent survey of 3,330 likely voters, found that 53% supported having the right to vote for employee representatives on the boards of large companies, while just 22% were opposed, and 25% did not know. With the current President and Congress there will be no federal law reform. But two-thirds of companies are incorporated in Delaware, California and New York, where the political balance is favorable to meaningful progress. States can start the shift, revive as laboratories of democracy and enterprise, recreate a living law, by democratizing the corporation.

The complete article is available for download here.

Print

Print

One Comment

It would probably be an improvement if employees could elect 40% of board members. But why freeze this at only 40%? This would still give asset management firms and other passive investors 60% over-riding control. Why not give employees majority – or even 100% – control? Then the passive investors’ interests could be turned into non-voting preferred shares or variable income bonds, which is what they are in effect anyway.