Adena Friedman is President and CEO of Nasdaq, Inc. This post is based on a Nasdaq publication by Ms. Friedman.

Robust public markets are the fuel that ignites America’s economic engine and wealth creation. Companies list on U.S. exchanges to access a steady, dependable stream of capital to grow and create jobs, and investors choose our markets because they are the world’s most trusted venues for long-term wealth creation.

Built on the shoulders of entrepreneurs with great ideas, public companies drive innovation, job creation, growth and opportunity across the global economy. A central reason for the success of U.S. capital markets is that American public companies are among the most innovative and transparent in the world. Additionally, the mechanisms that govern our markets ensure opportunity through fair and equal access—providing a solid foundation for the diversity of investing perspectives, participants and strategies represented in our capital markets.

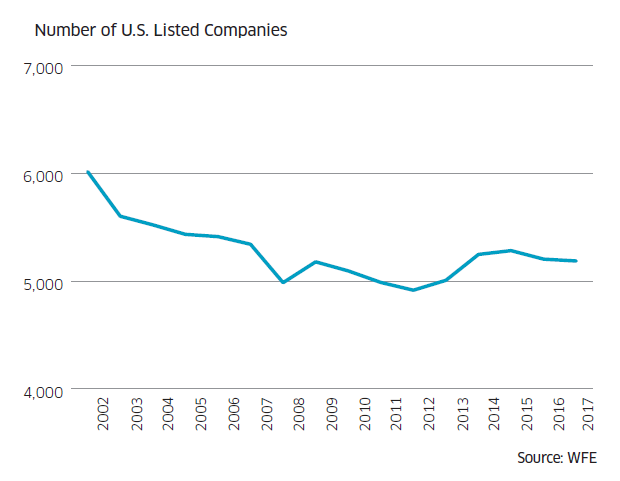

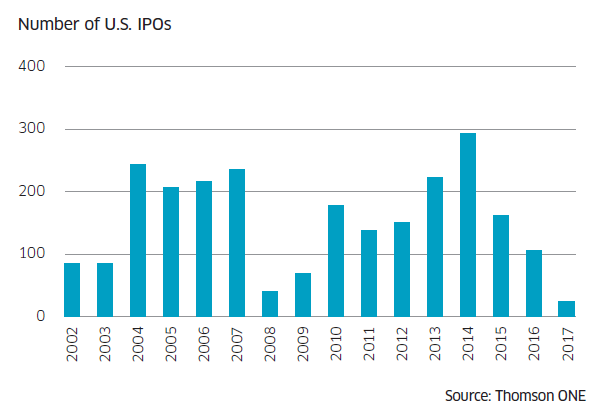

There is no question that companies that choose to participate in equities markets and make their shares available to the public take on a greater obligation for transparency and responsible corporate practices. Regulations are needed to maintain these “rules of the road.” But as the U.S. has continued to add layer after layer of obligation, we have reached a point where companies increasingly question whether the benefits of public ownership are worth the burdens. If not addressed, this could ultimately represent an existential threat to our markets. In fact, in recent years, a growing number of companies have been choosing to remain private—and some public companies are reversing course and going private.

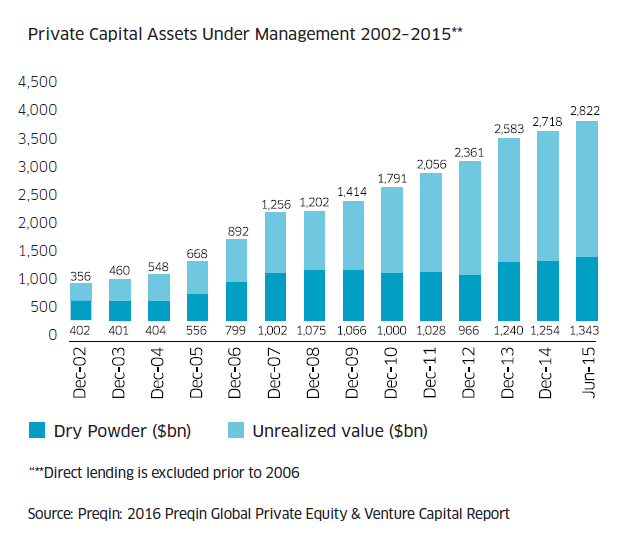

The dynamics catalyzing the turn away from public markets are complex. They range from concerns about: a) activists, b) frivolous shareholder litigation, c) pressure to prioritize short term returns over long-term strategic growth, d) burdensome costs and headaches of the proxy process as well as irrelevant but required disclosures, to name a few. Once public, particularly smaller issuers sometimes find that the cost of accessing equity capital to fund growth can be expensive given the distributed nature of trading across markets and trading venues today. Therefore, they seek private sources of capital, and in today’s environment, many dynamic companies are finding an abundant supply of that capital available.

While the risk of a diminishing public capital market may not yet be fully realized, it is not difficult to anticipate what may lie ahead: since not everyone has the opportunity to invest in private companies, main street investors may lose the chance to share in wealth creation, which could foster a greater divide between the wealthiest and everyone else. Additionally, American companies could increasingly consider foreign public markets; and top international companies might opt not to list in the United States.

The case for strong public markets is overwhelming. Since 1970, 92% of job creation has occurred after IPO. The vast majority of Americans are invested in and count on public markets, either directly through stock ownership or through pension funds, mutual funds, and retirement accounts.

Additionally, with more investors choosing index strategies to meet their investment needs, funds and ETP providers are relying upon a deep and healthy selection of public companies across industries and at various stages of maturity and growth to provide investors a wide range of index strategies with strong return profiles. Investor access to vibrant and growing public capital markets is a critical driver of wealth creation and financial security for the American people.

Private investment firms (a.k.a. alternative asset managers) state that they represent average investors indirectly by serving pension funds that exist on behalf of American workers, and that is indeed true. However, today, pension funds are slowly shrinking and being replaced with defined contribution retirement plans as the core savings vehicles for average American workers. Additionally pension plans allocate only a small percentage of their overall portfolios to private alternative funds because the underlying investments are very illiquid and difficult to value. Defined contribution plans are even more limited in their ability to invest in private securities and private equity funds today due to the lack of liquidity and valuation transparency. Therefore, for the foreseeable future, pension funds and most mutual funds that serve average investors will continue to rely heavily on the public markets to supply investment opportunities that will help them reach their return thresholds. That will get harder and harder if there are fewer growth-oriented companies coming into the public markets.

Nasdaq believes that private markets do serve an important role in our economy. Our goal is to apply the best aspects of private markets—including the ability for companies to manage themselves to the longer-term—to the public markets. At the same time, we are advocates for private markets that also adapt to feature the best aspects of public markets—including the opportunity for more frequent liquidity events with price discovery—to open up the private markets to a broader client base, most notably defined contribution plans.

Our concerns over the state of our public markets fall into three categories:

First, a complex patchwork of regulation that disincentivizes market participation.

Second, a one-size-fits-all market structure that deprives companies of the benefits they need to participate and succeed in public markets, particularly for small and medium growth companies;

And third, a culture in the investment community and in the mainstream media that increasingly values short-term returns at the cost of long-term growth. We focus on concrete solutions across three topic areas:

1. Reconstructing the Regulatory Framework

Nasdaq strongly believes that safe markets need guardrails. The regulations enacted during and immediately after the credit crisis accomplished some important goals in key areas of systemic risk. However, for issuers much-needed improvements to the capital markets have been largely ignored while regulators shoulder the burden of shoring up the most critical components of the financial system. Therefore, during this period of relative market calm, now is the time to address those burdens on public companies that create an unwelcome capital market environment.

One crucial area of regulatory reform is in the proxy process. While proxy voting can be an important tool to raise legitimate concerns, it is far too often used for unhelpful purposes that cause a nuisance and significant financial strain on companies, particularly smaller ones. A number of simple, common-sense reforms can protect the shareholder voice while filtering out needless and costly headaches.

Nasdaq believes it is long past time to move away from a one-size-fits-all approach to corporate disclosure. Transparency is critical to healthy markets, but technology and markets have evolved to a point where a reasonable degree of flexibility can allow for disclosure requirements that are shareholder-friendly while reducing the burden on companies. For example, if companies report all key financial and business details in quarterly press releases, we should consider eliminating the archaic 10-Q form, which is duplicative and bureaucratic. We should also study options that allow for greater flexibility in reporting schedules, so that as long as companies are transparent with shareholders, they have the flexibility to report on a less-rigid structure. This would also promote our third goal of promoting long-termism.

We also believe that companies of all sizes will benefit from comprehensive litigation and tax reform, two topics that are debated endlessly but have yet to see comprehensive action.

We are seeing a record rate of securities class action lawsuits and a record number of dismissals. In fact, filing these cases has become its own cottage industry. But companies and shareholders are paying a steep price for these frivolous cases, which also discourage private companies from going public.

Nasdaq supports the current administration’s efforts to lower tax rates for U.S. companies, as well as a territorial taxation system for foreign corporate earnings. We also advocate for lower taxes for individuals, specifically related to their investments in public securities. Appropriate tax reform will encourage companies and investors to put more of their dollars to work to grow and/or gain financial security. We are particularly intrigued by the concept of creating a tax structure for individual investors that ties a low-level of taxes on investments to the overall value of the account, rather than a higher dividends and capital gains tax on earnings within the account. This could result in a dramatic rise in the number of individual investors and more of the dollars staying with the investors to shore up their longer-term financial security.

2. Modernizing Market Structure

The last ten years have seen extraordinary technological advances and regulatory changes to the way markets function. As a result, just as bridges built for pedestrians required rebuilding for the age of automobiles, the regulatory infrastructure upon which yesterday’s markets were built must be modernized to support the complex markets of today.

One of the unintended consequences of current market structure is that small and medium growth companies (and investors in them) are not receiving a proportional share of the benefits. The relatively high volatility and low transaction volume of smaller issues is exacerbated by an inflexible one-size-fits-all construct that spreads already-thin trading across too many venues. In fact, thoughtful market reforms will broadly benefit companies of all sizes. Modern markets can and must be flexible markets. We need to move past the rigid, one-size-fits-all thinking of the past and leverage technology to solve emerging problems and benefit all market participants.

3. Promoting Long-Termism

A variety of factors in recent years have made it more difficult for companies to focus on the long-term goals of innovation, expansion and job creation, which are critical to healthy markets and a strong U.S. economy. In addition to harming companies, the trend away from long-termism also harms the vast majority of investors.

While the term “activist investing” is complex and some forms of activism achieve worthy goals, the trend toward exerting pressure for short-term gains at the expense of long-term health is concerning. Nasdaq especially believes that the goals, tactics and financial arrangements of activist investors should be examined by policy makers and made transparent to the companies and their other shareholders.

We also support dual class structures in appropriate situations. America is a breeding ground and magnet for entrepreneurship and innovation, and in order to maintain this strength, we must offer entrepreneurs multiple paths to participate in public markets. Dual class structures allow investors to invest side-byside with innovators and high-growth companies, enjoying the financial benefits of these companies’ success.

In this post, we offer a broad range of policy recommendations that we believe will accomplish these critical goals. Some of these proposals are straightforward and ready to be implemented today. Others are more conceptual and require further study. Some have long been debated, while others are newer. For these reasons, we consider this post a blueprint to engage stakeholders and move the conversation toward concrete action.

If investors, industry groups and policymakers come together, we can construct healthier U.S. equities markets and a durable economy that works for all Americans.

Section One: Reconstructing the Regulatory Framework

The flurry of regulation following the financial crisis accomplished some important goals, but we have also seen many unintended consequences and corners of the market that are still desperately in need of modernization. The result is an inconsistent regulatory patchwork that under-regulates some areas and overregulates others. Public companies—and those contemplating an entrance into public markets—are increasingly hamstrung by the complexity and cost of navigating this regulatory maze, and investors are harmed both by the impact of these costs on companies that do go public and the shrinking investment options as more companies avoid going public. Establishing a modern framework that can adapt to different industries and types of companies will unleash economic productivity across our economy by reducing costs and complexity and allowing companies to focus on growing and innovating, to the benefit of both issuers and investors.

Reform the proxy proposal process.

Nasdaq supports shareholder-friendly regulations that provide healthy interactions between public companies and shareholders. However, current regulations governing the way shareholders access a company’s proxy statement can poison the company-shareholder relationship by amplifying the voice of a tiny minority over the best interests of the vast majority. The cost to public companies in legal expense, let alone the time and attention of management and boards, is real and significant. Therefore, the following reforms are crucial:

Raise the minimum ownership amount and holding period to ensure proposals have meaningful shareholder backing. SEC rules allow any shareholder holding $2,000 or more of company stock for one year or longer the ability to include an issue on the company proxy for a shareholder vote, even if the issue is not material or relevant to the company’s business. A study sponsored by the Manhattan Institute reported that one-third of shareholder-led proxy proposals in 2016 were driven by six small investors and their families. The current process is costly, time-consuming and frustrating for companies, which in aggregate must address thousands of such proposals each year. Deleting this meaningless dollar threshold and instead requiring that a proposing shareholder hold at least 1% of the issuer’s securities entitled to vote and increasing the holding period to three years, would ensure that shareholder proposals representing the views of a meaningful percentage of the companies’ long-term owners are considered at shareholder meetings.

Update the SEC process for removing repetitive, unsuccessful proposals from proxies. Congress should adopt the Choice Act proposal to significantly increase the shareholder support that a proxy proposal must receive before the same proposal can be reintroduced at future meetings. The SEC should study the categories of topics suitable for shareholder proxies and modify its rules accordingly to ensure that proposals considered at annual meetings are properly placed before shareholders, are meaningful to the business of the company, and are not related to ordinary business matters.

Create transparency and fairness in the proxy advisory industry. Due to the large number of proposals they must consider within a concentrated time period, institutional investors have come to rely on proxy advisory firms to analyze corporate proxy votes and provide insight into how to vote. While this service is valuable in theory, in practice the industry is a largely unregulated black box, rife with opacity, lack of accountability and conflicts of interest. Absent requirements to explain their criteria or to provide companies a means to question analysis or even correct factual errors, the outcome of critical decisions is often at the whim of unpredictable and impenetrable advisory firms. Additionally, these firms are not even required to disclose whether they have a financial relationship or ownership stake in the companies on which they report. The SEC took preliminary steps to address these concerns with the proxy advisory industry several years ago, but these efforts are far from sufficient. Proxy advisors must have a line of communication with the companies they analyze and clear transparency around ownership of, or short interest in, covered companies.

Reduce the burden of corporate disclosure.

Investors demand and deserve clear, consistent reporting of key company information on a regular basis. Nasdaq fully supports the transparent and robust disclosure, which is one of the reasons why U.S. markets are the world’s most trusted. However, this necessary disclosure must be re-evaluated to reduce the cost and burden for smaller companies while maintaining the level of access and detail that investors need

Offer flexibility on quarterly reporting. For many large companies, quarterly reporting remains the ideal vehicle for regular disclosure. However, some companies looking to encourage long-termism and reduce costs would benefit from the flexibility to provide full reports semiannually, as has been done in the United Kingdom. Companies would be able to update key metrics for any material changes between mandated reports using the tools readily available to communicate directly with shareholders.

Streamline quarterly reporting obligations for small and medium growth companies. In today’s market, between detailed, annual Form 10K disclosures, companies provide key data via an earnings press release each quarter. For virtually all investors, the press release is the quarterly report. Yet companies are then required to file a formal Form 10-Q document with the SEC, which is complex, time-consuming, and provides little additional actionable information that cannot be found in the press release. By establishing simple guidelines, the press release can replace the 10-Q entirely for issuers that prefer to report information quarterly, aligning regulatory and shareholder interests and significantly decreasing corporate reporting red tape without reducing the key disclosure that investors rely upon. Detailed disclosures would continue to be available through the annual Form 10-K process.

Along the same lines, advancing technology has created new alternatives that many feel reduce the usefulness of eXtensible Business Reporting Language (XBRL), the XML standard language that public companies are required to use in order to tag data in their financial statements and related footnote disclosures. With many analysts deploying their own sophisticated research tools, XBRL should be reconsidered to ensure that the benefit to investors outweighs the complexity and burden of implementation.

Expand classifications for disclosure relief. Current regulations permit certain types of companies, including small growth companies, to submit disclosure reports that are robust and transparent but far less burdensome than those required for more mature companies. This important exemption makes being public far more appealing for private companies contemplating the regulatory requirements of going public, and significantly decreases the resources necessary to file until the company has become mature. However, the definitions of classes like “smaller reporting company,” “emerging growth company” and “non-accelerated filer” are narrow, sometimes limited in duration, and difficult to navigate; as a result, fewer companies benefit from the spirit of these carve-outs. They should be expanded and simplified by:

- Expanding the JOBS Act’s “test-the-waters” provisions, allowing emerging growth companies to communicate with certain potential investors, and file their registration statement confidentially to all companies and all capital raising transactions.

- Raising the revenue cap to qualify as emerging growth company from the current $1 billion (subject to inflation adjustment every five years) to $1.5 billion and deleting the current phase-out five years after the IPO.

- Harmonizing the definitions for smaller reporting company and non-accelerated filer with those of emerging growth company to avoid a patch work of inconsistent and illogical exemptions.

On a broader level, the SEC should complete its 2016 “Disclosure Effectiveness Initiative” to strip out unnecessary and duplicative requirements to simplify requirements so that disclosure is less onerous for companies and more meaningful to investors. In a similar vein, the Commission should consider ways to streamline the offering process by giving all public companies the opportunity to raise capital using simplified and faster “shelf registrations” and reducing the requirements for supplemental forms and other bureaucracy associated with capital raising that serve no meaningful purpose.

Roll back politically-motivated disclosure requirements.

We can and should make a clearer distinction between disclosure of material information that investors require to evaluate a company’s financial performance and economic prospects and those that are motivated by social and political causes or otherwise aren’t relevant to a company’s bottom line. For example, we support the elimination of the currently-required reporting of conflicts minerals and executive pay ratio, along with a comprehensive review of all disclosure requirements and the elimination of those that do not have a clear connection with a company’s financial performance, practices and outlook. These disclosures impose costs and burdens on public companies that their private competitors do not face, without a concomitant benefit to their investors.

Litigation reform

Defending meritless class action lawsuits is more than a “cost of doing business” for public companies. 2016 saw a record number of securities class actions—and a record number of dismissals.

Class actions target public companies more than private ones; the broader public disclosures and the greater number of shareholders offer class action mills greater leverage to extract settlements and legal fees. Class action settlements also tend to benefit one set of stockholders (investors at the time of the alleged fraud) at the expense of another set (more recent investors).

Nuisance cases that result in dismissal are not costless. The mere filing of a securities class action has been estimated to wipe out an average of 3.5% of the equity value of a company, and companies must bear the cost of defense, estimated to exceed $1 billion per year in aggregate. As the rate of these cases rises, it has become a major reason cited by private companies for staying out of the public markets. Given the trend of third-party investors financing these cases. there is every reason to expect that the number of cases filed will only increase—along with the burden placed on public companies—unless litigation reform is prioritized.

Nasdaq supports reforms that reduce the burden of meritless class actions, recognizing that it can be difficult to distinguish legitimate from frivolous cases. Litigation rules can raise the bar for filing class actions by, for example, making it easier to impose sanctions for frivolous suits. Steps to promote conclusive resolution of cases at an earlier stage would reduce the amount and duration of leverage enjoyed by class action profiteers.

Support Congressional action. Nasdaq supports the enactment of legislation currently before Congress that addresses litigation reform. The legislation would, among other things:

- Ease the standard for imposing sanctions on lawyers bringing frivolous lawsuits.

- Tighten the requirements for granting class certification.

- Facilitate interlocutory appeal of decisions to grant class certification.

- Require disclosure of third-party financing of litigation.

- Limit plaintiff legal fees.

Expand scope of provisions under Congressional consideration. Congress should also consider enhancing this legislation with additional similar provisions that would:

- Allow interlocutory appeals from the denial of a motion to dismiss.

- Allow a plaintiff to amend its complaint only once.

- Further codify the standards for pleading with respect to scienter and loss causation, and clarify the exclusive nature of federal jurisdiction over securities claims.

- Require proof of actual knowledge of material misstatements or omissions (as opposed to mere recklessness).

- Make SEC findings in enforcement consent decrees inadmissible in private litigation.

Study longer-term comprehensive reform. Given the significant costs of the current system and questions about whom the system actually benefits, long-term consideration should also be given to more comprehensive changes. These might include:

- For securities class action suits, adopt the English system of requiring the loser to pay legal fees of the winner, and ensure that plaintiffs have adequate resources to cover such fees by requiring them to post a bond or demonstrate financing.

- Allow companies to adopt charter/by-law provisions that require stockholders to pursue claims against the company, directors, and officers through arbitration.

Tax reform

The federal government has repeatedly failed to enact meaningful tax reform for more than thirty years. As a result, public companies and investors are left with a tax system that is complex, burdensome, inefficient, and does not properly incentivize longterm investing. It is long past time to reform U.S. tax policies to promote, rather than discourage, saving and investment in the U.S. economy. The personal savings rate in the U.S. is half what it was in the 1950s and 1960s, and in 2015 the U.S. savings rate was near the bottom of the OECD member countries. Nasdaq supports strong consideration of modern, forward-looking solutions.

Offer “investment savings accounts” for investors. In 2012, Sweden introduced a compelling new structure that ties taxes on investment to the value of a Swedish investment savings account (or “ISK account”), rather than earnings (known as capital gains) within the account. The ISK account is available to individual investors and there is no maximum amount which an investor may contribute to an ISK account. The individual investor manages the ISK account and can freely move funds within the account. Funds in the ISK account may be invested in cash (including foreign currency), financial instruments which are traded on a regulated market, or financial instruments traded on a multilateral trading facility. The investments may be made in either the Swedish or global marketplace.

In a relatively short time, this investor-friendly concept has attracted approximately 1.6 million Swedish individual investors (approximately 16% of the total Swedish population) to the ISK accounts as of 2015, and the number of ISK accounts held by Swedish citizens has more than doubled in 2014-2015. Based on other information made available by the Swedish Tax Agency (or “STA”), the value in such accounts increased 68% in 2014-2015, as compared to a decrease in the OMX Stockholm 30 Index of 1% over the same period. We can also ascertain from the information published by the STA that the value of the ISK accounts have been taxed at a rate of approximately 0.3% to 0.6% for the years 2012-2015. Using the S&P 500 index as a benchmark to track the value of an U.S. equity investment account, if the ISK account model had been adopted in the U.S. over the past ten years, investors would have benefited from considerably lower taxes on their investments, allowing for increased longer-term savings.

Over the same period of time, from 2014-16, the number of IPOs in Sweden has almost doubled, with two-thirds of the new companies listing on the First North market, a market dedicated to smaller growth companies. It is early days for statistical gathering of ISK’s impact on the market. That said, after four years, the data indicates a correlation between ISK and the Swedish IPO Market.

Nasdaq supports the creation of this optional type of investment account in which U.S. investors may invest in the global markets. Alternatively, investments solely in the U.S. markets are also acceptable.

Expand tax exemption on sale of small business stock to the secondary market. The tax code currently includes an exemption from tax on the sale of the stock of small startup businesses; however, the exemption is narrowly defined. Because in practice it will be difficult to apply this exemption to shares of public companies, the benefits accrue only to venture capitalists and high net worth individuals—not to the potential broader class of smaller shareholders of companies seeking public funding. Furthermore, due to the complexity of these rules, this provision of the tax code is rarely used by taxpayers. This exemption should be expanded to include all qualified domestic corporations. We also recommend considering shortening the ownership tenure requirement from five years to three years, and increasing the maximum asset threshold from $50 million to $100 million. This shareholder-friendly move would enable these smaller companies to access the public markets.

Enact 100% dividends received deduction for holders of corporate stock. One of the most irrational elements of our current tax code is the double taxation of corporate profits. The company pays taxes on profits, and then the shareholder is taxed on distributions derived from those profits. For individuals, the rate of taxation on dividends can be as high as the tax rate applied to ordinary income. Nasdaq strongly supports complete elimination of the double taxation of corporate profits through a 100% dividends received deduction for holders of qualified domestic corporate stock.

Eliminate net investment income tax. Enacted in 2013, individual investors currently pay a surcharge tax—above and beyond the tax applied to dividends and capital gains—of 3.8%. This tax increases the over-taxation of corporate profits and penalizes individuals from participating in markets. It should be repealed.

Exclude dividends and capital gains from income for purposes of determining the phase-out of itemized deductions. Enacted in 1991, individual taxpayers’ itemized deductions are limited if their gross income exceeds certain levels. Nasdaq supports continuation of the phase-out of itemized deductions for higher earners, however investment income should be excluded in determining this phase-out as a means to encourage greater investment.

Section Two: Modernizing Market Structure

In many ways, today’s markets bear little resemblance to those of just a decade ago. The old images of brokers fielding telephone calls and floor traders hollering orders has long since given way to a profoundly interconnected, technology-driven marketplace that transacts across an astonishing array of exchanges and trading venues. As the founder of electronic trading, Nasdaq views market innovation as a tremendous force for good, unlocking competition and unleashing the flow of capital to catalyze economic activity. Yet, as markets have advanced, the fundamental structure that underpins them has not evolved to benefit all market segments equally. While efficient markets benefit both issuers and investors, inefficient markets can choke the flow of capital, become a drain on growth, and block companies—particularly small and medium growth companies—from reaching their fullest potential. We sit in a unique position to observe both the areas of excellence and of challenge in our markets, and to recommend solutions that improve conditions for Issuers, Investors, and our economy.

Many of the regulations that form the foundation of today’s markets—including Reg NMS and Reg ATS—were developed and implemented more than a decade ago. Now is the time to write new rules of the road that ensure U.S. equities markets continue to enable efficient capital flow and formation to support the U.S. economic engine. We can accomplish this with new and improved market constructs that account for the different needs amongst market participants and the fluid nature of our markets. It’s time to address the one-size-fits-all regulatory regime.

Strengthen markets for smaller companies.

Despite incremental improvements to markets in recent years, liquidity and the trading experience for small and medium growth companies and investors in these companies still lag far behind that of larger issuers. For small and medium growth companies—those with a market capitalization below $1 billion, particularly when the lower market cap is accompanied by low daily trading volume—relatively small orders can create dramatic price movements. This increases costs for both the companies and their investors. For example, regardless of the listing market that a company may choose, small and medium growth companies have shown a worsening incidence of high-volatility days, which increases investor confusion and undermines confidence in our markets.

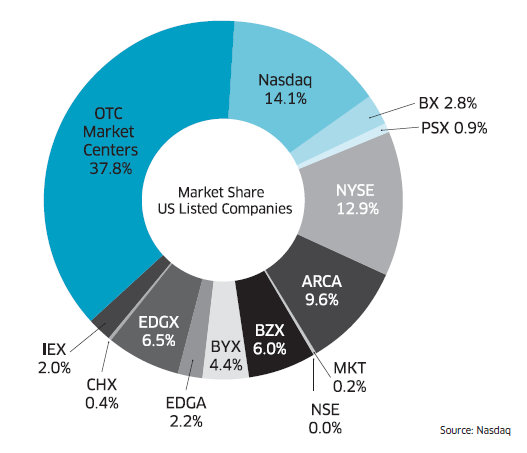

This liquidity dilemma stems from a long-term trend towards fragmentation, where liquidity has spread across an increasing number of trading venues. As recently as 15 years ago, more than 90% of liquidity was often concentrated in a single exchange with the small remainder spread over an additional eight to ten other exchanges and electronic communications networks. Today, liquidity is spread thinly across fifty or more venues (there are 12 exchanges alone), and no single market controls even 25% of trading.

As a result, every venue has a very thin crust of liquidity for small and medium growth companies, a crust that can be broken by a single large order. When the liquidity crust is broken, the order can quickly impact the market’s ability to efficiently absorb it, resulting in a poor experience for the investor who placed the order.

Compounding that trend, liquidity has also moved off exchanges and onto alternative trading venues, making it more difficult to find latent liquidity. Nearly half of U.S. publicly traded small and medium growth companies have more than 50% of their trading occurring off-exchange, away from the benefits of price formation and transparency of U.S. exchanges.

Nasdaq believes concentrating that disaggregated liquidity onto a single exchange, with limited exceptions, will allow investors to better source liquidity. In addition, investors will enjoy a higher level of transparency because exchanges are required to display their best quotes to the public, and most exchanges choose also to publish full supply and demand information (i.e. order book depth information) within their markets.

The introduction of Unlisted Trading Privileges (UTP) gave rise to fragmentation, combined with a proliferation of alternative trading systems. In 1975, Congress determined that investors would benefit from greater competition if securities listed on one exchange were available for trading on all other exchanges and in over-the-counter trading venues. In 1998, determining that further steps were necessary to foster competition, the Securities and Exchange Commission enacted Regulation ATS, which lowered the bar for the launch of alternative trading systems. Advances in technology and further regulatory changes, most notably Regulation NMS, enacted in 2006, then led to an explosion of ATSs and exchanges, culminating in the current environment in which we have 40-plus active trading venues. While these changes have spurred competition that has brought benefits to larger Issuers, they have proven extremely challenging for less liquid companies. When it comes to UTP, the law of diminishing marginal returns applies—and we have far exceeded the point at which the benefit outweighs the costs.

With creativity and flexibility, this liquidity challenge can be solved, making capital markets far more cost-effective and attractive for small and medium growth companies:

Give issuers choice to consolidate liquidity and improve trading quality.

Nasdaq recommends permitting issuers to choose to trade in an environment with consolidated liquidity. By creating a market for smaller issuers that is voluntary for issuers to join and that is largely exempt from the UTP obligations—subject to key exemptions—we can concentrate liquidity to reduce volatility and improve the trading experience. Eliminating UTP for small and medium growth companies would reduce the number of exchanges authorized to trade them; most importantly, it would allow liquidity to develop, and for supply and demand to find one another. Without the rigidity of Regulation NMS which was enacted to cater to a UTP market model, the new markets would also create natural opportunities for other market structures to develop and thrive—for example, intraday auctions to bring together supply and demand for the benefit of all. Further requirements for off-exchange trading, described below, would likely further concentrate liquidity and limit fragmentation. The net effect would be a substantial “thickening” of the liquidity crust on the exchange that lists the security.

Off exchange trading represents 38.4% of small and medium growth company trading volume today. While there are great benefits to consolidating on-exchange trading, there is also important value provided by off-exchange trading that merit consideration, especially block trades and price-improved trades. The network of off-exchange brokers also supports systemic resiliency for the trading of these securities. We want to work with the industry towards constructive solutions that balance on- and off-exchange activities.

Nasdaq has learned from experience that for small and medium sized issuers, consolidation offers significant benefits to investors. Nasdaq operates the First North market in Sweden, containing small and medium low liquidity stocks in an even less liquid Swedish market. Unlike in the U.S., the limited liquidity is concentrated on a single market rather than distributed over many markets. When comparing the trading characteristics of the securities on the unfragmented First North market with the corresponding stocks in the fragmented U.S. markets, spreads are 37% better and volatility is also better on First North, even though the stocks listed are smaller than those listed in the U.S.

Some may wonder—separate from the impact to specific issuers and their investors—whether consolidation creates more systemic risk than we have today. Consolidation for this segment of the market will reduce the level of unnecessary complexity related to the many interconnections of exchanges. Furthermore, order types designed specifically to accommodate market fragmentation can be removed also increasing simplicity and decreasing risk. Reducing fragmentation does not have to come at the cost of reduced resilience. The listing exchange should ensure that a robust “hot-hot” backup system is in place—as well as a named backup exchange—to ensure resiliency for the trading of these securities. For example, Nasdaq has a proud history of maintaining resiliency in markets, including robust testing, geographically diverse systems, primary/backup systems operating simultaneously which could be replicated here. In sum, these changes would work to bring additional benefits to small and medium growth companies and their investors.

- Deploy intelligent tick sizes for small and medium growth companies. Every company listed on U.S. markets trades with the same standard tick sizes, but technology makes this standardization unnecessary. Nasdaq’s experience and research demonstrates that a one-size-fits-all approach to tick size is suboptimal for many, particularly small and medium growth companies, which should trade in a suitable tick regime determined by their listing exchange. Nasdaq believes that these companies should have the ability to trade on sub-penny, penny, nickel, or dime increments. Transparent and standardized methodologies can and should be used to accurately determine the optimal tick size to increase liquidity and reduce trading costs.

- Cultivate innovative market-level solutions that improve the trading of small and medium growth companies. Much of the trading and routing functionality in use today was designed in response to UTP and Regulation NMS. For issuers that choose to list in a non-UTP structure, much of that complex functionality will no longer be necessary to trade these companies. In addition, with the consolidation of liquidity, the listing exchange is appropriately incented to develop innovative solutions designed to cultivate liquidity and improve the trading experience for investors in small and medium growth companies. In a world where liquidity is more effectively nurtured, we will be able to address the unique needs of small and medium growth companies. We recognize the cost of adopting new technology across the industry in considering such innovations and believe that any such cost would be outweighed by the benefit to the market. We have several key ideas we’ve been working on and look forward to discussing in further detail with the industry.

- Implement an intelligent rebate/fee structure that promotes liquidity and avoids market distortions. Nasdaq is committed to balancing the privileges and obligations for market makers in small and medium growth securities to help incentivize tight spreads and a high-quality trading environment for all participants in these less liquid stocks. The opportunity for market making reforms and the impact of these changes would be magnified in a world where liquidity is concentrated as Nasdaq proposes. We do need to be very careful about policies that would eliminate or significantly reduce rebates in the context of less liquid stocks where incentivization of market making is most impactful.

- Ensure fair and reasonable pricing for participants in the context of limiting exchange competition. If UTP were to be revoked for small and medium growth companies, flexible tick sizes and liquidity incentivization must occur within a construct that preserves competition amongst market participants and does not inappropriately advantage the market operator itself. The SEC plays an important role for efficient and well-operating markets, and to help establish appropriate pricing policies to address the goals of stakeholders. We are committed to working with the industry to ensure that a consolidated ecosystem operates effectively for investors, Issuers and all other market participants.

Nasdaq is focused here on the elements of market structure and regulation that directly impact small and medium growth companies. While many of our targeted proposals would change Regulation NMS as it currently applies to these companies, we view our current analysis as separate from the broader, more comprehensive review of Regulation NMS that the SEC has undertaken through the Equity Market Structure Advisory Committee. Nasdaq will continue to engage energetically on the critical topics already being discussed, including protection of investors’ orders, measures of market performance, market maker incentive structures (including rebate structures), availability and uses of market data, and systemic risk and resiliency. That broad review of Regulation NMS is important, but that review should not delay or defer changes that Nasdaq purposes that are vital to small and medium growth companies.

Section Three: Promoting Long-Termism

Nasdaq understands and respects that there are many investing strategies, and we believe that this mix of approaches help ensure vibrant markets. However, in recent years, a variety of market dynamics have started to disfavor long-term investors and longterm corporate strategies. Market participants and the investing community have become less patient with corporate management, boards of directors and their overarching strategies to deliver shareholder returns.

Against this backdrop, private companies are forced to weigh the capital raising benefits of public markets with the risks that they will be unable to pursue productive long-term strategies. The trend away from long-term thinking is also harmful to investors with long-term outlooks and to the broader American economy, because sustained job creation and economic output depends on a company’s ability to measure performance not in quarters or fiscal years, but in decades. Nasdaq advocates for reforms that help public companies plan and execute for long-term growth, job creation and innovation, and ensure that long-term investors are able to participate in wealth creation on a level playing field with those who focus on speed and market timing.

Address concerns regarding activist investors

“Activist investing” is a complex term. Over the last five years, shareholder activism has become less taboo and has dramatically evolved into its own distinct investment style. Accordingly, this approach now includes a broad assortment of perspectives, motivations and strategies. Consequently, this swift development and unique classification has also placed a higher degree of complexity and confusion within the space. The investment community continues to think of activism on par with “value,” “growth” or “GARP,” however it has proven itself far harder to define. Regardless, while some activism has proven to be benign and beneficial, there exist some particular aspects of the style that ultimately act as an overall detriment to the public markets, especially with respect to long-termism. It is possible to begin to separate the first category of activist investing from the second with the following commonsense steps:

- Call to action for industry dialogue. There are many dimensions to this issue and Nasdaq is a strong believer in the capital markets ecosystem, exchanges, issuers, investors, coming together to develop a comprehensive solution to this topic. For instance, Nasdaq strongly supports, and has built into its rule book, the need for greater transparency around arrangements by which activist investors tie director compensation to share price, which creates the potential for conflicts between the activist’s and the company’s best interest. This dialogue can and should focus on several key issues that promote transparency so that investors and activists are on a level playing field when engaging with the company.

- Equalize short interest transparency. Equalize short interest transparency. Currently, securities laws require certain investors to disclose their long positions 45 days after the end of each quarter and require institutions to make disclosure within ten days after their position reaches or exceeds 5% of a company’s outstanding shares. There are no corresponding disclosure requirements applicable to short positions. Legitimate short selling contributes to efficient price formation, enhances liquidity, and facilitates risk management, and short sellers may benefit the market and investors in other important ways, including by identifying and ferreting out instances of fraud and other misconduct at public companies.

- However, the asymmetry of information between long investors and those with short positions deprives companies of insights into trading activity and limits their ability to engage with investors and it deprives investors of information necessary to make meaningful investment decisions.

- Several European countries require disclosure of short positions. Within the U.S., the policies that underlie the Section 13 disclosure requirements applicable to investors with long positions—transparency, fairness and efficiency—apply equally to investors with significant short positions. Moreover, investors with short positions can pursue strategies designed to invisibly drive down share prices or rely on regulatory processes to inexpensively challenge key intellectual property of a company, intending to profit from the uncertainty created. To provide transparency to other investors and the affected companies, we therefore support extending existing disclosure requirements for long investors, such as on Form 13F, Schedule 13D and Schedule 13G, to persons with short positions, including any agreements and understandings that allow an investor to profit from a loss in value of the subject security.

- Continue to support dual class structure. One of America’s greatest strengths is that we are a magnet for entrepreneurship and innovation. Central to cultivating this strength is establishing multiple paths entrepreneurs can take to public markets. Each publicly-traded company should have flexibility to determine a class structure that is most appropriate and beneficial for them, so long as this structure is transparent and disclosed up front so that investors have complete visibility into the company. Dual class structures allow investors to invest side-by-side with innovators and high growth companies, enjoying the financial benefits of these companies’ success.

- Encourage, rather than mandate, ESG disclosure. According to CSRHub research, as much as 84% of all Nasdaq-listed companies make some Environmental, Social and Governance disclosures. They do this not just because they believe in responsible business practices and because they understand that investors are increasingly expecting to analyze ESG metrics in their decision-making process. Many ESG disclosures and policies are intrinsically long-term in their focus. By being proactive in ESG disclosure, companies can set the tone in their long-term focus. Further, many companies find that the lack of ESG disclosure gives rise to activist concerns. As a result, companies end up needing to deploy an immediate, short term response to their challenge. By addressing ESG proactively, and on their terms, companies can keep their focus on more orderly long term business planning and execution. In keeping with our support of custom solutions for complex markets, we generally support the principle that ESG reporting shouldn’t become so prescriptive that it loses its value. Many companies are already doing a great job identifying the proper and appropriate ways to report material ESG metrics for their business practices and industry. This should be encouraged, rather than mandated.

Immediate Action and Further Study

Comprehensive market reform is extraordinarily complex. Nasdaq recognizes that it would be unrealistic and imprudent to enact all the reforms we recommend at once. Some are “shovel-ready” and could be implemented immediately with great benefits and little to no disruptions, while other reforms we support require additional study and fine-tuning.

Because this report is meant to be a blueprint that catalyzes dialogue and action, the summary below clarifies our view on which reforms are ready for immediate action and which are part of a longer-term strategy.

Reconstructing the Regulatory Framework

Immediate Action:

- Reform the proxy process

- Raise minimum ownership amount and holding period

- Streamline the SEC process for removing nuisance proxy proposals from the docket

- Create transparency and fairness in the proxy advisory industry

- Reduce the burden of corporate disclosure

- Offer flexibility on quarterly reporting

- Eliminate 10-Qs and reconsider XBRL tagging requirement while keeping annual 10-Ks.

- Expand and harmonize classifications for disclosure relief

- Roll back politically-motivated disclosure requirements

- Litigation reform

- Reduce the burden of litigation

- Support Congressional action

- Expand scope of provisions under Congressional consideration

- Tax Reform

- Enact 100% dividends received deduction

- Eliminate net investment income tax

- Exclude dividends and capital gains from income for purposes of determining the phase-out of itemized deductions

Further Study:

- Investment Accounts

- Expand tax exemption on sale of small business stock

- Study longer-term comprehensive litigation reform (loser pays)

- Mandatory arbitration

Modernizing Market Structure

Immediate Action:

- Allow issuer choice to revoke UTP for small and medium companies with select exemptions

- Deploy intelligent tick sizes for small and medium growth companies

- Cultivate innovative market level solutions that improve the trading of small and medium growth

- Incentivize quality market making

Further Study:

- Broader market structure review

Promoting Long-Termism:

Immediate Action:

- Continue to provide choice on share class structure

- Equalize short interest transparency

Further Study:

- Address concerns regarding activist investors specific to tactics that coerce companies into short-term actions to the detriment of long-term planning and actions

The complete publication, including footnotes, is available here.

Print

Print