Joseph E. Bachelder is special counsel in the Tax, Employee Benefits & Private Clients practice group at McCarter & English, LLP. The following post is based on a column by Mr. Bachelder which first appeared in the New York Law Journal. Andy Tsang, a senior financial analyst with the firm, assisted in the preparation of this post. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

Much criticism is directed at executive pay on the ground it lacks sufficient emphasis on the “long-term.” The meaning we give to “long-term” in this context is not always clear. Three years appears to be the earn-out period most frequently covered by incentive awards that are described as “long-term.” Descriptions are contained in proxy statements and surveys of incentive pay practices. [1] In particular cases, as discussed below, “long-term” can be significantly longer than three years.

The earn-out requirements that apply to a long-term award vary considerably. An earn-out may simply require that the executive continue in employment over the term of the award (with exceptions for certain circumstances, such as death or disability). On the other hand, an earn-out may require that performance targets be met. Examples are targeted growth in earnings per share or in return on equity. Total shareholder return (change in stock price plus dividends during the earn-out period) is another frequently used target. (Adjustments typically are made for falling short of the target and sometimes additional amounts are earned for exceeding the target.)

In addition to forfeitures during an earn-out period, payments of awards to executives of public corporations may be subject to clawbacks. An example of a circumstance that may result in clawback is a requirement that the employer file a financial restatement due to errors contained in the original statement.

Following is an analysis of an executive pay package in terms of its “long-term” elements. It reviews the compensation package of a leading U.S. executive, Rex W. Tillerson, who recently resigned as Chief Executive Officer of Exxon Mobil to accept the position of U.S. Secretary of State. Mr. Tillerson’s compensation package is noteworthy because of long-term components that go substantially beyond the “norm” of three years.

The total compensation shown below for Mr. Tillerson is for 2015 as reported in Exxon Mobil’s proxy statement for its 2016 annual meeting (the 2016 Proxy Statement). That is the most recent proxy statement for the company available at the time this column was written. As discussed further below, in consequence of his resignation to accept appointment to the position of Secretary of State, a portion of Mr. Tillerson’s outstanding incentive compensation was forfeited and a significant portion was transferred into a “blind trust,” according to an Exxon Mobil 8-K filed with the SEC on January 4, 2017. Details of Mr. Tillerson’s resignation arrangements are contained in a Cancelation and Exchange Agreement dated January 3, 2017 attached to the 8-K.

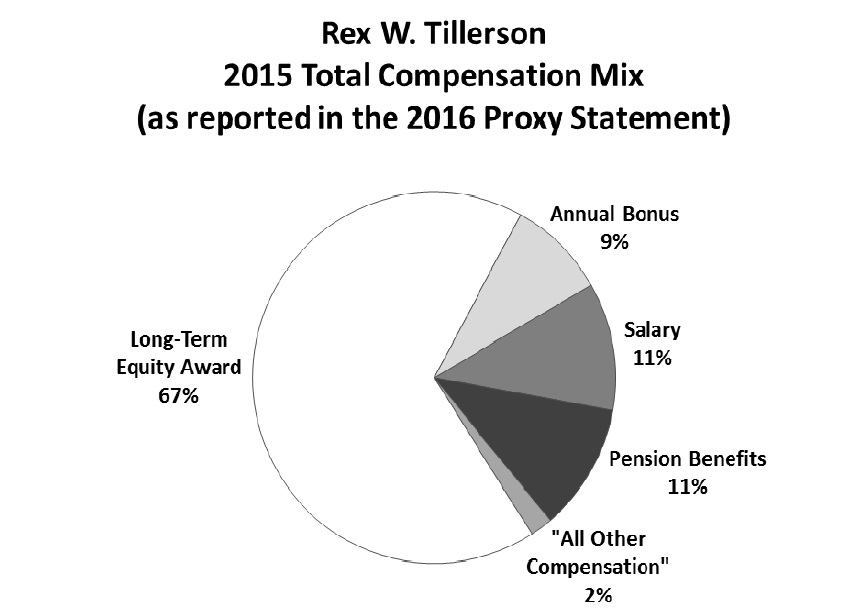

Based on the 2016 Proxy Statement, Mr. Tillerson’s total compensation for 2015 was $27,297,458. Following is a breakdown of Mr. Tillerson’s 2015 compensation (before taking into account consequences to his compensation arrangements (including some of those relating to 2015) as a result of his resignation from Exxon Mobil at the end of 2016):

- Salary: $3,047,000

- Annual Bonus (50 percent deferred as discussed in the text below): $2,386,000

- Long-Term Equity Award (restricted stock unit (RSU) award): $18,288,000

- Pension Benefits (change in pension value during 2015): $3,036,167

- “All Other Compensation” (miscellaneous benefits and perquisites): $540,291

Next is a chart, also provided in the 2016 Proxy Statement, showing each of these compensation elements expressed as a percentage of Mr. Tillerson’s total compensation:

Following is a discussion of the long-term aspects of Mr. Tillerson’s 2015 compensation package:

- Annual Bonus. One-half of the annual bonus is deferred for three years. Payout of that half is based on the achievement of a cumulative earnings per share target. [2]The deferred portion of the bonus, in addition to being subject to achievement of performance targets, is subject to forfeiture if the executive’s employment is terminated during the three-year period. Exception is made in the case of death, retirement at or after age 65 or “to the extent the administrative authority (which, in the case of reporting persons, must be the Compensation Committee) determines otherwise.” [3] It is also subject to forfeiture if the executive engages in “detrimental activity,” a term that includes “cause” as well as numerous “bad acts” (not necessarily within the traditional definition of “cause”), whether before or after termination of employment.4The entire bonus paid to Mr. Tillerson is subject to clawback in the event the company’s “reported financial or operating results become subject to a material negative restatement.” [5] The clawback applies as to each bonus amount paid for a period of five years following its payment.

- RSU Award. One-half of the RSU award vests on the fifth anniversary of the grant. The other one-half vests on the later of (i) retirement and (ii) the 10th anniversary of the grant. Vesting of the RSU award is accelerated upon death. The portion of the RSU award that has not yet vested at any point in time, like the deferred portion of the annual bonus, is subject to forfeiture if the executive’s employment is terminated other than by death, retirement at or after age 65 or “to the extent the administrative authority (which, in the case of reporting persons, must be the Compensation Committee) determines otherwise.” [6] It is also subject to forfeiture if the executive engages in “detrimental activity,” whether before or after termination of employment. [7]

- Pension Benefits. Mr. Tillerson is a participant in a defined benefit pension plan. According to the 2016 Proxy Statement, the present value of the accumulated pension benefit as of the end of 2015 was $69,551,627. [8] The non-qualified portion of the pension is subject to significant forfeiture and clawback provisions that continue to apply after termination of employment. [9]

- Stock Retention Requirements. According to the 2016 Proxy Statement “it is ExxonMobil’s policy that executives hold significant amounts of restricted stock or restricted stock units for multiple years after retirement.” While the Proxy Statement does not provide details of the policy, under the vesting structure of the RSU award as noted above (50 percent of the award vesting on the later of retirement and the 10th anniversary of the grant) Mr. Tillerson already held, at the time of his resignation, significant equity in the form of unvested RSUs vesting over an extended period of time.

Note Regarding Mr. Tillerson’s Resignation. According to the January 3 Cancellation and Exchange Agreement, upon resignation Mr. Tillerson (i) surrendered all of his unpaid deferred cash bonuses, totaling $3.9 million, for no consideration and (ii) surrendered all restricted stock and RSUs (including the 2015 RSU award discussed above), consisting of 2,026,000 underlying shares, in exchange for the transfer of a cash payment into a blind trust for his benefit in an amount that reflects a 1.6 percent discount from the value of the stock at the time of the transfer (based on the January 3 closing stock price of Exxon Mobil ($90.89), the cash payment in respect of 2,026,000 shares, after applying the 1.6 percent discount, would have a value of approximately $181 million). According to the 8-K noted above, the blind trust is designed to replicate conditions attaching to Mr. Tillerson’s restricted stock and stock unit awards and to adhere to federal ethics guidelines regarding conflicts of interest. [10]

Mr. Tillerson’s long-term awards, as discussed, have included earn-out features that go beyond the three-year term that appears to be the most typical length of time covered by long-term awards. This suggests a question: Why does a substantial portion of Mr. Tillerson’s long-term award extend significantly beyond “the norm”? One reason may be that Mr. Tillerson served as Chief Executive Officer and had been employed by Exxon Mobil for approximately 41 years. Another reason may be that Exxon Mobil is such a large and dominant company in the global energy industry. Its long-term planning and strategies are very important to it and its investors. Most U.S. public companies, smaller in size and many in less established industries, are in a constant competition for talented executives. Most do not contain the talent pool that Exxon Mobil does. Recruiting of upper-level executives is a continuous effort and often requires packages that emphasize short-term compensation. These “sign on” packages impact on the compensation arrangements for other executives at the employer in question as well.

Following is a suggestion that would allow existing incentive pay structures to continue, including annual bonuses and awards with three-year earn-out periods, while at the same time recognizing the importance of attention being given to performance over longer periods of time (i.e., five years, or longer). New incentive awards (including annual bonuses and three-year “long-term” awards) would be made subject to a “rolling” five-year adjustment factor. The adjustment factor would be applied each year based on a five-year cumulative performance target for the five years ending with that year. For example, the five-year period January 1, 2013 through December 31, 2017 would have a performance target (e.g., return on equity for the five-year period). Actual achievement would be expressed as a percentage of target (100 percent—exactly on target, 90 percent for 90 percent achievement of target, etc.). This percentage would be applied to incentive awards being earned out at the end of that year. For example, at a 90 percent-achievement of the five-year performance target, each incentive award otherwise earned out would be adjusted to 90 percent of the earned-out award. If the five-year performance exceeded target, a corresponding adjustment upward would be made. In this way existing incentive programs could be continued without basic change but would be subject to adjustment, taking into account how well the employer is doing in its performance over periods longer than three years.

Endnotes

1See, for example, “2016 Top 250 Report,” published by Frederic W. Cook & Co., Inc. (FW Cook) (December 2016), at p. 11, available at http://www.fwcook.com/content/documents/publications/12-19-16_FWC_2016_Top_250_Final.pdf. (go back)

2The deferred portion of the bonus is in the form of an Earnings Bonus Unit (EBU) Award (which is comprised of EBUs, each of which is the equivalent of a right to a cash payment equal to the cumulative earnings per share over the three-year period (or a shorter period as discussed in the next sentence), capped at $6.50). If the cumulative earnings per share equals or exceeds the maximum payout amount per EBU in the period from the beginning of the three-year period through a quarter prior to the last quarter of the three-year period, the grantee will receive the maximum payout amount per EBU as of such earlier quarter. See Sections 1 and 2 of the Earnings Bonus Unit Award (filed as Exhibit 10(iii)(b.2) to Exxon Mobil’s Annual Report on Form 10-K for 2015).(go back)

3Section XI(1) of Exxon Mobil’s Short Term Incentive Program (the Exxon Mobil STIP) (filed as Exhibit 10(iii)(b.1) to Exxon Mobil’s Annual Report on Form 10-K for 2013).(go back)

4“Detrimental activity” is defined in Sec. II(10) of the Exxon Mobil STIP.(go back)

5Section XII(1) of the Exxon Mobil STIP.(go back)

6Section XV(1) of Exxon Mobil’s 2003 Incentive Program (filed as Exhibit 10(iii)(a.1) to Exxon Mobil’s Annual Report on Form 10-K for 2012).(go back)

7“Detrimental activity” for purposes of the RSU award has essentially the same meaning given to it under the Exxon Mobil STIP noted above. See Section II(11) of Exxon Mobil’s 2003 Incentive Program.(go back)

8This accumulated benefit is based upon an annual benefit equal to 1.6 percent multiplied by (i) the sum of (A) the annualized amount of the average of the highest 36 consecutive months of salary in the 10 years of service prior to retirement and (B) the average of the annual bonuses for the three highest grants of the last five bonuses awarded prior to retirement and (ii) the number of years of credited service. Mr. Tillerson had 40.58 years of credited service as of the end of 2015.(go back)

9The forfeiture and clawback provisions as contained in the non-qualified pension plan documents include, in addition to “cause” (not defined), the pensioner’s engaging “in gross misconduct harmful to the Corporation” or committing “a criminal violation harmful to the Corporation” (whether before or after retirement). See Section 5.5 of the ExxonMobil Supplemental Pension Plan (filed as Exhibit 10(iii)(c.2) to Exxon Mobil’s Annual Report on Form 10-K for 2014) and Section 7.5 of the ExxonMobil Additional Payments Plan (filed as Exhibit 10(iii)(c.3) to Exxon Mobil’s Annual Report on Form 10-K for 2013).(go back)

10According to the Exxon Mobil January 4 8-K: “Key elements of the Trust include:

- Principal contributed to the Trust will only be distributed to Mr. Tillerson at times and amounts in the future that correspond with the 10-year payment schedule that would otherwise apply had he retained his restricted stock and restricted stock units.

- Trust distributions may not be accelerated except in case of death.

- Any assets remaining in the Trust will be forfeited and paid to charities of the trustee’s choosing if Mr. Tillerson, after leaving government service, becomes employed or otherwise engaged in an oil and/or gas business.”(go back)

Print

Print