Like many people I suppose, when I have written about the effects of the new rule on value-added tax, I’ve done so from the point of view of myself, as a seller of ebooks. But what of the costs to readers?

Just to recap, or put you in the picture for the first time, the new ruling states that sellers of digital goods have to levy the rate of VAT that pertains where the buyer is. That in itself poses all sorts of difficulties, such as knowing what rate to charge if the buyer is an English national attempting to make a purchase while on a train travelling to France.

There’s a lot more, especially the terrifying potential to get snarled up in dealing with tax queries from several member states of the EU if you make a mistake.

OK, you might say, cue the violins. But it does affect readers too, in at least three ways:

Withdrawal of products

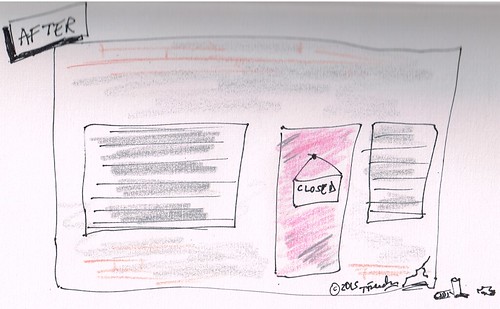

Before VatMOSS...

Before VatMOSS... ... After VatMoss

... After VatMoss

Like many people, I’ve stopped selling ebooks while I try to work out what the best way of dealing with this is. I’m not the only one: I’ve read about, and know of, several people who have either shut up shop, or decided not to open up in the first place. That represents a cost to readers in terms of fewer products to enjoy and benefit from.

A slower service

To give you an idea of how arcane some of the regulations are, we are allowed to sell digital products as long as they are emailed manually. So, you pay by Paypal, say, and then I send you the file by email. But I wouldn’t be able to send you a download link, because then that would count as a digital service, and therefore be subject to the new rules.

And apparently, its being OK to manually email the file only applies in the UK, because other countries have a different interpretation of the rules.

So, you might think, well, that’s not too bad: a little patience never hurt anyone.

But what if you are in the USA 8 hours behind me, and pay for the product at noon your time? I am trying to get into the habit of switching everything off by 7, so I won’t even see your order until 12 hours later.

What if I’m away working, or laid up in hospital? The delay could be even longer. (If I do reinstate my ebooks, I’ll make sure I write copious instructions so that Elaine can fullfil the orders too, so hopefully that won’t be too much of a problem. But you can see how the service would become slower, at a time when we all expect instant gratification in terms of online purchases. Not so much back to the future as forward to the past.

Cheaper if you’re in a low tax area?

Not necessarily. My understanding is that if I were to throw in the independent towel and sell everything via Amazon, I’d set the price of the product, and then Amazon would deduct the correct amount of VAT according to where the buyer is. So living in a low tax part of the EU wouldn’t necessarily benefit readers at all in terms of lower prices.

The paradoxical thing is that many of us will probably end up selling through Amazon, thereby making that company even more powerful than it already is. Given that one of the reasons for the new legislation was to bring such companies to heel, at least as far as charging different VAT rates is concerned, that is rather ironic in a bitter sort of way.

As it happens, I would probably go through Amazon eventually anyway, because of the marketing advantages it offers. But I’d rather do so out of choice, rather than from a feeling of not having much choice at all.

Action

If you as a reader are concerned about the VAT issue, please take part in the Twitterstorm taking place today, at 9am-10am (GMT) and 5pm-6pm (ditto).