Kellie C. Huennekens and Jamie Smith are Associate Directors at the EY Center for Board Matters. This post is based on their EY publication.

This proxy season we are seeing enhanced disclosure around board composition, gains in board gender diversity and more companies disclosing investor engagement.

These changes reflect shared goals between companies and institutional investors around the benefits of having a diverse board aligned to corporate strategy and key risks.

At the same time, more investors are using proxy votes to amplify the call for more women on boards and to support increased transparency and accountability on environmental and social issues. Overall, investor support remains high—more than 90% average support—for director elections and executive compensation programs across various sectors and market capitalization, despite growing scrutiny of executive compensation and board composition across many dimensions.

This post provides five key takeaways for boards as they reflect on this proxy season and evolving governance developments. [1]

Five key board takeaways

1. More companies voluntarily enhance board composition disclosures

Today’s largest companies are enhancing their proxy statements to give investors clearer insights to the diversity of expertise represented on the board and how those qualifications align with the company’s strategy and risk oversight needs. They are also using graphics to highlight other kinds of diversity included on the board, such as diversity of tenure, gender, race, age and nationality.

Skills matrix disclosures climb sharply

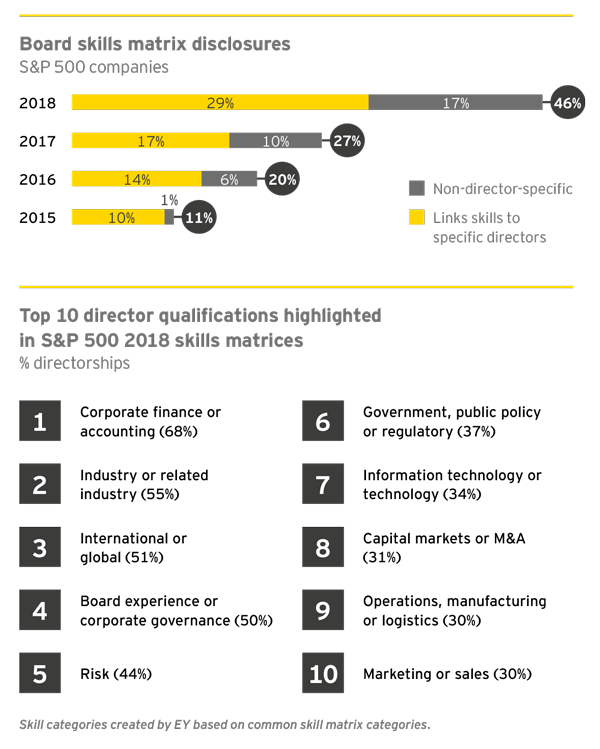

This year close to half of S&P 500 companies disclosed a board skills matrix in their proxy, which is more than four times the 11% that did so in 2015. While companies are required to disclose director qualifications, [2] these graphic snapshots have evolved as a voluntary disclosure tool that enhances readability and visually highlights the board’s strengths. They highlight board diversity across skills, backgrounds and areas of expertise, in many cases mapping such skills to individual directors. The most successful of these explain how the skill categories connect to the company’s strategy and risk oversight needs and clearly align with the information provided in the director biographies.

Graphics highlighting diversity now commonplace

More than half (56%) of S&P 500 company proxies used graphics this year to visually highlight different aspects of board diversity, up from just 20% three years ago. The most common aspect highlighted is tenure, followed by gender, race/ethnicity and age. Director diversity by race/ethnicity remains difficult to track with limited and varying approaches to voluntary disclosure.

Because companies take different approaches to skills matrices, comparisons yield an informative but somewhat limited view. For example, one matrix may highlight only directors with deep expertise (though additional directors may have relevant experience), while another matrix may represent that all directors have every skill and experience listed.

Additionally, companies may change their disclosure approach over time by further narrowing or broadening the skills categories presented. For example, we looked at the 114 S&P 500 companies that provided a skills matrix in both 2018 and 2017 and observed a significant increase in the percentage of directorships associated with expertise in risk, strategy, board experience/ corporate governance and government/public policy/ regulatory matters. Upon closer review, we found that the changes appear to be driven in part by changes in disclosure (e.g., companies adding a new skills matrix category for risk or strategy in 2018) as opposed to new directors bringing new skills to the boards.

Disclosure of a well-developed, company-specific skills matrix may help convey to stakeholders how board composition is aligned

with the company’s unique circumstances, strategy and risk. Using graphics to highlight key aspects of the board’s diversity—particularly those aspects that are not otherwise discernable (e.g., ethnicity or race)—may help demonstrate that the board values and considers such diversity when making director nominations.

2. Push for gender diversity advances

Investor calls for increased gender diversity on boards have grown more urgent in recent years, with some major institutional investors incorporating gender diversity expectations into their director voting policies. [3] Driving this push is the recognition that a diverse board makes better, more robust decisions and sets the tone at the top for the diverse talent the company seeks to attract. This year two things have become clear: many companies share this goal of bringing more women into the boardroom and are driving change, and a growing number of investors are willing to oppose boards that they perceive as insufficiently diverse.

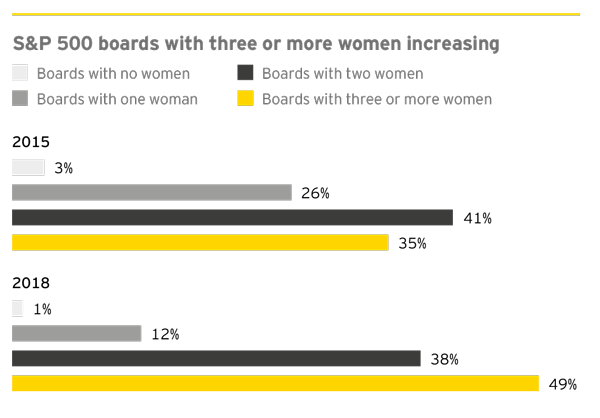

Nearly half of S&P 500 boards now include three or more women

S&P 500 boards show a commitment to diversity that goes beyond just checking the box: they continue to add more women to the board. Since 2015, the portion of boards with at least three women has increased by 14 percentage points.

Rate of increase in women-held directorships has accelerated

Since 2013, the proportion of women-held directorships at S&P 1500 companies has grown just one percentage point each year—a pace that would take more than 30 years to reach gender parity. This year that proportion has already increased by two percentage points, growing from 19% to 21%, with the second half of 2018 still to go. The rate of increase has, finally, accelerated.

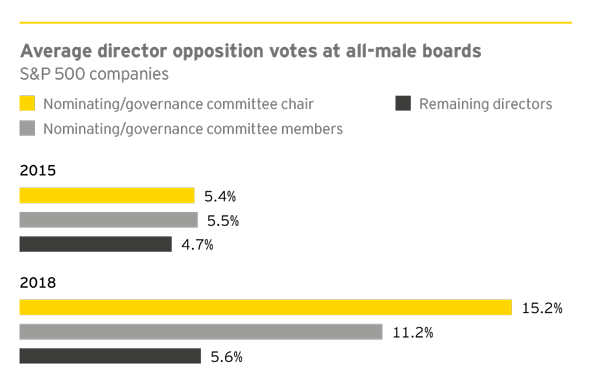

All-male boards face increasing opposition

While director opposition votes typically average 3% to 4%, average votes against all-male boards are significantly higher—and rising. Votes against nominating/governance chairs have grown at the very limited number of S&P 500 boards that lack gender diversity. Notably, opposition votes at all-male S&P 1500 boards have more than doubled since 2015, with those chairs receiving an average opposition vote of 15.2% this year vs. just 3.6% for the same role at boards that are 20% female. Similarly, votes against nominating/governance committee members and all other board members at all-male S&P 1500 boards, rose to 11.2% and 5.6%, respectively, compared with 3.3% and 2.3%, respectively, for their counterparts at boards comprised 20% of women.

The portion of companies with three or more women on the board is growing, while all-male boards are becoming extinct. This shift—along with the increased willingness by investors

to vote against boards lacking female directors—increases the pressure on boards to diversify. While the spotlight remains on gender for now, boards should also prioritize strengthening other types of diversity.

3. Environmental and social shareholder proposals gain traction

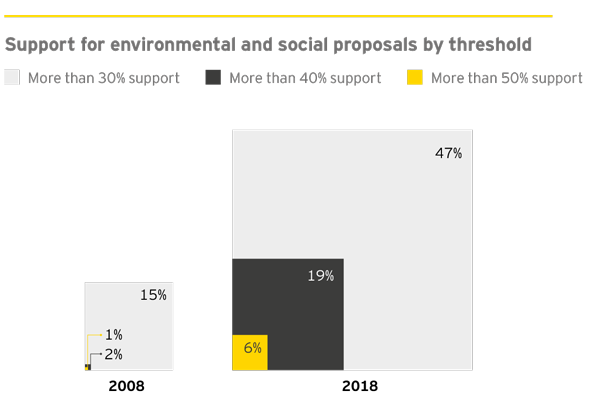

At the 106 Russell 3000 companies where shareholder proposals on environmental and social topics came to a vote, these proposals saw a marked increase in support, with a larger portion of these proposals reaching key support thresholds.

The percentage of environmental and social proposals securing majority support doubled, with 6% passing the 50% mark, up from 3% or less over the past decade. Similarly, 19% secured at least 40% support, up from 12% last year. And 41% attained at least 30% support, up from 29% last year.

Reaching these voting thresholds matters. Thirty-percent support is the level at which many boards take note of the proposal topic, and at 50% support, if the board is deemed to take insufficient action in response, many investors will consider voting against incumbent directors at the next annual meeting.

Proposal topics securing majority support so far this year include climate risk, coal-related risks, greenhouse gas emissions, gun safety, the opioid crisis and sustainability reporting. Notably, two of four climate risk proposals voted so far secured majority support, and a third secured 46%, building on the historic majority votes from last year [4] and reinforcing climate risk as a mainstream investor concern.

Increasing support for environmental and social shareholder proposals indicates that more mainstream investors may view these topics as material to shareholder value. Withdrawal of these proposals remains common, with close to a third being withdrawn this year. Engagement with proponents may reveal areas of common ground.

4. Investor engagement continues to grow

Since company-investor engagement began to reshape the governance landscape, engagement on governance topics—and disclosure of these efforts in the proxy statement—continues to grow. So far this year 77% of S&P 500 companies have disclosed engaging with investors over the previous year, up from 56% in 2015. And director involvement in these efforts is also increasing. This year one-quarter of S&P 500 companies, or one-third of the companies disclosing engagement, said that board members were involved, up from 10% or less than a fifth of companies disclosing engagement in 2015.

These dialogues with investors continue to influence changes in company disclosure and practices. This year 45% of the companies that disclosed engagement also disclosed making engagement-related changes (most commonly regarding executive compensation) compared with 46% in 2015.

As outreach to and direct engagement with shareholders cements itself as a key feature of the governance landscape, engagement practices and related investor expectations continue to evolve. Companies undertaking engagement should make efforts to anticipate and meet these expectations.

5. Say-on-pay gets steady support in wake of pay ratio disclosures

With the long-anticipated CEO pay ratio disclosures now in proxy statements—and in the press—investors continue to show overwhelming support for most executive compensation programs. Overall support for say-on-pay (SOP) proposals continues to hover around 91% across nearly all companies, and the portion of proposals failing to receive 50% support remains at around 2%. Even looking at the 20 companies with the highest pay ratios so far, more than half secured support from 90% or more—including three of the companies among the top 5 highest ratios.

That pay ratios do not appear to be significantly impacting SOP support is not unexpected, as only a few investors raised the topic with us in our outreach conversations as an area of focus—and mainly in the context of talent and human capital management. Instead, a variety of investors reported different approaches regarding pay, with some focused on the rigor of performance incentive structures, others focused on how pay incentives align with strategy and/or sustainability goals, and others looking into how pay aligns with risk culture and pay equity.

Given increasing investor attention to human capital management, [5] it is possible that the now-public median pay figures may further inform engagement around how companies are investing in their workforce.

Proactive outreach to investors, enhanced pay disclosures and changes to pay practices in response to shareholder feedback remain key opportunities for securing voting support. Some companies may consider enhanced disclosure around how investing in and compensating the workforce fits into the company’s talent agenda.

- Are there opportunities to enhance communication around how directors’ skills and areas of expertise align with the company’s unique oversight needs?

- Does the proxy statement showcase the board’s diversity and disclose diversity goals to help demonstrate the value the board places on diversity?

- How is the board overseeing environmental and social risk and value drivers, particularly in relation to long-term strategy? And how is the company communicating to investors on these topics?

- How does the board stay informed about key shareholders’ engagement priorities and views of the company’s governance practices?

- How do workforce pay practices—including pay equity for women and minorities—support the company’s culture and talent agenda?

Endnotes

1Vote results and shareholder proposal data for 2018 are as available for meetings through June. Proxy disclosure data is based on 454 S&P 500 company proxy statements available as of 9 July. All other data is full year and based on the Russell 3000 index unless otherwise specified.(go back)

2Under proxy statement disclosure enhancement rules effective 28 February 2010, companies are required to disclose the particular experience, qualifications, attributes or skills that led the company’s board to conclude that the person should serve as a director of the company.(go back)

3See BlackRock Proxy voting guidelines for U.S. securities, February 2018, and State Street Global Advisors’ Guidance on Enhancing Gender Diversity on Boards, 2018.(go back)

4See our 2017 proxy season review.(go back)

5See our 2018 proxy season preview for more on investor areas of focus.(go back)

Print

Print