Joseph E. Bachelder is special counsel in the Tax, Employee Benefits & Private Clients practice group at McCarter & English, LLP. The following post is based on a column by Mr. Bachelder which first appeared in the New York Law Journal. Andy Tsang, a senior financial analyst with the firm, assisted in the preparation of this post.

In 2017, CSX Corporation, a leading railroad company, paid or committed to pay (subject to certain conditions) over $200 million (including grant-date value of a stock option discussed below) to attract E. Hunter Harrison as its new chief executive officer.

On January 18, 2017, Canadian Pacific Railway Limited announced that Mr. Harrison was resigning as its CEO. The Wall Street Journal reported (after regular trading hours ended) that Mr. Harrison, who is age 72, was “joining with an activist investor in an attempt to shake up management at rival railroad CSX Corp. They are expected to try to put Mr. Harrison in a senior management position at CSX….” [1] The following day, January 19, the price of CSX shares on the Nasdaq Stock Market jumped approximately $8 billion to $42 billion—an increase of 23 percent from $34 billion. As of June 30, CSX’s stock market value had increased over $16 billion to $50 billion, an increase of 47 percent, since the day before the public announcement.

Mr. Harrison, before becoming employed by CSX as its CEO on March 6, had compiled an extraordinary record in leading three major companies in the railroad industry: Illinois Central Railroad Co., Canadian National Railway Company and Canadian Pacific Railway Limited. In each case he applied what is described as “precision railroading” or “precision scheduled railroading.” “Precision railroading” includes, among other things, keeping trains running as close to schedule as possible and making major reductions in “down-time” of rail equipment. Following is a chart, based on a presentation to shareholders of CSX by the activist investor involved, Mantle Ridge LP, showing the reduction in operating costs as a ratio of operating revenues over the periods of time that Mr. Harrison served as an executive of the three railroads noted. [2]

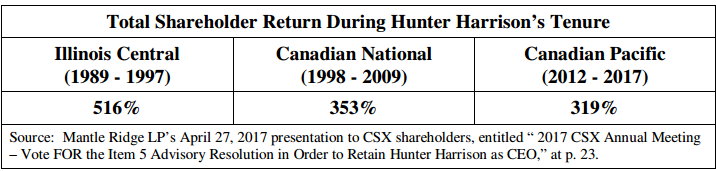

During the same periods of time, the following chart, also based on the Mantle Ridge presentation, shows the total shareholder return for each of the three companies, as follows:

Mantle Ridge was instrumental in Mr. Harrison’s move from Canadian Pacific to CSX. Mantle Ridge was founded by Paul C. Hilal who had been a partner of William A. Ackman at another hedge fund, Pershing Square Capital Management, L.P. In late 2011 Pershing Square acquired a 14 percent stake in the shares of Canadian Pacific and led a proxy fight against Canadian Pacific that was started in January 2012 and settled in May 2012, resulting in, among other things, Pershing Square getting its seven director nominees on the Board on May 17, 2012 and getting its CEO-pick, Mr. Harrison, the CEO role on June 28, 2012. History repeated itself in 2017 as Mantle Ridge became an activist shareholder in CSX and Mr. Harrison became the CEO of CSX.

The departure from Canadian Pacific was costly to Mr. Harrison. He forfeited valuable pension rights and equity awards at Canadian Pacific. The costs to Mr. Harrison in leaving Canadian Pacific apparently totaled approximately $90 million. On January 18, 2017, Mr. Harrison entered into a separation agreement with Canadian Pacific which provided, among other things, that he would be subject to restrictive covenants (CSX was excluded from the no-compete covenant) and, as noted, he would forfeit pension benefits and equity awards. [3]

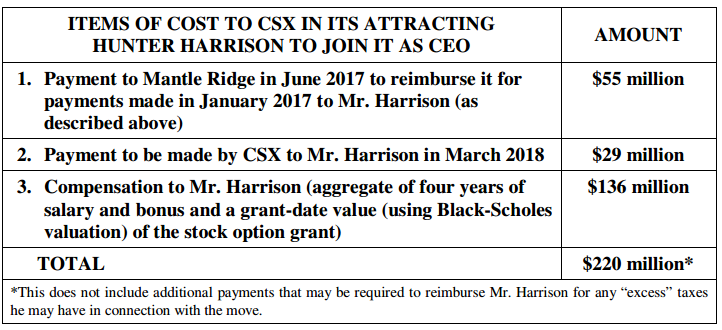

Also on January 18, 2017, Mr. Harrison entered into an agreement with Mantle Ridge under which Mantle Ridge committed, subject to certain conditions, to pay Mr. Harrison approximately $84 million plus “excess” income taxes. [4] “Excess” income taxes meant those income taxes in excess of income taxes Mr. Harrison would have incurred in respect of the forfeited pension amounts and equity awards if he had remained at Canadian Pacific. (The aggregate commitment to pay $84 million plus any “excess” income taxes is sometimes referred to below as “Departure Reimbursements.”) The agreement provides for payment by Mantle Ridge to Mr. Harrison of $55 million on January 31, 2017 and another $29 million before March 15, 2018 (totaling the $84 million noted above). Mantle Ridge made the $55 million payment to Mr. Harrison on January 31.

According to a February 14, 2017 CSX news release, Mantle Ridge and Mr. Harrison met with the Board of Directors of CSX on February 1 and proposed the appointment of Mr. Harrison as CEO. [5] They also proposed the resignation from the Board of four directors (including Michael Ward, who had been serving as Chairman and Chief Executive Officer) and the election of six new directors including Mr. Hilal and Mr. Harrison. Mantle Ridge also proposed that Mr. Hilal be appointed Vice Chairman.

On March 6, 2017, the Board of Directors of CSX met and took action in response to Mantle Ridge’s proposals. The action included [6]:

- Entering into an employment agreement with Mr. Harrison pursuant to which he became CEO of CSX.

- Appointing Mr. Hilal as Vice Chairman.

- Accepting the resignations of Mr. Ward as a director, approving the appointment of five new directors, including Mr. Hilal and Mr. Harrison and agreeing that by the 2017 annual meeting three other directors would resign.

- Making certain amendments to the CSX by-laws.

- Authorizing a non-binding vote by shareholders of CSX on the Departure Reimbursements at their annual meeting on June 5.

The proxy statement for the June 5 annual meeting contains the following statement: “Mr. Harrison joined CSX on the assumption that CSX would reimburse these forfeiture costs and has indicated that if the Company does not do so then he will resign from CSX after the 2017 Annual Meeting in order to maintain the contingent protection he currently has from Mantle Ridge.” [7] Apparently, under the agreement between Mr. Harrison and Mantle Ridge noted above, Mr. Harrison would have been required to repay, and forfeit if not yet paid to him, the Departure Reimbursements if the Board did not approve CSX’s assumption of the Departure Reimbursements from Mantle Ridge and if Mr. Harrison then failed to resign within thirty days following the annual meeting. [8] Ninety-three percent of shareholders voted in favor of the payments at the June 5 meeting. On June 16, CSX paid the $55 million to Mantle Ridge.

Under the employment agreement Mr. Harrison received the following compensation:

- Salary of $2.2 million per year.

- Target annual bonus of $2.8 million per year.

- A stock option award covering 9 million shares of CSX common stock (approximately 1 percent of CSX’s total outstanding shares of common stock) to be earned out over four years (50 percent time-vested and 50 percent performance-based). The value of the option at the time of grant (March 6, 2017) is estimated by the author to have been approximately $116 million, using a Black-Scholes valuation. [9]

Thus, in connection with Mr. Harrison’s joining CSX as CEO, CSX agreed to pay the following (including the Departure Reimbursements):

In the first six months of 2017 the total common stock value of CSX grew approximately $17 billion. During this same period, Mantle Ridge’s interest in CSX, assuming it held 4.5 percent throughout the period, grew approximately $800 million. (Mantle Ridge apparently held as much as 4.9 percent in early 2017.) As of June 30, Mr. Harrison’s spread in his March 6 option was approximately $43 million.

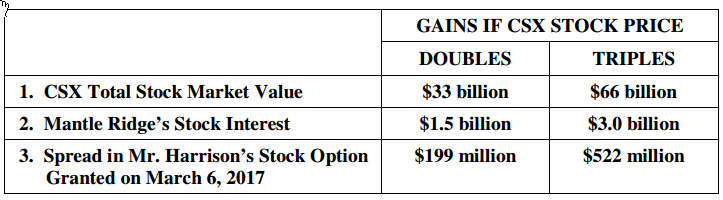

If CSX stock doubles or triples from its value at the beginning of 2017, gains will be as follows. (Amounts shown are approximations.)

CSX made a significant investment in Mr. Harrison in order to attract him as its new CEO. But if Mr. Harrison succeeds in doing for CSX and its shareholders what he did for Illinois Central, Canadian National and Canadian Pacific, and their shareholders, it will be a very successful venture for CSX as well as for Mantle Ridge and Mr. Harrison.

Endnotes

1Benoit, David, and McNish, Jacquie, “Outgoing Canadian Pacific CEO and Activist Investor to Target CSX,” The Wall Street Journal, January 18, 2017. (go back)

2The April 27, 2017 presentation by Mantle Ridge LP to CSX shareholders, entitled “2017 CSX Annual Meeting—Vote FOR the Item 5 Advisory Resolution in Order to Retain Hunter Harrison as CEO,” is contained in a CSX Form DFAN14A filed with the SEC on April 27, 2017. (go back)

3The Separation Agreement between Canadian Pacific and Hunter Harrison dated January 18, 2017, is filed as Exhibit 10.1 to a Canadian Pacific Form 8-K filed with the SEC on January 23, 2017. (go back)

4The agreement between Mantle Ridge and Hunter Harrison referred to in the text is not publicly available. It is described in CSX’s proxy statement for its 2017 annual meeting at pp. 84-85. (go back)

5CSX News Release, “CSX Calls Special Meeting in Light of Extraordinary Mantle Ridge and Hunter Harrison Requests” (February 14, 2017). (go back)

6See the agreement between CSX and Mantle Ridge dated March 6, 2017 filed as Exhibit 10.1 to a CSX Form 8-K filed with the SEC on March 7, 2017. (go back)

7CSX’s proxy statement for its 2017 annual meeting, at p. 82. (go back)

8Id. at p. 84. (go back)

9The assumptions used by the author are as follows: a grant-date closing stock price for CSX of $49.79; a strike (exercise) price for the option of $49.79; an expected life for the option of 6.25 years; a stock price volatility of 27 percent (calculated based on the daily closing stock prices over the 6.25-year period prior to the grant date); a risk-free interest rate of 2.2 percent (based on the Daily Treasury Yield Curve rates on the grant date); and a dividend yield of 1.4 percent.

In the April 27, 2017 presentation by Mantle Ridge to CSX shareholders, noted in the text, Mantle Ridge valued the option at $48 million. A principle factor causing the much lower option valuation by Mantle Ridge was its use of the closing stock price for CSX on January 18, $36.88, rather than the closing price on March 6, $49.79. Mantle Ridge explained its use of the January 18 price as follows: “The economics of this option are best measured with reference to CSX’s share price before the announcement of Mr. Harrison’s availability to join the Company that drove shares up 23.4 [percent] in a single day (January 19, 2017).” See April 27, 2017 presentation by Mantle Ridge LP to CSX shareholders, note 2 above, at p. 35. (go back)

Print

Print