Subodh Mishra is Executive Director at Institutional Shareholder Services, Inc. This post is based on an ISS Analytics publication by Kosmas Papadopoulos, Associate Director at ISS Analytics.

[On Thursday, November 23], the United States celebrates Thanksgiving, a holiday that has roots across many cultures in celebrating a bountiful harvest. And so we thought it fitting to take this week to appreciate the year’s harvest of advances in corporate governance that companies around the world have made since the beginning of the year. While issuers and investors no doubt have their plates full (pun intended) with more complex and numerous governance topics to consider, they have plenty of reasons to cherish the positive changes resulting from their labors throughout the past year.

In our effort to identify reasons to give thanks in the corporate governance world, we reviewed ISS’ Governance QualityScore factors for four select markets (the United States, Canada, United Kingdom and Australia). In this assessment, we look at net improvement in each governance factor by counting the number of companies where practices improved and subtracting the number of companies whose practice deteriorated for a given factor. For example, in the S&P 500, 104 companies increased their proportion of non-executive directors with tenure of less than 6 years, while 51 companies saw the percentage of such board members decline. As such, the S&P 500 universe experienced a net improvement in board refreshment of 53 companies since the beginning of the year.

Gender Diversity Takes the Cake

In the U.S., Canada and the United Kingdom, gender diversity ranks consistently among the top factors that showed improvement since the beginning of the year. In the U.S., a net of 18 percent of Russell 3000 companies showed an increase in the proportion of women on the board. The trend can largely be attributed to an increasing number of asset managers and asset owners publicly declaring board diversity as a priority issue in their stewardship campaigns. In particular, 2017 marks the first year when all of the three largest U.S. asset managers put board gender diversity on top of their engagement agendas. SSGA adopted a voting policy in March, while Vanguard recently joined the U.S. Chapter of the 30% Club, and BlackRock identified gender diversity as one of its engagement priorities for 2017-2018. The trend will likely continue as more investors embrace gender diversity initiatives.

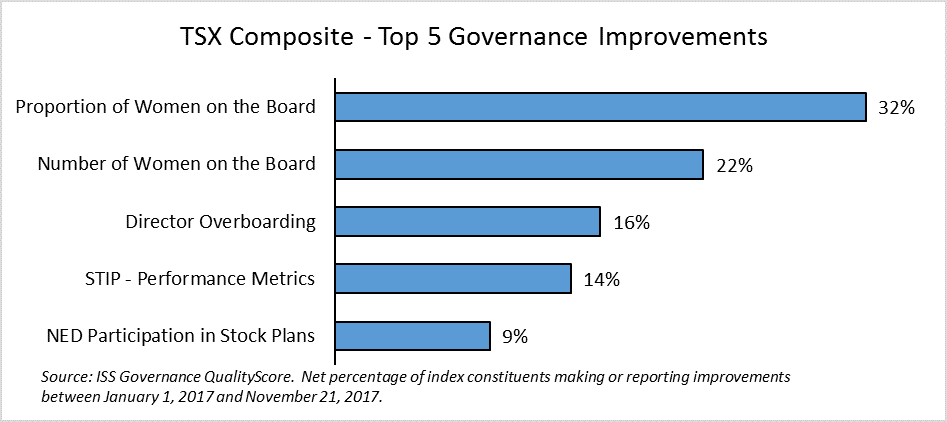

In Canada, the rate of change is even faster with a net improvement of 32 percent of TSX Composite companies showing an increase in the proportion of women on boards. The trend is driven in part by regulation and in part by investor initiatives, per the recent amendments to National Instrument 58-101 to include a Diversity Disclosure Requirement for TSX-listed companies. At the same time, the Canadian Coalition of Good Governance and several large individual asset owners and asset managers have adopted policies to promote gender diversity on boards.

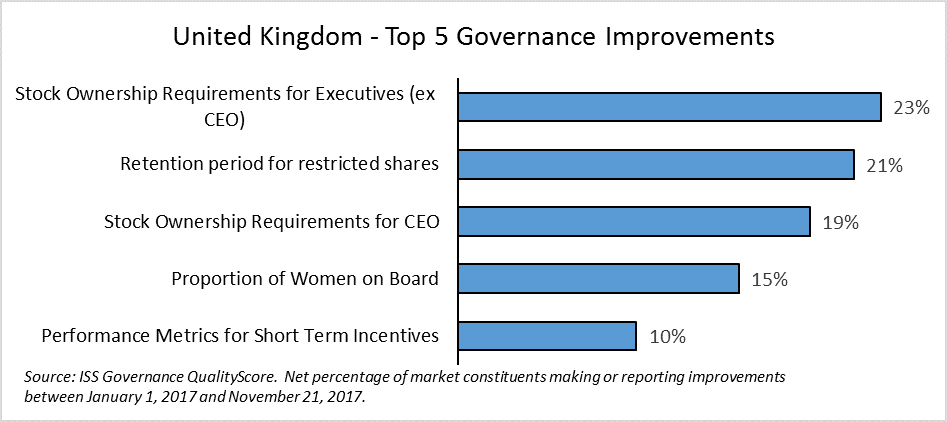

In the United Kingdom, gender diversity ranked as the fourth most-improved factor this year. Gender diversity became a focus item in 2011, when the first target of 25% gender diverse boards for the FTSE 100 was set by the government-backed Lord Davies Women on Boards report. Since then, the objectives have evolved, with the most recent target set at women comprising one-third of FTSE 350 boards by 2020. As such, the trend in the UK market shows that board gender diversity is a long-term issue that will continue to develop as companies reevaluate their board composition priorities (often in response to investor initiatives and regulatory changes).

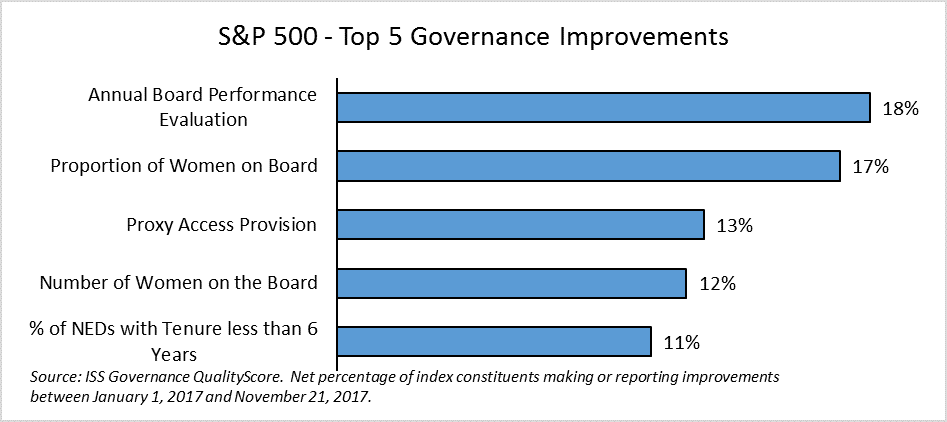

S&P 500 – Board Evaluations, Refreshment and Proxy Access

The highest-ranking improvement factor among S&P 500 companies is the disclosure of enhanced practices for annual board evaluation with a net 18% of companies disclosing an improvement. It is not clear whether companies are actively improving the board evaluation process or if this is merely an improvement in disclosure; either way, this is a welcome change, which will likely lead to more transparency and accountability on board structure. Gender diversity appears at both the second and fourth places on the list, with S&P 500 companies leading the way in the U.S. with bringing more women into the boardroom. As of today, 22.7% of all S&P 500 directorships are held by women. Not surprisingly, proxy access is third on the list due to continuing shareholder campaigns to introduce access rights. As of now, approximately 60 percent of S&P 500 companies have adopted proxy access. And finally, in line with the greater emphasis placed on board composition and board renewal in recent years, the proportion of non-executive directors with a tenure of less than six years is the fourth most improved governance factor.

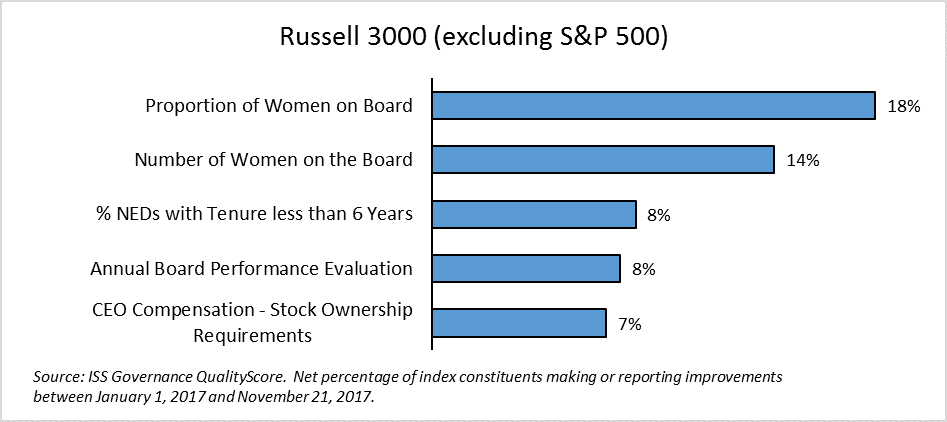

Russell 3000 (ex S&P 500) – Following the Lead of Larger Companies

Governance improvements among smaller U.S. firms were similar to the trends observed in the S&P 500 index. Gender diversity, board refreshment and annual board performance evaluation are on the top four spots, confirming the proposition that best practices established by larger firms tend to trickle down to smaller firms. In addition, stock ownership requirements for CEOs made the top-five list in this segment of the market. Compensation improvements are widely dispersed but fairly common among top improvement factors below the top five for both large and small companies. Such practices include the adoption clawback provisions, vesting periods for stock options, anti-pledging policies and prohibitions of option cash buyouts.

Canada – Advancing on Multiple Governance Fronts

Gender diversity takes top honors in Canada, with strong increases in both the proportion and number of women serving on Canadian boards. Canadian investors have paid significant attention to overboarded directors in recent years, especially given the pervasiveness of a small network of interconnected boards in certain sectors. Greater engagement on the issue appears to lead to positive change, as fewer companies appear to have directors with overboarding concerns. Improved disclosure on performance metrics for short-term incentive plans corresponds with the recent trend of voluntary adoption of say-on-pay votes, which has driven better disclosure on compensation issues. Finally, fewer companies allow for the discretionary participation of non-employee directors in equity-based plans. This trend corresponds to investor expectations to limit such practices and to align director compensation with the long-term interests of shareholders.

United Kingdom – Compensation Leads the Way

In the United Kingdom, improvements to compensation practices dominate the landscape. This trend matches investors’ experience relative to meeting agendas, whereby much of the discussion focuses on the non-binding approval of the remuneration report and the binding proposal on remuneration policy. The most common compensation-related improvements suggest a strengthening of the link between executive compensation and the long-term interests of shareholders. Stock ownership requirements for executives and retention periods for restricted stock awards are meant to improve accountability and protect against short-termism in executive’s decision making. At the same time, better disclosure on performance metrics for short-term incentives aligns with the overall principle of pay-for-performance.

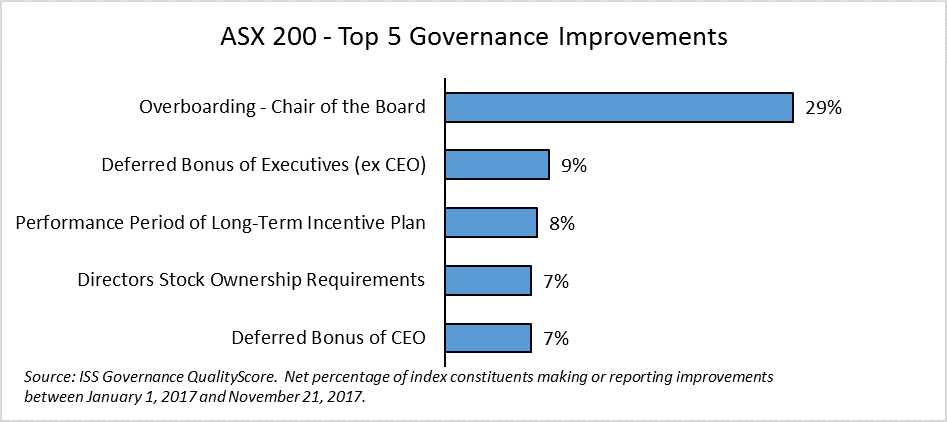

Australia – Fewer Overboarded Directors and Improved Incentive Structures

In Australia, the board-related practice of overboarding stands out as the most improved governance practice of the year. This trend is in line with investor expectations (also reflected in ISS’ most recent policy update) to limit the number of board positions held by directors, especially those in senior leadership such as the Chair of the Board or the CEO. The remaining factors are primarily compensation-related. An increase in the deferral of bonuses coincides with newly proposed rules for increased regulatory oversight of executive remuneration in the banking sector in light of a series of recent scandals. As such, bonus deferral policies may become the norm in future years.

Global Trends – A World of Change

The improvements discussed above are indicative of only some of the major trends observed globally. Overall, improved disclosure requirements and revised codes of best practice drive a sea-change in governance practices in both developed and emerging markets in Europe, Asia and Latin America. In addition, company disclosures on environmental and social issues improve, as corporations, investors and regulators explore better ways to assess the potential risks related to ESG factors. We will monitor changes in governance practices in the future, as policy priorities are bound to evolve further.

Print

Print