Holly M. Bauer and Adam L. Kestenbaum are partners in, and Bradd L. Williamson is global Co-chair of, the Benefits, Compensation & Employment Practice at Latham & Watkins. This post is based on a Latham & Watkins publication by Ms. Bauer, Mr. Williamson, Mr. Kestenbaum, David T. Della Rocca, and James D.C. Barrall. Related research from the Program on Corporate Governance includes: Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here); and The Growth of Executive Pay by Lucian Bebchuk and Yaniv Grinstein.

2018 brings significant changes to the executive and director compensation landscape due to the passage of H.R. 1—informally known as the Tax Cuts and Jobs Act [1] (the TCJA)—the implementation of the CEO pay ratio disclosure rules, and a surprising court decision in Delaware regarding director compensation. These developments, along with the perennial proxy season compensation considerations, warrant new or renewed attention and may affect proxy disclosure or annual meeting agenda items.

Key Items That May Affect a Company’s Proxy Statement

CEO Pay Ratio Rules

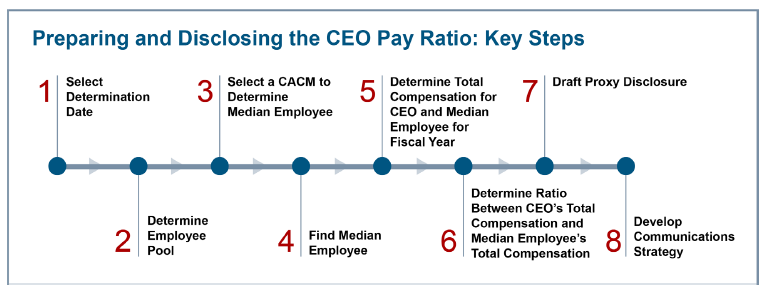

The Securities and Exchange Commission’s (SEC’s) final rules requiring companies to disclose their CEO and median compensated employee pay ratio are effective for compensation paid in fiscal years beginning on or after January 1, 2017. As a result, the CEO pay ratio disclosure is required for most proxies filed in 2018. [2] In order to help those companies that do not yet have this process down to a science, or perhaps have not yet started the process, the following is a brief overview of the key steps to take when preparing and disclosing the CEO pay ratio.

- Select Determination Date. The determination date for purposes of defining the employees to be included in the analysis must be within the last three months of the most recently completed fiscal year.

- Determine Employee Pool. All full-time, part-time, seasonal, or temporary worldwide employees (independent contractors excluded) as of the determination date should be included. There are limited exceptions for a de minimis number of non-US employees (5% of workforce), and compliance with local data privacy laws.

- Select a Consistently Applied Compensation Measure (CACM) to Determine Median Employee. Any compensation measure reasonably reflecting annual compensation may be used. Examples include Form W-2 or equivalent compensation; cash compensation plus equity; total cash compensation; base compensation; and summary compensation table total compensation. Issuers can rely on existing internal records, such as payroll or tax records (even if such records do not include every element of compensation, such as equity awards widely distributed to employees). Certain technical requirements related to the period of time over which the CACM may be measured and annualizing compensation will apply.

- Find Median Employee. Reasonable estimates, assumptions, and methodologies may be used, including statistical sampling.

- Determine Total Compensation for CEO and Median Employee for Fiscal Year. This determination must be made in accordance with summary compensation table rules (subject to certain limited exceptions).

- Determine Ratio Between CEO’s Total Compensation and Median Employee’s Total Compensation. This calculation represents the mathematical relationship between the two compensation amounts and may be expressed as a ratio or in narrative form.

- Draft Proxy Disclosure. In general, less is more. While the process for determining the CEO pay ratio may seem daunting, the SEC rules require very little in the way of the actual disclosure. The disclosure must include a brief description of:

- The total annual compensation of the CEO and the identified median employee (as discussed above) determined in accordance with the summary compensation table rules

- The ratio of the two (expressed as a ratio or in narrative form)

- The methodology used to identify the median employee

- Any material assumptions, adjustments, and estimates usedWith respect to the location of the disclosure, it is not required to appear in the Compensation Discussion and Analysis (CD&A). The disclosure will likely most often appear at the end of the tabular executive compensation disclosure. The SEC acknowledges that the pay ratio disclosures may involve a “degree of imprecision”; therefore, an issuer may state in its disclosure that the pay ratio is a reasonable estimate calculated in a manner consistent with the final pay ratio rules.

- Develop Communications Strategy. Consider various constituents when drafting the CEO pay ratio disclosure, including the company’s employee base. Some constituents will be most interested in the actual ratio itself, while others may be more interested in the actual amount of the median employee’s total compensation. In some cases it may be appropriate to provide additional context for disclosure, such as a description of the workforce, an explanation of unusually high CEO total compensation (e.g., a special purpose equity award), or inclusion of supplementary disclosure regarding only US employees or only full-time employees.

Complete the CEO pay ratio analysis and draft disclosure for 2018 filings in a timely manner.

Director Compensation Disclosure and Potential Plan Amendments

The Delaware Supreme Court recently issued an opinion which continues the trend of enabling plaintiffs to sue companies for their director compensation more easily. The decision, in In re Investors Bancorp, Inc. Stockholder Litigation, Case No. 169 [3], in reversing the decision of the Court of Chancery, found that equity awards granted to the directors of Investors Bancorp were “self-interested decisions” and must be reviewed under the “entire fairness” standard (as opposed to the business judgment rule), even where stockholders had previously approved the plan under which the directors received such awards and such plan contained a specific stockholder-approved limit on the aggregate awards that could be made to directors under the plan (30% of all shares available for awards under the plan).

Under Delaware law, a decision of a board of directors generally receives the protection of the business judgment rule and will be subject to challenge only if a plaintiff can show that the decision had no rational business purpose. If, however, a stockholder rebuts the business judgment standard by, for example, alleging facts that lead to a reasonable inference that the directors breached their fiduciary duties in granting director equity awards, then the court will review such decision under the higher standard of “entire fairness.” The higher standard means the court will determine whether the decision was made based on fair dealing and at a fair price, unless the decision was “ratified” by the company’s stockholders.

Delaware courts have consistently refused to treat stockholder approval of an equity plan as ratification of director equity awards if the challenged equity plan did not include meaningful non-employee director award limits. However, Delaware courts have failed to clearly delineate what constitutes “meaningful” in this context. [4] In Investors Bancorp, the Court of Chancery initially dismissed the case because the plan contained “meaningful, specific limits” on awards to directors under the plan, and the awards granted by the board members to themselves were consistent with those limits. The Delaware Supreme Court disagreed, and found that because the directors retained discretion to determine the specific awards to directors under the plan, even within the confines of a stockholder-approved limit, the stockholder approval of the plan limits was insufficient to support a stockholder ratification defense.

Prior to the Investors Bancorp decision, a general annual limit on awards that is not targeted at non-employee directors and that is far greater than any conceivable reasonable annual pay amount for directors clearly did not provide sufficient specificity for a stockholder ratification defense. [5] After the Investors Bancorp opinion, it is equally clear that there is no absolutely safe approach short of stockholder approval of specific awards or a self-executing formula plan where there is no director discretion over individual awards.

The Investors Bancorp opinion, while based on allegations of unusual underlying facts, highlights the vulnerability that many US public companies face with respect to potential claims alleging breaches of fiduciary duty in connection with director compensation. While each company’s situation will be unique, companies may wish to consider taking some action in order to reduce the risk of these types of derivative claims.

Review Existing Director Compensation Arrangements

Companies should review their director compensation program and practices, including the process for determining director compensation, any applicable limits on director compensation, a comparison of director compensation (both cash and equity) against the company’s compensation peer group, and proxy disclosure regarding the process for determining and amounts of director compensation. By proactively reviewing current director compensation practices, a company will be best-positioned to determine what, if any, modifications to its director compensation practices and governing documents may be appropriate in light of the current litigation environment. Working with the company’s compensation consultant to complete this review is advisable.

Consider Potential Plan Changes

If, after weighing the potential litigation defense and deterrent benefits of changes to their director compensation program against the benefits of maintaining flexibility in its compensation arrangements, a company determines that changes to its director compensation program are warranted, it may wish to consider:

- Stockholder Approval of Formulaic Director Awards. The most protective measure a company may take to insulate itself and its directors from attacks on director compensation practices is to have its stockholders approve a director compensation plan prescribing the precise terms of formulaic equity awards, or to include such formulaic equity awards in the company’s omnibus equity plan. A standalone directors’ plan, however, provides several specific benefits, including (1) maintaining a distinct framework for a company’s director compensation, and (2) allowing for clear and distinct proxy disclosure and a more straightforward process for stockholder approval of director compensation. [6]

- Stockholder Approval of Specific Director Compensation Limit. Companies should consider adding (or continuing to include) specific annual limits on total director compensation under stockholder-approved compensation plans, most typically their equity compensation plans. Companies can usually amend such plans to include director limits without obtaining stockholder approval. [7] However, in light of the weight the Delaware courts have placed on stockholder ratification of director compensation awards in current decisions, adding limits without stockholder approval will not provide failsafe protection against stockholder claims in Delaware so companies will need to reevaluate the utility of these types of limits. Companies will want to weigh carefully the costs and benefits of submitting plans for stockholder approval, and may also wish to consider seeking such approval in conjunction with other amendments, such as an increase in the share pool, as opposed to separately.

- Taking a Wait and See Approach. While an annual limit on director compensation as described above may reduce litigation risk, the Investors Bancorp decision indicates that an annual limit may not insulate companies from lawsuits challenging director pay under the entire fairness standard. To the extent director compensation is aligned with or is below the average of the applicable peer group, companies may determine that immediate action is unwarranted and may delay stockholder approval of director limits to the next meeting in which approval is sought for other reasons. Companies not incorporated in Delaware may have particular incentive to take a wait and see approach to see whether the reasoning employed in the Investors Bancorp decision is adopted by courts in other states. Such decision must be made on a company-by-company basis.

Regardless of whether any plan changes are determined to be advisable, in light of the increased focus on director compensation that cases such as Investors Bancorp may engender, it will be more important than ever for companies to include clear disclosure of their director compensation. Companies should provide their reasoning in establishing the programs and amounts, as well as the relationship of such compensation to the company’s peers and any material variances from the median of such peers, in their proxy statement and other filings. While disclosure alone will not ensure the application of the business judgment rule to director compensation decisions, fulsome and thoughtful disclosure may help deter claims by plaintiffs or, in the event a claim is brought, rebut allegations made by plaintiffs.

Section 162(m) Disclosure and Potential Plan Amendments

The TCJA repealed the qualified performance-based compensation exception under Section 162(m) of the Internal Revenue Code (the Code) effective for tax years beginning on or after January 1, 2018, subject to limited transition relief. [8]

The elimination of this exception provides US companies with the opportunity to reevaluate their performance-based compensation programs without the confines of the requirements of this performance-based compensation exception, as described below. In addition, the elimination of this exception will have proxy disclosure implications.

Disclosure Considerations and Action Items

SEC disclosure rules require US public companies to disclose and discuss the “material elements” relating to seven features of their compensation plans in the CD&A section of their annual proxy statements. Subsection (b) of Item 402(b)(2) states that the material information “may include” the impacts of the accounting and tax treatment of the compensation. Most public companies have adopted the practice of including a brief description of the rules of Section 162(m) and Section 409A of the Internal Revenue Code (relating to the taxation of deferred compensation) and the relevant accounting rules in their CD&As, stating that while these matters are taken into consideration by the compensation committee in setting pay, they are only factors and not dispositive, and noting that their compensation committees reserve the discretion to pay compensation that is not deductible.

At a minimum, companies should review their existing proxy disclosure related to Section 162(m) and revise it accordingly in light of the TCJA. In particular, companies should consult with outside counsel to discuss the SEC’s disclosure requirements relative to the accounting and tax treatment of the company’s compensation programs, and what constitutes material information in respect of those requirements. Whether companies will wish to affirmatively address the impact of the TCJA on their compensation programs will depend on the company’s particular facts and circumstances and, potentially, historical disclosure.

Further, companies that have previously included proxy disclosure related to Section 162(m) (such as in proposals in past years to approve equity plans or cash bonus plans, pursuant to which qualified performance-based compensation could be awarded) should consider several factors. For example, they may wish to consider whether current disclosure is required in cases where 2018 compensation decisions or awards will vary from the terms of those plans and such previous disclosure, even if these actions are permitted under the terms of those plans. Under certain circumstances, current disclosure on a Form 8-K may be warranted. In others, proxy disclosure of such changes may suffice. Carefully drafted, protective disclosure, reserving the right to adjust compensation programs in light of the TCJA and the fact that the qualified performance-based compensation exception no longer applies, could help to avoid any potential claims by stockholders that previous disclosure implied a course of action from which a company was not expected to vary.

Plan Amendments

As discussed in this post, with the passage of the TCJA and the corresponding changes to Section 162(m), US public companies should consider the impact of those changes on the design and implementation of their performance-based compensation plans and arrangements. In the current environment of engaged stockholders and influential proxy advisory firms, performance-based compensation clearly will remain a key component of executive compensation programs. That said, programs may now be designed and implemented without regard to the procedural requirements of Section 162(m), subject to any accounting considerations.

Equity and incentive plans typically contain extensive provisions designed to ensure that awards can qualify as performance-based compensation for Section 162(m) purposes. In order to ensure that the provisions of any plan documents do not prevent any desired changes to the design of performance-based compensation, companies should carefully review their plan documents to determine the extent to which any provisions included in those documents that were specifically related to the performance-based compensation exception under Section 162(m) must be removed to permit any changes. Alternatively, companies could amend these plans to remove these provisions as a housekeeping matter to bring the plans into line with the TCJA. Whether stockholder approval of any such amendments is required will largely depend on the equity plan’s amendment language and applicable national stock exchange rules on equity plans, though many amendments should not require stockholder approval. How the proxy advisory firms will view proxy proposals to amend plans to remove Section 162(m) provisions remains unclear.

Companies will also want to be mindful that the scope of the Section 162(m) transition rules under the TCJA remain unclear at present and that certain (generally material) amendments may cause a loss of the ability to rely on the transition relief. In addition, state law may vary from federal law on the deductibility of executive compensation. Companies should also consider any continuing rules under state law before they make adjustments to existing executive compensation arrangements.

Review existing proxy disclosure regarding Section 162(m) and consider what changes or new disclosure is advisable after consulting with outside advisors. Companies should confer with their legal, tax, and accounting advisors to determine whether Section 162(m) provisions can and should be removed, whether stockholder approval is required, and how any contemplated actions may affect applicable transition relief.

Proxy Advisory Policy Updates

Institutional Shareholder Services (ISS) and Glass Lewis recently released updates to their 2018 voting policies (along with corresponding ISS FAQs), effective for all companies with annual meetings on or after February 1, 2018. Set forth below is a summary of certain compensation-related policy changes and updates that companies should consider going into the 2018 proxy season.

Consequences for Excessive Non-Employee Director Pay

In response to increasing interest in board compensation and an effort to hold “directors accountable who approve excessive non-employee director pay without compelling rationale,” ISS has introduced a new policy. The policy provides for negative vote recommendations for any compensation committee members or other board members who are responsible for setting or approving director compensation if ISS establishes a “pattern of excessive non-employee director pay” in two or more consecutive years without a compelling rationale or other mitigating factors. To determine whether non-employee director compensation is “excessive,” ISS will compare individual non-employee director pay totals to the median of all non-employee directors at companies in the same index and industry. Any non-employee directors paid above the top 5% of all comparable directors (deemed by ISS to be the “extreme outliers”) may be found to have received “excessive” compensation. Because this new guideline is triggered by a “pattern,” it will not impact vote recommendations in 2018. Negative recommendations will only be triggered beginning in 2019 upon looking back to 2018 director pay approvals to establish if a consecutive pattern exists.

Update to Pay for Performance Methodology

In connection with its pay-for-performance analysis, ISS will now consider, as part of its quantitative evaluation, the “Relative Pay and Financial Performance Assessment” or (FPA) test. ISS introduced the FPA test in its 2017 voting policy updates as part of its qualitative, second-level assessment. The FPA test looks at a company’s ranking (within an ISS selected peer group) of CEO total pay and company financial performance over a three-year period relative to three or four metrics (depending on the company’s industry). For further details regarding ISS’ quantitative metrics, please refer to Latham’s February 9, 2017 post.

Equity Plan Proposals

ISS made some minor adjustments to its methodology for the review of equity plan proposals for the 2018 proxy season. Perhaps the biggest adjustment is that a passing score for companies subject to the S&P 500 scoring model will increase from 53 points out of 100 to 55 points out of 100. ISS also now provides that only full credit or no credit will be awarded in four areas (change in control vesting, holding requirements, CEO vesting requirements, and discretionary vesting authority). ISS has also provided that, while it will generally follow its equity plan scorecard model in evaluating equity plan proposals, ISS may recommend against the proposal despite a passing score in exceptional cases, if the proposed amendments as a whole represent a substantial diminishment to stockholders’ interests.

Say-on-Pay

ISS now provides that it will recommend a vote against or withhold from the members of the compensation committee and potentially the full board if a company fails to include a say-on-pay or say-when-on-pay proposal when required under SEC requirements or a company’s declared say-on-pay frequency.

Pledging

ISS will now recommend against the members of the board committee that oversees risks related to pledging, or the full board, if ISS determines that a significant level of pledged company stock by executives or directors raises concerns. ISS will consider such factors as a disclosed anti-pledging policy, the magnitude of the pledged stock, disclosure that ownership or holding requirements do not include pledged stock, and progress towards reducing the magnitude of pledging over time.

CEO Pay Ratio

ISS has informally stated that CEO pay ratios will not have any impact on ISS analysis or vote recommendations in 2018. However, ISS will include the information in its reports. Glass Lewis has informally stated that it will take a similar approach to CEO pay ratios in 2018.

Companies should consider how ISS and Glass Lewis voting policies may affect their proxy proposals. Enhanced disclosure and additional planning prior to a proxy filing to counter a potential adverse recommendation may be appropriate in certain cases.

Equity Plan Matters

Companies that are already planning to include equity plan proposals on their annual meeting agendas during 2018 to obtain additional shares or for other reasons will also want to consider the following items when crafting their new or amended equity plans and the related proposals:

Section 162(m) Provisions

As described in more detail above, companies should determine whether any changes are needed or desired to plan documents containing provisions related to the performance-based compensation exception to Section 162(m) and whether stockholder approval of any such changes would be needed. Companies should also review and potentially update equity plan prospectuses if the prospectuses include tax disclosure regarding Section 162(m). With the repeal of the performance-based compensation exception to Section 162(m), reapproval of plans intended to qualify under such exception will no longer be required every five years or after the expiration of applicable transition periods.

Director Compensation Provisions

As described in more detail above, companies may wish to include specific director compensation limits or formula director awards in their equity plans to address increased risk of legal attacks on director compensation in their equity plans. Companies should also carefully review any disclosure in their equity plan proposals related to potential awards to directors.

Share Withholding Under Equity Awards

Effective for annual reporting periods beginning after December 15, 2016, the Financial Accounting Standards Board adopted rules that permit companies to net settle equity awards for withholding purposes above the minimum statutory tax rate (up to the maximum statutory tax rate) without subjecting the awards to liability (mark-to-market) accounting. Companies with equity plan proposals going before stockholders for other reasons should consider amending their equity plans and current award agreements, and approving new form award agreements, to provide additional flexibility for share withholding above the minimum statutory rates. Companies without other equity plan proposals in 2018 generally may undertake amendments to provide for share withholding in excess of the minimum statutory rates without stockholder approval—unless plan language provides otherwise.

Clawbacks

At this time, the SEC’s proposed rules on clawbacks under Dodd-Frank have still not been finalized (and it does not appear that they will be finalized any time soon). In order to allow companies to claw back compensation under possible Dodd-Frank final clawback rules, or pursuant to misconduct under other clawback policies that might be adopted in the future, companies that have not already done so should consider adding provisions in their incentive compensation plans and agreements providing that all awards made thereunder are subject to such clawback policies.

Plan Expiration Dates

Companies should review their equity plans to determine whether the plans are subject to expiration in the coming year, and whether action needs to be taken at the 2018 annual meeting to extend the plan or adopt a new plan prior to any such expiration.

Companies should carefully evaluate a number of plan provisions if an equity plan proposal is on their annual meeting agenda.

Other Proxy Season Reminders

2017 Say-on-Pay Vote Response

As always, public companies that conducted a say-on-pay vote in 2017 should consider the results and determine what, if any, changes they should make to executive compensation programs and disclosure. Many companies, particularly those that received less than 70% support, have likely been engaging with stockholders and reviewing their compensation programs for some time. ISS, in its most recent guidelines, now recommends even more fulsome disclosure of the company’s response to a say-on-vote of less than 70%, including disclosure related to stockholder outreach, concerns voiced by stockholders, and meaningful company actions taken to address stockholder concerns. The authors of this post believe that, in most cases, companies in this situation will be able to address the ISS recommendations in the context of their disclosure—describing what they heard from stockholders, how they responded, and why.

Companies, particularly those that received less than 70% support in their most recent say-on-pay vote, should disclose their response to this vote.

Emerging Growth Companies Must Confirm Continuing EGC Status

An emerging growth company (EGC) generally must hold a say-on-pay vote no later than one year after it ceases to qualify as an EGC. However, if a company has been an EGC for less than two years after its initial public offering (IPO), the company has up to three years after the IPO to hold the vote, though a say-when-on-pay vote may need to occur earlier. For EGCs, the say-when-on-pay vote is required as early as the first annual meeting after the company ceases to be an EGC, regardless of when the company ceased being an EGC following its IPO. Keep in mind that companies that lose EGC status also will need to revise the compensation disclosure in their proxy statements to incorporate a full CD&A (as opposed to complying with the reduced compensation disclosure requirements that apply to EGCs). In addition, EGCs are required to include CEO pay ratio disclosure related to compensation during the first year after exiting EGC status. For example, if a company ceases to be an EGC on December 31, 2016, it will be required to include CEO pay ratio disclosure in its proxy statement filed in 2018 that includes 2017 compensation disclosure.

Companies that are or have been EGCs should reconfirm current status and potential exit date to ensure timely compliance with rules that apply once EGC status is lost.

Say-on-Pay and Say-When-on-Pay Votes

Under Dodd-Frank, public companies generally are required to hold a non-binding, advisory say-when-on-pay vote at least every six years, beginning in 2011, requesting stockholder advice as to whether say-on-pay votes should be held annually, biennially, or triennially. Accordingly, companies that last submitted say-when-on-pay votes to their stockholders in 2012 will need to do so again in 2018. Companies will want to review and confirm whether a say-on-pay or say-when-on-pay proposal is required in this year’s proxy.

Confirm whether one or both proposals are required in 2018. If a say-on-pay vote is required, consult with outside advisors regarding likelihood of adverse recommendations by proxy advisory firms.

Compensation Advisor Independence

As has been required under Dodd-Frank since 2013, compensation committees must consider the six independence factors set forth in the New York Stock Exchange’s and Nasdaq’s listing standards prior to selecting or receiving advice from any compensation consultant, legal counsel, or other adviser who provides advice to the compensation committee.

Ensure compensation advisor independence analysis is undertaken prior to retention of new compensation advisors. Best practice is to perform such analysis on an annual basis.

Compensation Risk Assessment

Compensation committees should review management’s evaluation of the company’s compensation policies and practices, and management’s assessment of whether the policies and practices encourage risk taking that is reasonably likely to have a material adverse effect on the company, and the company’s proxy disclosure regarding such “pay risk.” In the current environment and in view of recent events, in making these pay-risk assessments and reviews, management and committees should keep in mind that pay plans for rank-and-file employees, as well as senior employees, need to be reviewed, and that risks to a company’s reputation can have a material adverse effect.

Ensure compensation risk assessment is undertaken on an annual basis and review SEC disclosures, if any.

Review Compensation Committee Membership

Compensation committee members may no longer need to qualify as “outside directors” for purposes of Section 162(m), although the national stock exchanges and securities laws still impose requirements on compensation committee member qualifications. However, under the Section 162(m) transition relief under the TCJA, ensuring compensation committee members satisfy the Section 162(m) requirements until any grandfathered awards are certified and paid may be necessary. Companies should review the qualifications of their compensation committee members under stock exchange and securities law requirements and reconfirm that their proxy disclosure on such points is still accurate.

Review proxy disclosure to confirm that it appropriately reflects any changes to a company’s compensation committee member requirements in light of Section 162(m) changes under the TCJA.

The Bottom Line

In 2018, more than ever, US public companies will need to be on top of the changing executive compensation rules when preparing their proxy statements and annual meeting agendas. Companies should consult with their legal, tax, and accounting advisors to confirm compliance with new disclosure requirements, such as CEO pay ratio disclosure, as well as existing compensation disclosure requirements that will require continued attention in 2018. In addition, the TCJA and recent case law create a need to review proxy disclosure more carefully and potentially to take action with respect to equity plan documents and other compensation arrangements.

Endnotes

1The TCJA is Public Law No. 115-97. Shortly before final Congressional approval of the TCJA, the Senate parliamentarian ruled that the previously attached short title, the “Tax Cuts and Jobs Act,” violated procedural rules governing the Senate’s consideration of the legislation. Accordingly, the TCJA no longer bears a short title, although commentators likely will continue to refer to it as the Tax Cuts and Jobs Act.(go back)

2The CEO pay ratio rules apply to all issuers other than emerging growth companies, smaller reporting companies, foreign private issuers, Multijurisdictional Disclosure System filers, and registered investment companies.(go back)

32017 WL 1277672 (Del. Sup. Ct. Dec. 13, 2017).(go back)

4Calma v. Templeton, C.A. No. 9579-CB (Del. Ch. April 30, 2015); Seinfeld v. Slager, 2012 WL 2501105 (Del. Ch. June 29, 2012); Sample v. Morgan, 914 A.2d 647 (Del. Ch. 2007).(go back)

5Calma v. Templeton, C.A. No. 9579-CB (Del. Ch. April 30, 2015). For additional analysis of the Calma decision, please refer to Latham’s May 28, 2015 Client Alert.(go back)

6Equity plans solely for non-employee directors will generally not be subject to the “equity plan scorecard” analysis utilized by Institutional Shareholder Services, or ISS, for “omnibus” equity plans. See ISS’ 2018 U.S. Proxy Voting Guidelines (available at http://www.issgovernance.com/file/policy/latest/americas/US-Voting-Guidelines.pdf) for more information regarding the plan features necessary to receive a positive ISS recommendation.(go back)

7The authors of this post recommend that the structure and amount of such limit be carefully reviewed with the company’s compensation consultants and legal counsel to assure it is a meaningful limitation on director awards. Specific consideration should be given to the scope of such limit (e.g., whether it takes into account both cash and equity compensation) and the method of calculating compensation for purposes of such limit (e.g., a specific number of shares or specified dollar amount).

The authors of this post generally recommend that the limits encompass both equity and cash compensation.(go back)

8The TCJA contains transition relief for certain Section 162(m) performance-based compensation arrangements pursuant to “written binding contracts” in effect as of November 2, 2017, so long as such arrangements are not “modified in any material respect.” The scope of the transition relief and its applicability to various existing arrangements remains unclear and companies should generally avoid amending outstanding agreements and arrangements pursuant to which compensation would be payable to covered employees until IRS guidance is issued unless the loss of any potential grandfathering is not problematic.(go back)

Print

Print