Plow & Hearth going away (old news) should cause catalog professionals to go ... hmmm?

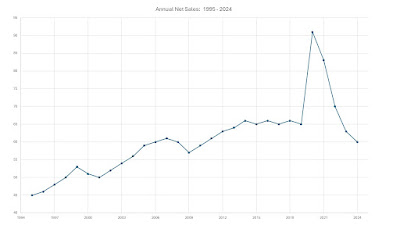

Let's step back for a moment. Here's what an awful lot of you in the catalog world are experiencing. This is what net sales look like over time.

Click on the image for a bit more resolution. Notice the COVID bump in 2020, and the dramatic deflation of the COVID bump in 2021-2022. On October 29, 2020, I told you to SELL (click here), to take full advantage of that gigantic peak in the image. Remember that?

Did you listen?

Did you listen?

Look at the image above ... notice that sales generally stalled after 2014, and if you remove the COVID bump from the image you see a general trend happening ... and it isn't positive.

Now let's adjust the image above for inflation. Tell me what you observe.

You see constant decline from 2006 forward. Remember 2006? 2006-2007 was when the list industry consolidated. The trend, after factoring inflation into the mix, is a consistent downturn ... from 2006 forward. A mature industry hit "retirement age" in 2006, and has been contracting ever since.

Since then, you handed the keys over to the co-ops, who squeezed your data for every penny they could and optimized their algorithm to the point where the algorithm shoveled every 70 year old name they could at you at the very time when you needed 35 year old customers. This further accelerated the inflation-adjusted demise.

Behind the scenes, your trusted partners ... paper folks and printers ... they were contracting in response to declining demand for their products. Sure, publicly, they told you all was well. They demanded you continue to put paper in the mail as part of a vibrant "omnichannel" strategy. They had to tell you this. They had to stay in business. As a paper rep told me in 2019 ... "I'm not going to let you take food off of my table, even if you are right."

The contraction of the paper/printing world was revealed in late 2020 and 2021 when catalogers suddenly had twelve-month buyer files that were anywhere between 20% and 100% bigger than they were a year prior. Catalogers needed paper. Paper didn't exist. Printers couldn't handle the increase in workload even if paper did exist. From a customer standpoint, being locked in your home for two months will fundamentally disrupt an industry. Supply exceeded Demand.

Paper/Printing costs increased, paper availability decreased. Tack the USPS increase on top of that, and yeah, there's trouble brewing.

Subsequent inflation and industry dynamics yield a world where paper/printing/postage costs are +15% per year, every year, for several years. This doesn't work in a contracting industry with old (70 year old) customers.

It doesn't take a rocket scientist to correlate contracting businesses with increasing costs and a very old customer base ... you correlate it and you get Plow & Hearth. They said it to you, using actual words, in the link above. Read it.

Unless you are a strong digital marketer catering to a 35 - 55 year old customer (which many of you are, fortunately), your future may well include an exit strategy or becoming a third-party seller on various marketplaces. It's survival, yes, but it is a lot less work than figuring out how to get a Google customer to click through a PLA and trust your website via multiple visits to finally purchase and then send catalogs or emails or SMS messages to beg the customer to come back and buy again before finally paying Google/Facebook another set of tolls so you can get another customer.

Think carefully, folks. This is a major inflection point in the trajectory of your brand. I advised you for (literally) decades at no cost. I wouldn't say what I'm saying if this weren't a major inflection point. And I wouldn't lead you astray.

There's nothing wrong with adapting, changing, and moving forward. Get busy moving forward. I have faith in you to move your brand forward. Let's go!