Matthew Goforth is Senior Governance Advisor at Equilar, Inc. This post is based on an Equilar publication by Mr. Goforth.

Institutional Shareholder Services (ISS) published annual updates to its proxy voting guidelines in November, followed by a set of preliminary FAQs offering further clarity around changes the shareholder advisory firm will implement in its voting recommendations next year. These much-anticipated updates will apply to U.S. public companies* holding shareholder meetings on or after February 1, 2018. ISS released changes to its assessments across a spectrum of governance areas, but this blog will focus on board governance matters, including diversity and compensation. Follow-up installments will address changes to ISS’ guidelines related to Say on Pay (quantitative pay-for-performance screens and shareholder engagement), equity plan scorecard (EPSC), and environmental/social/governance (ESG) shareholder proposals.

ISS Adds Diversity and Pay to the Board Governance Mix

ISS says:

“Boards should be sufficiently diverse to ensure consideration of a wide range of perspectives. [… ] [ISS will] highlight boards with no gender diversity. However, no adverse vote recommendations will be made due to any lack of gender diversity.”

The data show:

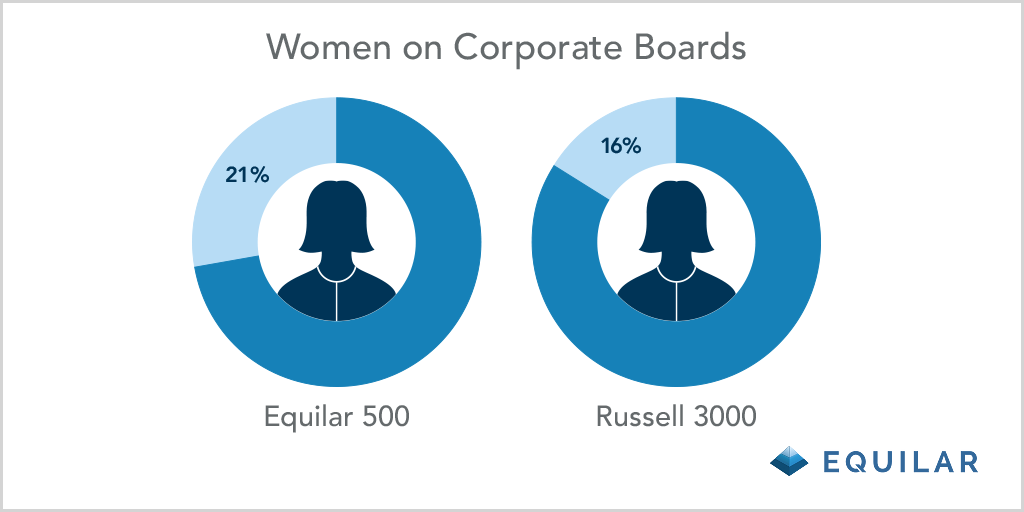

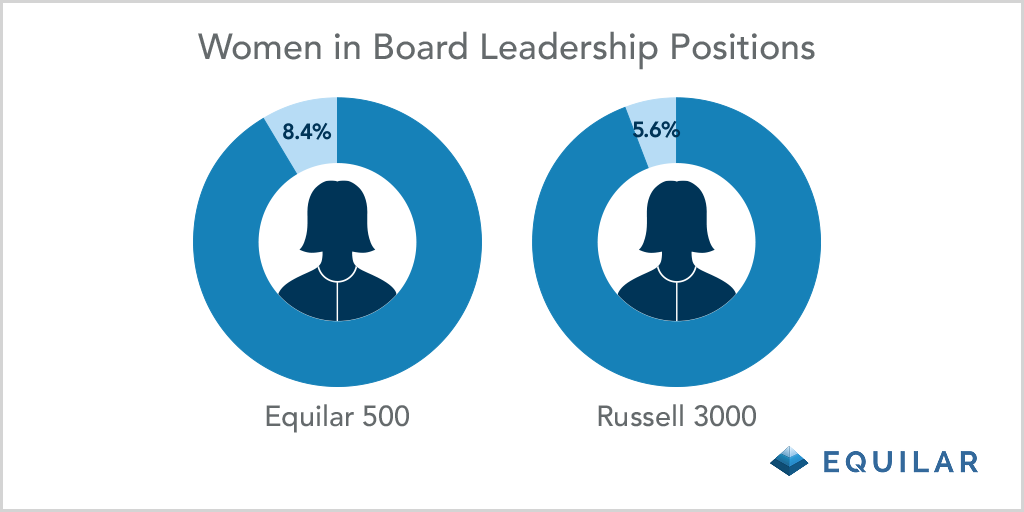

The percentage of board seats occupied by women at Russell 3000 companies moved from 12.3% in 2013 to 16% in 2017—a gain of nearly one percentage point per year—according to the Equilar report Board Composition and Director Recruiting Trends, featuring commentary from KPMG’s Board Leadership Center and Semler Brossy Consulting Group. Between 2016 and 2017, more than 100 companies added a woman to the board where there were previously none, and three additional boards reached gender parity in Q3 of 2017, as reported in the Equilar Gender Diversity Index (GDI). Nonetheless, only 5.6% of chair or independent lead director positions on Russell 3000 boards were occupied by women, and women were more likely to serve on multiple boards than their male colleagues. Over 600 Russell 3000 boards didn’t include a woman at the end of 2017’s third quarter.

In a separate study, Equilar found that about 45% of large-cap companies disclosed the gender diversity of their boards, while about 40% disclosed ethnic diversity. Nearly 60% included photos of directors along with their biographies in annual proxy statements.

Additional commentary:

According to PwC’s 2017 Annual Corporate Directors Survey, 46% of directors think that at least one fellow director should be replaced, a percentage that climbed to 53% among respondents with tenure of two years or less. Over 90% of surveyed directors stated that diversity added unique perspectives to the boardroom, while only 27% thought there was too much focus on gender diversity in the current governance universe.

While ISS stated that it will not take specific action with respect to voting recommendations, some of the largest institutional investors have already taken their voting guidelines a step further when it comes to gender diversity. State Street Global Advisors made headlines earlier this year with its “Fearless Girl,” a bronze statue facing off with the Wall Street “Charging Bull,” and vowed to scrutinize boards without women directors. Other institutional asset managers like BlackRock, Vanguard and CalPERS issued their own memos stating intentions to scrutinize and potentially vote down boards lacking gender diversity. Both State Street and BlackRock voted against some boards that lacked diversity this year, sending a message that these guidelines will carry weight. Furthermore, organizations including CalPERS/CalSTRS Diverse Director Datasource have joined the Equilar Diversity Network (EDN), which has registered over 3,000 diverse board-ready candidates in its initial year, according to Equilar BoardEdge data.

Notably, Glass, Lewis & Co.’s proxy voting updates stated it will begin recommending against directors on the nominating and governance committees at companies without women on the board beginning in 2019.

Director Compensation

ISS says:

“[ISS will] generally [recommend a] vote against members of the board committee responsible for approving/setting non-employee director compensation if there is a pattern (i.e. two or more years) of awarding excessive non-employee director compensation without disclosing a compelling rationale or other mitigating factors.”

The data show:

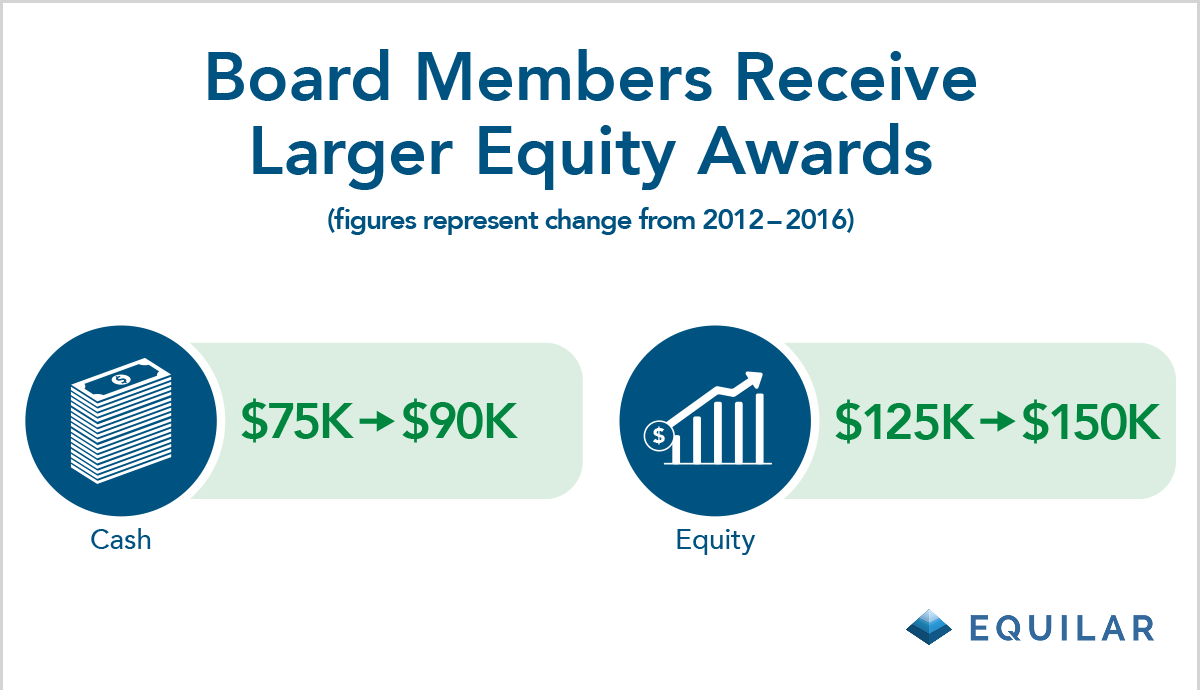

The median retainer for a large-cap board member increased nearly 20% in five years, as cash and equity awards totaling $205,000 in 2012 increased to $245,000 in fiscal year 2016, according to the Equilar report Director Pay Trends, featuring commentary from Meridian Compensation Partners. Equity continues to weigh more heavily in the director pay mix, accounting for over 60% of the median retainer in 2016.

Additional commentary:

While many board members receive additional compensation for serving in leadership and committee roles, the majority of the average director’s pay comes in annual equity-based grants that vest after one year (typically on the date of the following year’s annual shareholder meeting). To avoid scrutiny of “excessive pay” by shareholders, many boards have added non-employee director compensation limits to their companies’ equity incentive plans, typically doing so by capping equity awards or total compensation at two to three times the annual rate. Director limits have been set at a median $500,000 according to an Equilar study of large-cap equity incentive plans.

Director compensation has been in the spotlight a number of times over the last couple of years as shareholders brought suits against boards alleging excessive pay. Courts refused to allow boards review under the “business judgment rule” and instead imposed the heightened “entire fairness” standard given the level of self-interest involved when a board sets its own compensation. Since decisions ratified by shareholders are subject to the business judgment rule, boards began inserting “meaningful limits” to non-employee director compensation in shareholder approved equity incentive plans in ever greater numbers.

In an example of limits working in a corporate issuer’s favor, the Delaware Chancery Court dismissed a case brought against Investors Bancorp for alleged excessive director pay in April of 2017 explicitly because shareholders had approved its equity incentive plan that contained director-specific limits on awards. The grants made to the Investors Bancorp board totaled about $2 million per director, which came in under the shareholder approved limit.

Although shareholder focus on director pay appears to have simmered, ISS nonetheless added additional scrutiny of director pay into its evaluation of committee members that set compensation for the board.

*Updates to the Americas’ voting guidelines also included Canadian and Brazilian companies.

Print

Print