John C. Wilcox is Chairman of Morrow Sodali. This post is based on a Morrow Sodali publication by Mr. Wilcox. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors by Lucian Bebchuk, Alma Cohen, and Scott Hirst; and Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

The positive response to Morrow Sodali’s 2018 Institutional Investor Survey goes to show how Institutional Investors continue to recognize the importance of their stewardship activities, working to improve their investee companies’ ESG practices through corporate engagement and proxy voting. Also, fulfilling their fiduciary duty to their clients by driving changes that increase shareholder value. The rise of index funds has also increased reputational and regulatory pressure, causing both active and passive investment managers to ensure strong corporate governance oversight.

Board effectiveness and executive pay remain key issues for investors as we head into 2018. There is an increased demand for companies to disclose relevant aspects of their business strategy and more likelihood that Institutional Investors will support credible activist strategies compared with previous years.

Our results show that an increasing number of Institutional Investors will focus their attention on board effectiveness, looking at the skills of each board member, considering these as the most critical factor when evaluating directors. After skills and experience, gender was chosen as the most significant board diversity factor, with geography, age and ethnicity following behind.

Executive pay is still one of the main areas where boards and shareholders are likely to disagree during 2018. Institutional Investors are expected to up the ante when scrutinizing pay policies, demanding enhanced disclosure of pay metrics and seeking a closer alignment between pay and performance. Further pressure will come to bear on companies with excessive pay practices, particularly with the introduction of the CEO pay ratio.

When evaluating remuneration plans, Institutional Investors are interested in receiving information on the sustainability metrics used, particularly those linked to a company’s risk management and business strategy. For example, the incorporation of climate risk into remuneration plans is likely to be a key topic for the most exposed industries.

Activism remains in the spotlight. The rise of Investment Stewardship strategies is redefining how Institutional Investors think about company performance and investment decisions. In this regard, many Institutional Investors confirm that they are more likely to support activists who put forward a credible story focused on long-term strategy. Institutional Investors are assigning more resources to assess companies’ risks and opportunities and are collaborating more to better understand the merits of activist proposals.

Many of the emerging issues will no doubt resonate with our readers. We believe it’s important to keep abreast of the many changes affecting proxy voting and corporate engagement. We hope the 2018 Institutional Investor survey results will provide companies with useful insights and help them navigate the complex world of corporate governance as they work to achieve their long-term strategic goals.

About the Survey

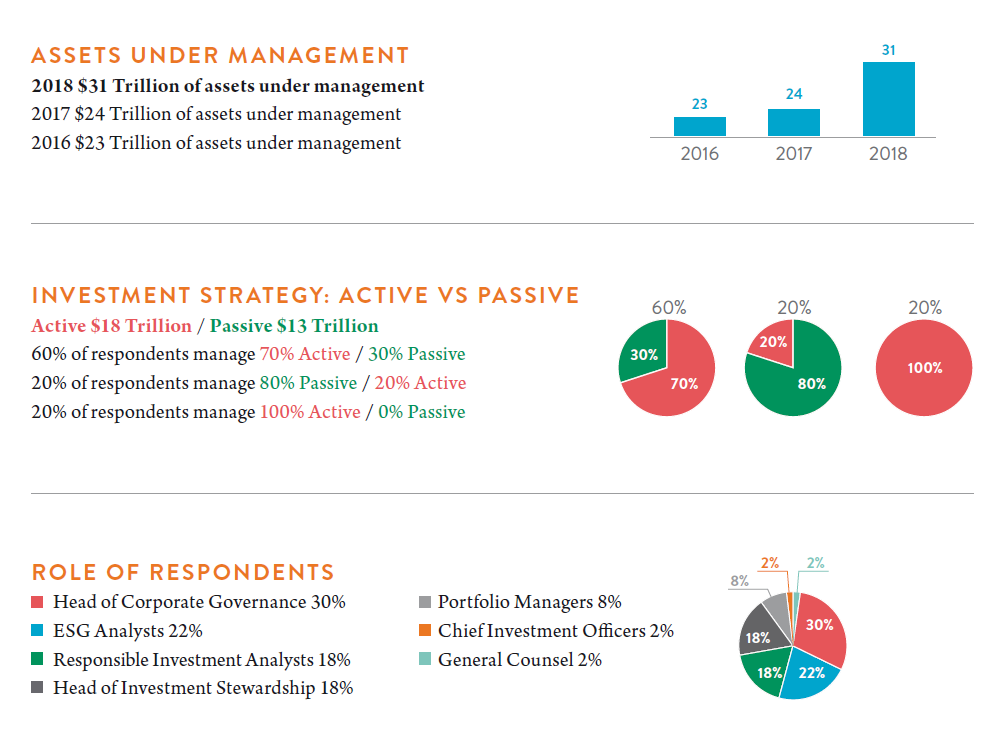

This is Morrow Sodali’s 3rd Annual Institutional Investor Survey. Forty-nine global Institutional Investors—managing a combined $31 Trillion in assets under management—took part. We continue to monitor the views of Investment Managers and Institutional Investors on a wide variety of global trends and emerging issues around the Annual Shareholder Meeting, ESG Engagement, Board Practices, Executive Pay, Activism and Investment Stewardship Strategies.

The purpose of this year’s survey is to determine which issues will have priority for Institutional Investor’s during the 2018 annual meeting season. Our goal is to alert clients to these issues and help them prepare to manage and engage effectively with their shareholders. Institutional Investors responding to this year’s survey have the following characteristics:

Key Insights

Institutional Investors responding to Morrow Sodali’s 2018 Survey revealed three critical areas of increasing concern:

- The need for a clear articulation of a portfolio company’s business strategy and goals.

- More detailed information about the directors’ skills, qualifications, experience and how each member contributes to the effectiveness of the board.

- An explanation of the business rationale for board decisions and how they align with strategy and performance.

Based on our findings, we identified the following top priorities for 2018:

- Investors will prioritize skills ahead of gender or ethnic diversity. 71% of respondents representing $23 Trillion AUM overwhelmingly felt that “Skills” was the most important diversity criteria. 54% of respondents representing $17 Trillion AUM felt that engagement with shareholders on succession planning was the most important issue.

- Unjustified pay will come under intense scrutiny say 88% of respondents representing $24 Trillion AUM. Respondents want to see better alignment between pay and performance. This is up from 75% last year. 61% of respondents representing $17 Trillion AUM suggest the CEO pay ratio disclosure will gain a lot of attention and be a useful statistic. The rigor of incentive schemes will also come under the microscope according to 46% of respondents managing $17 Trillion AUM.

- Investor collaboration around broader Annual Shareholder Meeting topics will increase exponentially. Nearly two thirds of respondents representing $13 Trillion AUM stated collective engagement and collaboration with other shareholders related to annual general meetings is a powerful tool to help influence change.

- Institutional Investors are increasingly likely to support a credible activist story say 61% of respondents representing $18 Trillion AUM. Poor capital allocation is a key concern according to 54% of respondents representing $19 Trillion AUM. The Board’s role in capital allocation will receive greater scrutiny.

- 93% of respondents representing $30 Trillion AUM confirm ESG integration into investment decision making is either fully integrated or progressing towards full integration. Respondents want to see companies better prepared to provide more detail around ESG risks and opportunities.

- Investors seek enhanced disclosure around materiality and sustainable metrics linked to long-term business strategy say 71% of respondents representing $20 Trillion AUM. There is more demand to understand a company’s purpose and boards should provide more detail in the annual report and in particular, corporate governance statements.

What these answers tell us is that respondents to the Morrow Sodali survey are looking beyond compliance and one-size-fits-all voting policies. Instead they are seeking specific information from individual portfolio companies that will help them understand the fundamentals of the business and its strategic goals, the value contributed by the board of directors and the links between board policies and decisions, management’s effectiveness and the company’s long-term economic performance. This is good news for companies willing to make these disclosures, as it opens the path to closer relations with investors based on business fundamentals rather than compliance with external standards.

Respondents’ answers to other questions further indicate that they are taking a more individualized approach to portfolio companies and moving away from standardized policy-based box-ticking voting criteria.

The complete publication is available here.

Print

Print