I’m sure you’ve heard about the new tax law, and you probably have an opinion. But did you know that the new law includes an employment law issue?

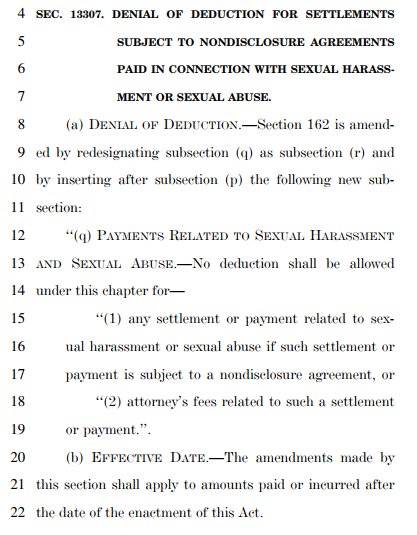

The final Tax and Jobs Act included a little discussed provision that says this:

I’m no tax lawyer. But one time I thought about booking a room at a Holiday Inn Express. So, my take –

Normally, lawsuit settlements are tax deductible to businesses on their corporate tax returns. This provision pasted above appears to say that employers no longer may deduct settlements in sexual harassment cases, when the settlement includes a confidentiality provision (!)

So, employers must either remove confidentiality provisions to take the deduction, or forego the deduction. That will make settlements 21% more expensive (no deduction means higher income and higher tax).

The law does not mention what happens when a settlement involves more claims than just sexual harassment. Can the employer allocate the payments among different claims? Stay tuned.

Anyway, please talk with your tax advisers regarding the meaning of this new provision and if there’s a tax-friendly work around that protects confidentiality.

Happy holidays to all.