Cristina Banahan is an Associate and Gabriel Hasson is a Senior Associate at ISS Corporate Solutions. This post is based on an ISS Corporate Solutions memorandum by Ms. Banahan and Mr. Hasson.

Proponents of more women on corporate boards have brought forth multiple arguments that have become widely acceptable in the field of corporate governance and more broadly. First, there is the normative argument based on equity and fairness, which suggests that women and men should have an equal opportunity to attain leadership positions, including corporate board memberships. Second, expanding the perceived pool of director candidates to an under-tapped population of highly qualified women leaders opens a new source of managerial talent, who are also more representative of the general workforce and society. Third, women directors are likely to bring fresh and diverse perspectives to complex issues. Finally, the economic argument for gender diversity, backed by a growing literature [1], suggests that board gender diversity can serve as a driver for better performance and increased financial returns.

In this post, we examine the relationship between board gender diversity and Environmental & Social (E&S) management. We find that companies with gender-diverse boards are associated with better performance on ISS’ environmental and social risk management measures. In particular, we compare Environmental, Social and Governance (ESG) performance for gender-diverse boards and their non-diverse counterparts in the S&P 500 index. Here, the phrase “gender-diverse boards” refers to boards with three or more women, and non-diverse boards as those with two or fewer women. Three women was chosen as the gender diversity threshold to provide consistency with previous studies. [2] As a metric of ESG performance, we use ISS-oekom’s [3] ESG scores, which include a general combined ESG Score, an Environmental Score, and a Social Score. Notably, the ISS-oekom methodology does not include board gender diversity as a score component; the two data sets (board gender diversity and ESG scores) are independent of each other, reducing concerns of bias. We find that gender-diverse boards outperform their peers on ESG metrics, and this correlation becomes stronger for long-term gender-diverse boards.

Gender diversity associated with better ESG performance

Companies with diverse boards receive higher scores on ESG performance metrics more often than those with non-diverse boards. Approximately half the companies in the S&P 500 universe currently have at least three female directors on their boards (245 firms). In our review, we looked at three separate ISS-oekom scoring metrics: general combined ESG Score, Environmental Score, and Social Score. ISS-oekom’s ESG methodology scores companies based on 700 factors, and assigns grades ranging from “A+,” being the best, to “D-,” being the worst. The factors cover a variety of areas including: Corporate Governance and Business Ethics; Society and Product Responsibility; Environmental Management; Products and Services; and Eco-efficiency. The methodology does not include board gender diversity, so the results are not skewed in favor of diverse boards. The Social Score contains a factor that measures gender parity in executive management, which is independent of board diversity.

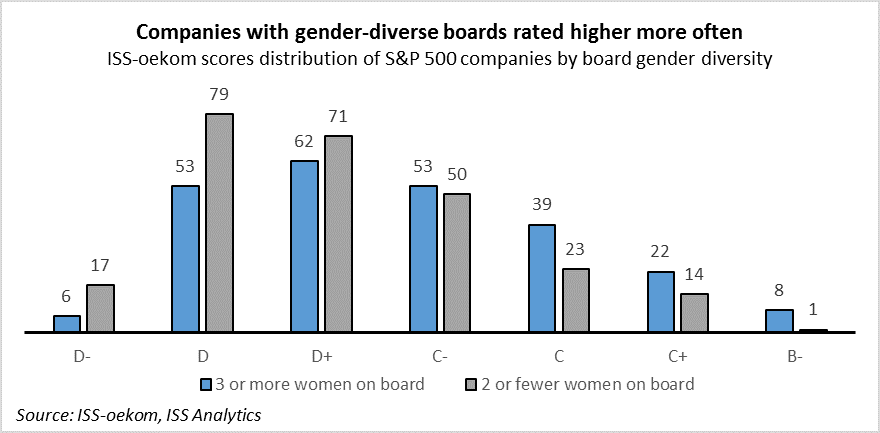

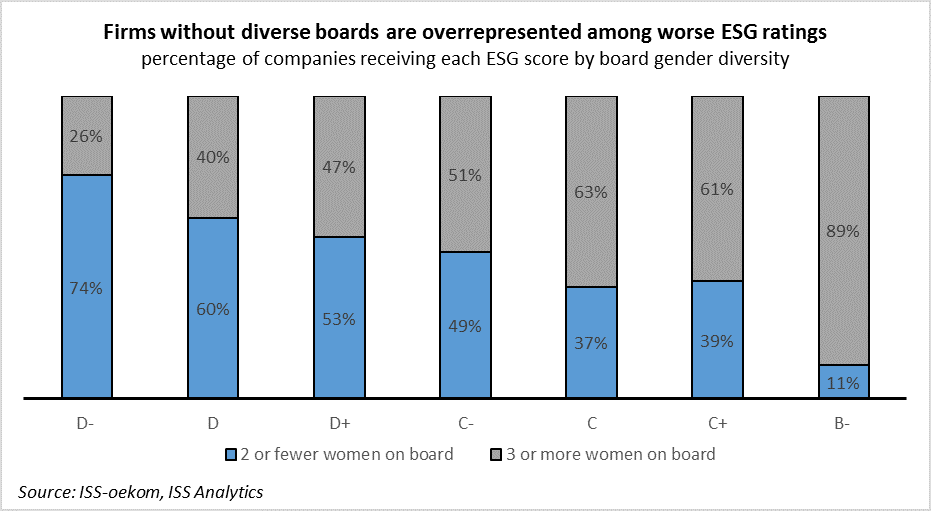

Companies with gender-diverse boards generally have higher ESG scores, indicating that companies with diverse boards adopt better sustainability practices. As seen on the graph above, the peak of the distribution for companies with diverse boards is at “D+,” while the peak of the distribution for companies with fewer women on the board is at “D.” A comparison across the grade spectrum shows that companies with diverse boards constituted the majority of firms with higher scores, while companies with less diverse boards constituted the majority of firms with lower scores.

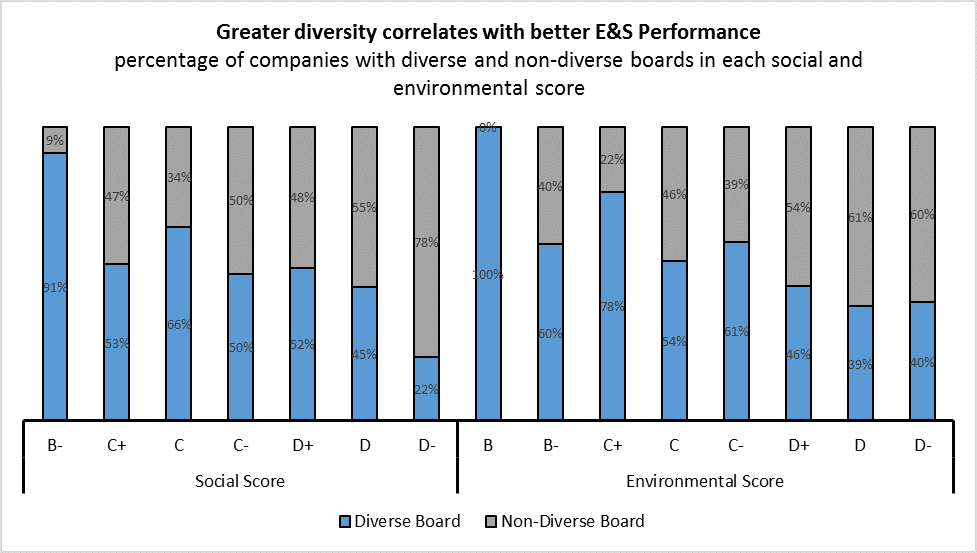

We observe the same trend in all three areas evaluated: combined ESG, environmental and social scores. Individual evaluation of environmental and social scores shows that companies with gender-diverse boards outpace their women-scarce counterparts in the highest scores. On environmental matters, companies with diverse boards were two to three times more likely to receive a higher score than non-diverse boards. On social matters, gender-diverse boards lead the way being the only ones to receive “B” scores, in addition to the bulk of the other high marks.

The time factor: long-term gender diversity correlates with better ESG performance

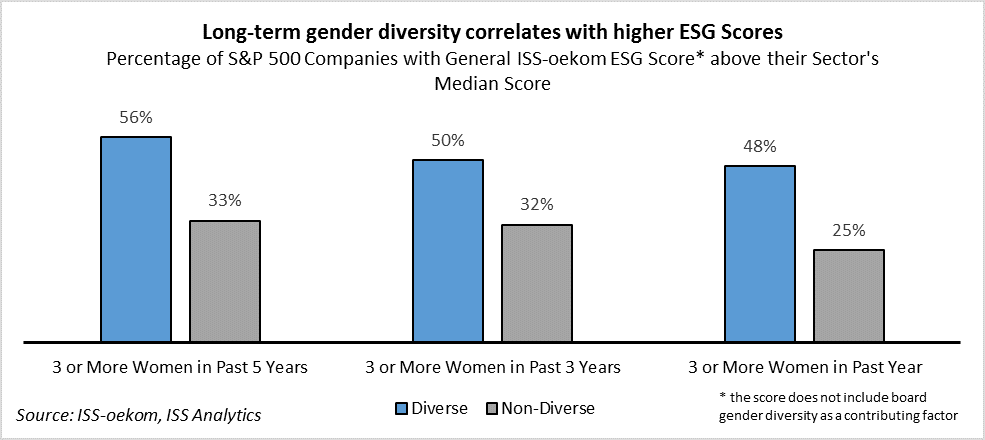

To better understand the potential impact of adding more women to the board, we looked at diverse and non-diverse boards in the current S&P 500 companies during the past one-, three-, and five-year periods. Companies in the S&P 500 who had diverse boards during all three time periods tended to perform better on ESG metrics compared to their sector peers who did not. Furthermore, the graph below shows that the longer that the company had a diverse board, the more likely the company’s sustainability practices tended to improve over time. Lastly, the results remove sector bias, since companies’ ESG scores are compared to the median score of their sector.

The link between gender diversity and ESG Performance

Our survey of existing literature on gender board diversity and corporate performance, in addition to our own thoughts, inspired the following list of potential links between increases in female board membership and ESG performance. We identify three key arguments:

- Gender-diverse boards manage risk better. Gender diversity in corporate decision-making is a crucial factor in effective leadership because it helps companies be more attentive and responsive to risk. Other publications [4] assert that women and men generally have different attitudes towards risk and economic principles. Because of these differences, a gender-diverse board could lead to a more balanced decision-making process. Following this line of argument, we should expect to see better environmental and social risk monitoring by gender-diverse boards, since these areas of board oversight constitute just another form of risk management.

- Gender diverse boards offer more comprehensive understanding of key company stakeholders. Women may also provide additional insight into consumer trends and consumer priorities for the companies of the boards they serve. For some industries, this can be particularly important; since women make 70 percent [5] of consumer purchasing choices, consumer-focused corporations with gender-diverse boards may have an advantage in decision-making that is more responsive to their customers. More diverse boards may have greater insight into issues driving key stakeholder behavior, particularly in industries focused on consumer preference. Those issues may include corporate social responsibility and environmental stewardship. In fact, academic research [6] finds that corporate social responsibility affects consumer behavior. Thus, diverse boards may be more comprehensive at identifying and responding to these trends, perhaps helping support superior ESG performance.

- Gender diversity increased board attendance and effectiveness. A study [7] of the financial crisis found that in the banking sector, gender diverse boards had improved director attendance, and that diverse boards were more effective dealing with crises. Female directors, in particular, were less likely to have attendance issues than their male-counterparts. The study found that as the number of female directors increases, male attendance also improves; improvements in attendance, in turn, seem to help boost firm performance overall. While the study does not specifically address the impact of attendance on ESG, improvements in attendance are likely to help the board better evaluate all risks because members are present at meetings to discuss the merits of a particular issue, including those posed by ESG challenges.

The way forward

The relationship between ESG and board diversity appears to be mutually beneficial. As boards continue to increase the number of women on the board, due to internal and external pressures, we can expect to see a continued focus on ESG for the benefits to company’s bottom line and long-term growth. As ESG continues to be on the radar for owners and asset managers, pressure will continue on a host of E&S issues, including having a critical mass of women on the board.

In addition to the reported improvements in financial returns, leadership diversity and fairness, having gender diverse members on boards appears to have quantifiable benefits on ESG performance. The inescapable conclusion of our findings is that women contribute to the boards they sit on in a host of ways, such as improving customer responsiveness, ethical accountability and risk management. The old adage that “a woman’s place is in the kitchen,” perhaps should be relocated to the boardroom, in light of the contributions and skills that female board members bring to the table, as supported by the data.

Endnotes

1Credit Suisse, The CS Gender 3000: Reward for Change (Sep. 2016), available at https://glg.it/assets/docs/csri-gender-3000.pdf; Linda-Eling Lee et al., Women on Boards, MSCI (Nov. 2015), available at https://www.msci.com/documents/10199/04b6f646-d638-4878-9c61-4eb91748a82b; Maelia Bianchi and George Iatridis, Board gender diversity and corporate financial performance: Evidence from CAC 40, Investment Management and Financial Innovations, Vol. 11, issue 4 (2014), available at https://businessperspectives.org/images/pdf/applications/publishing/templates/article/assets/6059/imfi_en_2014_04_Bianchi.pdf; McKinsey & Co., Women Matter 2016: Reinventing the workplace to unlock potential of gender diversity, available at https://www.mckinsey.com/~/media/mckinsey/featured%20insights/women%20matter/reinventing%20the%20workplace%20for%20greater%20gender%20diversity/women-matter-2016-reinventing-the-workplace-to-unlock-the-potential-of-gender-diversity.ashx (“For the past 10 years, McKinsey & Company has researched companies and managers for the “Women Matter” series, and in each year, has built a case for higher representation of women in top management positions and explored concrete ways to change corporate attitudes toward women in the workplace. In particular, our research has consistently shown a correlation between the proportion of women on executive committees and corporate performance.”).(go back)

2Allison M. Konrad and Vicki W. Kramer, How Many Women Do Boards Need? (Dec. 2006), available at https://hbr.org/2006/12/how-many-women-do-boards-need.(go back)

3ISS-oekom, available at http://www.oekom-research.com/.(go back)

4See generally, 2018 Gender Balance Index, OMFIF, available at https://30percentclub.org/assets/uploads/UK/Third_Party_Reports/Gender_Balance_Index.pdf.(go back)

5Laura Colby, Women on Boards, Bloomberg, (May 19, 2017), available at https://www.bloomberg.com/quicktake/women-boards.(go back)

6Sankas Sen et al., Corporate social responsibility: a consumer psychology perspective, available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2333495.(go back)

7Laura St. Claire et al., Braving the Financial Crisis: An Empirical Analysis of the Effect of Female Board Directors on Bank Holding Company Performance, Office of the Comptroller of the Currency (Jun. 2016), available at https://occ.treas.gov/publications/publications-by-type/occ-working-papers/2016-2013/wp2016-1.pdf.(go back)

Print

Print