Nick Dawson is Co-Founder & Managing Director at Proxy Insight. This post is based on a Proxy Insight publication.

With the first ever 2 degrees Celsius campaign proposal recently passing at Occidental Petroleum, this post looks at the increasing success of climate change shareholder proposals alongside Proxy Insight data on the subject.

Warming to climate change

Investors in Occidental Petroleum recently passed a shareholder resolution on climate change reporting. The vote was hailed as historic, marking the first time such a resolution has passed at a major US fossil fuel company, indicating what could be the next hot topic in global corporate governance standards.

A few years ago, climate change was a fringe issue. Ignored by mainstream investors, environmental resolutions were lucky to receive 5 percent support. Now, issuers who try to ignore the associated risks could face serious financial consequences.

The victory of Occidental’s shareholders was arguably the result of a perfect storm. Over the past few years, climate change resolutions have become increasingly sophisticated. Where once they tended to be overly prescriptive and confrontational, they now aim to appeal to all parties involved.

Many resolutions exploit investors’ fiduciary obligation to act in the best interests of their clients by emphasizing the relevance of the disclosures being requested. Recent climate change proposals also make more of an effort to placate companies. Indeed, by being more general, and in many cases advisory, most current proposals rely on investor support to pressure companies into implementing what they want.

BlackRock’s change of heart

One of the main reasons for the success of the climate change resolution at Occidental was the support of BlackRock. The asset manager has a 7.8 percent holding in Occidental, making it the company’s largest single shareholder. In an unprecedented move, BlackRock supported the climate change proposal in defiance of management.

In 2016, several institutional investors received shareholder proposals at their annual meetings which questioned their track record on a number of issues. Blackrock was one of those investors, alongside the likes of BNY Mellon, Franklin Templeton and T. Rowe Price.

Climate change was among the issues highlighted by BlackRock’s shareholders, who pointed to the gap between the asset manager’s voting policy and its record of actual votes cast.

Although the resolution at BlackRock only garnered 5 percent support, it seems to have had an impact. Earlier this year, BlackRock announced that it would be applying new pressure to companies on issues such as climate change and boardroom diversity.

2 degrees Celsius campaign

The resolution at Occidental Petroleum is a classic example of today’s more sophisticated climate change proposals. It asks the company to explain how it intends to handle the impact of the Paris Agreement, which seeks to limit global warming to 2 degrees Celsius.

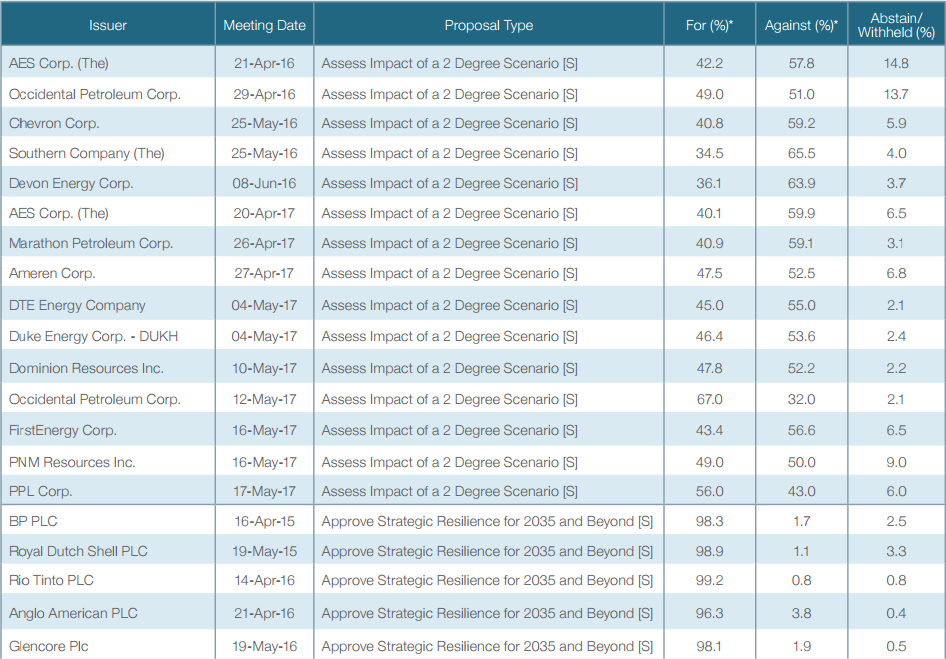

The resolution therefore provides a fiduciary incentive for investors to support it and a clear justification for companies to disclose, as governments may in future impose penalties on high-emission companies. The success of the 2 degrees campaign is reflected by strong investor support. Its resolutions receive an average of 45.7 percent of votes, compared to just 26.0 percent for other climate change proposals.

Strategic Resilience for 2035 and Beyond

A similar, even more successful campaign was Strategic Resilience for 2035 and Beyond. Resolutions for this campaign were submitted to a number of major UK fossil fuel companies last year by the “Aiming for A” coalition.

Through extensive dialogue with boards, every one of these resolutions secured management backing. When it came to a vote, this helped the campaign achieve an average support level of over 98.1 percent across all companies.

The resolutions require that, from 2017 onwards, companies provide additional disclosure in several areas through their annual reporting. This includes more comprehensive information about ongoing operational emissions management, public policy positions on climate change issues and any research and development or investment strategies in low-carbon energy.

Companies are also required to analyze the resilience of asset portfolios to the International Energy Agency’s (IEA) scenarios, and to detail relevant strategic key performance indicators (KPIs) and executive incentives that relate to environmental issues.

The campaign’s resolutions go on to suggest that this additional information could supplement disclosures that are already made. Either they could be attached to disclosures made to the CDP (formerly the Carbon Disclosure Project), or those contained within companies’ Annual Report and Sustainable Development Reports.

As Table 1 illustrates, support for the 2 degrees campaign has been slowly increasing since the signing of the Paris Agreement in April 2016. The average support for 2 degrees resolutions was 40.5 percent in 2016, whereas so far in 2017 such resolutions have received an average of 48.3 percent.

Consequently, as shareholder proposals on climate change continue to garner more support, issuers will have to put more effort into their climate change reporting, lest they risk having their cards revealed by investors.

Table 1: Voting results for 2 degrees Celsius and Strategic Resilience for 2035 and Beyond shareholder proposals *For (%) and Against (%) columns do not include Abstain/Withheld percentages Source: Proxy Insight

Print

Print