Cristiano Guerra is Head of Special Situations Research, Institutional Shareholder Services, Inc. This post is based on an ISS publication by Mr. Guerra. Related research from the Program on Corporate Governance includes Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here).

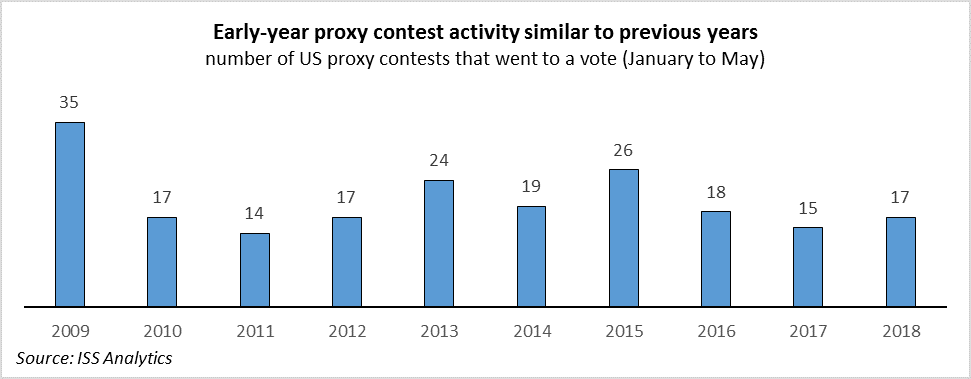

As the U.S. proxy season is heating up, activity in contentious situations remains as energetic as ever, with a healthy number of high-profile company targets, personal disputes, and even unexpected shareholder alliances. While it is still relatively early in the year, we begin to see some interesting patterns. Many of the largest companies that have been targeted by activists appear to prefer the settlement route instead of proceeding to full-blown proxy contests, continuing a trend observed in the past three years. The newer trend we see pertains to an increased number of “vote no” campaigns that are primarily motivated by concerns related economic or strategy-related issues. Some of these campaigns stem from dissatisfaction with company performance or disagreements about strategic decisions, while some take place in lieu of proxy contests.

Most high-profile targets settle with dissidents

Settlements have taken a big bite out of proxy fight volumes in the U.S. this year; in contrast to last year, this is especially true among the high-profile proxy fights. Some of these situations include:

- Avis Budget Group Inc. settled with SRS Investment Management;

- Tenet Healthcare Corporation settled with Glenview Capital; and

- Energen Corporation settled with Corvex.

In each of these cases, the activist was the company’s largest shareholder, which likely factored heavily in the three boards’ decisions to settle.

The contest at Newell Brands Inc., which was shaping up to be the most interesting fight of the year, also settled peacefully. Starboard was seeking to replace the entire board, until the company reached a deal with a very unusual “off-white knight” in Carl Icahn. In the end, the two activists reached a compromise, and together oversaw the replacement of most of the board.

Even Xerox Corporation, which fiercely resisted an attempt by Icahn and Darwin Deason to halt the company’s planned merger with Fujifilm, eventually capitulated. The board reneged on an initial settlement with the activists before agreeing to a second settlement proposal. The Xerox board faced an uphill battle on this contest after the New York State Supreme Court Justice opined that the merger was “largely negotiated by a massively conflicted CEO.”

Despite these settlements, both Starboard and Icahn remain involved in situations that could go to a vote:

- Icahn is looking to replace the board of SandRidge Energy Inc. on June 19, after rejecting the company’s offer of adding two seats to the five-member board, and

- Starboard is looking to replace the board of Mellanox Technologies Ltd., an Israeli-based provider of computer networking products; that meeting is slated for late July.

- In these two fights, shareholders will be able to cast their votes on universal cards, meaning that they will have the rare opportunity to pick and choose nominees from both slates.

“Vote no” campaigns are the new contests

“Vote no” campaigns have been all the rage this year. The ISS Special Situations Research team has already covered five such campaigns launched by frustrated hostile bidders, shareholders upset by sudden share price declines, and dissidents who were unable to offer their own nominees.

One of the most high-profile “vote no” campaigns was against building materials company USG Corporation. Knauf, a family-owned German company in the same industry, made two non-binding offers beginning late last year, which the board rejected. The hostile bidder—which owns 11 percent of USG—launched the “vote no” campaign because it felt the board was not seriously engaging to discuss its offer.

By rejecting Knauf’s approach, however, the USG board was also ignoring the wishes of its largest shareholder: Berkshire Hathaway. Warren Buffett’s company, which controls 30 percent of USG, felt strongly enough about the offer that it gave Knauf the option to purchase its stake at the offer price. In fact, Berkshire felt so strongly about the situation that it also took the unprecedented step of announcing it would vote against the USG directors standing for election at this year’s annual meeting. At the May 9th AGM, all four director nominees fell way short of majority support, each receiving support by only 23 percent of the votes cast. The board has since changed its stance and entered into a confidentiality agreement with Knauf.

Another early May meeting, QTS Realty Trust Inc., was challenged by REIT activist Land and Buildings—who specifically targeted the company’s Chairman/CEO and the Chairman of the Compensation Committee. Land and Buildings alleged that the company’s ineffective communication with the market reflected poor governance and was to blame for its inferior performance. The company’s abrupt announcement of a strategic shift in February certainly took the market by surprise, causing the stock to drop 23 percent in one day. Because this happened after the nomination deadline for this year’s annual meeting had already passed, the dissident was limited to running a “vote no” campaign. Though both targeted directors were reelected on May 3, the Chairman of the Comp Committee received a significant percentage of withhold votes, with approximately 30 percent of votes cast against his nomination.

Along these same lines, Moab Capital Partners launched a “vote no” campaign against the entire board of Macquarie Infrastructure Corporation. In this case, during its Q4 earnings call, the company announced the sudden termination of contracts impacting its liquid storage business. The bad news seemed to directly contradict the optimism expressed by the company’s outgoing CEO, who stepped down from his executive role at the end of last year and has since joined the board. Such was the market’s surprise at this unexpected turn of events that the company saw more than $2 billion dollars in market cap and more than 40 percent of its valuation disappear overnight. Three of the targeted directors received opposition of more than 39% of the votes cast, while the company’s say-on-pay proposal received more than 37% of votes against.

Of course, another high-profile campaign targeted Wynn Resorts Limited, where Elaine Wynn, the ex-wife of former Chairman/CEO Steve Wynn, solicited votes against the re-election of long-tenured director John Hagenbuch. One of the premises of her campaign was that Hagenbuch should not have been part of the Special Committee tasked with investigating the sexual harassment allegations that prompted Steve Wynn to step down as CEO and director, as well as sell his shares in the company, given that the two men are close personal friends.

This is a case where the current board responded swiftly to the crisis—including by appointing three women to the board in record time. However, many shareholders are perhaps wondering if such a crisis could have been averted in the first place had the legacy board—which included Hagenbuch and Elaine Wynn herself—taken a more diligent approach to corporate governance over the years.

The Wynn Resorts campaign resolved itself before the vote. A few days before the May 16 annual general meeting, the company announced that Hagenbuch, as well as another long-tenured director, Robert Miller, would not stand for reelection.

Upcoming Meetings to Watch

Another “vote no” campaign worth highlighting is HomeStreet Inc., a West Coast bank that will hold its meeting on May 24. Roaring Blue Lion Capital Management, a top-5 shareholder with a 6-percent stake in the company, sought to nominate two director candidates, arguing that the company’s underperformance resulted from its inability to effectively address its dependency on mortgage origination. Blue Lion’s campaign morphed into a “vote no” campaign after the board determined that its notice was deficient due to omissions in the director questionnaires, an interpretation which was ultimately upheld by a Washington state court.

The HomeStreet fight illustrates the fact that some companies seem to be mounting defenses in the initial stages of contests, in some cases on fronts that would have otherwise flown under the radar in past seasons. This push appears to be transforming some of the administrative safeguards of shareholder interests into hurdles for activists, which may in turn result in outcomes that reconcile with the letter but not necessarily the spirit of the law.

On May 31, shareholders will also get to vote on the general meeting of Taubman Centers Inc. This is a repeat proxy contest. Last year, last-minute governance improvements by the company allowed the board to overcome a campaign by Land and Buildings to replace two directors. This year, Land and Buildings is back, seeking to replace Billy Taubman—the company’s COO and a member of the founding family—as a member of the board.

Print

Print